Doesn't this seem to happen a lot? We get right up to these critical levels on happy talk over Trade and the Fed and Earnings but then, just as the Media is telling us how great things are and what a fool you are for not chasing the market – it all falls apart – again. To a large extent, it's because the indexes (and the individual components that make them up) are already priced for a perfect outcome. When you pay 30 times earnings for a stock, you are getting an effective return of 3.3% and there is, of course, the risk that something bad might happen over the time you hold the stock, causing it to go down, not up. A 30-year note yeilds 2.2% and has, theoretically no risk – though the real risk is you are locked into the low-rate note while inflation rises faster than your note or that newer notes start giving a better return than your note – causing the present value of your note to go lower. That would not effect your 2.2% reuturns but it would make it almost impossible to sell your note to someone else without steeply discounting it. Still, the " risk-free " rate of return is 2.2% while a 30x stock is giving you 3.3% but should just 1 out of 3 of your stocks fail to go up this year, your rate of return drops to 2.2% anyway. That means you have to be right 66% of the time with your 30x picks just to keep up with TBills. We are able to do that using options since Being the House gives us an inherent advantage but people buying straight stocks at these prices barely stand a chance. IN PROGRESS

Doesn't this seem to happen a lot?

Doesn't this seem to happen a lot?

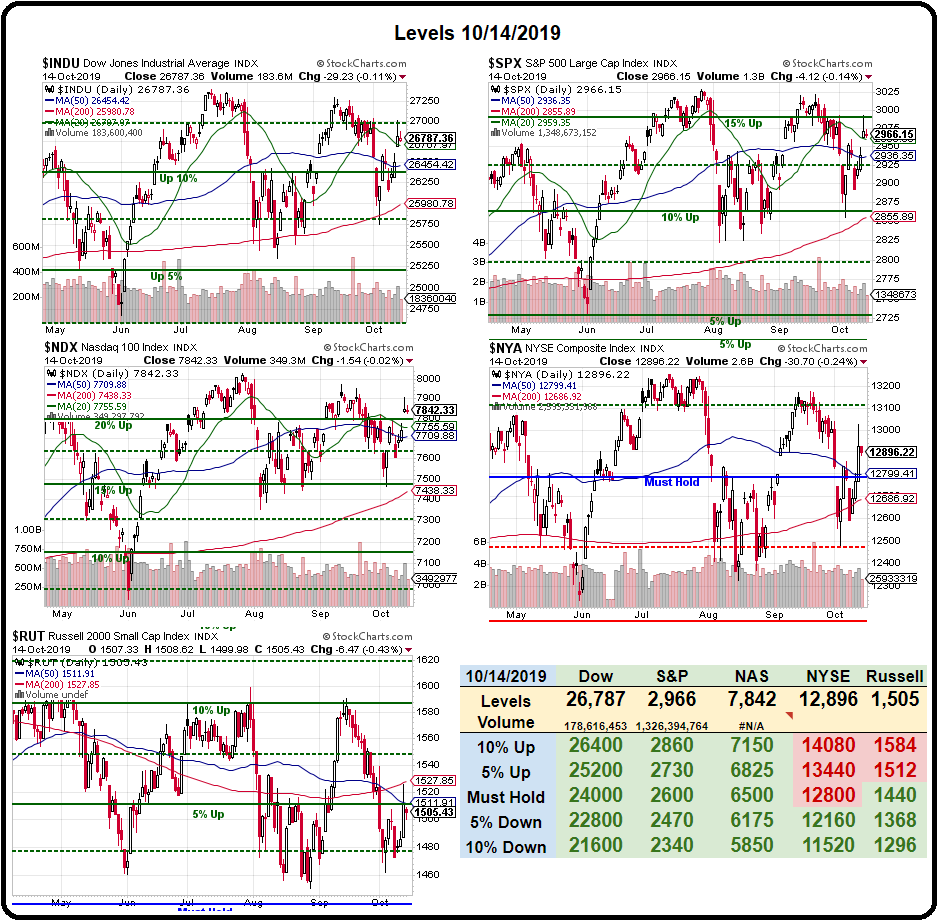

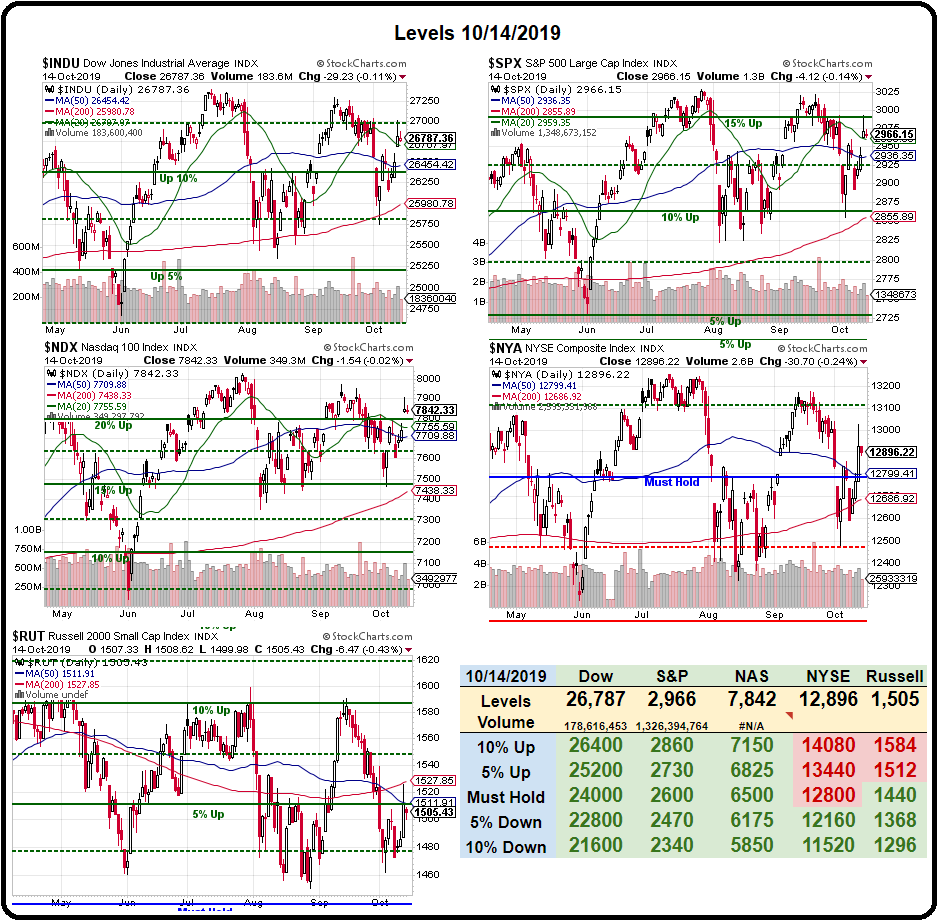

We get right up to these critical levels on happy talk over Trade and the Fed and Earnings but then, just as the Media is telling us how great things are and what a fool you are for not chasing the market – it all falls apart – again. To a large extent, it's because the indexes (and the individual components that make them up) are already priced for a perfect outcome.

When you pay 30 times earnings for a stock, you are getting an effective return of 3.3% and there is, of course, the risk that something bad might happen over the time you hold the stock, causing it to go down, not up.

A 30-year note yeilds 2.2% and has, theoretically no risk – though the real risk is you are locked into the low-rate note while inflation rises faster than your note or that newer notes start giving a better return than your note – causing the present value of your note to go lower. That would not effect your 2.2% reuturns but it would make it almost impossible to sell your note to someone else without steeply discounting it.

Still, the "risk-free" rate of return is 2.2% while a 30x stock is giving you 3.3% but should just 1 out of 3 of your stocks fail to go up this year, your rate of return drops to 2.2% anyway. That means you have to be right 66% of the time with your 30x picks just to keep up with TBills. We are able to do that using options since Being the House gives us an inherent advantage but people buying straight stocks at these prices barely stand a chance.

IN PROGRESS

Doesn't this seem to happen a lot?

Doesn't this seem to happen a lot?