Continued global momentum, partially offset by US performance, delivered all-time high revenue in FY23

AB InBev (Brussel:ABI) (BMV:ANB) (JSE:ANH) (NYSE:BUD):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240228688664/en/

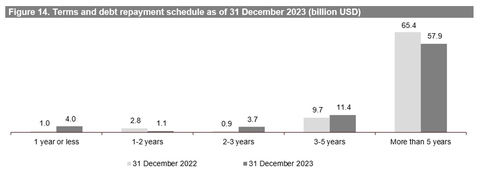

Figure 14. Terms and debt repayment schedule as of 31 December 2023 (billion USD) (Graphic: Business Wire)

Regulated and inside information1

“Our business delivered another year of consistent profitable growth with a revenue increase of 7.8% and EBITDA growth of 7.0%. Strong free cash flow generation enabled us to progress on our deleveraging, propose an increased dividend to our shareholders and execute on a 1 billion USD share buyback. Our results are a testament to the strength of the beer category, resilience of our business and people, consistent execution of our replicable growth drivers and our unwavering commitment to invest for long-term growth and value creation.” – Michel Doukeris, CEO, AB InBev

Total Revenue 4Q +6.2% | FY + 7.8% Revenue increased by 6.2% in 4Q23 with revenue per hl growth of 9.3% and by 7.8% in FY23 with revenue per hl growth of 9.9%.

24.6% increase in combined revenues of our global brands, Budweiser, Stella Artois, Corona and Michelob Ultra, outside of their respective home markets in 4Q23, and 18.2% in FY23.

Approximately 70% of our revenue through B2B digital platforms with the monthly active user base of BEES reaching 3.7 million users.

Over 550 million USD of revenue generated by our digital direct-to-consumer ecosystem.

Total Volume 4Q - 2.6% | FY - 1.7% In 4Q23, total volumes declined by 2.6% , with own beer volumes down by 3.6% and non-beer volumes up by 3.0%. In FY23, total volumes declined by 1.7% with own beer volumes down by 2.3% and non-beer volumes up by 2.1%.

Normalized EBITDA 4Q + 6.2% | FY +7.0% In 4Q23, normalized EBITDA increased by 6.2% to 4 877 million USD with a normalized EBITDA margin contraction of 2 bps to 33.7%. In FY23, normalized EBITDA increased by 7.0% to 19 976 million USD and normalized EBITDA margin contracted by 23 bps to 33.6% . Normalized EBITDA figures of FY23 and FY22 include an impact of 44 million USD and 201 million USD, respectively, from tax credits in Brazil. |

Underlying Profit (million USD) 4Q 1 661 | FY 6 158 Underlying profit (profit attributable to equity holders of AB InBev excluding non-underlying items and the impact of hyperinflation) was 1 661 million USD in 4Q23 compared to 1 739 million USD in 4Q22 and was 6 158 million USD in FY23 compared to 6 093 million USD in FY22.

Underlying EPS (USD) 4Q 0.82 | FY 3.05 Underlying EPS was 0.82 USD in 4Q23, a decrease from 0.86 USD in 4Q22 and was 3.05 USD in FY23, an increase from 3.03 USD in FY22.

Net Debt to EBITDA 3.38x Net debt to normalized EBITDA ratio was 3.38x at 31 December 2023, compared to 3.51x at 31 December 2022.

Capital Allocation Dividend 0.82 EUR The AB InBev Board proposes a full year 2023 dividend of 0.82 EUR per share, subject to shareholder approval at the AGM on 24 April 2024. A timeline showing the ex-dividend, record and payment dates can be found on page 16.

Out of the one billion USD share buyback program announced on 31 October 2023, 870 million USD was completed as of 23 February 2024. |

The 2023 Full Year Financial Report is available on our website at www.ab-inbev.com.

1The enclosed information constitutes inside information as defined in Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, and regulated information as defined in the Belgian Royal Decree of 14 November 2007 regarding the duties of issuers of financial instruments which have been admitted for trading on a regulated market. For important disclaimers and notes on the basis of preparation, please refer to page 17. |

Management comments

Creating a future with more cheers

Our business delivered another year of consistent profitable growth, with an EBITDA increase of 7.0%, in-line with our medium-term growth ambition and outlook for the year. While our full growth potential was constrained by the performance of our US business, we remained true to our purpose and laser focused on the execution of our strategy.

We made disciplined revenue management and resource allocation choices, delivering broad-based growth with top- and bottom-line increases in four of our five operating regions. Our results are a testament to the strength of the beer category, resilience of our business and people, consistent execution of our replicable growth drivers and our unwavering commitment to invest for long-term growth and value creation.

As with any year, there was success to celebrate and challenges from which to learn. We are taking the learnings and moving forward in a stronger position to realize our full growth potential.

Delivering consistent profitable growth

Our top-line increased by 7.8% in FY23, with revenue growth in more than 85% of our markets, driven by a revenue per hl increase of 9.9% as a result of pricing actions, ongoing premiumization and other revenue management initiatives. Volumes declined by 1.7% as growth in many of our emerging and developing markets was primarily offset by performance in the US and a soft industry in Europe.

EBITDA increased by 7.0%, with our top-line growth partially offset by anticipated transactional FX and commodity cost headwinds and increased sales and marketing investments. Underlying EPS was 3.05 USD, an increase of 0.02 USD per share versus FY22.

Progressing our strategic priorities

-

Lead and grow the category

We remain focused on the consistent execution of our five proven and replicable category expansion levers. In FY23, the beer and beyond beer category continued to gain share of alcohol by volume globally, led by gains in South America and China, according to Euromonitor.

We focused our investments behind the megabrands in our portfolio that are driving the majority of our growth and the global mega platforms that consumers love and that bring people together. Our portfolio of brands is unparalleled, with 7 out of the top 10 most valuable beer brands in the world, according to Kantar BrandZ, and 20 iconic billion-dollar revenue beer brands. The combination of our iconic brands with mega platforms such as the Olympics, FIFA World CupTM, Copa America, NFL, UFC, NBA, Lollapalooza and Tomorrowland has us uniquely positioned to lead and grow the category.

The relevance, authenticity and effective creativity of our marketing work continues to be recognized. At the 2023 Cannes Lions International Festival of Creativity, campaigns and brands from all 5 of our operating regions were awarded and we were honored to be named as the Creative Marketer of the Year for the second year in a row.- Category Participation: In FY23, the percentage of consumers purchasing our portfolio of brands increased or remained stable in the majority of our markets, according to our estimates. Our brand, pack and liquid innovations drove increased participation with female consumers across key markets in Africa, Latin America and Europe, and new legal drinking age consumers in the US and Canada.

- Core Superiority: Our mainstream portfolio delivered high-single digit revenue growth in FY23 with double-digit growth in markets such as South Africa, Colombia and Dominican Republic. Our mainstream brands gained or maintained share of segment in the majority of our key markets, according to our estimates.

- Occasions Development: Our global no-alcohol beer portfolio continued to outperform, delivering high-teens revenue growth in FY23, with our performance driven by Budweiser Zero and Corona Cero. Our digital direct-to-consumer products enabled us to develop deep consumer insights and new consumption occasions, such as Corona Sunset Hours, Brahma Soccer Wednesdays and increased in-home consumption of returnable glass bottle packs.

- Premiumization: Our above core beer portfolio grew revenue by low-teens in FY23, with our premium and super premium brands gaining share of segment in a number of key markets, including South Africa, Mexico and Brazil, according to our estimates. Our global megabrands grew revenue by 18.2% outside of their home markets led by Corona which grew by 22.1%. Budweiser delivered a revenue increase of 17.1%, with broad-based growth in more than 25 markets, Stella Artois grew by 18.8% and Michelob Ultra by 7.5%.

- Beyond Beer: In FY23, our Beyond Beer business contributed approximately 1.5 billion USD of revenue and grew by mid-single digits, as growth globally was partially offset by the performance of malt-based seltzer in the US. Growth was primarily driven by Brutal Fruit and Flying Fish in Africa, our spirits based ready-to-drink portfolio in the US and Beats in Brazil, all of which grew revenue by double-digits.

-

Digitize and monetize our ecosystem

The digital transformation of our route to consumer is a fundamental evolution in how we do business and serve our customers. Our digital platforms are enabling us to increase the distribution of our brands, reduce our cost to serve and improve our relationship with customers and consumers. It is a key competitive advantage, and we continue to explore new ways to monetize our digital and physical assets to create additional profitable revenue streams.-

Digitizing our relationships with our more than six million customers globally: As of 31 December 2023, BEES was live in 26 markets, with approximately 70% of our 4Q23 revenues captured through B2B digital platforms. In FY23, BEES reached 3.7 million monthly active users and captured 39.8 billion USD in gross merchandise value (GMV), growth of 27% versus FY22.

BEES Marketplace was live in 15 markets with 67% of BEES customers also Marketplace buyers. Marketplace captured approximately 1.5 billion USD in GMV from sales of third-party products this year, growth of 52% versus FY22. - Leading the way in DTC solutions: Our omnichannel direct-to-consumer (DTC) ecosystem of digital and physical products generated revenue of approximately 1.5 billion USD this year. Our DTC megabrands, Zé Delivery, TaDa and PerfectDraft are available in 21 markets, fulfilled over 69 million e-commerce orders and generated revenue of more than 550 million USD in FY23, growth of 15% versus FY22.

- Unlocking value from our ecosystem: We continue to explore opportunities to generate scalable incremental revenue streams for our business through EverGrain, our upcycled barley ingredients company, and Biobrew, our precision fermentation venture.

-

Digitizing our relationships with our more than six million customers globally: As of 31 December 2023, BEES was live in 26 markets, with approximately 70% of our 4Q23 revenues captured through B2B digital platforms. In FY23, BEES reached 3.7 million monthly active users and captured 39.8 billion USD in gross merchandise value (GMV), growth of 27% versus FY22.

-

Optimize our business

-

Maximizing value creation: Our objective to maximize long-term value creation is driven by our focus on three areas: optimized resource allocation, robust risk management and an efficient capital structure. Our culture of everyday financial discipline enables us to optimize resource allocation and invest for growth. In FY23, we invested 11.6 billion USD in capex and sales and marketing while delivering free cash flow of approximately 8.8 billion USD, a 0.3 billion USD increase versus FY22.

We continued to deleverage, reducing gross debt by 1.8 billion USD to reach 78.1 billion USD, resulting in a net debt to EBITDA ratio of 3.38x as of 31 December 2023. Our robust risk management was recognized earlier this year with a credit rating upgrade from Baa1 to A3 by Moody’s and from BBB+ to A- by S&P.

As a result, we have additional flexibility in our capital allocation choices. The AB InBev Board of Directors has proposed a full year dividend of 0.82 EUR per share, a 9% increase versus FY22. In addition, as of 23rd February 2024 we have completed nearly 90% of our 1 billion USD share buyback program announced on 31 October 2023. -

Advancing our sustainability priorities: In FY23, we continued to make progress towards our ambitious 2025 Sustainability Goals. We contracted the equivalent of 100% of our global purchased electricity volume from renewable sources with 73.6% operational. Since 2017, we reduced our absolute GHG emissions across Scopes 1 and 2 by 44% and GHG emissions intensity across Scopes 1, 2 and 3 by 24.2%. In Sustainable Agriculture, 95% of our direct farmers met our criteria for skilled, 92% for connected and 86% for financially empowered. In Water Stewardship, we are investing in restoration and conservation efforts across 100% of our sites in high stress areas, with 56% of sites in scope for our 2025 goal already seeing measurable improvement in watershed health. For Circular Packaging, 77.5% of our products were in packaging that was returnable or made from majority recycled content. We are also progressing on our ambition to achieve net zero by 2040, with 36 lighthouse projects implemented worldwide in 2023.

In recognition of our leadership in corporate transparency and performance on climate change and water security, we were awarded a double A score by CDP.

We are committed to Smart Drinking and improving moderation habits all over the world. Since 2016, we have invested 900 million USD in social norms marketing and are on track to deliver our 1 billion USD goal by 2025. We have also undertaken the largest voluntary guidance labeling initiative, with 100% of our labels now featuring Smart Drinking icons and moderation actionable messages in 26 markets.

Please refer to our Sustainability Statements in our 2023 annual report here for further details.

-

Maximizing value creation: Our objective to maximize long-term value creation is driven by our focus on three areas: optimized resource allocation, robust risk management and an efficient capital structure. Our culture of everyday financial discipline enables us to optimize resource allocation and invest for growth. In FY23, we invested 11.6 billion USD in capex and sales and marketing while delivering free cash flow of approximately 8.8 billion USD, a 0.3 billion USD increase versus FY22.

Looking forward

As we reflect on 2023, while our full potential was constrained, the fundamental strengths of our business drove another year of consistent profitable growth. Beer is a large, profitable and growing category, gaining share of alcohol globally and with significant headroom for premiumization. Our diversified footprint, global scale and unparalleled ecosystem uniquely position us to lead and grow the category. We have replicable growth drivers such as our portfolio of megabrands that consumers love, digital products that unlock value and a category expansion model that drives organic growth. Our business generates superior profitability and cash generation, and our dynamic capital allocation framework provides us flexibility to maximize value creation. The resilience, relentless commitment and deep ownership culture of our people is truly unwavering, and we thank all our colleagues globally for their hard work and dedication.

Looking ahead to 2024, our purpose as a company remains as relevant as ever. Guided by our strategy and our focus on customer and consumer centricity, we are energized about the opportunities ahead to activate the category through our megabrands and platforms. We believe in the potential of the beer category, the fundamentals of our company and our people, and our ability to generate superior long-term value and create a future with more cheers.

2024 Outlook

(i) Overall Performance: We expect our EBITDA to grow in line with our medium-term outlook of between 4-8%1. The outlook for FY24 reflects our current assessment of inflation and other macroeconomic conditions.

(ii) Net Finance Costs: Net pension interest expenses and accretion expenses are expected to be in the range of 220 to 250 million USD per quarter, depending on currency and interest rate fluctuations. We expect the average gross debt coupon in FY24 to be approximately 4%.

(iii) Effective Tax Rates (ETR): We expect the normalized ETR in FY24 to be in the range of 27% to 29%. The ETR outlook does not consider the impact of potential future changes in legislation.

(iv) Net Capital Expenditure: We expect net capital expenditure of between 4.0 and 4.5 billion USD in FY24.

1Please refer to the FY24 presentation update on organic growth on page 16 |

Figure 1. Consolidated performance (million USD) |

|||

4Q22 |

4Q23 |

Organic |

|

growth |

|||

Total Volumes (thousand hls) |

148 775 |

144 706 |

-2.6% |

AB InBev own beer |

128 502 |

123 764 |

-3.6% |

Non-beer volumes |

19 421 |

19 998 |

3.0% |

Third party products |

853 |

944 |

13.1% |

Revenue |

14 668 |

14 473 |

6.2% |

Gross profit |

8 007 |

7 794 |

5.3% |

Gross margin |

54.6% |

53.9% |

-49 bps |

Normalized EBITDA |

4 947 |

4 877 |

6.2% |

Normalized EBITDA margin |

33.7% |

33.7% |

-2 bps |

Normalized EBIT |

3 608 |

3 491 |

6.9% |

Normalized EBIT margin |

24.6% |

24.1% |

16 bps |

|

|||

Profit attributable to equity holders of AB InBev |

2 844 |

1 891 |

|

Underlying profit attributable to equity holders of AB InBev |

1 739 |

1 661 |

|

|

|||

Earnings per share (USD) |

1.41 |

0.94 |

|

Underlying earnings per share (USD) |

0.86 |

0.82 |

|

FY22 |

FY23 |

Organic |

|

growth |

|||

Total Volumes (thousand hls) |

595 133 |

584 728 |

-1.7% |

AB InBev own beer |

517 990 |

505 899 |

-2.3% |

Non-beer volumes |

73 241 |

74 810 |

2.1% |

Third party products |

3 903 |

4 019 |

4.7% |

Revenue |

57 786 |

59 380 |

7.8% |

Gross profit |

31 481 |

31 984 |

6.7% |

Gross margin |

54.5% |

53.9% |

-53 bps |

Normalized EBITDA |

19 843 |

19 976 |

7.0% |

Normalized EBITDA margin |

34.3% |

33.6% |

-23 bps |

Normalized EBIT |

14 768 |

14 590 |

6.4% |

Normalized EBIT margin |

25.6% |

24.6% |

-31 bps |

|

|||

Profit attributable to equity holders of AB InBev |

5 969 |

5 341 |

|

Underlying profit attributable to equity holders of AB InBev |

6 093 |

6 158 |

|

|

|||

Earnings per share (USD) |

2.97 |

2.65 |

|

Underlying earnings per share (USD) |

3.03 |

3.05 |

|

Figure 2. Volumes (thousand hls) |

||||||

4Q22 |

Scope |

Organic |

4Q23 |

Organic growth |

||

growth |

Total |

Own beer |

||||

North America |

23 451 |

- 149 |

-3 563 |

19 738 |

-15.3% |

-16.2% |

Middle Americas |

38 286 |

- |

348 |

38 635 |

0.9% |

0.9% |

South America |

46 860 |

- |

- 157 |

46 704 |

-0.3% |

-2.0% |

EMEA |

24 094 |

50 |

- 180 |

23 964 |

-0.7% |

-1.0% |

Asia Pacific |

15 903 |

- |

- 438 |

15 465 |

-2.8% |

-2.9% |

Global Export and Holding Companies |

181 |

-52 |

71 |

200 |

55.0% |

54.8% |

AB InBev Worldwide |

148 775 |

- 151 |

-3 919 |

144 706 |

-2.6% |

-3.6% |

FY22 |

Scope |

Organic |

FY23 |

Organic growth |

||

growth |

Total |

Own beer |

||||

North America |

102 674 |

-118 |

-12 417 |

90 140 |

-12.1% |

-12.6% |

Middle Americas |

147 624 |

- |

1 106 |

148 730 |

0.7% |

0.1% |

South America |

164 319 |

- |

-1 859 |

162 460 |

-1.1% |

-2.0% |

EMEA |

90 780 |

204 |

- 771 |

90 213 |

-0.8% |

-1.1% |

Asia Pacific |

88 898 |

- |

3 828 |

92 726 |

4.3% |

4.2% |

Global Export and Holding Companies |

838 |

-236 |

-143 |

459 |

-23.7% |

-26.4% |

AB InBev Worldwide |

595 133 |

- 151 |

-10 255 |

584 728 |

-1.7% |

-2.3% |

Key Market Performances

United States: Revenue declined by 9.5% impacted by volume performance

-

Operating performance:

- 4Q23: Revenue declined by 17.3% with sales-to-retailers (STRs) down by 12.1%, primarily due to the volume decline of Bud Light. Sales-to-wholesalers (STWs) declined by 16.1% as shipments lagged stronger depletions in December. Revenue per hl decreased by 1.4% due to negative mix and cycling the October price increase in 4Q22. EBITDA declined by 34.2%, with approximately two thirds of this decrease attributable to market share performance and the remainder from productivity loss, increased sales and marketing investments and support measures for our wholesaler partners.

- FY23: Revenue declined by 9.5% with revenue per hl growth of 3.7%. STWs declined by 12.7% and STRs were down by 11.9%. EBITDA decreased by 23.4%.

- Commercial highlights: The beer industry remained resilient in FY23, with volumes improving sequentially throughout the year and with beer gaining share of total alcohol by value in the off-premise, according to Circana. Our beer market share has seen continued gradual improvement since May through the end of December. While our mainstream beer revenues declined this year, our above core beer megabrands continued to grow. In Beyond Beer, our spirits-based ready-to-drink portfolio delivered strong double-digit volume growth, outperforming the industry. To support our long-term strategy, we continue to invest in our megabrands, wholesaler support measures and key mega platforms including the NFL, MLB, PGA and the NBA as well as new partnerships with the UFC, Copa America and Team USA for the Olympic and Paralympic Games.

Mexico: High-single digit top- and bottom-line growth with margin expansion

-

Operating performance:

- 4Q23: Revenue was flat with low-single digit revenue per hl growth driven by revenue management initiatives in an environment of moderating inflation. Volumes declined by low-single digits, underperforming the industry, primarily impacted by adverse weather in the Acapulco region. EBITDA grew by mid-single digits with margin expansion of over 150bps.

- FY23: Revenue and revenue per hl grew by high-single digits with volumes declining slightly, in-line with the industry. EBITDA grew by high-single digits with margin expansion of approximately 60bps.

- Commercial highlights: Our performance this year was driven by consistent execution across all three pillars of our strategy. Our above core portfolio continued to outperform in FY23, delivering low-single digit volume growth, while our core brands remained healthy, increasing revenues by high-single digits. We continued to progress our digital initiatives with our digital DTC platform, TaDa, operating in over 60 major cities with more than 90 000 monthly active users. We continue to explore and scale value added services through the BEES platform, such as Vendo, which enabled more than 650 000 transactions for digital utilities payments and mobile data purchases in FY23, and BEES Marketplace.

Colombia: Record high volumes delivered double-digit top-line and high-single digit bottom-line growth

-

Operating performance:

- 4Q23: Revenue grew by low-teens with mid-single digit volume and high-single digit revenue per hl growth, driven by revenue management initiatives. EBITDA grew by mid-single digits as top-line growth was partially offset by anticipated transactional FX and commodity cost headwinds.

- FY23: Revenue grew by low-teens with revenue per hl growth of high-single digits. Volumes grew low-single digits. EBITDA grew by high-single digits.

- Commercial highlights: Driven by the consistent execution of our category expansion levers, the beer category continues to grow, gaining 70bps share of total alcohol this year and with our volumes reaching a new record high. Our core portfolio led our performance in FY23, delivering low-teens revenue growth with a particularly strong performance from Poker which grew volumes by high-single digits.

Brazil: High-single digit top-line and double-digit bottom-line growth with margin expansion of 462bps

-

Operating performance:

- 4Q23: Revenue grew by 5.8% with revenue per hl growth of 5.0% driven by revenue management initiatives. Total volumes grew by 0.8%, with beer volumes declining by 1.1% as we cycled FIFA World CupTM activations in 4Q22. Non-beer volumes increased by 5.3%. EBITDA increased by 26.3% with margin expansion of 537bps.

- FY23: Revenue increased by 8.7% with revenue per hl growth of 8.5%. Total volumes grew by 0.2% with beer volumes down by 1.0%, slightly underperforming the industry according to our estimates, and non-beer volumes up by 3.6%. EBITDA increased by 28.0% with margin expansion of 462bps.

- Commercial highlights: Our performance this year was led by our premium and super premium brands, which delivered volume growth in the mid-twenties and gained share of the premium beer segment, according to our estimates. Our core beer portfolio remained healthy, increasing revenues by high-single digits. Non-beer performance was led by our low- and no-sugar portfolio, which grew volumes by over 25%. BEES Marketplace continued to expand, reaching over 835 000 customers, a 17% increase versus 4Q22, and grew GMV by over 35% in FY23. Our digital DTC platform, Zé Delivery, reached 5.7 million monthly active users in 4Q23, a 19% increase versus 4Q22, and increased GMV by 8% in FY23.

Europe: High-single digit top- and low-single digit bottom-line growth

-

Operating performance:

- 4Q23: Revenue grew by mid-single digits with high-single digit revenue per hl growth, driven by pricing actions and continued premiumization. Volumes declined by low-single digits, outperforming a soft industry in the majority of our key markets according to our estimates. EBITDA declined by approximately 10%, as top-line growth was offset by anticipated commodity cost headwinds.

- FY23: Revenue increased by high-single digits, driven by low-teens revenue per hl growth. Volumes declined by mid-single digits, driven by a soft industry. EBITDA increased by low-single digits.

- Commercial highlights: We continued to premiumize our portfolio this year with our premium and super premium brands delivering high-single digit revenue growth, led by Corona, Leffe and Stella Artois. Through the consistent execution of our strategy and investment in our brands, we gained or maintained market share in the majority of our key markets in FY23, according to our estimates. Our digital transformation in Europe is progressing, with BEES now live in the UK, Germany, Belgium, the Netherlands, and the Canary Islands.

South Africa: Record high volumes delivered double digit top- and high-single digit bottom-line growth

-

Operating performance:

- 4Q23: Revenue grew by high-teens, with revenue per hl growth of mid-teens, driven by pricing actions and continued premiumization. Our volumes increased by low-single digits, outperforming the industry according to our estimates. EBITDA grew by mid-twenties.

- FY23: Revenue grew by mid-teens with low-teens revenue per hl growth and a mid-single digit increase in volume. EBITDA grew by high-single digits, as top-line growth was partially offset by anticipated transactional FX and commodity cost headwinds.

- Commercial highlights: Driven by focused commercial investment and the consistent execution of our strategy, the momentum of our business continued in FY23. Our portfolio delivered all-time high volumes, with increased Brand Power of our beer and beyond beer portfolios driving market share gains of both beer and total alcohol according to our estimates. Our core beer portfolio continued to outperform, and our global brands grew volumes by more than 30%, driven by Corona and Stella Artois. In Beyond Beer, our portfolio grew volumes by high-single digits led by Flying Fish and Brutal Fruit.

China: Double digit top- and bottom-line growth with margin expansion of 125bps

-

Operating performance:

- 4Q23: Revenue grew by 11.2% with revenue per hl increasing by 14.7%, driven by continued premiumization and supported by a favorable comparable in 4Q22. Total volumes declined by 3.1%, driven by a softer mainstream industry, however our premium and super-premium volumes grew by double-digits. EBITDA increased by 31.6%.

- FY23: Revenue grew by 12.3% with a revenue per hl increase of 7.6% and volume growth of 4.3%, outperforming the industry according to our estimates. EBITDA grew by 16.3% with margin expansion of 125bps.

- Commercial highlights: We continue to invest behind our commercial strategy, focused on premiumization, channel and geographic expansion, and digital transformation. In FY23, our premium and super premium portfolio continued to outperform, delivering double-digit revenue growth and driving overall market share expansion, according to our estimates. The roll out and adoption of the BEES platform continued, with BEES now present in approximately 260 cities and with 70% of our revenue generated through digital channels in December.

Highlights from our other markets

- Canada: Revenue declined by mid-single digits this quarter with revenue per hl growth of mid-single digits. In FY23, revenue was flat with revenue per hl growth of high-single digits, driven by revenue management initiatives and the continued outperformance of our above core beer portfolio. Volumes declined by high-single digits in 4Q23 and by mid-single digits in FY23, underperforming a soft industry.

- Peru: Revenue and revenue per hl increased by mid-single digits this quarter with volumes declining by low-single digits. In FY23, our portfolio gained share of total alcohol with revenue growth of high-single digits and revenue per hl increasing by approximately 10%, driven primarily by revenue management initiatives. Volumes declined by low-single digits, outperforming a soft industry.

- Ecuador: Revenue declined by low-single digits this quarter driven by a volume decline of mid-single digits as the industry was impacted by four fewer trading days due to election related dry laws. In FY23, our portfolio gained share of total alcohol with revenue increasing by mid-single digits led by our above core beer brands, which delivered a high-single digit revenue increase. Beer volumes were flattish.

- Argentina: Volumes declined by mid-single digits in 4Q23 and high-single digits in FY23, as overall consumer demand was impacted by inflationary pressures. Revenue increased by over 100% on an organic basis in both the quarter and full year, driven by revenue management initiatives in a highly inflationary environment. Reported USD revenues declined in FY23, driven primarily by the hyperinflation accounting treatment of the currency devaluation in December 2023. Refer to the note on page 14 for further details.

-

Africa excluding South Africa: In Nigeria, revenue grew by over 30% this quarter driven by pricing actions and other revenue management initiatives. Beer volumes declined by high-single digits, driven by a soft industry which was impacted by the continued challenging operating environment. In FY23, revenue increased by high-teens with a beer volume decline of low-teens.

In our other markets, we grew revenue in aggregate by high-single digits in 4Q23 and by low-teens in FY23, driven by Tanzania, Botswana and Zambia. - South Korea: Total revenue increased by low-single digits in 4Q23 with mid-single digit volume decline and high-single digit revenue per hl growth, driven by revenue management initiatives. In FY23, revenue decreased by low-single digits with flattish revenue per hl and a low-single digit volume decline, underperforming the industry.

Consolidated Income Statement

Figure 3. Consolidated income statement (million USD) |

|||

4Q22 |

4Q23 |

Organic |

|

growth |

|||

Revenue |

14 668 |

14 473 |

6.2% |

Cost of sales |

-6 661 |

-6 679 |

-7.4% |

Gross profit |

8 007 |

7 794 |

5.3% |

SG&A |

-4 592 |

-4 537 |

-4.3% |

Other operating income/(expenses) |

193 |

234 |

11.4% |

Normalized profit from operations (normalized EBIT) |

3 608 |

3 491 |

6.9% |

Non-underlying items above EBIT (incl. impairment losses) |

19 |

-165 |

|

Net finance income/(cost) |

-1 221 |

-1 290 |

|

Non-underlying net finance income/(cost) |

798 |

550 |

|

Share of results of associates |

89 |

95 |

|

Non-underlying share of results of associates |

- |

-35 |

|

Income tax expense |

5 |

-376 |

|

Profit |

3 298 |

2 270 |

|

Profit attributable to non-controlling interest |

454 |

379 |

|

Profit attributable to equity holders of AB InBev |

2 844 |

1 891 |

|

|

|||

Normalized EBITDA |

4 947 |

4 877 |

6.2% |

Underlying profit attributable to equity holders of AB InBev |

1 739 |

1 661 |

|

FY22 |

FY23 |

Organic |

|

growth |

|||

Revenue |

57 786 |

59 380 |

7.8% |

Cost of sales |

-26 305 |

-27 396 |

-9.0% |

Gross profit |

31 481 |

31 984 |

6.7% |

SG&A |

-17 555 |

-18 172 |

-7.4% |

Other operating income/(expenses) |

841 |

778 |

19.8% |

Normalized profit from operations (normalized EBIT) |

14 768 |

14 590 |

6.4% |

Non-underlying items above EBIT (incl. impairment losses) |

-251 |

-624 |

|

Net finance income/(cost) |

-4 978 |

-5 033 |

|

Non-underlying net finance income/(cost) |

829 |

-69 |

|

Share of results of associates |

299 |

295 |

|

Non-underlying share of results of associates |

-1 143 |

- 35 |

|

Income tax expense |

-1 928 |

-2 234 |

|

Profit |

7 597 |

6 891 |

|

Profit attributable to non-controlling interest |

1 628 |

1 550 |

|

Profit attributable to equity holders of AB InBev |

5 969 |

5 341 |

|

|

|||

Normalized EBITDA |

19 843 |

19 976 |

7.0% |

Underlying profit attributable to equity holders of AB InBev |

6 093 |

6 158 |

|

We are reporting our Argentinean operation applying hyperinflation accounting under IAS 29, following the categorization of Argentina as a country with a three-year cumulative inflation rate greater than 100%, since 2018. Inflation in Argentina has accelerated, resulting in a more significant impact on the organic revenue growth of AB InBev than historically. For illustrative purposes, fully excluding the Argentinean operation, the 4Q23 organic revenue increase for AB InBev would be 0.5% versus the 6.2% reported. For FY23, revenue growth for AB InBev would be 3.8% versus the 7.8% reported.

Consolidated other operating income/(expenses) in FY23 increased by 19.8% primarily driven by higher government grants. In FY23, Ambev recognized 44 million USD income in other operating income related to tax credits (FY22: 201 million USD). The year-over-year change is presented as a scope change and does not affect the presented organic growth rates.

Non-underlying items above EBIT & Non-underlying share of results of associates

Figure 4. Non-underlying items above EBIT & Non-underlying share of results of associates (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

COVID-19 costs |

-2 |

- |

-18 |

- |

Restructuring |

-47 |

-64 |

-110 |

-142 |

Business and asset disposal (incl. impairment losses) |

72 |

-23 |

-71 |

-385 |

Claims and legal costs |

- |

-66 |

- |

-85 |

AB InBev Efes related costs |

-3 |

-12 |

-51 |

-12 |

Acquisition costs / Business combinations |

-1 |

- |

-1 |

- |

Non-underlying items in EBIT |

19 |

-165 |

-251 |

-624 |

Non-underlying share of results of associates |

- |

- 35 |

-1 143 |

- 35 |

EBIT excludes negative non-underlying items of 165 million USD in 4Q23 and 624 million USD in FY23. Business and asset disposal (including impairment losses) for FY23 includes a loss of approximately 300 million USD recognized upon disposal of a portfolio of eight beer and beverage brands and associated assets in the US to Tilray Brands, Inc in 3Q23.

Non-underlying share of results of associates of FY22 includes the non-cash impairment of 1 143 million USD the company recorded on its investment in AB InBev Efes in 1Q22.

Net finance income/(cost)

Figure 5. Net finance income/(cost) (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Net interest expense |

-785 |

-712 |

-3 294 |

-3 131 |

Net interest on net defined benefit liabilities |

-18 |

-26 |

-73 |

-90 |

Accretion expense |

-231 |

-228 |

-782 |

-808 |

Net interest income on Brazilian tax credits |

22 |

61 |

168 |

168 |

Other financial results |

-208 |

-385 |

-997 |

-1 172 |

Net finance income/(cost) |

-1 221 |

-1 290 |

-4 978 |

-5 033 |

Other financial results were negatively impacted by 125 million USD in 4Q23 versus 4Q22 and by 269 million USD in FY23 versus FY22, due to a decrease in hyperinflation monetary adjustments resulting from the devaluation of the Argentinean Peso in December 2023.

Non-underlying net finance income/(cost)

Figure 6. Non-underlying net finance income/(cost) (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Mark-to-market |

454 |

294 |

606 |

-325 |

Gain/(loss) on bond redemption and other |

344 |

256 |

223 |

256 |

Non-underlying net finance income/(cost) |

798 |

550 |

829 |

-69 |

Non-underlying net finance cost in FY23 includes mark-to-market losses on derivative instruments entered into to hedge our shared-based payment programs and shares issued in relation to the combination with Grupo Modelo and SAB.

The number of shares covered by the hedging of our share-based payment program, the deferred share instrument and the restricted shares are shown in figure 7, together with the opening and closing share prices.

Figure 7. Non-underlying equity derivative instruments |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Share price at the start of the period (Euro) |

46.75 |

52.51 |

53.17 |

56.27 |

Share price at the end of the period (Euro) |

56.27 |

58.42 |

56.27 |

58.42 |

Number of equity derivative instruments at the end of the period (millions) |

100.5 |

100.5 |

100.5 |

100.5 |

Income tax expense

Figure 8. Income tax expense (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Income tax expense |

-5 |

376 |

1 928 |

2 234 |

Effective tax rate |

-0.2% |

14.5% |

18.6% |

25.2% |

Normalized effective tax rate |

12.2% |

16.7% |

23.8% |

24.3% |

The increase in normalized ETR in 4Q23 compared to 4Q22 and the increase in FY23 compared to FY22 is driven mainly by country mix.

Figure 9. Underlying Profit attributable to equity holders of AB InBev (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Profit attributable to equity holders of AB InBev |

2 844 |

1 891 |

5 969 |

5 341 |

Net impact of non-underlying items on profit |

-1 127 |

-360 |

153 |

614 |

Hyperinflation impacts in underlying profit |

22 |

130 |

- 30 |

203 |

Underlying profit attributable to equity holders of AB InBev |

1 739 |

1 661 |

6 093 |

6 158 |

Underlying profit attributable to equity holders in 4Q22 and FY22 were positively impacted by 13 million USD and 186 million USD respectively, and in 4Q23 and FY23 by 55 million USD and 122 million USD respectively, after tax and non-controlling interest related to tax credits in Brazil.

Basic and underlying EPS

Figure 10. Earnings per share (USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Basic EPS |

1.41 |

0.94 |

2.97 |

2.65 |

Net impact of non-underlying items on profit |

-0.57 |

-0.18 |

0.07 |

0.31 |

Hyperinflation impacts in EPS |

0.01 |

0.06 |

-0.02 |

0.10 |

Underlying EPS |

0.86 |

0.82 |

3.03 |

3.05 |

Weighted average number of ordinary and restricted shares (million) |

2 013 |

2 016 |

2 013 |

2 016 |

Figure 11. Key components - Underlying EPS in USD |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Normalized EBIT before hyperinflation |

1.83 |

1.86 |

7.41 |

7.42 |

Hyperinflation impacts in normalized EBIT |

-0.04 |

-0.13 |

-0.07 |

-0.18 |

Normalized EBIT |

1.79 |

1.73 |

7.34 |

7.24 |

Net finance cost |

-0.61 |

-0.64 |

-2.47 |

-2.50 |

Income tax expense |

-0.14 |

-0.18 |

-1.16 |

-1.15 |

Associates & non-controlling interest |

-0.19 |

-0.15 |

-0.67 |

-0.64 |

Hyperinflation impacts in EPS |

0.01 |

0.06 |

-0.02 |

0.10 |

Underlying EPS |

0.86 |

0.82 |

3.03 |

3.05 |

Weighted average number of ordinary and restricted shares (million) |

2 013 |

2 016 |

2 013 |

2 016 |

Reconciliation between normalized EBITDA and profit attributable to equity holders

Figure 12. Reconciliation of normalized EBITDA to profit attributable to equity holders of AB InBev (million USD) |

||||

4Q22 |

4Q23 |

FY22 |

FY23 |

|

Profit attributable to equity holders of AB InBev |

2 844 |

1 891 |

5 969 |

5 341 |

Non-controlling interests |

454 |

379 |

1 628 |

1 550 |

Profit |

3 298 |

2 270 |

7 597 |

6 891 |

Income tax expense |

-5 |

376 |

1 928 |

2 234 |

Share of result of associates |

-89 |

-95 |

-299 |

-295 |

Non-underlying share of results of associates |

- |

35 |

1 143 |

35 |

Net finance (income)/cost |

1 221 |

1 290 |

4 978 |

5 033 |

Non-underlying net finance (income)/cost |

-798 |

-550 |

-829 |

69 |

Non-underlying items above EBIT (incl. impairment losses) |

-19 |

165 |

251 |

624 |

Normalized EBIT |

3 608 |

3 491 |

14 768 |

14 590 |

Depreciation, amortization and impairment |

1 338 |

1 386 |

5 074 |

5 385 |

Normalized EBITDA |

4 947 |

4 877 |

19 843 |

19 976 |

Normalized EBITDA and normalized EBIT are measures utilized by AB InBev to demonstrate the company’s underlying performance.

Normalized EBITDA is calculated excluding the following effects from profit attributable to equity holders of AB InBev: (i) non-controlling interest; (ii) income tax expense; (iii) share of results of associates; (iv) non-underlying share of results of associates; (v) net finance income or cost; (vi) non-underlying net finance income or cost; (vii) non-underlying items above EBIT; and (viii) depreciation, amortization and impairment.

Normalized EBITDA and normalized EBIT are not accounting measures under IFRS accounting and should not be considered as an alternative to profit attributable to equity holders as a measure of operational performance, or an alternative to cash flow as a measure of liquidity. Normalized EBITDA and normalized EBIT do not have a standard calculation method and AB InBev’s definition of normalized EBITDA and normalized EBIT may not be comparable to that of other companies.

Argentinean Peso devaluation

In December 2023, the Argentinean Peso underwent a significant devaluation with the USDARS exchange rate closing at 809 on 31 December 2023 compared to 350 on 30 September 2023. IFRS (IAS 29) require us to restate the year-to-date results for the change in the general purchasing power of the local currency, using official indices before converting the local amounts at the closing rate of the period (i.e. FY23 and FY22 results at the closing rate on 31 December 2023 and 2022, respectively). The December 2023 devaluation negatively impacted our revenue and Normalized EBITDA as reported in 4Q23 and FY23. The impact of hyperinflation accounting in 4Q22 and 4Q23, as well as FY22 and FY23 were as follows:

Impact of hyperinflation (million USD) |

||||

Revenue |

4Q22 |

4Q23 |

FY22 |

FY23 |

Indexing (1) |

161 |

156 |

483 |

561 |

Currency(2) |

-268 |

-855 |

-578 |

-1 279 |

Total impact |

-107 |

-699 |

-95 |

-717 |

|

||||

Normalized EBITDA |

4Q22 |

4Q23 |

FY22 |

FY23 |

Indexing (1) |

41 |

83 |

150 |

211 |

Currency(2) |

-107 |

-356 |

-209 |

-525 |

Total impact |

-66 |

-274 |

-59 |

-314 |

|

||||

USDARS average rate |

128 |

294 |

||

USDARS closing rate |

177 |

809 |

(1) |

Indexation calculated at closing rate |

|

(2) |

Currency impact from hyperinflation calculated as the difference between converting the Argentinean peso (ARS) reported amounts at the closing exchange rate compared to the average exchange rate of each period |

Financial position

Figure 13. Cash Flow Statement (million USD) |

||

FY22 |

FY23 |

|

Operating activities |

||

Profit of the period |

7 597 |

6 891 |

Interest, taxes and non-cash items included in profit |

12 344 |

14 181 |

Cash flow from operating activities before changes in working capital and use of provisions |

19 941 |

21 072 |

|

||

Change in working capital |

- 346 |

-1 541 |

Pension contributions and use of provisions |

- 351 |

- 419 |

Interest and taxes (paid)/received |

-6 104 |

-5 975 |

Dividends received |

158 |

127 |

Cash flow from/(used in) operating activities |

13 298 |

13 265 |

|

||

Investing activities |

||

Net capex |

-4 838 |

-4 482 |

Sale/(acquisition) of subsidiaries, net of cash disposed/ acquired of |

- 70 |

9 |

Net proceeds from sale/(acquisition) of other assets |

288 |

119 |

Cash flow from/(used in) investing activities |

-4 620 |

-4 354 |

|

||

Financing activities |

||

Net (repayments of) / proceeds from borrowings |

-7 174 |

-2 896 |

Dividends paid |

-2 442 |

-3 013 |

Share buyback |

- |

- 362 |

Payment of lease liabilities |

- 610 |

- 780 |

Derivative financial instruments |

61 |

- 841 |

Other financing cash flows |

- 455 |

- 704 |

Cash flow from/(used in) financing activities |

-10 620 |

-8 596 |

. |

||

Net increase/(decrease) in cash and cash equivalents |

-1 942 |

315 |

FY23 recorded an increase in cash and cash equivalents of 315 million USD compared to a decrease of 1 942 million USD in FY22, with the following movements:

- Our cash flow from operating activities reached 13 265 million USD in FY23 compared to 13 298 million USD in FY22. The decrease was driven by changes in working capital for FY23 compared to FY22 as a result of (i) higher trade and other receivables due partially to increased sales in December 2023 versus December 2022 and extended credit terms to our wholesalers in the US, and (ii) a decrease in trade and other payables due to lower inventory purchases and net capex, and US volume performance.

- Our cash outflow from investing activities was 4 354 million USD in FY23 compared to a cash outflow of 4 620 million USD in FY22. The decrease in the cash outflow from investing activities was mainly due to lower net capital expenditures in FY23 compared to FY22. Out of the total FY23 capital expenditures, approximately 40% was used to improve the company’s production facilities while 44% was used for logistics and commercial investments and 16% was used for improving administrative capabilities and for the purchase of hardware and software.

- Our cash outflow from financing activities amounted to 8 596 million USD in FY23, as compared to a cash outflow of 10 620 million USD in FY22. The decrease is primarily driven by lower debt redemption in FY23 compared to FY22.

Our net debt decreased to 67.6 billion USD as of 31 December 2023 from 69.7 billion USD as of 31 December 2022.

Our net debt to normalized EBITDA ratio was 3.38x as of 31 December 2023. Our optimal capital structure is a net debt to normalized EBITDA ratio of around 2x.

We continue to proactively manage our debt portfolio. After redemptions in December 2023 of 3 billion USD, 98% of our bond portfolio holds a fixed-interest rate, 41% is denominated in currencies other than USD and maturities are well-distributed across the next several years.

In addition to a very comfortable debt maturity profile and strong cash flow generation, as of 31 December 2023, we had total liquidity of 20.5 billion USD, which consisted of 10.1 billion USD available under committed long-term credit facilities and 10.4 billion USD of cash, cash equivalents and short-term investments in debt securities less bank overdrafts.

2024 presentation update

For FY24, the definition of organic revenue growth has been amended to cap the price growth in Argentina to a maximum of 2% per month. Corresponding adjustments will be made to all income statement related items in the organic growth calculations.

Proposed full year 2023 dividend

The AB InBev Board proposes a full year 2023 dividend of 0.82 EUR per share, subject to shareholder approval at the AGM on 24 April 2024. In line with the Company’s financial discipline and deleveraging objectives, the recommended dividend balances the Company’s capital allocation priorities and dividend policy while returning cash to shareholders. A timeline showing the ex-dividend, record and payment dates can be found below:

Dividend Timeline |

|||

Ex-dividend date |

Record Date |

Payment date |

|

Euronext |

3 May 2024 |

6 May 2024 |

7 May 2024 |

MEXBOL |

3 May 2024 |

6 May 2024 |

7 May 2024 |

JSE |

2 May 2024 |

6 May 2024 |

7 May 2024 |

NYSE (ADR program) |

3 May 2024 |

6 May 2024 |

7 June 2024 |

Restricted Shares |

3 May 2024 |

6 May 2024 |

7 May 2024 |

Notes

To facilitate the understanding of AB InBev’s underlying performance, the analyses of growth, including all comments in this press release, unless otherwise indicated, are based on organic growth and normalized numbers. In other words, financials are analyzed eliminating the impact of changes in currencies on translation of foreign operations, and scope changes. Scope changes represent the impact of acquisitions and divestitures, the start or termination of activities or the transfer of activities between segments, curtailment gains and losses and year over year changes in accounting estimates and other assumptions that management does not consider as part of the underlying performance of the business. The organic growth of our global brands, Budweiser, Stella Artois, Corona and Michelob Ultra, excludes exports to Australia for which a perpetual license was granted to a third party upon disposal of the Australia operations in 2020. All references per hectoliter (per hl) exclude US non-beer activities. Whenever presented in this document, all performance measures (EBITDA, EBIT, profit, tax rate, EPS) are presented on a “normalized” basis, which means they are presented before non-underlying items. Non-underlying items are either income or expenses which do not occur regularly as part of the normal activities of the Company. They are presented separately because they are important for the understanding of the underlying sustainable performance of the Company due to their size or nature. Normalized measures are additional measures used by management and should not replace the measures determined in accordance with IFRS as an indicator of the Company’s performance. As from 1 January 2023, mark-to-market gains/(losses) on derivatives related to the hedging of our share-based payment programs are reported in the non-underlying net finance income/(cost). The 2022 presentation was amended to conform to the 2023 presentation. We are reporting the results from Argentina applying hyperinflation accounting since 3Q18. The IFRS rules (IAS 29) require us to restate the year-to-date results for the change in the general purchasing power of the local currency, using official indices before converting the local amounts at the closing rate of the period. These impacts are excluded from organic calculations. In FY23, we reported a negative impact on the profit attributable to equity holders of AB InBev of 203 million USD. The impact in FY23 Basic EPS was -0.10 USD. Values in the figures and annexes may not add up, due to rounding. 4Q23 and FY23 EPS is based upon a weighted average of 2 016 million shares compared to a weighted average of 2 013 million shares for 4Q22 and FY22.

Legal disclaimer

This release contains “forward-looking statements”. These statements are based on the current expectations and views of future events and developments of the management of AB InBev and are naturally subject to uncertainty and changes in circumstances. The forward-looking statements contained in this release include statements other than historical facts and include statements typically containing words such as “will”, “may”, “should”, “believe”, “intends”, “expects”, “anticipates”, “targets”, “estimates”, “likely”, “foresees” and words of similar import. All statements other than statements of historical facts are forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect the current views of the management of AB InBev, are subject to numerous risks and uncertainties about AB InBev and are dependent on many factors, some of which are outside of AB InBev’s control. There are important factors, risks and uncertainties that could cause actual outcomes and results to be materially different, including, but not limited to the risks and uncertainties relating to AB InBev that are described under Item 3.D of AB InBev’s Annual Report on Form 20-F filed with the SEC on 17 March 2023. Many of these risks and uncertainties are, and will be, exacerbated by any further worsening of the global business and economic environment, including as a result of the ongoing conflict in Russia and Ukraine and in the Middle East, including the conflict in the Red Sea. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements should be read in conjunction with the other cautionary statements that are included elsewhere, including AB InBev’s most recent Form 20-F and other reports furnished on Form 6-K, and any other documents that AB InBev has made public. Any forward-looking statements made in this communication are qualified in their entirety by these cautionary statements and there can be no assurance that the actual results or developments anticipated by AB InBev will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, AB InBev or its business or operations. Except as required by law, AB InBev undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The fourth quarter 2023 (4Q23) and the full year 2023 (FY23) financial data set out in Figure 1 (except for the volume information), Figures 3 to 5, 6, 8, 9, 12 and 13 of this press release have been extracted from the group’s audited consolidated financial statements as of and for the twelve months ended 31 December 2023, which have been audited by our statutory auditors PwC Réviseurs d’Entreprises SRL / PwC Bedrijfsrevisoren BV in accordance with the standards of the Public Company Accounting Oversight Board (United States). Financial data included in Figures 7, 10, 11 and 14 have been extracted from the underlying accounting records as of and for the twelve months ended 31 December 2023 (except for the volume information). References in this document to materials on our websites, such as www.ab-inbev.com, are included as an aid to their location and are not incorporated by reference into this document.

Conference call and webcast

Investor Conference call and webcast on Thursday, 29 February 2024:

3.00pm Brussels / 2.00pm London / 9.00am New York

Registration details:

Webcast (listen-only mode):

AB InBev 4Q23 Results Webcast

To join by phone, please use one of the following two phone numbers:

Toll-Free: 877-407-8029

Toll: 201-689-8029

About Anheuser-Busch InBev (AB InBev)

Anheuser-Busch InBev (AB InBev) is a publicly traded company (Euronext: ABI) based in Leuven, Belgium, with secondary listings on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) stock exchanges and with American Depositary Receipts on the New York Stock Exchange (NYSE: BUD). As a company, we dream big to create a future with more cheers. We are always looking to serve up new ways to meet life’s moments, move our industry forward and make a meaningful impact in the world. We are committed to building great brands that stand the test of time and to brewing the best beers using the finest ingredients. Our diverse portfolio of well over 500 beer brands includes global brands Budweiser®, Corona®, Stella Artois® and Michelob Ultra®; multi-country brands Beck’s®, Hoegaarden® and Leffe®; and local champions such as Aguila®, Antarctica®, Bud Light®, Brahma®, Cass®, Castle®, Castle Lite®, Cristal®, Harbin®, Jupiler®, Modelo Especial®, Quilmes®, Victoria®, Sedrin®, and Skol®. Our brewing heritage dates back more than 600 years, spanning continents and generations. From our European roots at the Den Hoorn brewery in Leuven, Belgium. To the pioneering spirit of the Anheuser & Co brewery in St. Louis, US. To the creation of the Castle Brewery in South Africa during the Johannesburg gold rush. To Bohemia, the first brewery in Brazil. Geographically diversified with a balanced exposure to developed and developing markets, we leverage the collective strengths of approximately 155,000 colleagues based in nearly 50 countries worldwide. For 2023, AB InBev’s reported revenue was 59.4 billion USD (excluding JVs and associates).

Annex 1: Segment reporting (4Q)

AB InBev Worldwide |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

148 775 |

-151 |

- |

- |

-3 919 |

144 706 |

-2.6% |

of which AB InBev own beer |

128 502 |

-127 |

- |

- |

-4 610 |

123 764 |

-3.6% |

Revenue |

14 668 |

-67 |

-2 239 |

1 199 |

912 |

14 473 |

6.2% |

Cost of sales |

-6 661 |

22 |

914 |

-464 |

- 491 |

-6 679 |

-7.4% |

Gross profit |

8 007 |

-44 |

-1 325 |

736 |

421 |

7 794 |

5.3% |

SG&A |

-4 592 |

13 |

594 |

-358 |

-195 |

-4 537 |

-4.3% |

Other operating income/(expenses) |

193 |

48 |

-24 |

-4 |

22 |

234 |

11.4% |

Normalized EBIT |

3 608 |

17 |

-755 |

373 |

248 |

3 491 |

6.9% |

Normalized EBITDA |

4 947 |

22 |

-914 |

518 |

304 |

4 877 |

6.2% |

Normalized EBITDA margin |

33.7% |

33.7% |

-2 bps |

||||

|

|||||||

North America |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

23 451 |

-149 |

- |

- |

-3 563 |

19 738 |

-15.3% |

Revenue |

3 931 |

-37 |

2 |

- |

- 613 |

3 283 |

-15.7% |

Cost of sales |

-1 566 |

21 |

- |

- |

103 |

-1 442 |

6.6% |

Gross profit |

2 366 |

-16 |

1 |

- |

- 510 |

1 841 |

-21.7% |

SG&A |

-1 166 |

12 |

- |

- |

56 |

-1 098 |

4.9% |

Other operating income/(expenses) |

11 |

- |

- |

- |

7 |

18 |

- |

Normalized EBIT |

1 211 |

-4 |

1 |

- |

-448 |

761 |

-37.1% |

Normalized EBITDA |

1 397 |

-5 |

1 |

- |

-436 |

957 |

-31.3% |

Normalized EBITDA margin |

35.5% |

29.2% |

-660 bps |

||||

|

|||||||

Middle Americas |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

38 286 |

- |

- |

- |

348 |

38 635 |

0.9% |

Revenue |

3 913 |

-17 |

335 |

- |

206 |

4 437 |

5.3% |

Cost of sales |

-1 521 |

-7 |

-128 |

- |

- 76 |

-1 731 |

-5.0% |

Gross profit |

2 392 |

-23 |

208 |

- |

130 |

2 706 |

5.5% |

SG&A |

-879 |

12 |

-78 |

- |

10 |

- 934 |

1.2% |

Other operating income/(expenses) |

-3 |

6 |

- |

- |

25 |

27 |

- |

Normalized EBIT |

1 510 |

-5 |

130 |

- |

165 |

1 799 |

11.0% |

Normalized EBITDA |

1 872 |

- |

160 |

- |

138 |

2 170 |

7.4% |

Normalized EBITDA margin |

47.9% |

48.9% |

95 bps |

||||

|

|||||||

South America |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

46 860 |

- |

- |

- |

- 157 |

46 704 |

-0.3% |

Revenue |

3 380 |

3 |

-2 498 |

1 199 |

1 001 |

3 084 |

29.6% |

Cost of sales |

-1 661 |

-1 |

987 |

-464 |

- 312 |

-1 450 |

-18.8% |

Gross profit |

1 718 |

2 |

-1 511 |

736 |

689 |

1 635 |

40.1% |

SG&A |

-995 |

-12 |

673 |

-358 |

-197 |

- 890 |

-19.6% |

Other operating income/(expenses) |

97 |

43 |

-24 |

-4 |

7 |

119 |

6.7% |

Normalized EBIT |

820 |

34 |

-862 |

373 |

499 |

863 |

61.5% |

Normalized EBITDA |

1 050 |

34 |

-1 041 |

518 |

545 |

1 106 |

52.4% |

Normalized EBITDA margin |

31.1% |

35.8% |

541 bps |

EMEA |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

24 094 |

50 |

- |

- |

-180 |

23 964 |

-0.7% |

Revenue |

2 070 |

20 |

-82 |

- |

244 |

2 252 |

11.7% |

Cost of sales |

-1 101 |

-10 |

57 |

- |

-199 |

-1 253 |

-17.9% |

Gross profit |

969 |

9 |

-25 |

- |

46 |

999 |

4.7% |

SG&A |

-636 |

-14 |

3 |

- |

-8 |

- 655 |

-1.2% |

Other operating income/(expenses) |

60 |

-1 |

1 |

- |

-7 |

53 |

-11.1% |

Normalized EBIT |

393 |

-6 |

-21 |

- |

31 |

397 |

8.0% |

Normalized EBITDA |

676 |

-5 |

-32 |

- |

37 |

675 |

5.5% |

Normalized EBITDA margin |

32.6% |

30.0% |

-176 bps |

||||

|

|||||||

Asia Pacific |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

15 903 |

- |

- |

- |

-438 |

15 465 |

-2.8% |

Revenue |

1 185 |

-2 |

1 |

- |

83 |

1 267 |

7.0% |

Cost of sales |

-624 |

- |

2 |

- |

-16 |

- 637 |

-2.5% |

Gross profit |

561 |

-2 |

3 |

67 |

630 |

12.1% |

|

SG&A |

-520 |

1 |

7 |

- |

-22 |

- 533 |

-4.2% |

Other operating income/(expenses) |

34 |

- |

-1 |

- |

-8 |

26 |

-22.7% |

Normalized EBIT |

76 |

-1 |

10 |

- |

38 |

122 |

51.3% |

Normalized EBITDA |

234 |

-1 |

6 |

- |

49 |

288 |

21.0% |

Normalized EBITDA margin |

19.8% |

22.8% |

258 bps |

||||

|

|||||||

Global Export and Holding Companies |

4Q22 |

Scope |

Currency Translation |

Hyperinflation restatement |

Organic Growth |

4Q23 |

Organic Growth |

Total volumes (thousand hls) |

181 |

-52 |

- |

- |

71 |

200 |

55.0% |

Revenue |

189 |

-33 |

3 |

- |

-9 |

150 |

-6.0% |

Cost of sales |

-189 |

19 |

-5 |

- |

9 |

-166 |

5.0% |

Gross profit |

- |

-15 |

-1 |

- |

-1 |

-17 |

-4.7% |

SG&A |

-395 |

13 |

-11 |

- |

-34 |

-427 |

-8.9% |

Other operating income/(expenses) |

-6 |

- |

-1 |

- |

-2 |

-8 |

- |

Normalized EBIT |

-401 |

-1 |

-13 |

- |

-37 |

-453 |

-9.2% |

Normalized EBITDA |

-282 |

-1 |

-8 |

- |

-29 |

-320 |

-10.2% |

Annex 2: Segment reporting (FY)

AB InBev Worldwide |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

595 133 |

-151 |

- |

-10 255 |

584 728 |

-1.7% |

of which AB InBev own beer |

517 990 |

- 81 |

- |

-12 010 |

505 899 |

-2.3% |

Revenue |

57 786 |

-123 |

-2 744 |

4 460 |

59 380 |

7.8% |

Cost of sales |

-26 305 |

45 |

1 226 |

-2 362 |

-27 396 |

-9.0% |

Gross profit |

31 481 |

-78 |

-1 518 |

2 099 |

31 984 |

6.7% |

SG&A |

-17 555 |

-14 |

696 |

-1 299 |

-18 172 |

-7.4% |

Other operating income/(expenses) |

841 |

-146 |

-43 |

126 |

778 |

19.8% |

Normalized EBIT |

14 768 |

-238 |

-865 |

925 |

14 590 |

6.4% |

Normalized EBITDA |

19 843 |

-223 |

-1 012 |

1 368 |

19 976 |

7.0% |

Normalized EBITDA margin |

34.3% |

33.6% |

-23 bps |

|||

|

||||||

North America |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

102 674 |

-118 |

- |

-12 417 |

90 140 |

-12.1% |

Revenue |

16 566 |

-36 |

-80 |

-1 378 |

15 072 |

-8.3% |

Cost of sales |

-6 714 |

19 |

28 |

151 |

-6 517 |

2.2% |

Gross profit |

9 851 |

-17 |

-52 |

-1 227 |

8 554 |

-12.5% |

SG&A |

-4 587 |

-18 |

30 |

-43 |

-4 619 |

-0.9% |

Other operating income/(expenses) |

45 |

- |

3 |

-14 |

34 |

-30.3% |

Normalized EBIT |

5 309 |

-35 |

-19 |

-1 285 |

3 970 |

-24.4% |

Normalized EBITDA |

6 057 |

-37 |

-24 |

-1 269 |

4 727 |

-21.1% |

Normalized EBITDA margin |

36.6% |

31.4% |

-507 bps |

|||

Middle Americas |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

147 624 |

- |

- |

1 106 |

148 730 |

0.7% |

Revenue |

14 180 |

-16 |

875 |

1309 |

16 348 |

9.2% |

Cost of sales |

-5 540 |

-13 |

-320 |

-507 |

-6 379 |

-9.1% |

Gross profit |

8 639 |

-29 |

556 |

803 |

9 969 |

9.3% |

SG&A |

-3 390 |

-6 |

-228 |

-167 |

-3 792 |

-4.9% |

Other operating income/(expenses) |

-12 |

14 |

2 |

47 |

51 |

- |

Normalized EBIT |

5 238 |

-21 |

329 |

683 |

6 228 |

13.1% |

Normalized EBITDA |

6 564 |

-7 |

430 |

729 |

7 715 |

11.1% |

Normalized EBITDA margin |

46.3% |

47.2% |

80 bps |

|||

|

||||||

South America |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

164 319 |

- |

- |

-1 859 |

162 460 |

-1.1% |

Revenue |

11 599 |

4 |

-2 702 |

3 139 |

12 040 |

27.3% |

Cost of sales |

-5 976 |

-1 |

1 054 |

-1 062 |

-5 984 |

-18.0% |

Gross profit |

5 623 |

3 |

-1 647 |

2 077 |

6 056 |

37.2% |

SG&A |

-3 458 |

-28 |

697 |

-787 |

-3 575 |

-22.8% |

Other operating income/(expenses) |

473 |

-153 |

-38 |

112 |

394 |

40.6% |

Normalized EBIT |

2 638 |

-177 |

-988 |

1 402 |

2 875 |

58.3% |

Normalized EBITDA |

3 511 |

-177 |

-1 137 |

1 688 |

3 884 |

51.9% |

Normalized EBITDA margin |

30.3% |

32.3% |

542 bps |

EMEA |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

90 780 |

204 |

- |

- 771 |

90 213 |

-0.8% |

Revenue |

8 120 |

75 |

-491 |

885 |

8 589 |

10.8% |

Cost of sales |

-4 167 |

-40 |

297 |

-734 |

-4 645 |

-17.5% |

Gross profit |

3 953 |

35 |

-194 |

150 |

3 944 |

3.8% |

SG&A |

-2 604 |

-57 |

105 |

-58 |

-2 614 |

-2.2% |

Other operating income/(expenses) |

198 |

-8 |

-3 |

12 |

198 |

6.2% |

Normalized EBIT |

1 546 |

-30 |

-92 |

104 |

1528 |

6.9% |

Normalized EBITDA |

2 612 |

-29 |

-158 |

145 |

2 570 |

5.6% |

Normalized EBITDA margin |

32.2% |

29.9% |

-148 bps |

|||

|

||||||

Asia Pacific |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

88 898 |

- |

- |

3 828 |

92 726 |

4.3% |

Revenue |

6 532 |

-12 |

-350 |

655 |

6 824 |

10.0% |

Cost of sales |

-3 168 |

-1 |

170 |

-274 |

-3 272 |

-8.6% |

Gross profit |

3 364 |

-13 |

-180 |

380 |

3 551 |

11.4% |

SG&A |

-2 067 |

7 |

105 |

-178 |

-2 133 |

-8.6% |

Other operating income/(expenses) |

137 |

- |

-7 |

-17 |

113 |

-12.6% |

Normalized EBIT |

1 433 |

-6 |

-82 |

186 |

1 531 |

13.0% |

Normalized EBITDA |

2 104 |

-6 |

-118 |

206 |

2 186 |

9.8% |

Normalized EBITDA margin |

32.2% |

32.0% |

-7 bps |

|||

|

||||||

Global Export and Holding Companies |

FY22 |

Scope |

Currency Translation |

Organic Growth |

FY23 |

Organic Growth |

Total volumes (thousand hls) |

838 |

-236 |

- |

-143 |

459 |

-23.7% |

Revenue |

790 |

-137 |

4 |

-149 |

508 |

-22.8% |

Cost of sales |

-740 |

80 |

-3 |

64 |

-598 |

9.8% |

Gross profit |

50 |

-57 |

1 |

-84 |

-90 |

- |

SG&A |

-1 447 |

88 |

-13 |

-66 |

-1 439 |

-4.9% |

Other operating income/(expenses) |

1 |

- |

- |

-14 |

-13 |

- |

Normalized EBIT |

-1 396 |

32 |

-12 |

-165 |

-1 542 |

-12.1% |

Normalized EBITDA |

-1 004 |

33 |

-5 |

-130 |

-1 106 |

-13.4% |

Annex 3: Consolidated statement of financial position

Million US dollar |

31 December 2023 |

31 December 2022 |

ASSETS |

||

Non-current assets |

||

Property, plant and equipment |

26 818 |

26 671 |

Goodwill |

117 043 |

113 010 |

Intangible assets |

41 286 |

40 209 |

Investments in associates |

4 872 |

4 656 |

Investment securities |

178 |

175 |

Deferred tax assets |

2 935 |

2 300 |

Pensions and similar obligations |

12 |

11 |

Income tax receivables |

844 |

883 |

Derivatives |

44 |

60 |

Trade and other receivables |

1 941 |

1 782 |

Total non-current assets |

195 973 |

189 757 |

|

||

Current assets |

||

Investment securities |

67 |

97 |

Inventories |

5 583 |

6 612 |

Income tax receivables |

822 |

813 |

Derivatives |

505 |

331 |

Trade and other receivables |