( click to enlarge )

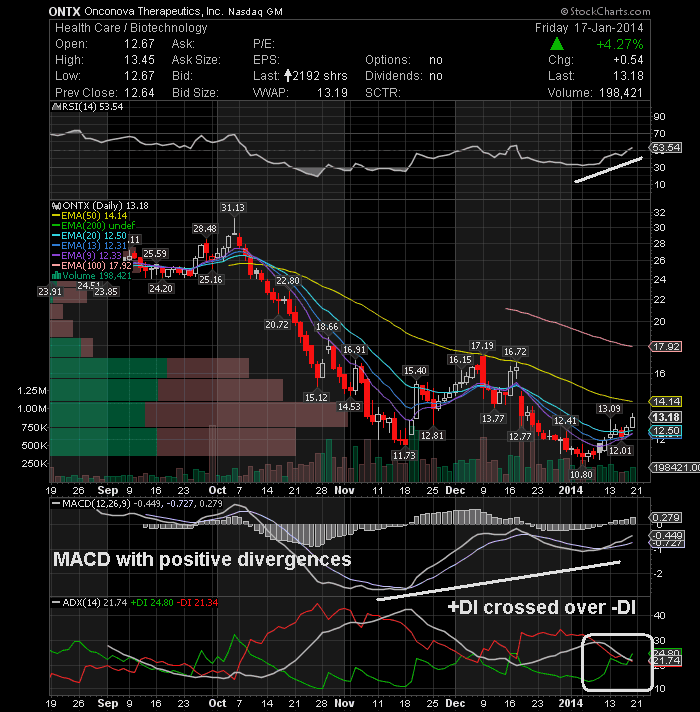

( click to enlarge )The stock price of Onconova Therapeutics Inc (NASDAQ:ONTX) could see a nice rally just based upon the current daily charts. The daily indicators are strengthening and the fast moving daily MACD has crossed over the Slow moving MACD with positive divergences. In addition, +DI crossed over -DI, which is bullish. So, key momentum oscillators are showing some promising signs.The 50-day EMA sits at $14.14 and the 100-day EMA is at $17.92, a lot of room to go higher. This stock is also a short squeeze candidate. Right now, 1.456 million of the company's outstanding shares are shorted, equivalent to 41.98% of float. This stock deserves watching going forward.

( click to enlarge )

( click to enlarge )Stemline Therapeutics Inc (NASDAQ:STML) Ended the week with a 39% BANG. The stock closed at $30.44 with a gain of 39.5% over Thursdays close. Congratulations to everyone who profited. It is just another good example of how stocks can rally after they have fallen sharply ;)

( click to enlarge )

( click to enlarge )Stereotaxis Inc (NASDAQ:STXS) strong bullish bar on Friday with a close near the highs of the day. Expecting continuation toward 5.85

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) Strong bullish engulfing day on high volume, likely continuation next week. The stock price continues to trade well above its key short-term EMAs. The MACD still indicating an up-move and the ADX is supporting this up-move. Long setup. Next key resistance lies at 9.37...above that level expect a massive short squeeze.

( click to enlarge )

( click to enlarge )Atmel Corporation (NASDAQ:ATML) nice bounce off 9-day EMA within a well formed bull flag. The stock price continues to trade above its key EMAs. Keep an eye for a possible breakout over 8.81

( click to enlarge )

( click to enlarge )Revett Minerals Inc (NYSEMKT:RVM) saw its shares surged almost 17% to 82c per share on Friday, closing above key resistance levels. The last time the stock price had a solid breakout in the 80c range, it doubled within 4 weeks. With technical daily chart showing strength, as MACD is above signal and RSI above 70, we could see this stock going strong for a while. It doesn't look to be too late to join the party :)

( click to enlarge )

( click to enlarge )Merck & Co., Inc. (NYSE:MRK) building a flag chart pattern, looking for a move through 53 and toward new highs. The ADX is signalling an upwards trend but the momentum slowing down. The MACD continues with its buy signal. Long setup.

( click to enlarge )

( click to enlarge )Cell Therapeutics Inc (NASDAQ:CTIC) Eight straight days closing in the green, indicate an extreme overbought condition, which could be solved with some profit taking in the coming sessions. It has almost doubled in value this year. The long-term trend is bullish, as the stock price is on top of both 50-day and 200-day exp moving average, with both moving averages going up. However as RSI is at overbought level (90) the risk of correction has increased. A pullback at this point would be healthy for the stock, because it would reignite some sideline cash imho.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC