( click to enlarge )

( click to enlarge )The 6 months technical chart of Microsoft Corporation (NASDAQ:MSFT) appears to have shaken off the bears, as the stock hit another four-month high today. Daily technical indicators are bullish. The MACD has crossed above its signal line in positive territory and changed its sideways trend. The RSI is also moving up above its 50% level. Long setup.

( click to enlarge )

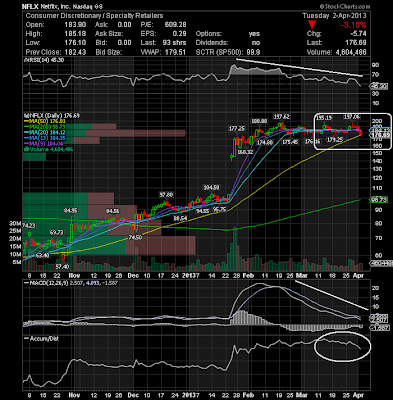

( click to enlarge )Netflix, Inc. (NASDAQ:NFLX) Daily technical indicators are looking bearish to me. The MACD is positive, but falling below its signal line. The RSI has slipped below its 50% level for the first time since November 2012 and the Accumulation/Distribution line is turning down. Some more correction can be expected. If it breaks the support level of its 50-day MA, it is likely to continue its way down until it reaches the next support level wich is at 160.

( click to enlarge )

( click to enlarge )Research In Motion Ltd (NASDAQ:BBRY) Bulls still in control. I expect a breakout over $15.55 any day now.

( click to enlarge )

( click to enlarge )Gencorp Inc (NYSE:GY) can potentially set-up very well for a swing-trade if it breaks through the resistance level at $13.81.

( click to enlarge )

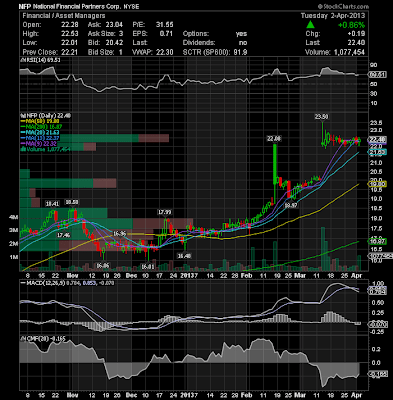

( click to enlarge )National Financial Partners Corp. (NYSE:NFP) consolidating in a tight range, probably need a catalyst here. Play the reaction.

( click to enlarge )

( click to enlarge )Team Health Holdings LLC (NYSE:TMH) is a potential breakout play. Momentum picking up with MACD climbing and RSI rising. Breakout watch over $37.15.

( click to enlarge )

( click to enlarge )Amgen, Inc. (NASDAQ:AMGN) broke out and never stopped all day. There is a good chance the stock will continue to move up.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC