Regeneron Pharmaceuticals, Inc. (REGN) holds an impressive portfolio of FDA-approved medications as well as a wide variety of promising product candidates across a breadth of disease areas. These include vision-impairing ocular conditions, severe inflammatory ailments such as asthma and atopic dermatitis, hematological conditions, pain management, and infectious diseases, including COVID-19. Regeneron’s standing in the market is further strengthened by its strategic alliances with leading-edge partners.

The company is set to disclose its third-quarter 2023 results on November 2, and given its commendable history of exceeding analysts’ revenue and earnings projections for the trailing four quarters, anticipation is high for the forthcoming report.

Market predictions for Regeneron indicate a 9.8% year-on-year increase to $3.22 billion in revenues for the quarter ending September 2023 and earnings per share of $10.82.

Regeneron attributes its strong market positioning to an expanding pipeline of products, exceptional partnerships, and the overall robustness of its operations that establish it as a valuable buy-and-hold biotech stock. This bullish sentiment is reinforced by several key metrics.

Understanding Regeneron Pharmaceuticals: A Comprehensive Financial Performance Analysis (December 2020 - June 2023)

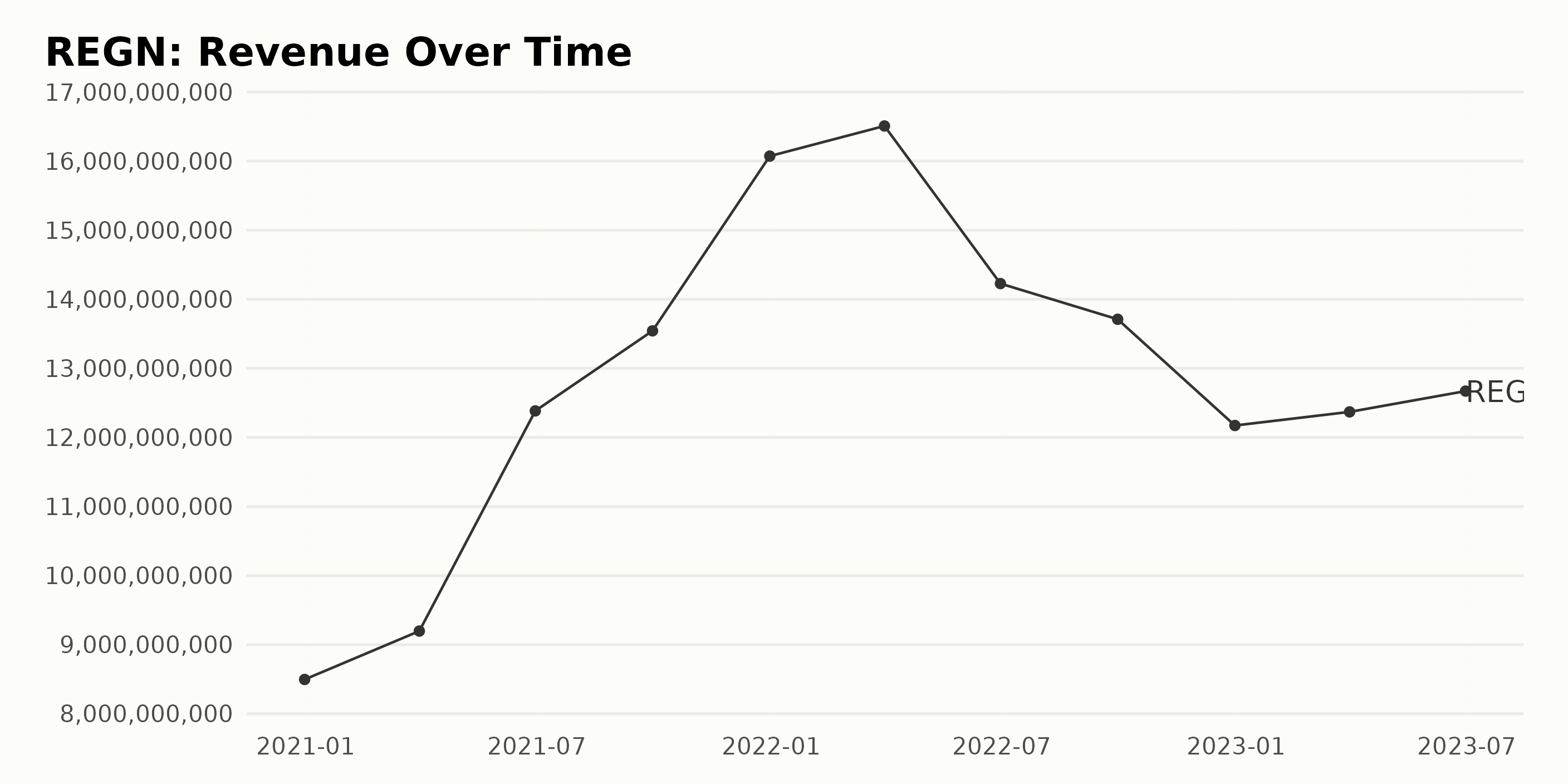

The trailing-12-month revenue trend for REGN over the analysed period shows a general upward trend with considerable fluctuations. A detailed analysis of the data is as follows:

- At the onset of our data set as of December 31, 2020, REGN reported a revenue of $8.5 billion.

- The company’s revenue displayed a growth pattern, reaching $9.2 billion by March 31, 2021.

- This growth trend persisted, and by June 30, 2021, the revenue skyrocketed to $12.38 billion.

- By September 30, 2021, revenue had peaked at $13.54 billion, thereafter, it noticed an impressive jump to $16.07 billion on December 31, 2021.

- The first quarter of 2022 marked another rise in revenue as it reached $16.51 billion by March 31, 2022.

- However, a downward trend emerged from the second quarter of 2022 as the revenues dropped to $14.23 billion by June 30, 2022, and further slid to $13.71 billion by September 30, 2022. This trend continued into the end of the year, with revenue at $12.17 billion on December 31, 2022.

- As of 2023, the revenue for REGN began to stabilize and then noticed an increase. It stood at $12.37 billion in March, and as of the most recent data point on June 30, 2023, it increased to $12.67 billion.

Calculating the growth rate from the first value ($8.5 billion) to the last value ($12.67 billion), REGN’s revenue has grown by approximately 49% over this period. However, it’s worthy of note that the highest revenue peak occurred in March 2022 with a value of $16.51 billion, which represented a growth of around 94% from the beginning of the data series. This analysis confirms the significant fluctuations in REGN’s revenue over time, underscored by periods of rapid growth and subsequent decline, followed by stabilization and growth in more recent periods.

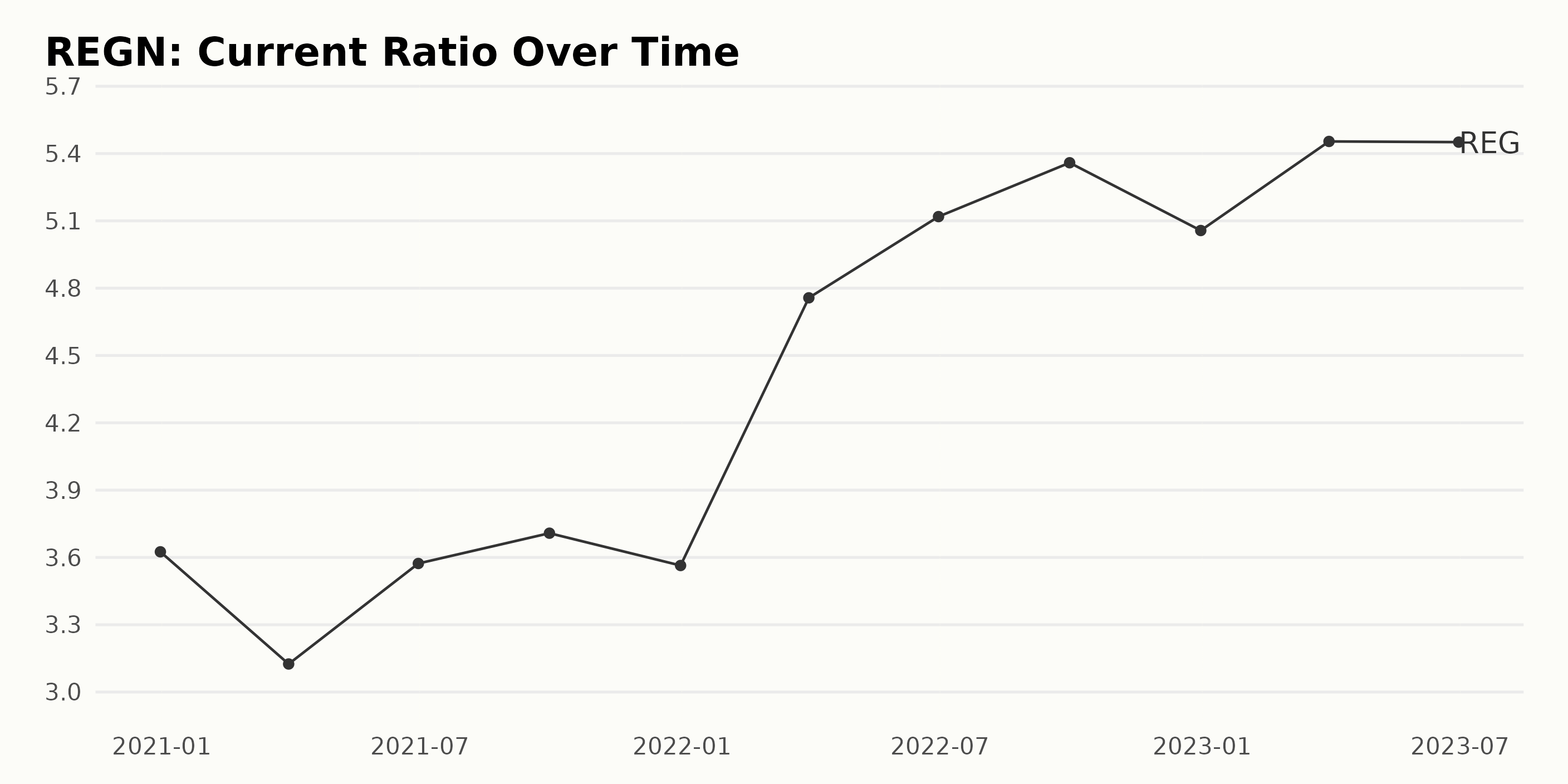

The Current Ratio of REGN has demonstrated a significant upward trend over the observed period. Commencing from a Current Ratio of 3.63 at the end of December 2020 to reaching a higher ratio of 5.45 by the end of June 2023. There have been minor fluctuations throughout this period with slight decreases observed at the end of December 2021 and again towards the end of December 2022. Below are the key points showing this progression:

- By the end of March 2021, the Current Ratio had dipped slightly to 3.13.

- Post this drop, a steady recovery is seen through to September 2021, with the value peeking at 3.71.

- A minor decrease to 3.56 was observed at the end of December 2021.

- Subsequently, the first noticeable increase in the Current Ratio occurred, leaping to 4.76 at the end of the first quarter of 2022.

- The growth continued until September 2022, with the Current Ratio reaching its then peak at 5.36.

- A small decline to 5.06 marked the end of December, 2022.

- Despite this, 2023 started off strong with the Current Ratio bouncing back to 5.45 by the end of the first quarter and holding steady through the second quarter.

This indicates an overall growth rate of approximately 50% in the Current Ratio of Regeneron Pharmaceuticals Inc. over the 2.5 years observed period, although there were some periodic fluctuations. This growth suggests that the company’s ability to cover its liabilities using its current assets has improved significantly, which is a positive indicator for the financial health of the organization.

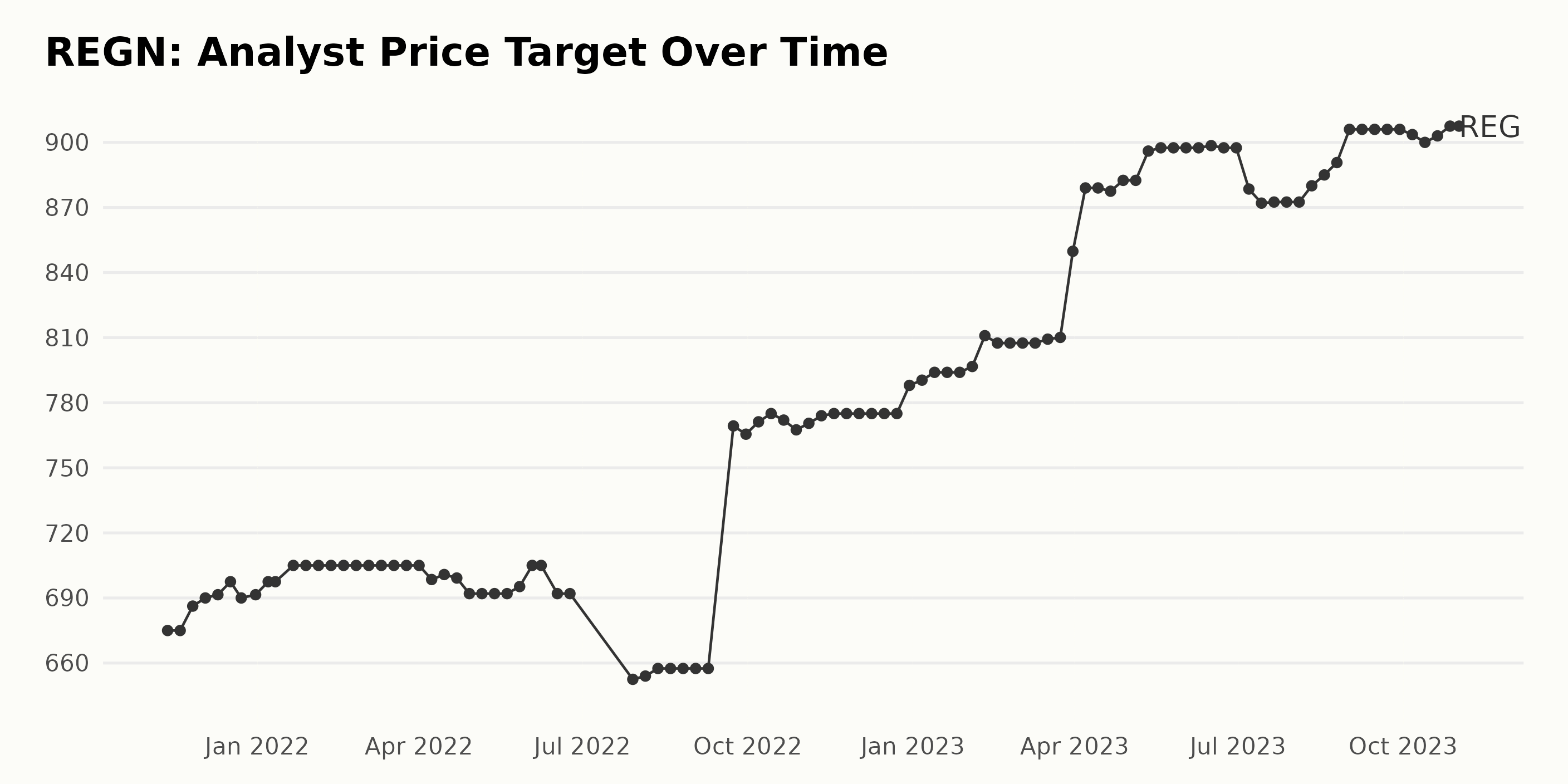

The Analyst Price Target (APT) of Regeneron Pharmaceuticals Inc. (REGN) has shown some variation over the past few years, with specific emphasis on more recent trends.

- Starting from November 12, 2021, the APT was $675. The series saw minor fluctuations early on then hit a relative high of $705 in January 2022, maintaining this value until early April 2022.

- It saw a drop to $692 by late May of 2022, then experienced another significant dip to $652.5 by late July.

- The APT began recovering afterwards, shooting up dramatically to $769.3 in late September, and continued to fluctuate within this range.

- A notable increase occurred around late March 2023 when the APT jumped from $810.1 to $849.8, ultimately reaching a peak value of $896 in May before seeing slight fluctuations.

- After June 2023, however, there seems to have been a gradual decrease in the APT, with dips and rises ranging between $872 and $906 respectively. As of the last measured date on November 1, 2023, the APT was at $907.5.

Comparing this value with the first recorded value, it represents an approximate growth rate of 34.44%, suggesting an overall upward trend despite fluctuations across the series. It may be noted that while the APT has seen fluctuations, the general trend over the timeline indicates a positive growth rate, thus showing an overall increase in Analyst Price Targets for REGN.

Regeneron Pharmaceuticals’ Stock Trends: An Analysis of Gains and Losses in 2023

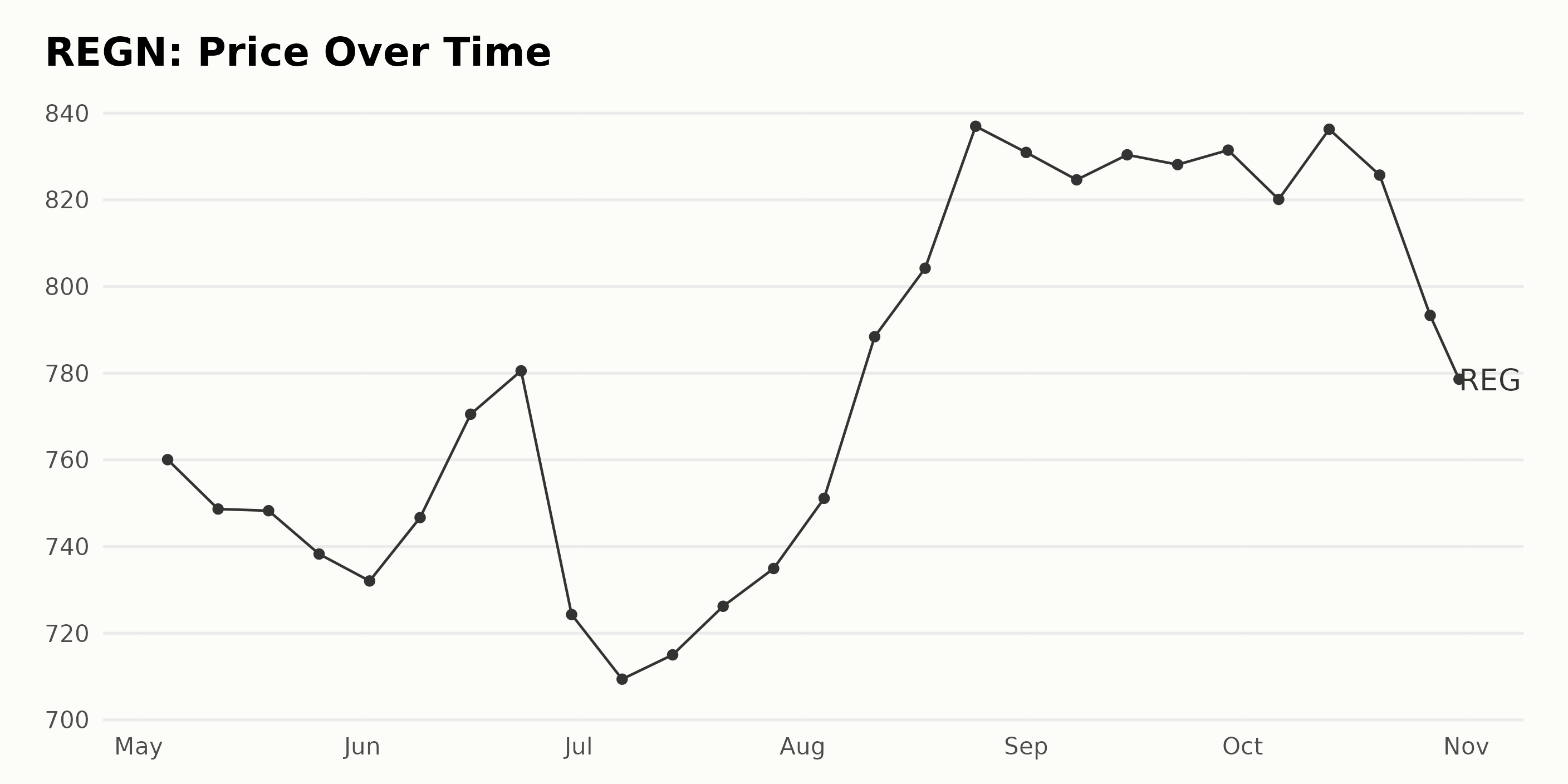

From the dataset provided, the trend for the share price of Regeneron Pharmaceuticals Inc. (REGN) from May to October 2023 is generally upward, although with some fluctuation.

- Starting from $760.05 on May 5, 2023, there is a short-term decline in May that ends at $738.27 by May 26, 2023.

- The price then starts climbing, reaching a peak of $780.55 by June 23, 2023.

- There is a brief dip after this peak dropping down to $709.39 by July 7, 2023.

- Fromhere, we see another upward trend starting, which accelerates and culminates with the price reaching a high of $836.97 by August 25, 2023.

- After late August, the price fluctuates but generally stays above $800, until a steep fall at the end of October, when it ends up at $778.61.

The growth rate of REGN prices over this period is not consistent. Initially, it was decreasing in May 2023, then started increasing until June 23, 2023. There’s a decrease again until early July, followed by an increase that accelerates until August 2023. The growth rate then slows down and finally becomes negative towards the end of October 2023. In conclusion, while an overall increase in share price can be observed from May to October 2023, there were periods of acceleration and deceleration within this overall upward trend. The most notable period of acceleration was from mid-July to late-August 2023. Here is a chart of REGN’s price over the past 180 days.

Assessing Regeneron Pharmaceuticals’ Performance: A Value, Quality and Momentum Analysis

REGN has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #23 out of the 355 stocks in the Biotech category.

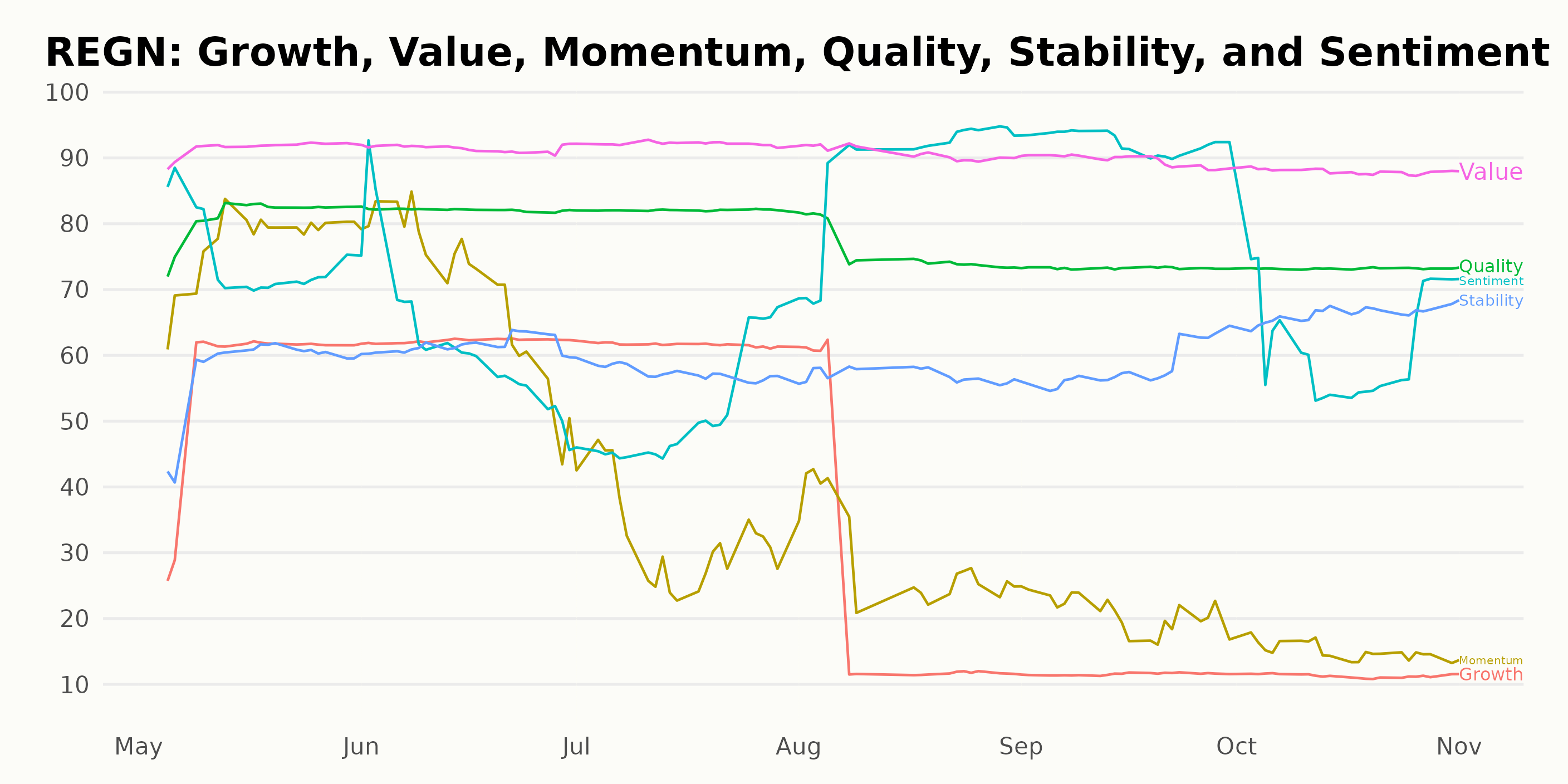

The POWR Ratings for REGN across the announced dimensions provides a significant overview of the company’s performance. The three most noteworthy dimensions over the observed period are Value, Quality, and Momentum. Let’s examine each of these dimensions:

Value: REGN maintained high POWR ratings for Value, indicating it was potentially undervalued relative to its intrinsic worth. The company had the highest ratings in this dimension over the observed period, maintaining a steady score above 90 May to September 2023, before seeing a slight decrease to 88 in October and November 2023.

Quality: The Quality dimension also consistently saw high ratings, starting with a score of 81 in May 2023, which rose marginally to 82 in June and July before showing a small decline during the late summer and autumn months, recording 76 in August, then 73 from September to November. Still, Quality remains one of REGN’s strongest aspects, which signifies well-managed debt, high return on equity, and sound financial health.

Momentum: In the case of Momentum, noticeable trends can be identified. Starting at 77 in May, the rating dipped mildly to 70 by the end of June 2023. However, a sharp downfall in the Momentum rating began in July, with ratings plunging to 32. This trend continued into the autumn months, presenting clear downward momentum, where Momentum hit its lowest, recorded at 14 in November 2023.

How does Regeneron Pharmaceuticals Inc. (REGN) Stack Up Against its Peers?

Other stocks in the Biotech sector that may be worth considering are Otsuka Holdings Co Ltd (OTSKY), Gilead Sciences Inc. (GILD), and Jazz Pharmaceuticals plc (JAZZ) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

REGN shares were trading at $786.20 per share on Wednesday afternoon, up $6.31 (+0.81%). Year-to-date, REGN has gained 8.97%, versus a 10.95% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Regeneron Pharmaceuticals (REGN) Earnings Analysis -- Should Investors Brace for Impact? appeared first on StockNews.com