There are signs things are getting better on the inflation front. And yet signs that things are getting worse on economic front.

This contradiction creates a very confusing gumbo for investors to digest. And likely explains why we continue to teeter on the edge of bear market territory at 3,855.

Let’s talk about these competing themes and how it has created 2 different scenarios for the stock market outlook. One bullish and one bearish.

I share which scenario is most likely and what it means for our trading plan in this week’s Reitmeister Total Return commentary.

Market Commentary

Let’s start with the Fed’s game plan as clearly spelled out in Chairman Powell’s Jackson Hole speech in August:

- This is a long-term battle to get inflation back to 2% target

- Do NOT expect lower Fed rates through 2023

- Expect “economic pain” which was further described as below trend growth and a weakening of employment.

Now let’s remember that this speech quickly sobered up investors who were enjoying a 18% summer rally up to 4,300 for the S&P 500 (SPY). A month later we were making new lows below 3,600.

The Fed cherishes clarity and consistency in their communication. And thus, I say that any investor who thinks there will be a meaningful change in policy announced Wednesday, only a couple months after the Jackson Hole speech, is smoking something that is still quite illegal.

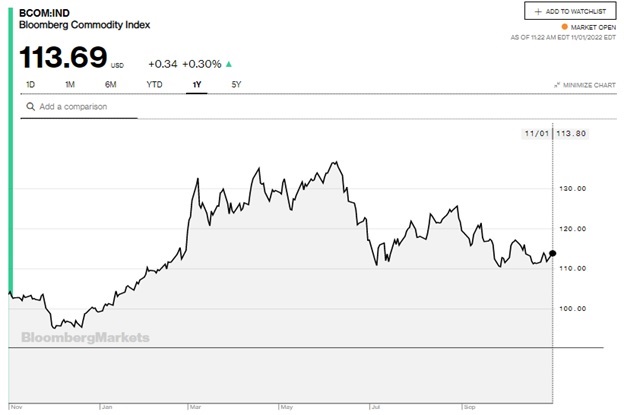

Yet bulls do have some things to cheer such as clear signs of moderating inflation. Almost every key commodity is well off their highs this year. The Bloomberg Commodity Index shows the price trend improving.

This moderation of inflationary pressures is what is behind the hope the Fed will not raise rates as aggressively in the future...and thus would create less damage to the overall economy. This has some folks calling bottom leading to the strong October rally (and hopes for beginning of new bull market).

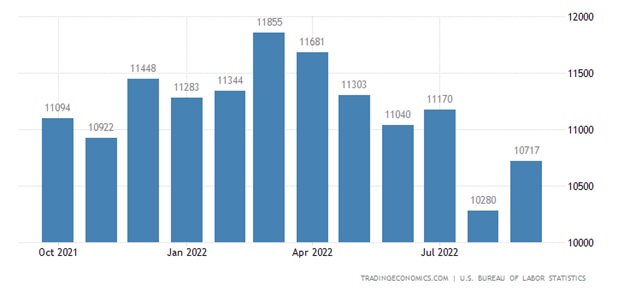

On the other hand, commodity prices are just one part of the inflationary picture. Don’t forget the “stickier” elements such as house prices and rents. Even more important is wage inflation. That got a JOLT in the wrong direction Tuesday morning (pun intended ;-)

See below the trend of job openings tracked in the monthly JOLTs report. For the previous 5 months it was trending lower which meant fewer job openings...which pointed to hopefully less wage inflation in the future. That is why the jump in that report Tuesday morning was greeted with an immediate stock sell off as it reignited inflationary fears.

Simultaneously to the JOLTs report was the release of ISM Manufacturing. As expected, that continues to move closer to recessionary levels with a reading of 50.2 with forward looking New Orders component a notch lower at 49.2. (Under 50 = contraction)

Here are some of the key statements recorded by ISM to go along with the Manufacturing report to provide color commentary on what is happening now and what it means for the future (bold put in by me for emphasis):

- “Customers are canceling some orders. Inventories of finished goods increasing. Expect some bounce back as some customers may be waiting for commodity prices to decline (further).” [Chemical Products]

- “Growing threat of recession is making many customers slow orders substantially. Additionally, global uncertainty about the Russia-Ukraine (war) is influencing global commodity markets.” [Food, Beverage & Tobacco Products]

- “We have seen a general pullback in available capital budgets from our customers, and that is having a significant impact on our sales in the fourth quarter.” [Machinery]

- “Customer demand has been slower for two months. Production is decreasing our inventory and (we are) implementing forecasts carefully. The headwind seems to be very strong, so we need to be prepared for that.” [Fabricated Metal Products]

- “International conditions loom large and seem very foreboding. Overall, we still think 2023 will be a positive year, with at least some moderate growth.” [Nonmetallic Mineral Products]

- “Lead times are improving. Plastic prices are coming down.” [Plastics & Rubber Products]

- “Prices are continuing a slight decline. Suppliers are trying to hold off decreases, but competition is increasing.” [Miscellaneous Manufacturing]

Net-net these statements reiterate the main point of my commentary today. That being clear signs the economy is slowing. But so too inflationary pressures are easing.

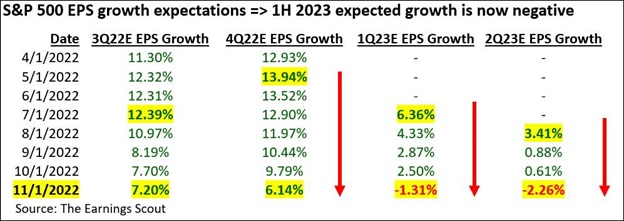

Now let me add one more element to consider before I get to my final conclusions. See the negative trend for the S&P 500 (SPY) earnings outlook as we are now more than half way through Q3 earnings season.

This data shows an across the board reduction in earnings estimates for coming quarters. In particular, you will see that Q1 and Q2 of 2023 are now expected to end with negative growth. This corresponds with a growing number of economists pointing to a recession forming in the first half of 2023.

These statistics were put together by Nick Raich who went on to say that Wall Street is being far too optimistic about the outlook. Meaning that the full measure of estimates cuts are not yet showing up and thus is recommending to clients that they expect more stock price downside until we see more of the typical 15-20% earnings loss that corresponds with recessions.

Now we get down to the tricky part. That being to determine which is the more likely scenario going forward.

Scenario 1: Inflation moderates sooner than expected leading to less total Fed intervention and creation of soft landing for economy. In this case, it is not unreasonable to say that we have reached market bottom and new bull market emerging.

Scenario 2: We have already opened up Pandoras box with the economy. Once the wheels are in motion to move towards recession, then the economy can go through a vicious cycle that grinds lower and lower. In this case the bear market is still in play with likely bottom closer to 3,000.

Which scenario is right?

I believe Scenario 2 is much more likely and why I remain bearish. However, Scenario 1 is a possible outcome that needs to be monitored closely.

Until investors are convinced which scenario is correct, then expect increased volatility as we have seen this past week. Heck, Tuesday alone was a prime example.

That being where the market opens up +1% and then immediately gives it all back and then some after the JOLTs and ISM Manufacturing reports. Then it stuck like glue around 3,855 which is an interesting support/resistance level.

Remember that 3,855 is the bear market dividing line representing a 20% drop from the all time highs of 4,818. That is as good of spot as any to have a tug of war over the future of the stock market.

Given history, the odds of soft landing are very low. Famed investor Mohamed El-Erian talks about the same thing in this new article: Chances of Soft Landing are “Meager”.

Like El-Erian, my outlook skews bearish. That is why my portfolio is constructed to profit as stock prices head lower.

However, I am sleeping with one eye open for the possibility that the soft landing scenario does emerge victorious where I would gladly switch to a more bullish stance.

Unfortunately, with the jobs market still too hot, then that inflationary pressure alone will keep the Fed on a rate hike war path which doesn’t end favorably for the economy and stock prices.

What To Do Next?

Discover my special portfolio with 9 simple trades to help you generate gains as the market descends further into bear market territory.

This plan has been working wonders since it went into place mid August generating a robust gain for investors as the S&P 500 (SPY) tanked.

And now is great time to load back up as we make even lower lows in the weeks and months ahead.

If you have been successful navigating the investment waters in 2022, then please feel free to ignore.

However, if the bearish argument shared above does make you curious as to what happens next...then do consider getting my updated “Bear Market Game Plan” that includes specifics on the 9 unique positions in my timely and profitable portfolio.

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, Stock News Network and Editor, Reitmeister Total Return

SPY shares were trading at $384.97 per share on Tuesday afternoon, down $1.24 (-0.32%). Year-to-date, SPY has declined -18.01%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Bull vs. Bear Debate Reignited! appeared first on StockNews.com