New legislation introduced by Congressman Danny Davis (D-IL-7) could reverse a decade-long decline in the number of Americans giving to charity. The Davis bill, H.R. 1260, would relieve all taxpayers – regardless of income level - from paying taxes on money they donate to charity. On behalf of Leadership 18, Susan Dreyfus, president and CEO of the Alliance for Strong Families and Communities, applauded Congressman Davis for introducing this legislation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190221005867/en/

(Graphic: Business Wire)

“This may be the single most important piece of legislation that touches all charities’ ability to raise private donations,” Ms. Dreyfus noted. “As a senior and highly-respected member of the Ways and Means Committee, Mr. Davis has taken his longstanding support for charities to a new level. Leadership 18, which includes some of the nation’s largest nonprofits, are heartened at his support and remain committed to helping Mr. Davis enact H.R. 1260.”

Dreyfus continued, “We have been fortunate to have bipartisan support for this issue, including bills introduced in the last Congress by Congressman Mark Walker (R-NC) and Chris Smith (R-NJ) and Henry Cuellar (D-TX). We will continue our bipartisan efforts in support of this critical policy.”

New Donor Data

The bill introduction comes as United Way Worldwide releases new analysis confirming troubling reductions in the percentage of Americans who donate to charities, which will lead to long-term challenges for mainstream charities that rely on private donations. United Way’s lead researcher on the study, Marie Eberlein, said, “From 2002 to 2014, the percentage of Americans donating to charity dropped from 68.5 percent to 55.5 percent. At the same time, overall giving continued to hover around 2.1 percent of GDP. We needed to dig deeper into the data to figure out what was going on.”

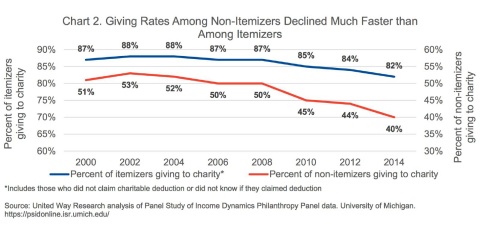

The United Way research team analyzed data compiled about giving by donors who itemize their taxes and compared it to information about donors who don’t itemize. In a key finding, researchers found that people who do not itemize their taxes give at half the rate of those who itemize. Shockingly, since 2008, the percentage decrease in giving by non-itemizers is double the loss in itemizers. The number of itemizers giving dropped by 5 percentage points, while the number of non-itemizers giving dropped by 10 percentage points.

Additionally, United Way researchers found that itemizers on average donated more than two and a half times as much as the amount donated by non-itemizers. Average donations by itemizers increased as the number of donors decreased. Conversely, donations from non-itemizers has remained relatively flat for nearly the entire 14-year period studied by United Way.

This finding raises alarms in the charitable sector because the recent changes to tax law will reduce the number of donors who itemize their taxes by 21 million, according to recent research.

Steve Taylor, Senior Vice President for public policy explained, “While overall giving has increased because of large and mega-donations to funds operated by wealth management companies and elite nonprofits like universities and hospitals, faith-based and social services charities that rely on middle- and lower-income donors have struggled to keep pace. The fact that overall giving has increased is very deceptive. Who is giving and where they give matters a lot for a robust charitable nonprofit sector.”

“United Way’s analysis shows that charities are right to be concerned that tens of millions of middle class donors will give less because of the new tax law,” according to Taylor, “but the real issue is fairness. Why should the rich get to make tax-fee donations, but low- and middle-income donors sacrifice to donate to their church or charity AND pay taxes on their donations? Mr. Davis’ bill will cure that inequity.”

About Leadership 18

Collectively, the members of Leadership 18 serve 87 million people with more than 5.6 million staff and volunteers. All of our member organizations share a specific mission to improve human development through deep community relationships. Leadership 18 members include the following: Alliance for Strong Families and Communities, American Cancer Society, American Heart Association, American Red Cross, Boy Scouts of America, Boys & Girls Clubs of America, Catholic Charities USA, City Year, Feeding America, Girl Scouts of the USA, Girls Inc., Goodwill Industries International, Inc., Habitat for Humanity, The Jewish Federations of North America, Lutheran Services in America, Mental Health America, National Council on Aging, The Salvation Army, United Way Worldwide, Volunteers of America, YMCA of the USA, and YWCA USA.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190221005867/en/

Contacts:

jennifer.devlin@cox.net