Every investor wants to know how to find the next Apple or Nvidia … Before the stock price explodes.

While no one can guarantee you’ll find the next monster stock, the right stock software is the first step to unearthing undervalued companies.

So what’s the best stock analysis software? No matter what program you choose, it should offer the analysis to help you trade smarter, whether you’re a technical or fundamental trader.

What does that mean? Keep reading…

The Two Primary Types of Stock Analysis Software & AppsDo you consider yourself a fundamental or technical investor? Your stock software should match your style.

Although both are used to make investment decisions, almost all investors lean one way or the other. Let’s take a look at the difference

- Fundamental Analysis: For buy-and-hold investors looking for tools to interpret a company’s financial statements, earnings, and key ratios to make long-term buying decisions

- Technical Analysis: For day traders looking for backtesting, chart analysis, and pattern recognition tools to capitalize on short-term price changes

Below, you’ll find a list of the Best Stock Analysis Software & Apps within these 2 categories, with details on features, the type of investor it’s for, and pricing.

Here’s the list of the best stock software for both styles of analysis:

The Best Fundamental Analysis Software & Apps in 2024- StockNews

- WallStreetZen

- Seeking Alpha

- Morningstar

- TradingView

- thinkorswim

- TrendSpider

Are you a fundamental analysis type of investor? Here are the best stock analysis apps for you.

1. StockNewsIn our (biased) opinion, StockNews offers some of the best stock analysis software. But don’t just take our word for it. There are plenty of reasons why investors consider StockNews the best stock software for fundamental analysis.

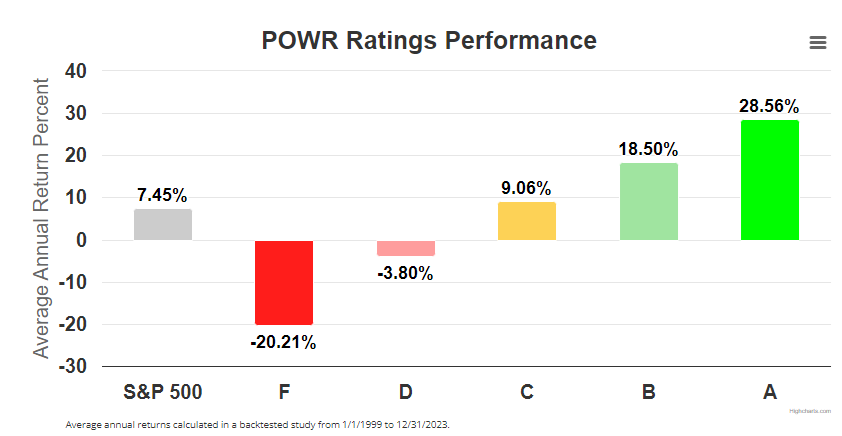

Let’s start with their proprietary POWR rating system. To come up with a rating for a given stock, the service evaluates 118 different factors for every stock. The combination of factors leads to a grade — and as you can see, “A” rated stocks (the highest rating) have delivered superior performance:

Source: StockNews

The POWR rating gives you a simple way to “take the temperature” of a given stock. No, you shouldn’t make investment decisions solely based on the score, but they can definitely strengthen your investment thesis. In addition to stocks, StockNews also rates ETFs.

But the POWR ratings aren’t the only selling point or the only reason why StockNews is considered one of the best stock analysis apps. It also boasts several other tools, including watchlists, screeners, and upgrades and downgrades.

If you want a leg up on your due diligence process, StockNews also offers a number of paid services / stock alerts where you can get specialized updates within an investing area of interest, such as low-priced stocks (the POWR Stocks Under $10 alert system), or gain access to a seasoned investor’s portfolio and trades with Reitmeister Total Returns, which is run by the site’s lead, Steve Reitmeister, who has four decades of market experience.

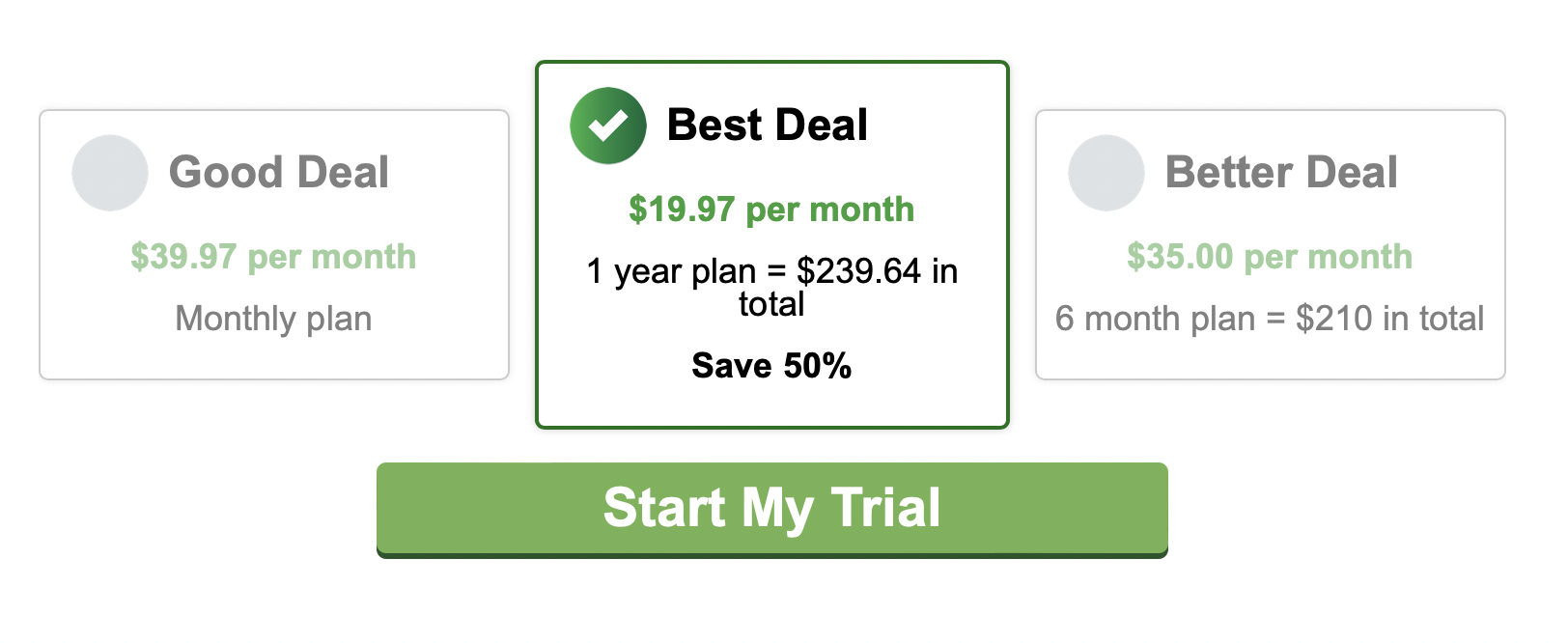

Who It’s ForWith a robust suite of stock research tools and alerts systems, StockNews is ideal for investors who like to do their own research but don’t have a lot of time. It speeds up the due diligence process and makes it easy to get a read on securities quickly and easily.PricingStockNews has a few different pricing options — the best deal for Premium access is the 1-year plan. It also offers a low-cost trial, which is a great way to test the waters before you commit.

Source: StockNews

2. WallStreetZenSource: WallStreetZen

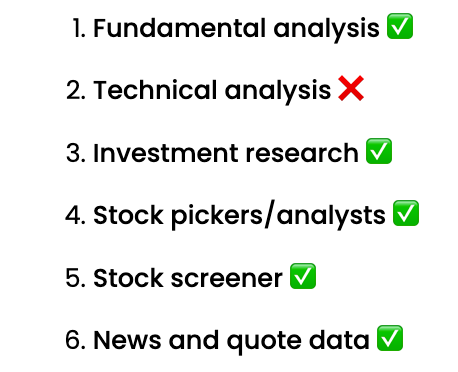

Looking for the best stock analysis software for fundamental investors? WallStreetZen is one of the best stock analysis software for fundamental investors in 2024.

This stock analysis software aggregates the latest financial data and performs deep fundamental analysis automatically, so you can interpret a stock’s fundamentals in minutes. It also provides simple, one-line explanations so you know the exact methods going into its calculations.

As mentioned above, WallStreetZen tracks the performance of stock analysts from institutions all over the world who have consistently proven their ability to pick huge winners (more on this below).

If you’re looking to perform fundamental analysis, generate new stock ideas, screen companies based on the criteria you find most important, or get stock picks from top analysts, WallStreetZen is the best stock program for you. Here are some of the highlights:

Zen ScoreThe proprietary Zen Score provides a quick overview of fundamental strengths and weaknesses, generated in seconds. The Score and its 5 dimensions serve as the high-level overview of fundamental analysis of a stock’s Valuation, Financials, Forecast, Performance, and Dividend.

With the Zen Score, you can look at the company as a whole and also look at each of the individual categories noted above.

Then, to round out your research, you can check out a given stock’s Forecast page, which includes a consensus from top-rated analysts as well as links to individual analyst ratings so you can see the “why” behind Strong Buy or other ratings.

Top AnalystsTop Analysts is a list of nearly 4,000 analysts from around the world. Beyond just sourcing their research reports, WallStreetZen ranks each analyst based on their returns, consistency, and win rate over multiple years, so you can get stock ideas and forecasts from proven performers.

For instance, Alex Henderson, a Top 1% Analyst, has had some huge wins in the Tech sector:

Source: WallStreetZen

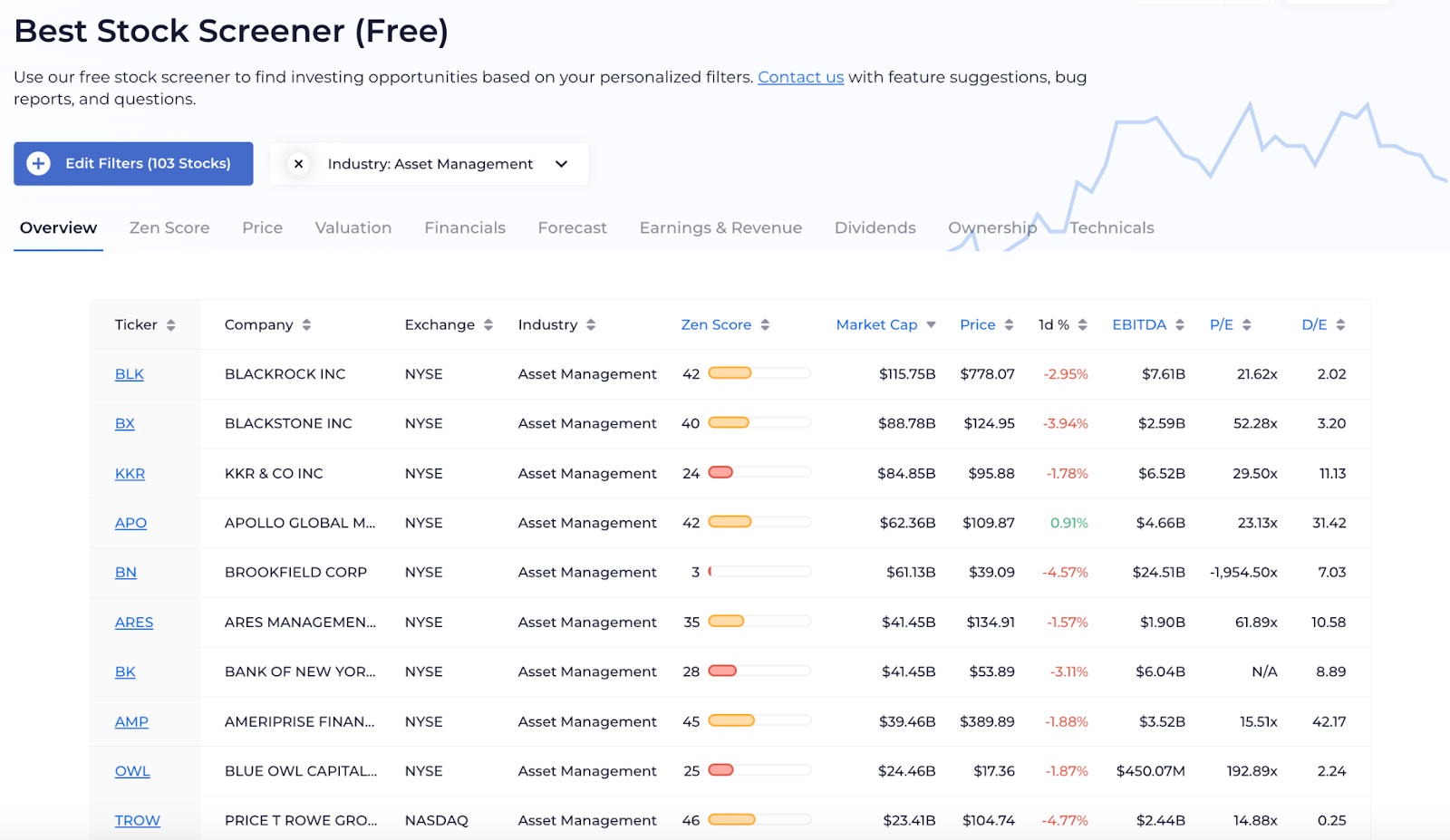

Stock ScreenerThe WallStreetZen Stock Screener makes it easy to turn your personal preferences into investment ideas by allowing you to filter qualitative and quantitative criteria:

Source: WallStreetZen

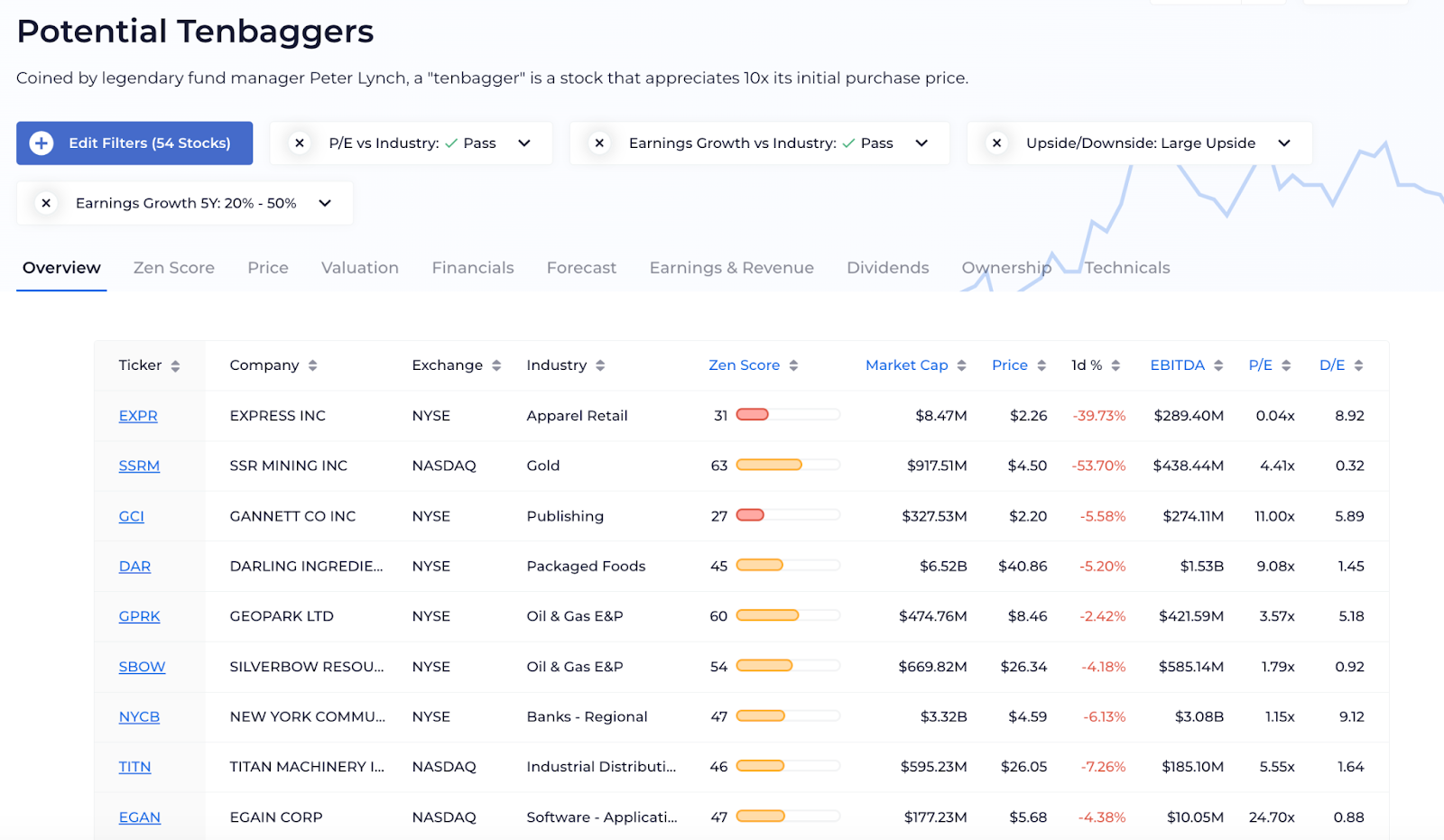

If you’re not sure where to start for stock criteria, check out a library of pre-built Stock Ideas, with categories including, but not limited to:

- Best Stocks Under $10

- Bullish Insider Buys

- Stable Stocks

- Undervalued Stocks

- Potential ‘tenbaggers’

Source: WallStreetZen

Plus, unlike most stock analysis software platforms, WallStreetZen offers the vast majority of its features for free, up to a certain number of uses per month, plus a 14-day trial of Premium.

Who It’s ForFor the fundamental investor, WallStreetZen is the best stock analysis software because its suite of tools can help guide your investing process from start to finish.

Zen Score, Top Analysts, Stock Screener and other ancillary features make this the best stock analysis software in 2024 for fundamental investors.

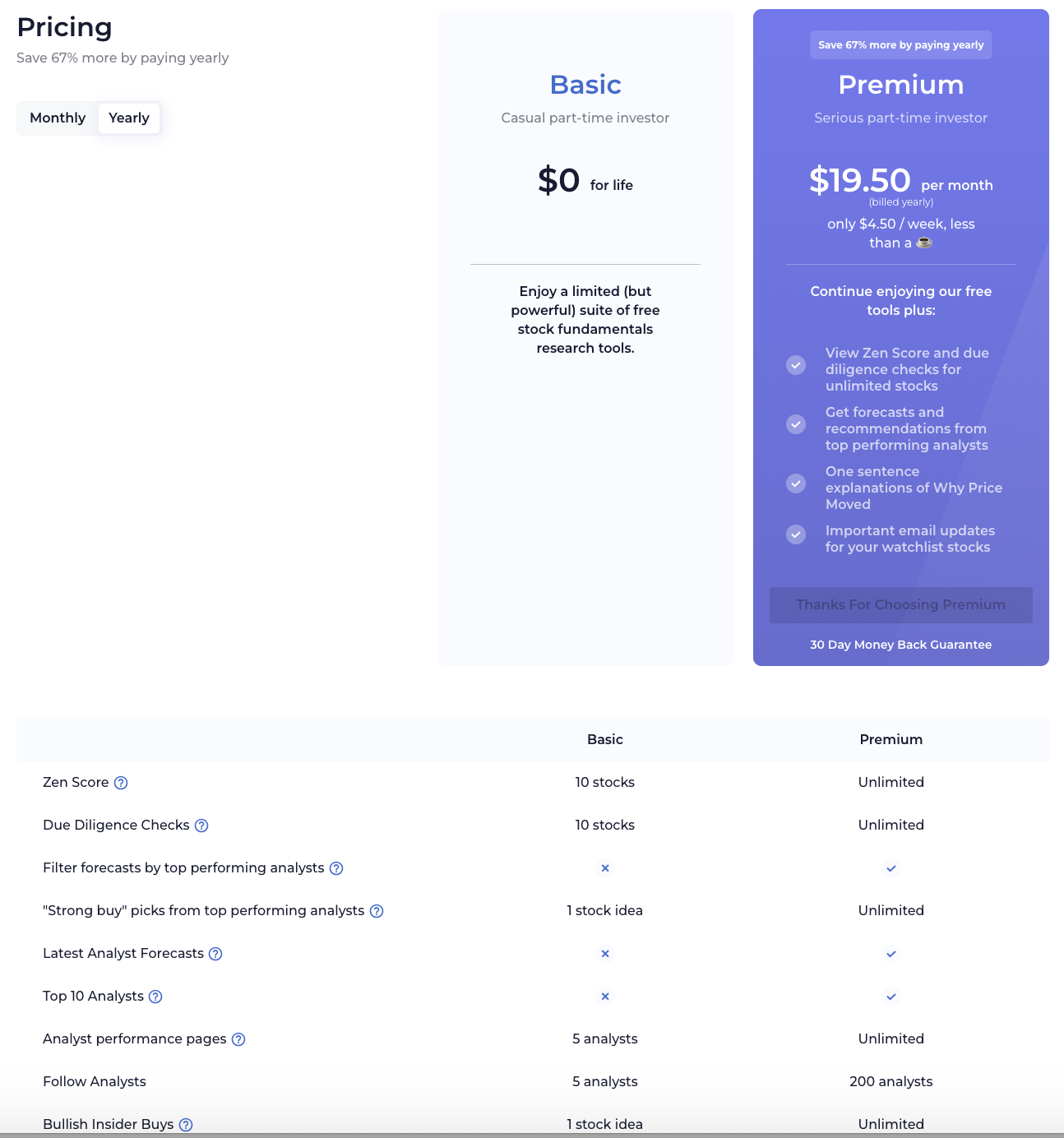

PricingWallStreetZen has two main plans — Basic and Premium:

Source: WallStreetZen

Unlike other stock analysis software, the Basic plan on WallStreetZen includes most of the Premium features. To unlock unlimited access, users will want to upgrade to Premium for $19.50/month (billed yearly).

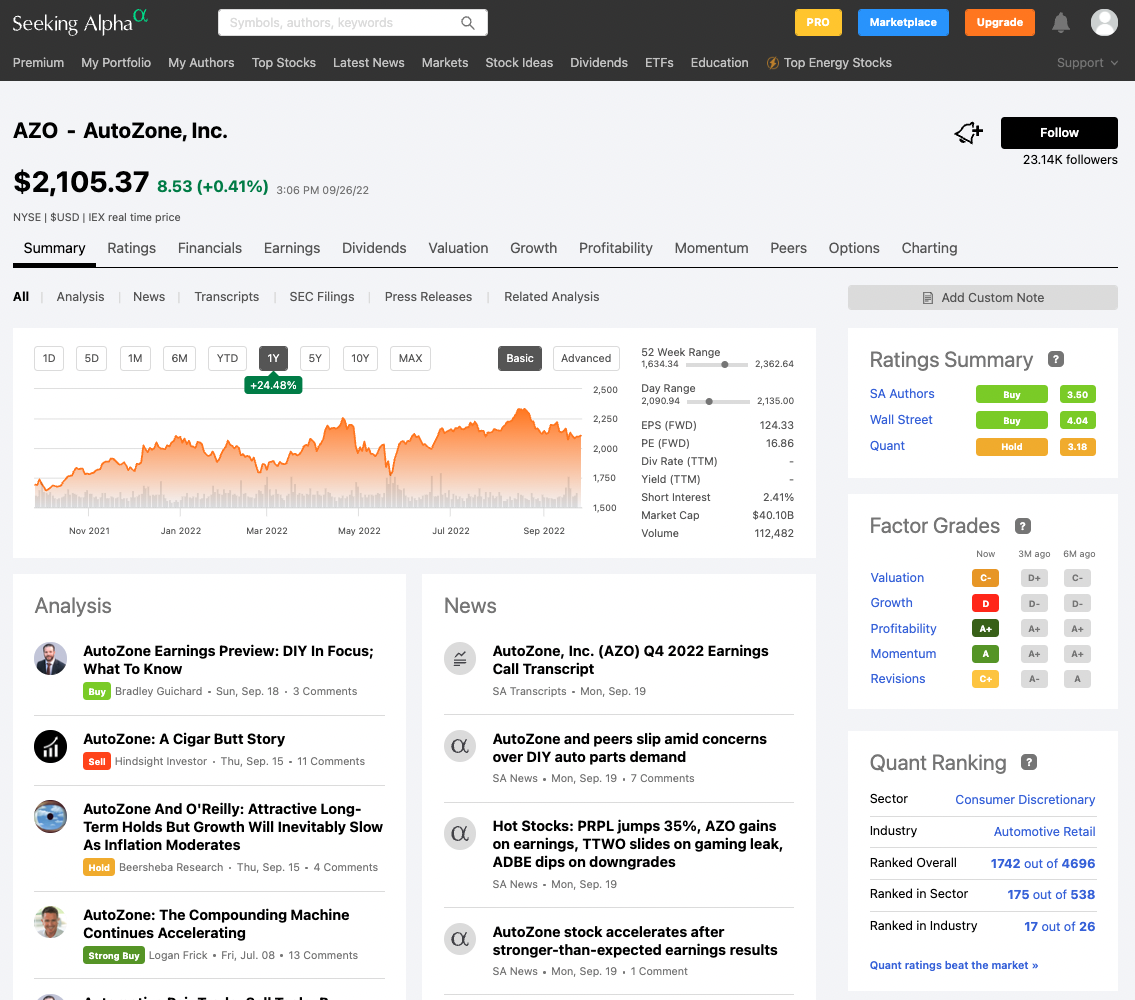

3. Seeking AlphaSeeking Alpha is unique in its approach compared to WallStreetZen. The Premium membership provides access to expert investor content (in addition to screeners and rating tools), giving it a peer-to-peer feel for investors looking for a community.

On the other hand, WallStreetZen focuses on aggregating data and utilizing tools to help guide you to make your investing decisions.

Source: Seeking Alpha

Each month, Seeking Alpha’s crowdsourced investment analysis draws approximately 20 million visitors and 2.6+ million newsletter subscribers. Over 18,000 people have contributed articles and blog posts over the years, including:

- Institutional investors

- Fund managers

- College students

- Retirees

Although technically anyone can contribute as an ‘SA Analyst,’ only top content that passes strict editing criteria makes the cut, with this top goal in mind:

“Does the analysis empower and inform investors so they can make better investment decisions?”

Seeking Alpha content covers stocks, ETFs, mutual funds, commodities and cryptocurrency. The platform works like social media where users are alerted with author buy and sell recommendations.

In addition to the community and social aspect, there are fundamental analysis components with a premium subscription. This includes Strong Buy stock picks, proprietary quant ratings, stock and ETF screeners, earnings and dividend forecasts and for the analytical investor — ten years of downloadable financial statements.

Seeking Alpha Premium is built to help make investors money and their crowdsourcing concept incentivizes SA Analysts to consistently produce insightful content that can help investors make informed decisions. This adds a layer of transparency you won’t find on other platforms.

Who It’s ForSeeking Alpha Premium is a solid stock analysis software option if you’re interested in getting investing perspective from a wide array of amateur and professional analysts. You can replicate the other’s portfolios and exchange investing ideas with your peers.

If you’re looking for a platform that simply provides tools to help you make your own investing decisions, Seeking Alpha may not be right for you.

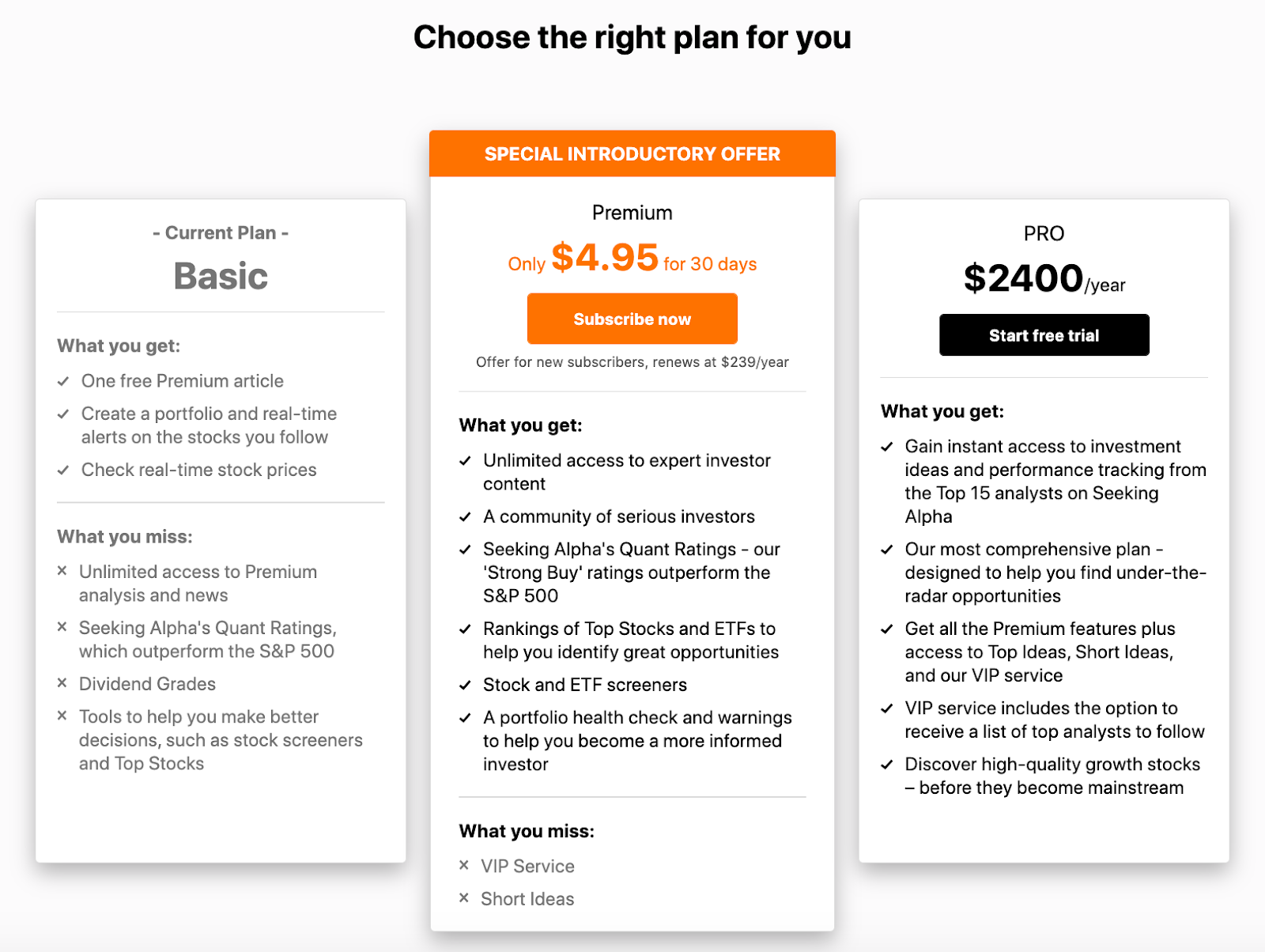

PricingSeeking Alpha has 3 tiers — Basic, Premium (best value) and Pro:

(Source: Seeking Alpha)

4. MorningstarMorningstar is one of the best stock analysis software offerings because of its proven methodology and emphasis on long-term value for the investor.

Although Morningstar may bring Wall Street to mind because of its long-standing ratings for stocks and mutual funds, its independent analysts filter out the Wall Street hype by consistently providing objective investment coverage so you can make informed decisions with confidence.

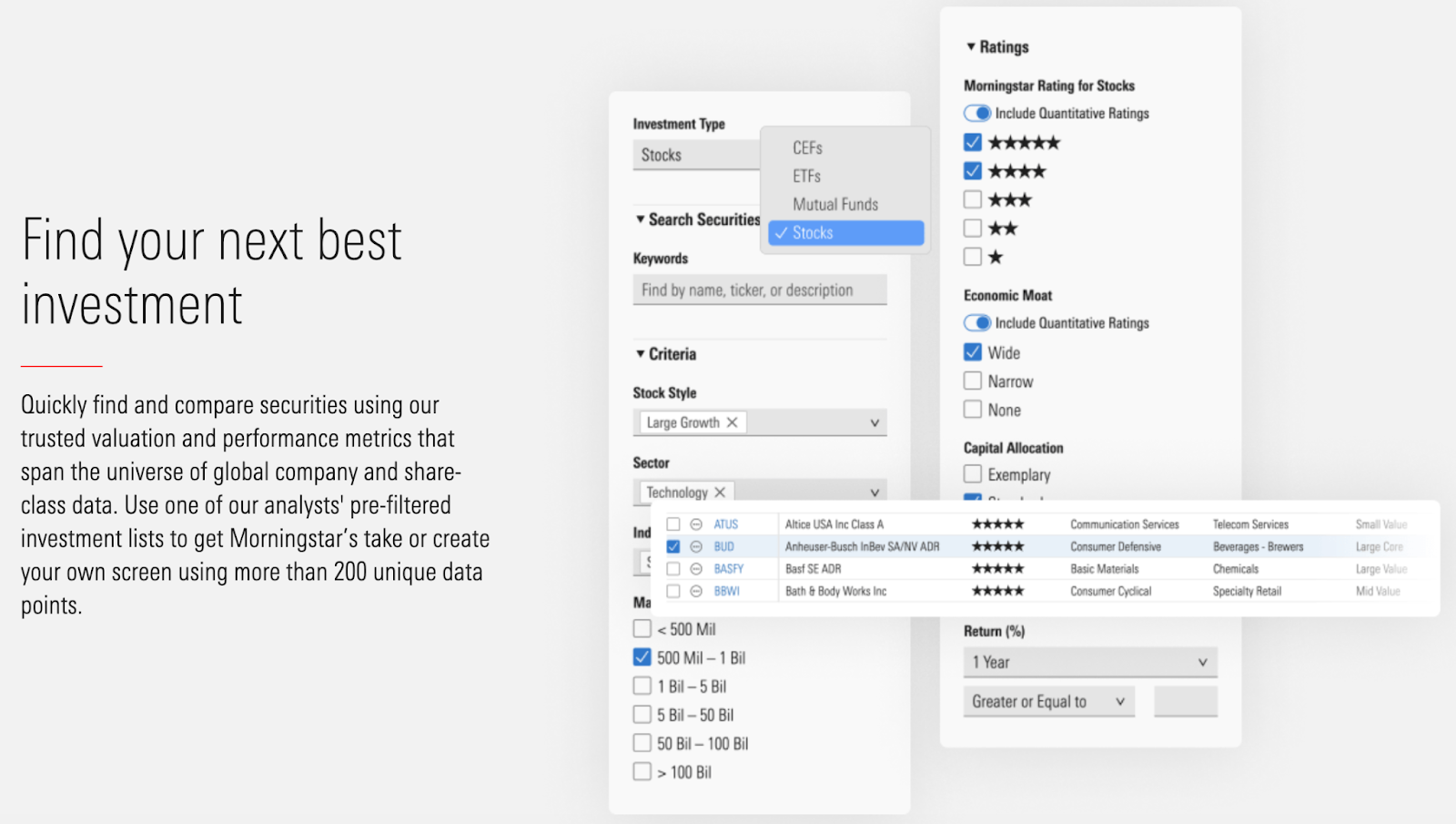

Source: Morningstar

Morningstar Investor is the platform's main stock picking software. Subscribers can build a portfolio from scratch and access research, data and tools from Morningstar’s investment experts — including commentary, news and their take on thousands of securities with reports.

Beyond the Morningstar Investor resources, the main website includes a plethora of educational articles, news, and market updates.

It should be no surprise to see Morningstar on nearly, if not all, lists for best stock analysis software. With over 12,000 employees worldwide and over 600,000 investments covered, Morningstar is one of the most credible and trusted financial companies.

Who It’s ForMorningstar Investor is a solid platform for long-term, fundamental investors looking for trusted tools to build a portfolio consisting of stocks, mutual funds and ETFs.

The general website is robust with free resources and can be overwhelming, but it is a widely trusted resource for daily financial market news.

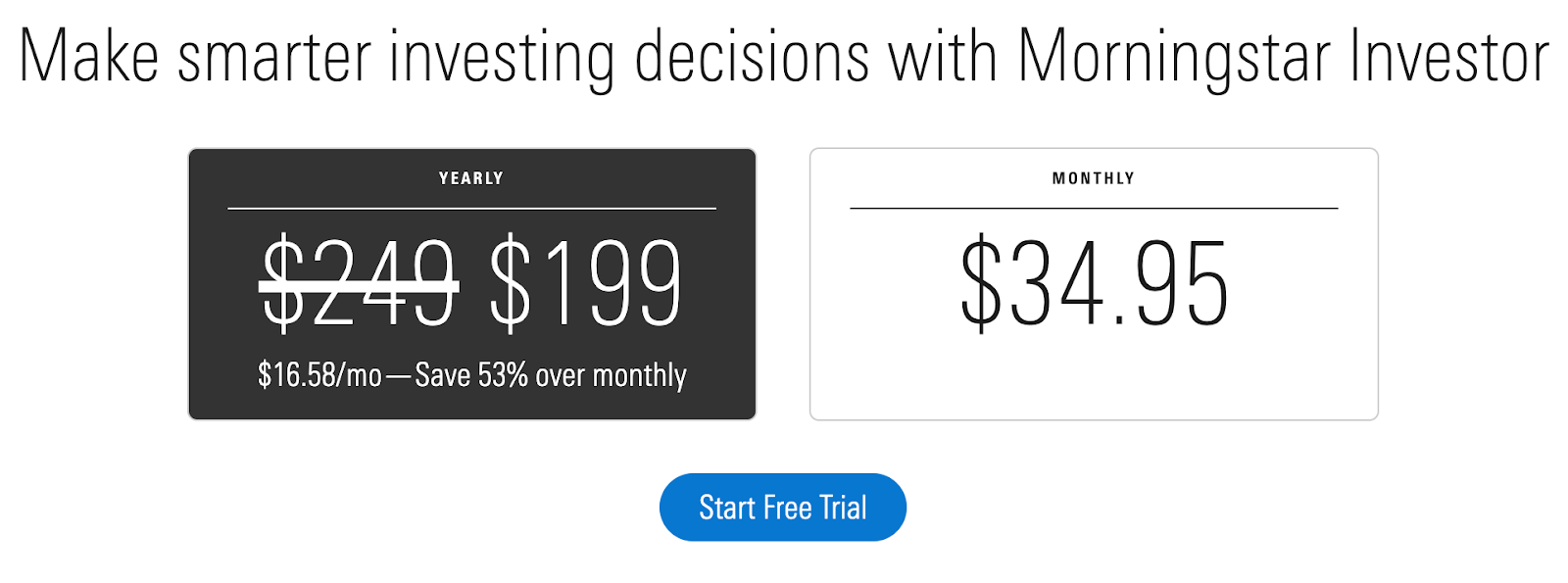

PricingMorningstar Investor pricing provides expertise, analysis, and tools and is the comparable option to other stock analysis software:

Source: Morningstar

The Best Stock Analysis Software & Apps For Technical TradersMost technical analysis software will have features similar to the fundamental software — tools, screeners, etc. Your decision will likely boil down to the layout, overall functionality and cost. Here is some of the best stock analysis software for technical traders:

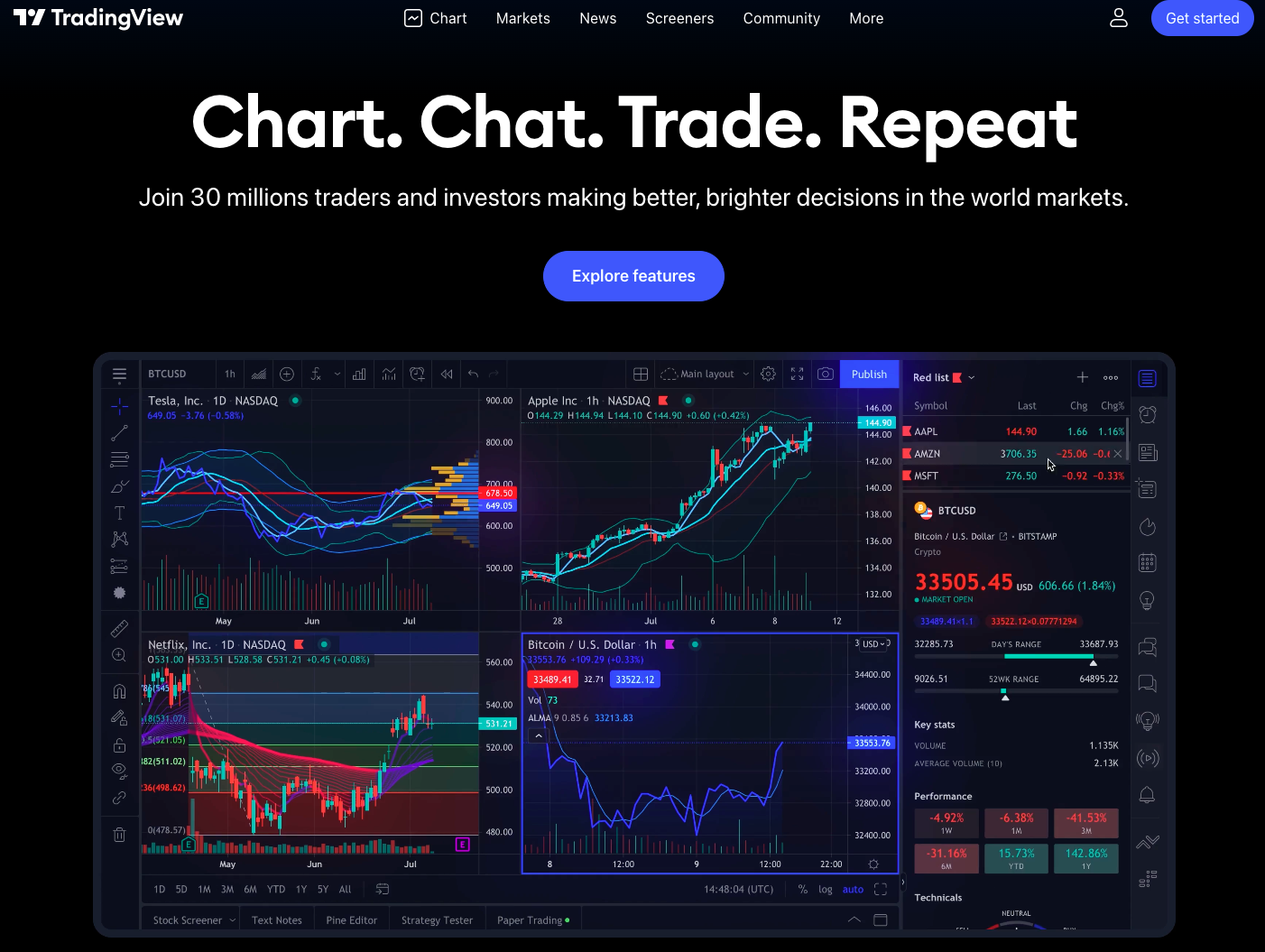

1. TradingViewTradingView is a charting platform and social media network used by 50+ million investors worldwide.

Source: TradingView

TradingView is among the best stock analysis software for beginner traders learning how to chart, since charts can be customized to be simple and you can increase the complexity as you advance. The ability to customize also makes it useful for seasoned veterans who want to build their own set of overlay functions.

The interface is intuitive and elegant, but it’s also loaded with technical analysis tools, equipped with hundreds of built-in indicators and strategies, intelligent drawing tools for in-depth analysis, including:

- 400+ built-in indicators and strategies

- 100,000+ public indicators

- 110+ smart drawing tools

- Volume profile indicators

- Candlestick pattern recognition

- Auto chart patterns

Technical stock analysis software — done right.

Plus, it offers a social network for your financial life. TradingView allows you to share predictions, market analysis and trade set-ups with other investors in the community.

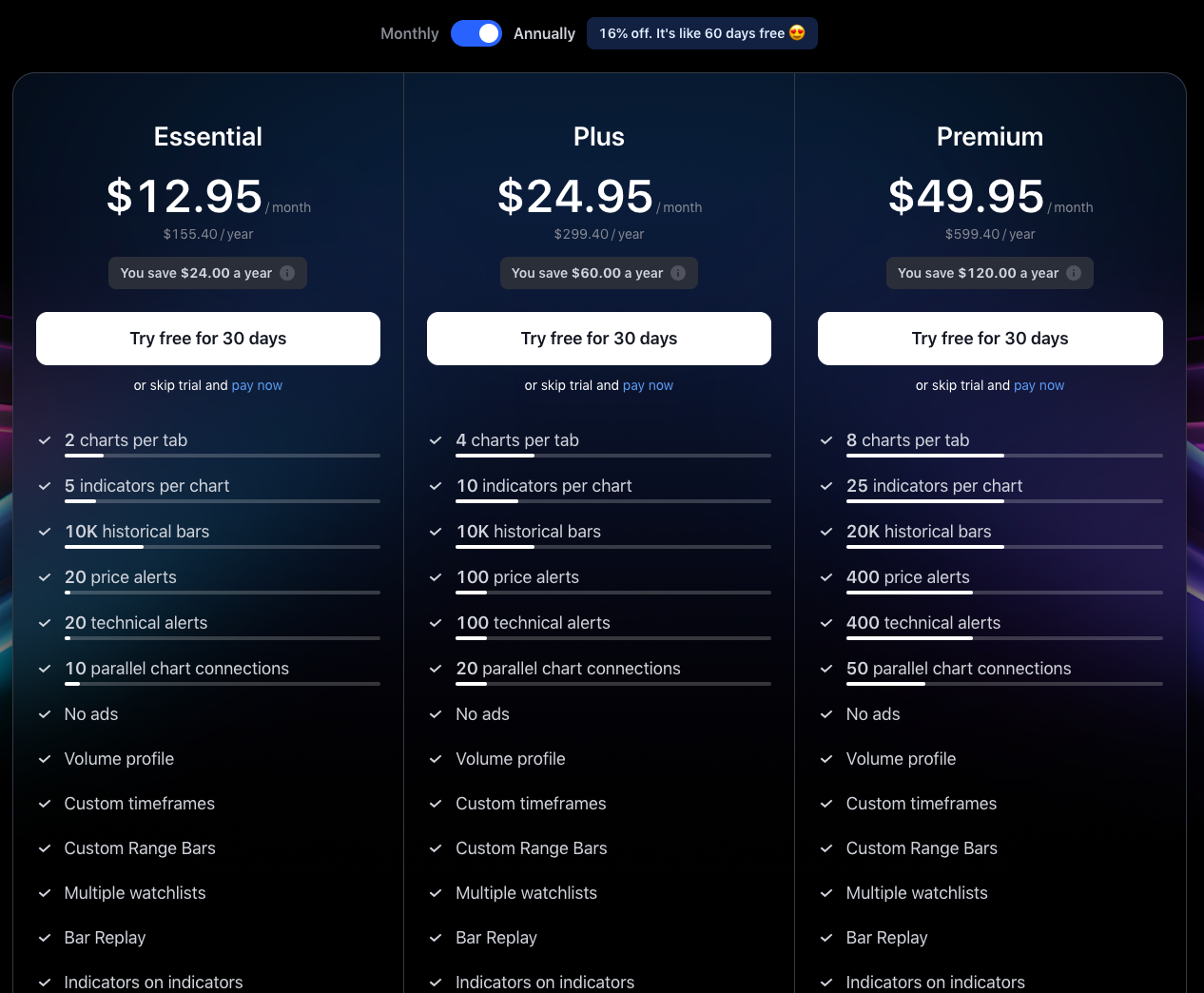

TradingView is the best free trading analysis software, offering a robust suite of tools for beginner traders to get started. But if you decide to trade full time, you’ll want to consider one of their paid plans for non-professionals.

Who It’s ForTradingView is a great option whether you’re a long-time charter or just getting started:

There’s a paid plan for every level of ambition, offering more volume at each tier:

Source: TradingView

These are the “non-professional” options. If you’re looking to take your trading skills to full time status, there are plans for professionals.

2. ThinkorswimSince 1999, TD Ameritrade’s thinkorswim (now also available at Charles Schwab) has stood the test of time and has remained a premier player in the world of technical analysis:

Source: thinkorswim

The thinkorswim platform meets you where you’re at on your trading journey to fit your skill level, style, and preferred way to trade, with 3 platforms:

- Thinkorswim desktop - the flagship platform providing fully customizable tools

- Thinkorswim mobile - stay connected to the market and trade on-the-go

- Thinkorswim web - the desktop packaged into a user-friendly interface

For beginner traders, the “PaperMoney” feature allows you to practice using real-time data without risking any money. Use the same tools you’d have with live trading and practice with $100,000 of virtual buying power.

Big bonus: the thinkorswim platform integrates with TD Ameritrade and Schwab brokerage accounts, allowing you to buy and sell from inside the program.

Who It’s ForThinkorswim’s 3 platforms make it a great fit for aspiring to seasoned traders, investors on-the-go who want an intuitive app, or traders who want fully customizable tools from a desktop:

There’s a lot to like about thinkorswim, especially for investors looking to keep their trading and investment accounts in one place.

PricingHere’s the best part: all three platforms are free. The fact that they’re also really good makes thinkorwim the best stock analysis app for budget-conscious investors.

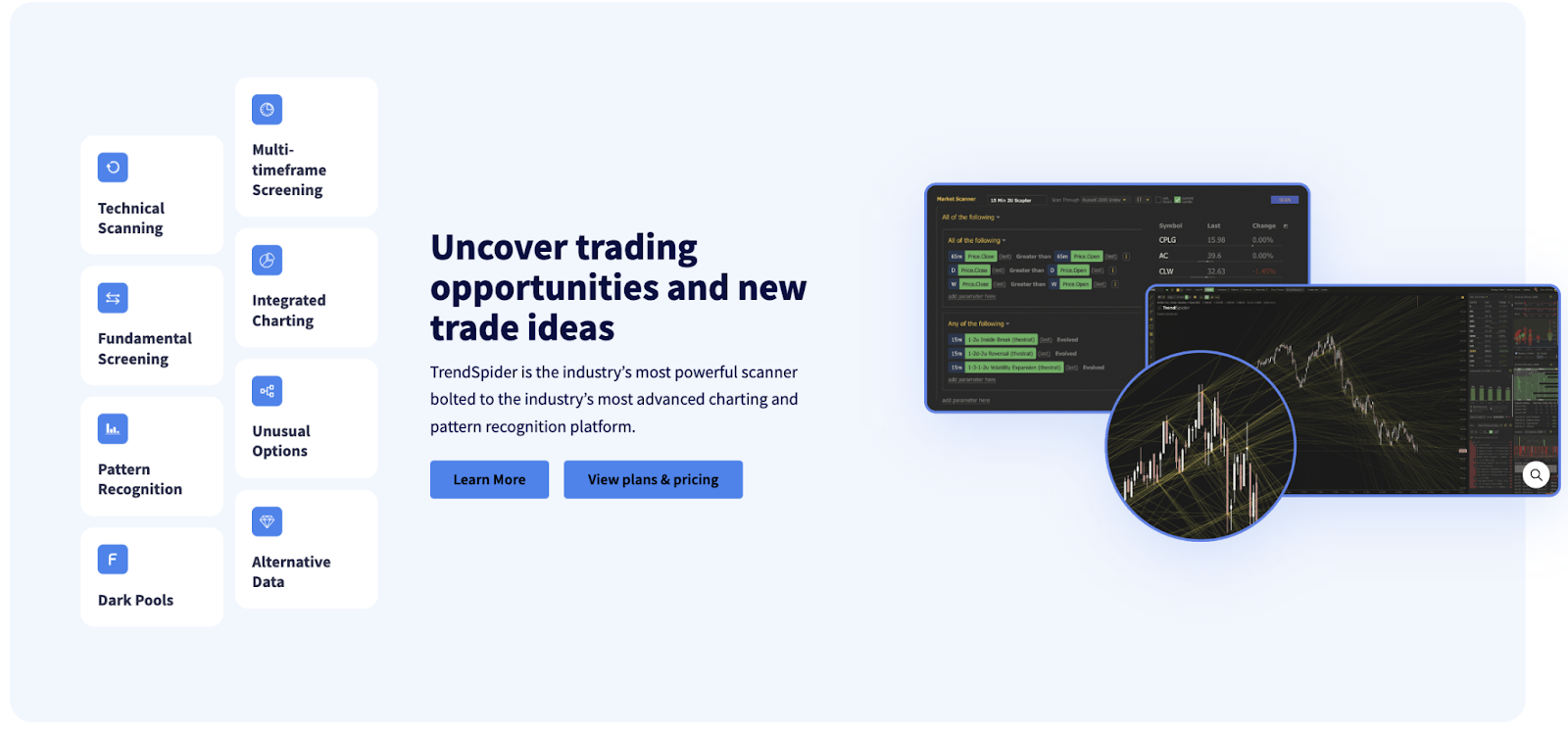

3. TrendSpiderSimilar to TradingView and thinkorswim, TrendSpider has the comprehensive technical analysis tools to help investors analyze assets and identify opportunities:

Source: TrendSpider

TrendSpider is perfectly suited for serious, part-time investors and swing traders. It offers easy-to-use technical analysis tools and charting software so you can quickly make informed decisions.

Features also include an integrated stock screener, price action heat maps, backtesting, dynamic alerts, unusual options flow, and fundamental screening.

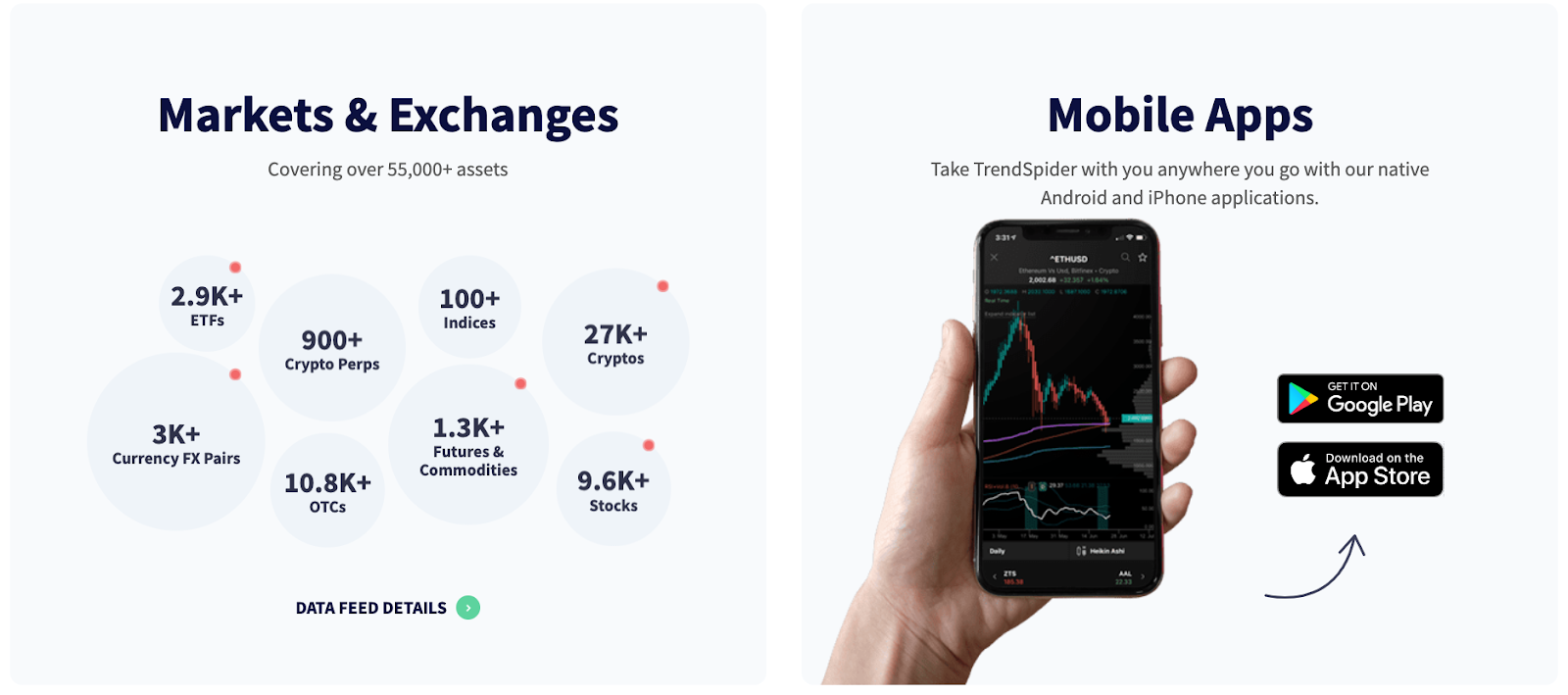

TrendSpider works on any browser, and subscribers can also use the iOS and Android apps.

Source: TrendSpider

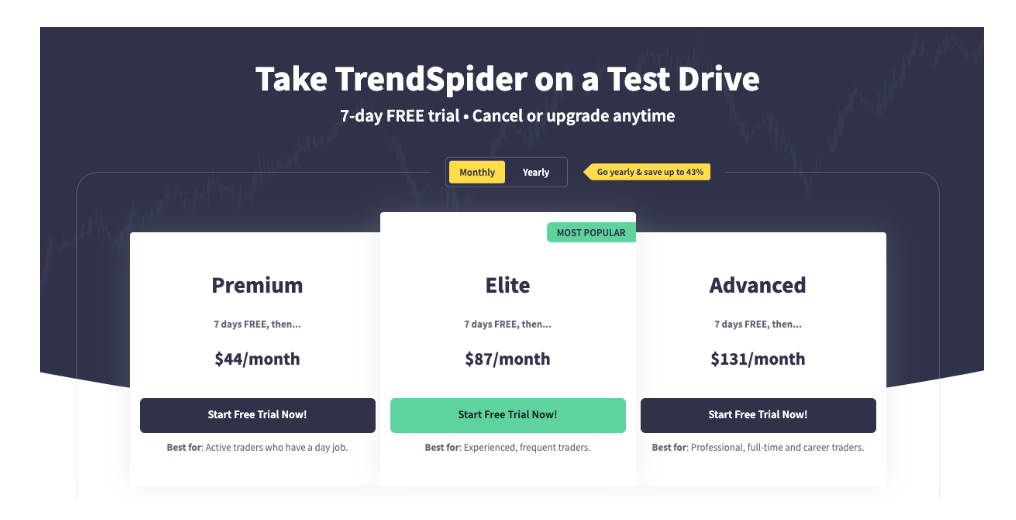

Who It’s ForTrendSpider’s automation tools make it a great fit for swing traders looking to exploit short-term market swings.

After a 7-day free trial, users can choose between Premium, Elite, and Advanced tiers:

Source: TrendSpider

Elite is the best value, at $87/month or $65/month when billed annually.

Summary: The Best Stock Analysis Software & Apps for Better Returns (2024)The best stock analysis software for you depends on if you’re a fundamental investor or a technical trader.

For fundamental investors, platforms like StockNews and WallStreetZen offer a lot of bang for your buck: stock ratings, a customizable screener, top-tier fundamental analysis and investment data, and more.

If you consider yourself a day trader, you may also want to supplement with a software focused on fundamentals, either to trade on high-quality stocks or to add to your long-term portfolio.

For technical traders, TradingView is arguably the best stock analysis app. Its user-friendly design and functionality coupled with its speed, accuracy, and affordability make it a compelling option for traders with wide ranges of experiences.

SPY shares were trading at $505.43 per share on Wednesday afternoon, down $1.50 (-0.30%). Year-to-date, SPY has gained 6.34%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post What’s the Best Stock Analysis Software? 7 Apps for Smarter Research (2024) appeared first on StockNews.com