As investing whirlwind Chamath Palihapitiya continues to make headlines with his full-court press to take private tech companies public via SPACs while markets are hot, one of his targets has disclosed financial information that helps us better understand the transaction it is undertaking.

Palihapitiya’s Social Capital Hedosophia Holdings Corp. II (a public, blank-check company, or SPAC) is combining with Opendoor, a San Francisco-based tech startup that facilitates real estate transactions. Opendoor often buys homes from sellers, later selling them itself. Given the complexity present in the residential real estate market and its scale, the company is an interesting play.

TechCrunch covered the Opendoor-SPAC tie-up in mid-September, when it was announced. Yesterday we got a fuller look into Opendoor’s financial results. So, this morning, let’s peek at the numbers to see if we can spy what Palihapitiya talked about in his investment thesis concerning the company’s future prospects.

The resultsOpendoor’s 2020 results are not stellar. But that fact is not a surprise. The company went through a round of layoffs in April, impacting around 35% of its staff at the time.

However, even then, TechCrunch reported that “home sales haven’t fallen as far or as fast as one might imagine.” Indeed, in many markets the real estate market has proved surprisingly durable during the COVID lockdowns as some leave major cities for smaller municipalities.

Opendoor says plainly in its SEC filing concerning its combination with the SPAC that COVID has “adversely affected our business.” Its results, then, are framed by a changing market and a pandemic, even if areas of residential real estate have held up better than we might have anticipated.

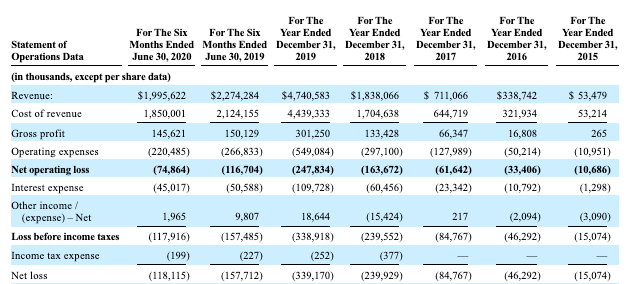

Here are Opendoor’s raw numbers, for your perusal:

You have to read right-to-left to follow the flow of time correctly.