Movado Group, Inc. (MOV), one of the world's premier watchmakers, places significant emphasis on innovative design approaches, product development, and strategic marketing endeavors. With these robust commitments, the company seeks to affirm its industry-leading position while also fostering sustainable growth and lucrative returns for its investors.

MOV has seen its revenue grow at a CAGR of 8.6% over the past three years, while its EBITDA grew at a CAGR of 63.2% over the same period.

Despite expectations of a challenging retail landscape in the immediate future, the company looks well-positioned to generate stable long-term returns. “We are committed to investing in our brand-building efforts and expect these initiatives to generate strong return on investment and enhance our growth potential over the medium and long term,” Efraim Grinberg, Chairman and Chief Executive Officer, stated.

Furthermore, anticipations for robust holiday expenditure have surged, with projections by the National Retail Federation indicating record-breaking levels during November and December. It predicts a growth between 3% and 4% over 2022, to figures between $957.30 billion and $966.60 billion.

With holiday sales growth returning to pre-pandemic levels, Movado Group presents a promising investment opportunity. Further, a review of key metrics validates an encouraging perspective: MOV is poised for success.

Analysis of Movado Group Inc.'s Economic Performance: Trends, Fluctuations, and Growth (2021-2023)

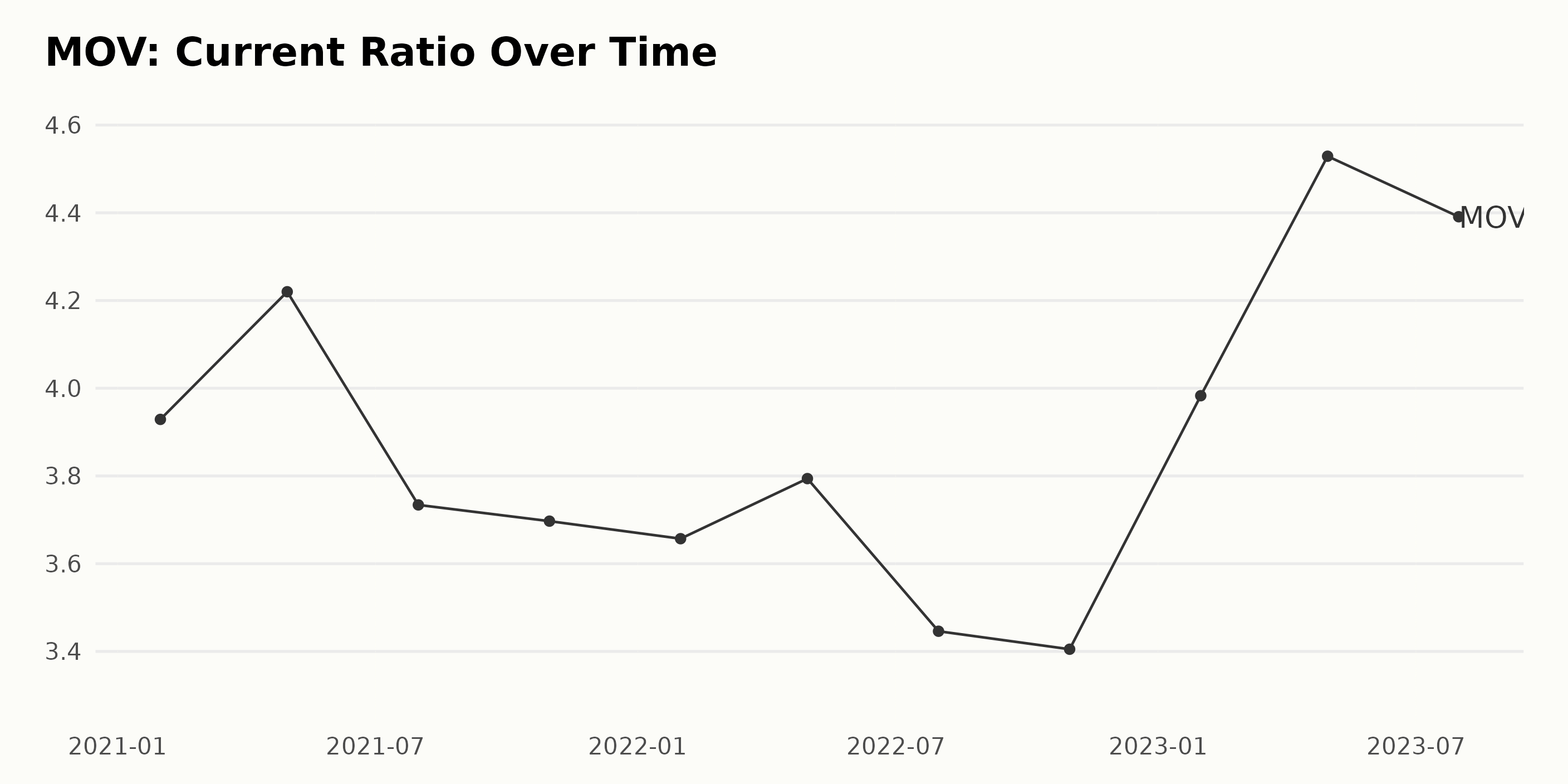

The data series illustrates the trend and fluctuations in the Current Ratio of the publicly traded US company Movado Group Inc. (MOV) from January 2021 to July 2023.

Key Points:

- The Current Ratio kicked off at 3.93 in January 2021, peaked at 4.22 in April 2021, then experienced a slight decrease to 3.70 by October 2021.

- From January 2022, there was a fluctuation, with a quick rise to 3.79 in April 2022, then dipped to 3.41 by October 2022.

- In January 2023, the Current Ratio significantly rose again to 3.98, reaching its highest point in the series at 4.53 in April 2023. By July 2023, it declined slightly to 4.39.

Overall, between January 2021 and July 2023, the Current Ratio of Movado Group Inc. demonstrated a growth rate of around 11.71%. This is calculated by the increase from the first value of 3.93 to the last value of 4.39 over the period.

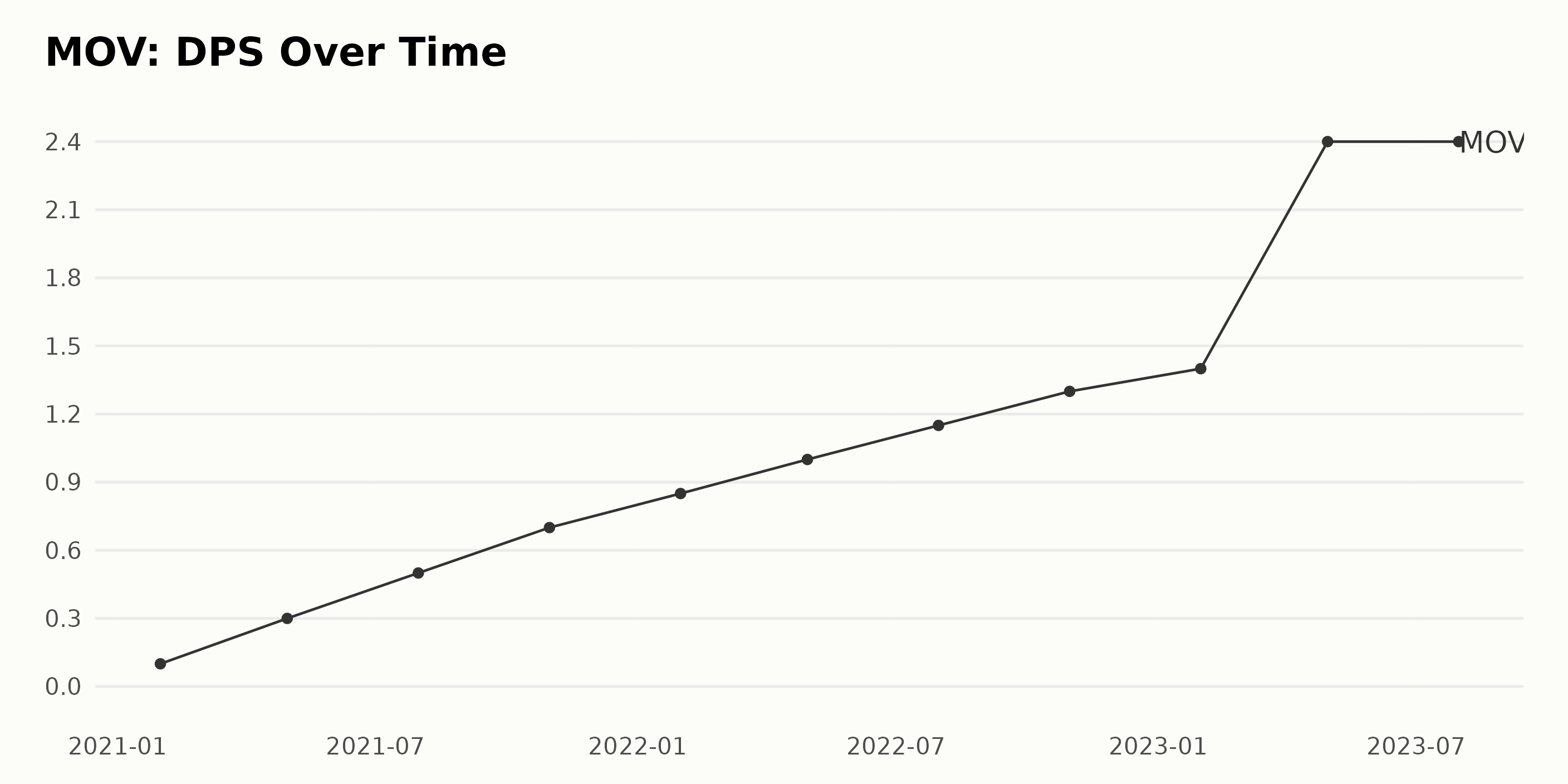

The DPS of MOV has shown a constant increase over a span of 2 years, from January 2021 to July 2023.

- The company started at a low of $0.1 in January 2021.

- The DPS value spiked to $0.3 by April 2021, marking a growth of 200% within the first three months.

- By July 2021, it rose further to $0.5.

- In October 2021, there was another significant rise, with the DPS reaching $0.7.

- As of January 2022, the value increased to $0.85.

- In April 2022, MOV hit the $1 mark.

- Continuing its growth trajectory, the DPS further increased to $1.15 in July 2022 and reached $1.3 by October 2022.

- It grew marginally to $1.4 in January 2023.

- The most significant spike was seen in April 2023, where the DPS jumped to $2.4, maintaining the same through July 2023.

Overall, the DPS of Movado Group Inc. saw a growth rate of 2300% over the reported period. This represents an extraordinary expansion for the company which has recently been maintaining its highest DPS value of $2.4 as of July 2023, showing strong stability after the last significant jump.

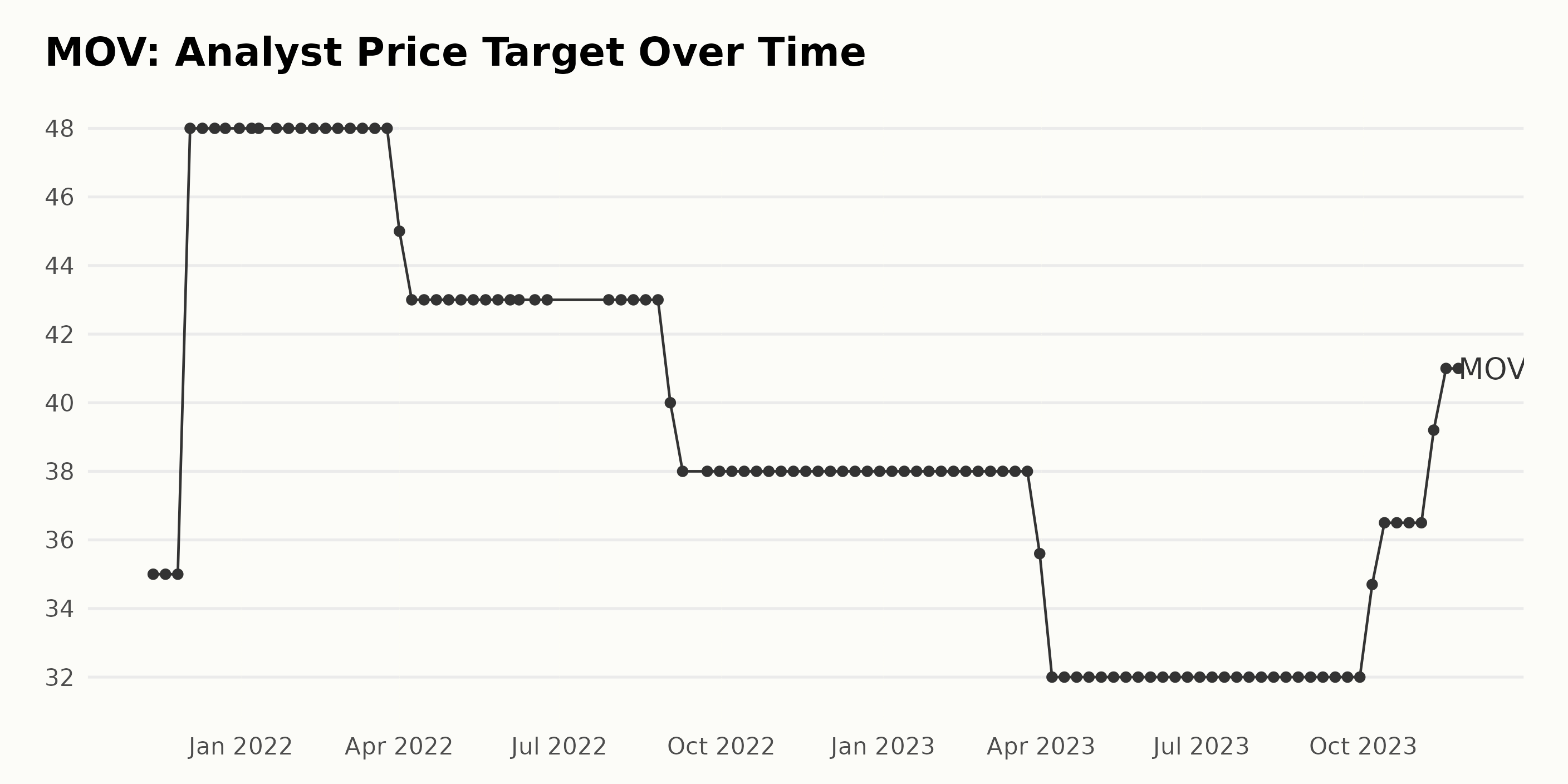

The data series showcases the Analyst Price Target for MOV from November 2021 to November 2023:

- In November 2021, the Analyst Price Target started at $35.

- It then saw a significant increase of 37% to $48 by December 2021, where it remained constant until April 2022.

- From April 2022, there was a gradual decrease in the price target, first to $43, followed by further drops to $40 in September, and then to $38, remaining constant at this figure to March 2023.

- In April 2023, the Analyst Price Target dropped to $32, holding steady till October 2023.

- Finally, there was an uptick in the last quarter of 2023 with an increase to $34.7 in October, and by mid-November, the price target recovered to its previous high of $41.

This indicates that across the two-year span, the Analyst Price Target for Movado Group Inc. grew by approximately 17.14%.

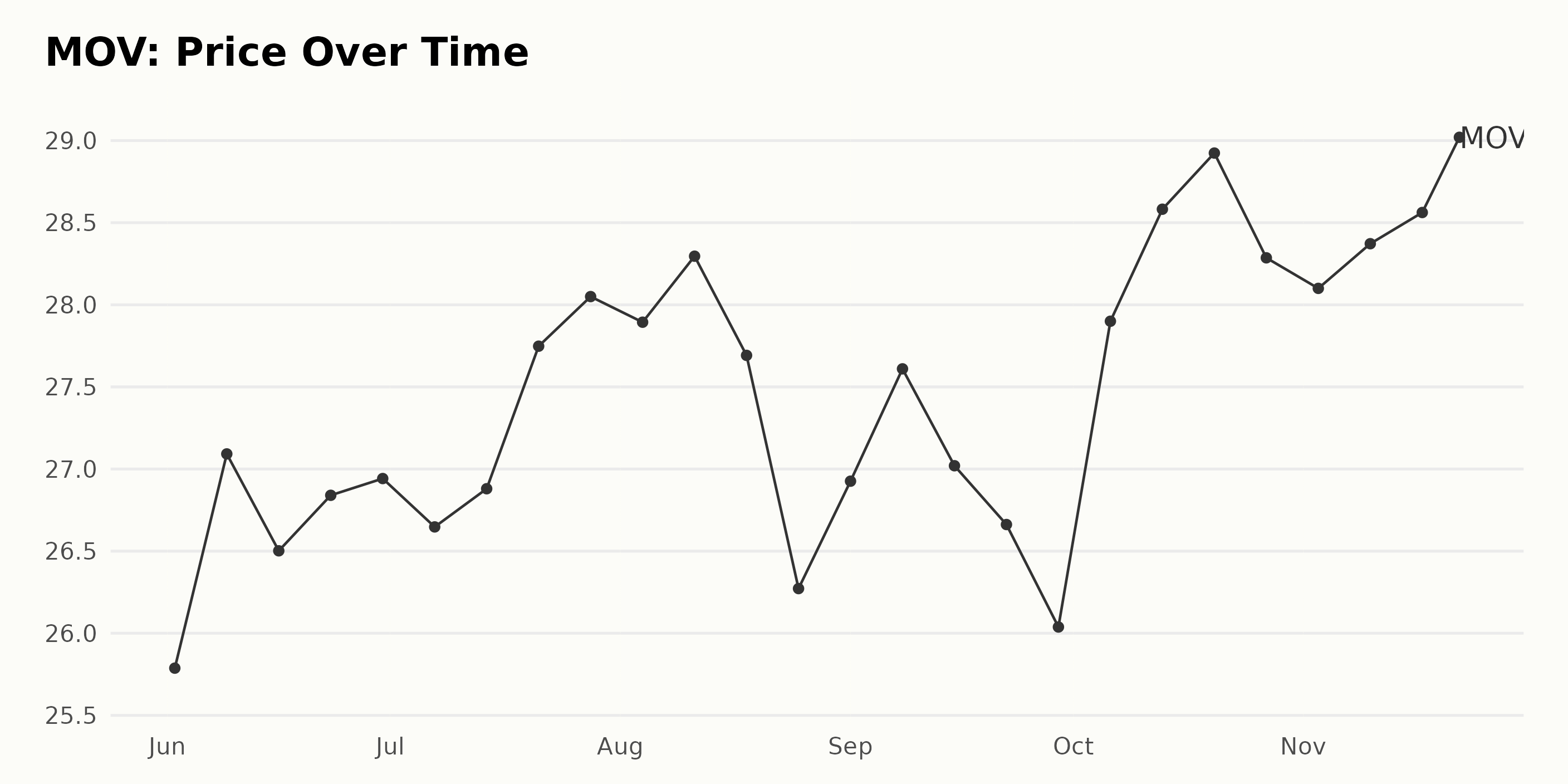

2023 Mid-Year Financial Review: Movado Group's Share Price Showcases Promising Growth Trend

Analyzing the provided data from June to November 2023, the share price of Movado Group Inc. (MOV) fluctuated but overall exhibited a positive growth trend:

- On June 2, 2023, the share price was $25.79.

- There was a slight rise in the shares with a price of $27.09 as of June 9, 2023.

- The share price fluctuates over June, with the highest value being $27.09 and concluding the month at approximately $26.94.

- In July 2023, the share prices started with $26.65 and saw moderate fluctuations. The peak value in July was at the end of the month at $28.05.

- The shares reached their highest from this data set on August 11, 2023, with $28.30 before dipping to $26.27 by August 25, 2023.

- Throughout September 2023, the share prices oscillate between $26.04 to $27.61.

- October 2023 began with a surge to $27.90 and at its peak on October 20, 2023, reaching $28.92, before falling slightly to $28.29 toward the month's end.

- The share prices remained relatively steady throughout November 2023, finishing the month at an all-year high of $29.02.

To summarize, MOV shares experienced fluctuations within a range of approximately $3 ($25.79 to $29.02) from June through November 2023. Despite short-term ups and downs, the overall trend for the MOV share price within this period is upward, indicating promising growth. By November 2023, the shares had gained approximately $3.23 compared to June 2023, a growth of around 12.54%. Please note that market conditions and numerous factors could affect share price performance, and historical trends might not reliably predict future trajectories. Here is a chart of MOV's price over the past 180 days.

Assessing Movado Group's Performance: Value, Quality, and Sentiment Ratings

MOV has an overall B rating, translating to a Buy in our POWR Ratings system. It is ranked #7 out of the 63 stocks in the Fashion & Luxury category.

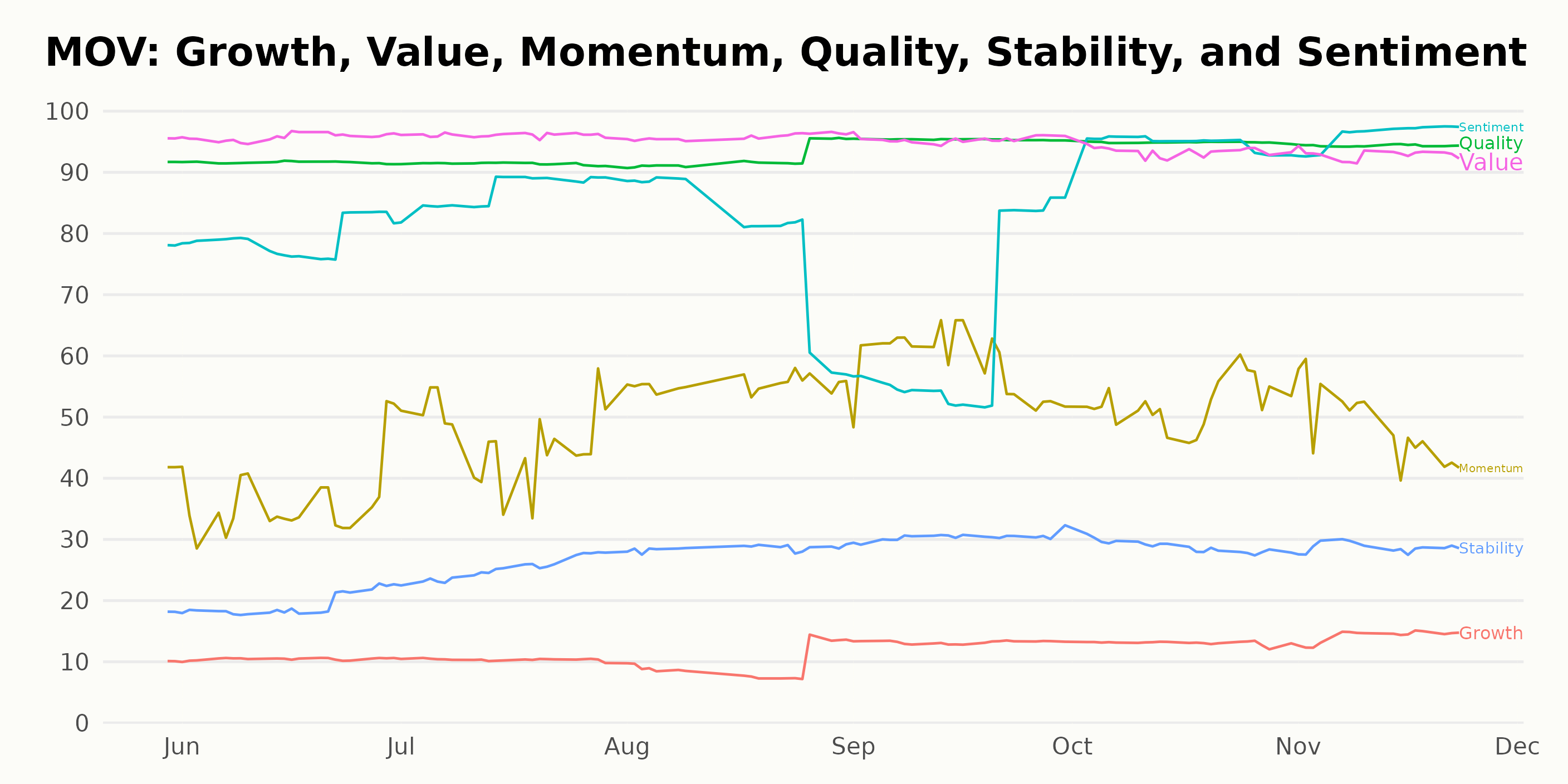

The POWR Ratings for MOV along three noteworthy dimensions - Value, Quality, and Sentiment show interesting patterns.

Value: Movado Group demonstrates a consistently high-value score in the POWR Ratings. In May 2023, the Value rating stands at 96 which stays consistent until July 2023. It drops slightly to 95 in September 2023, falls further to 93 in October 2023, and remains at this level in November 2023. Despite these slight variations, overall, MOV shows exceptional strength in the Value dimension throughout.

Quality: Similarly, the Quality rating of Movado Group is significantly high throughout the period. Starting from 92 in May 2023, the rating maintains a similar level till August 2023. However, it sees a boost in September and October 2023 when the rating increases to 95. It then decreases slightly to 94 in November 2023. This indicates sustained high quality through the period.

Sentiment: The Sentiment dimension displays a dynamic trend. From a rating of 78 in May 2023, the sentiment improves to 87 by July 2023. It then experiences a drop in September 2023 with a low of 64 before seeing significant improvement to reach a peak of 96 in November 2023. This fluctuation indicates changes in market sentiment towards Movado Group over this period.

These ratings provide insight into the performance and market perception of Movado Group Inc. across these critical dimensions and will be interesting to monitor in the future for potential investment decisions.

How does Movado Group Inc. (MOV) Stack Up Against its Peers?

Other stocks in the Fashion & Luxury sector that may be worth considering are Weyco Group Inc. (WEYS), and J. Jill Inc. (JILL) -- they have better POWR Ratings.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

MOV shares were trading at $28.71 per share on Friday afternoon, up $0.14 (+0.49%). Year-to-date, MOV has declined -4.06%, versus a 20.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Movado Group (MOV) Your Go-To Luxury Goods Stock This Holiday? appeared first on StockNews.com