New York City’s Peloton Interactive, Inc. (PTON) is a leading interactive fitness platform with more than seven million members worldwide. The company is known for its first-of-its-kind subscription platform.

However, PTON has an ISS Governance QualityScore of 10, indicating high governance risk.

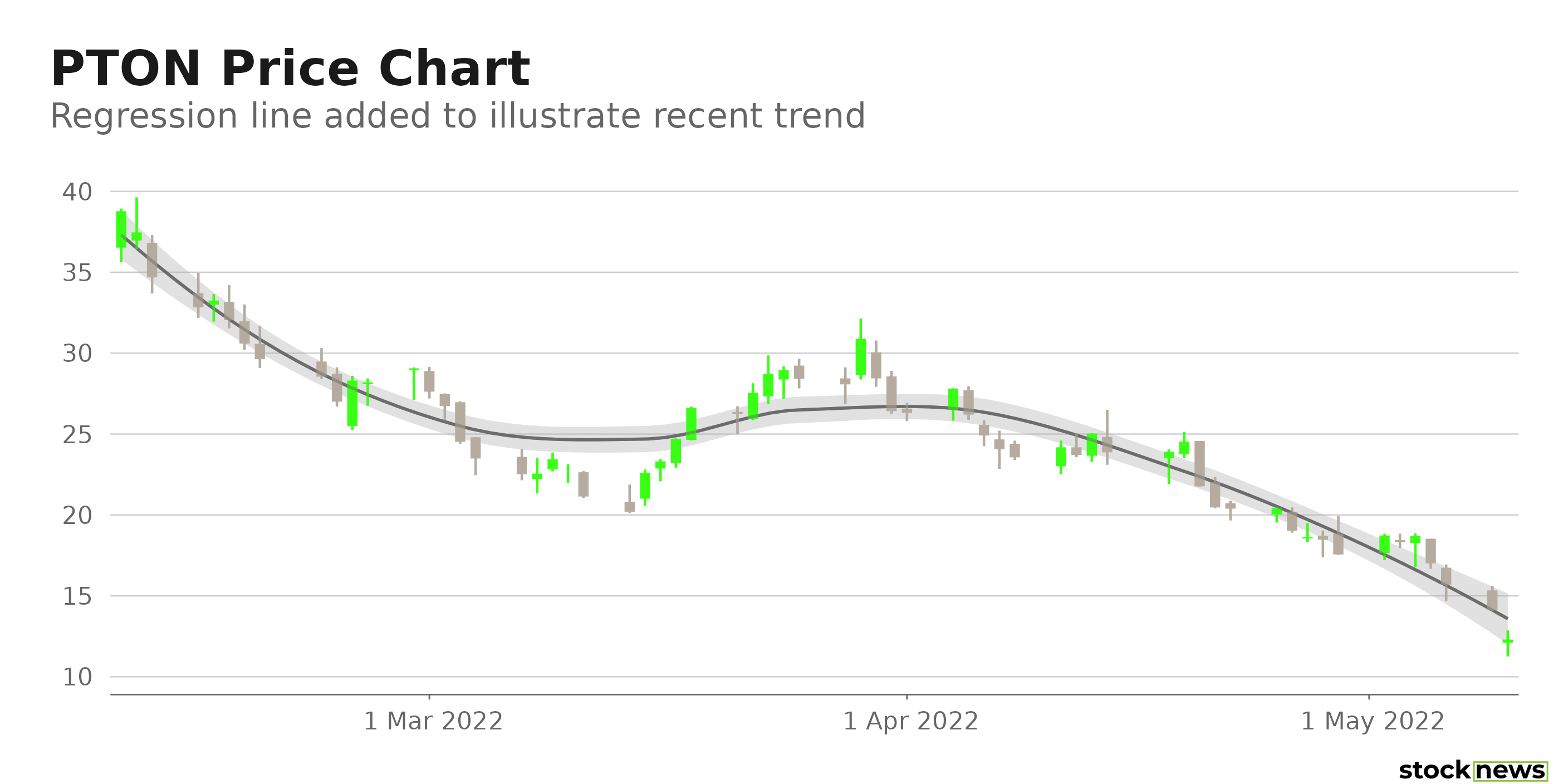

Shares of PTON have declined 86.6% in price over the past year and 66.7% year-to-date to close yesterday’s trading session at $14.13. Moreover, the stock plunged more than 25% in premarket today after reporting disappointing quarterly results.

Here is what could shape PTON’s performance in the near term:

Poor Financials

PTON’s total revenues declined 24% year-over-year to $1.26 billion in its fiscal third quarter, ended March 31, 2022. This can be attributed to a 42% slump in Connected Fitness Products revenues. The company’s total gross margin declined 1610 basis points from the same period last year to 35.2%. Its net loss was $8.60 million, while its free cash outflow amounted to $204 million. In addition, the company’s net operating cash outflow stood at $151.20 million.

PTON CEO Barry McCarthy said, “We finished the quarter with $879 million in unrestricted cash and cash equivalents, which leaves us thinly capitalized for a business of our scale.” Thus, the company might have to take on additional debt to finance its operations. However, given the increasing borrowing costs and PTON’s negative cash flows, additional debt might negatively impact its profit margins.

Restructuring Costs

PTON announced an extensive business restructuring plan on February 8. The company plans to reduce its manufacturing footprint and realign its business operations under this comprehensive program. The company expects to achieve at least $800 million in annual run-rate cost savings in its Connected Fitness segment.

PTON aims to reduce its planned capital expenditures by approximately $150 million in its fiscal 2022. However, it is expected to bear around $130 million in cash charges related to severance and other exit and restructuring activities. Furthermore, PTON’s non-cash restricting costs are expected to amount to $80 million.

PTON stated that most of these charges would be recorded in fiscal 2022. This is expected to impact the company’s profit margins adversely.

Negative Profit Margins

PTON’s trailing-12-month EBITDA margin is negative 22.6%, while its trailing-12-month net income margin is negative 27.48%. The company’s trailing-12-month levered free cash flow margin stands at negative 40.1%. Also, its trailing-12-month ROE, ROTC, and ROA are negative 52.92%, 19.55%, and 20.74%, respectively.

PTON’s 30% trailing-12-month gross profit margin is 17.2% lower than the 36.23% industry average. Furthermore, its 0.88% asset turnover ratio is 16.2% lower than the 1.05% industry average.

Bearish Growth Prospects

Analysts expect PTON’s revenues to decline 12.1% year-over-year to $823.74 million in its fiscal 2022 fourth-quarter, ending June 30, 2022. The company’s loss per share is expected to come in at $0.57 in the current quarter.

In addition, the Street expects PTON’s revenues to amount to $3.73 billion for its fiscal 2022 (ending June 20, 2022), indicating a 7.2% decline year-over-year. Also, the company’s loss per share is expected to worsen by 8078.6% from the same period last year to $3.88 in the current year.

Analysts expect PTON’s EPS to remain negative until at least fiscal 2023. Furthermore, the company’s EPS is expected to decline at a 26.9% rate per annum over the next five years.

POWR Ratings Reflect Bleak Prospects

PTON has an overall F rating, which translates to Strong Sell in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

PTON has an F grade for Quality and Growth. The company’s negative profit margins justify the Quality grade. In addition, its poor growth story is in sync with the Growth grade.

Among the 61 stocks in the D-rated Consumer Goods industry, PTON is ranked last.

Beyond what I have stated above, view PTON ratings for Momentum, Sentiment, Stability, and Value here.

Bottom Line

Earlier in January, PTON had stopped the production of fitness products such as bikes and treadmills due to rising costs amid sluggish demand. The reduced demand can be attributed to increased shoppers’ price sensitivity and competitor activity. Furthermore, given its poor free cash flows and negative profit margins, PTON is best avoided now.

How Does Peloton Interactive (PTON) Stack Up Against its Peers?

While PTON has an F rating in our proprietary rating system, one might want to consider looking at its industry peers, Mannatech, Incorporated (MTEX) and Société BIC SA (BICEY) which have an A (Strong Buy) rating.

PTON shares were trading at $12.08 per share on Tuesday morning, down $2.05 (-14.51%). Year-to-date, PTON has declined -66.22%, versus a -15.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post Is Peloton Interactive a Buy Under $15? appeared first on StockNews.com