$6,000 per contract!

$6,000 per contract!

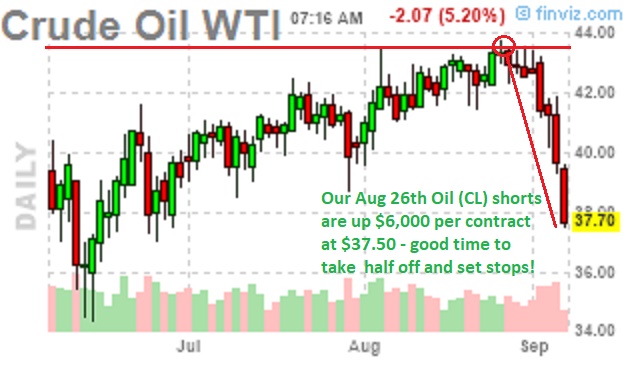

That's how much our Members have made (so far) shorting oil off our August 26th "Hurricane Edition." when I said to our Members in the Morning Report:

Hurricane Laura is coming.

It's a good excuse to get Oil (/CL) back to $43.50 but it makes a nice short there as nothing else is going on in the energy market to prop it up. We do have a holiday weekend approaching (next Friday) but driving is mostly off the table this year and, for oil, I'm a lot more concerned with the Dollar bouncing back from it's -10% position and kicking oil's ass after Powell's speech tomorrow at the Jackson Hole conference.

While I prefer to short the Oil (/CL) Futures at $43.50 with very tight stops over that line, we can also make the simple bet that oil won't be over $50 in April by picking up the following bearish spread on USO:

Buy 20 USO April $35 puts for $6 ($12,000)

Sell 20 USO April $30 puts for $3.15 ($6,300)

Sell 10 USO Sept $30 puts for 0.52 ($520)

If USO goes below $30, we need to take a loss on the short Sept $30 puts but, if not, we can sell those puts for 0.50 each month and collect $2,000 more through January. As it stands, the net of the spread is $5,180 and it's $8,000 in the money at $31 to start. If we drop our basis by $2,000 more, we should be in very good shape.

USO, as you can see, remains on track and the April $35 puts are now $7.80 ($15,600) and the $30 puts are $4.40 ($8,800) and the short Sept $30 puts died last week (Wednesday morning) at 0.75 ($750) so the spread is up about $1,000 (20%) at $6,050 so far. Setting those stops is key as the short puts are now $1.75 – exactly enough to wipe out our…

USO, as you can see, remains on track and the April $35 puts are now $7.80 ($15,600) and the $30 puts are $4.40 ($8,800) and the short Sept $30 puts died last week (Wednesday morning) at 0.75 ($750) so the spread is up about $1,000 (20%) at $6,050 so far. Setting those stops is key as the short puts are now $1.75 – exactly enough to wipe out our…