Hope you are having a great Thanksgiving !!! I would like to inform everybody that my friends at Marketfly are offering a great promotion for Black Friday. They have over 50 investing and trading products & portfolio alerts, available until Friday midnight for the unbelievable price of $10 each for their first month. If the price is not already marked at $10, just enter the coupon code FRIDAY for your instant discount. This represents over 90% off on some of the services. Click HERE or on the side-bar banner of the blog to read more about this offer. Make sure to take advantage of this awesome promotion for Black Friday.

( click to enlarge )

( click to enlarge )Twitter Inc (NYSE:TWTR) has formed a bullish candle Wednesday on solid volume. The stock price seems that has found a bottom here as we look on the technical daily chart and notice the rejection from 39 area, forming a sort of a rounding bottom pattern. The next step would be to break the key resistance at 43.95 but there we'll see tough fights between bulls and the bears. As you can see in my daily chart, the short term momentum indicators are showing positive divergences. MACD is on top of signal and %K line on top of %D line, both showing buy signal. RSI is also moving upwards now.

( click to enlarge )

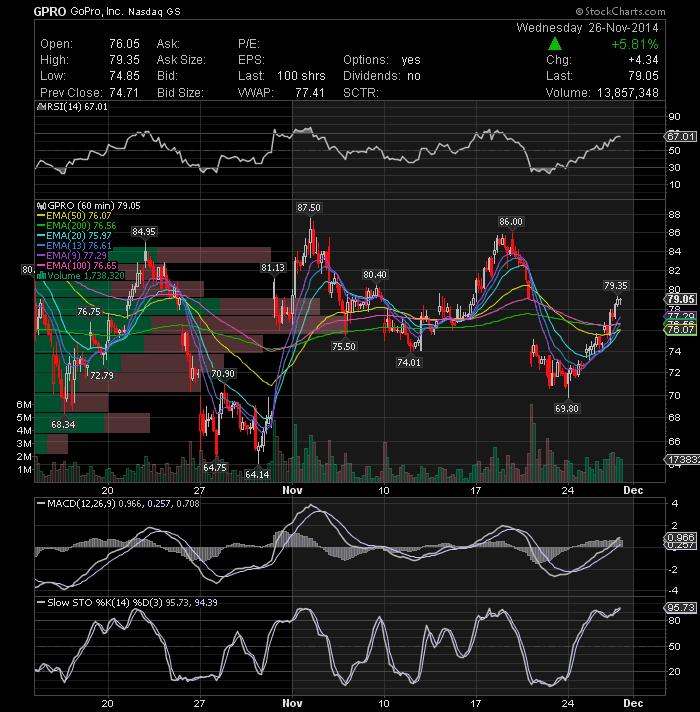

( click to enlarge )GoPro Inc (NASDAQ:GPRO) has surged in recent sessions amid heavy volume and closed on Wednesday above all major EMAs ( hourly charts ). With almost 28% of the float short, I think this stock is due for a continuation of the bullish uptrend. If the stock can break through $80.4 resistance level, we should see another strong upside move. GPRO will move very quickly, so watch the stock closely tomorrow.

( click to enlarge )

( click to enlarge )BlackBerry Ltd (NASDAQ:BBRY) The technical chart continues to look positive as the 50-day EMA has crossed on top of 200-day EMA around July to form Golden Cross. Although MACD indicates some weakness, buyers are back as Slow Stochastic hit oversold with stock dropping near 100-day EMA. Now that %K line is on top of %D line the stock should be expected to go higher. In my honest opinion, medium/long term Blackberry looks like it is destined to higher levels, perhaps to 15 and then 20. Note: Billionaire D.E. Shaw Bought 7.4 Million Shares of BlackBerry Ltd recently.

( click to enlarge )

( click to enlarge )NQ Mobile Inc (NYSE:NQ) has formed a clear resistance level around 7.50 as part of its short-term uptrend, setting up yet for a possible resistance breakout trade. Short term indicators are positive. A buy signal would be given on a break above resistance at 7.50, with the next resistance then at 7.85, 7.88 and 8.93. Support is at 7 and 6.81

( click to enlarge )

( click to enlarge )Novavax, Inc.(NASDAQ:NVAX) starting to get some momo once again. It is now riding on a short-term upward movement in share price. Technical indicators are becoming more favorable, with the MACD and RSI starting to turn up. Next resistance lies at $5.60 and then at $5.85

( click to enlarge )

( click to enlarge )Rambus Inc. (NASDAQ:RMBS) has a good chance to continue higher and a buy could be made as it moves over $12. If this happens, the stock is a good play. From a technical standpoint, the stock broke the DT line, its 50-day EMA and MACD back above zero.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC