(Please enjoy this updated version of my weekly commentary published September 01, 2021 from the POWR Growth newsletter).

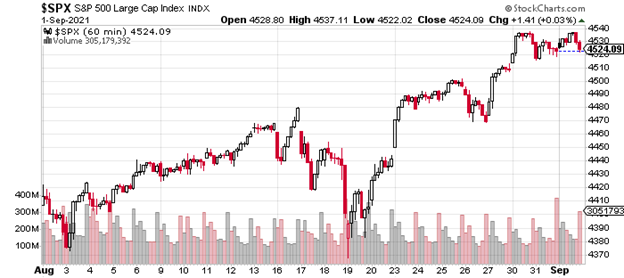

First, let’s do a quick review of the overall market and what’s happened in the last week.

Basically, there was some nice follow-through to the market’s breakout from last week. While this is encouraging, what’s even more encouraging is that the Russell 2000 is leading the charge:

However, it’s still too early to say that anything meaningfully has changed. In my opinion, the universe of small/mid/growth stocks continues to remain range-bound, while large-cap stocks are trending higher.

This circumstance has defined much of 2021. In essence, the market has soured on the growth outlook as evidenced by the decline in long-term rates. In a vacuum, lower growth is bad for stocks and even more so for small and mid-cap stocks.

However, lower rates are a boon for large-cap stocks as their borrowings costs decline, share buybacks accelerate, and they tend to have less volatility in terms of revenue.

Therefore, we continue to maintain our current strategy of trading more aggressively and being modest in our expectations with range-bound parts of the market, while taking a longer-term view with stocks that are benefitting or immune from the downtrend in growth expectations.

Narratives vs Reality

Let’s revisit this discussion from the intro. Basically, we make and consume narratives to make sense of reality. As real-world events develop and earnings come in, narratives either gain strength or lose momentum.

At times, narratives become so powerful they start shaping reality. This is often what happens during periods of extreme greed and fear.

Think about the tech bubble or the bottom of the market in 2008 and 2009.

Today’s market doesn’t have these types of ostensible extremes, but there are a few, dominant narratives that I believe are incorrect.

The main one I want to focus on is the behavior of long-term rates which are behaving as if the economy is going to plummet into a recession and that deflation will be the bigger threat. This is the only way to make sense of the 10-year yield trading around 1.3%.

It’s also reflected in the low multiples of materials, energy, and industrial stocks which are behaving as if the world is going to return to the pre-2020 norm of low-growth and low inflation. It’s also shaping real-world behavior as capital spending remains near low levels despite recent strength in prices.

Basically, I expect that this narrative is going to fall apart and lead to a big reaction in all types of assets such as energy, materials, small-caps, interest rates, etc. I believe this is going to be a major opportunity for investors and the POWR Growth portfolio.

What To Do Next?

The POWR Growth portfolio was launched in early April and is off to a fantastic start.

What is the secret to success?

The portfolio gets most of its fresh picks from the Top 10 Growth Stocks strategy which has stellar +46.42% annual returns.

If you would like to see the current portfolio of growth stocks, and be alerted to our next timely trades, then consider starting a 30 day trial by clicking the link below.

About POWR Growth newsletter & 30 Day Trial

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Growth Newsletter

SPY shares were trading at $452.54 per share on Thursday afternoon, up $0.74 (+0.16%). Year-to-date, SPY has gained 21.83%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of POWR Growth newsletter. Learn more about Jaimini’s background, along with links to his most recent articles.

The post Does the Underlying Narrative Match the Reality of the Market? appeared first on StockNews.com