Headline News about 7-10 Year Treasury Bond Ishares ETF

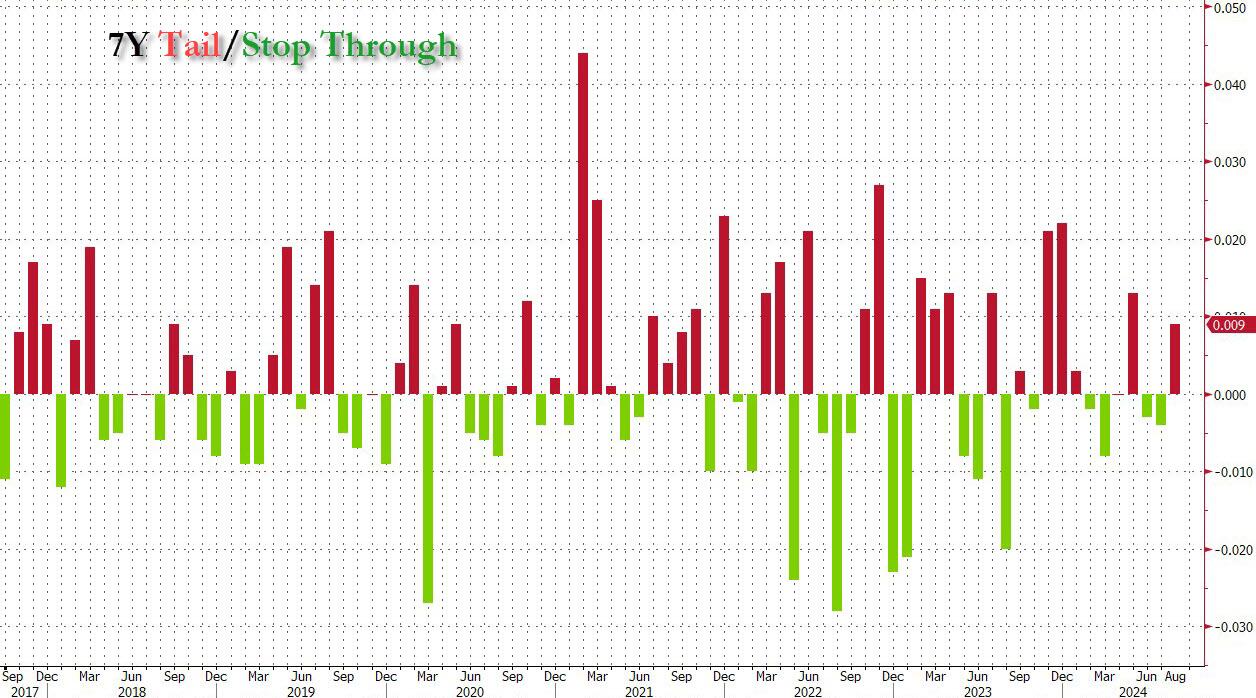

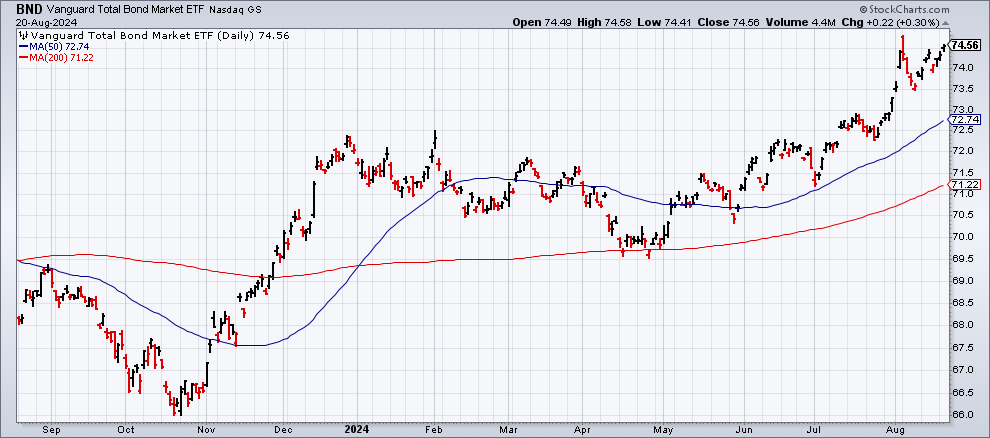

The Bond Market Should Be Careful What It Wishes For

August 30, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

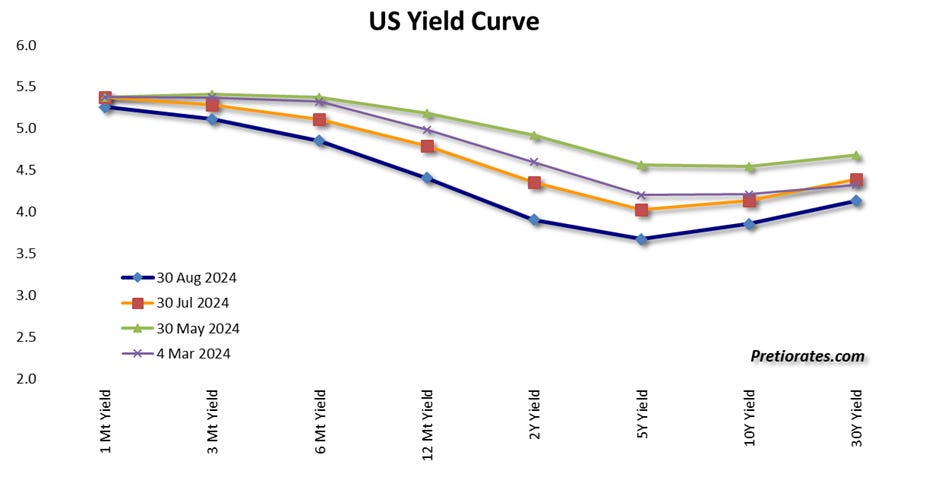

Yield Curve Shifts Offer Signals For Stockholders

August 28, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Asia Morning Bites For Tuesday, Aug 27

August 27, 2024

Via Talk Markets

Topics

World Trade

Exposures

Tariff

Via Talk Markets

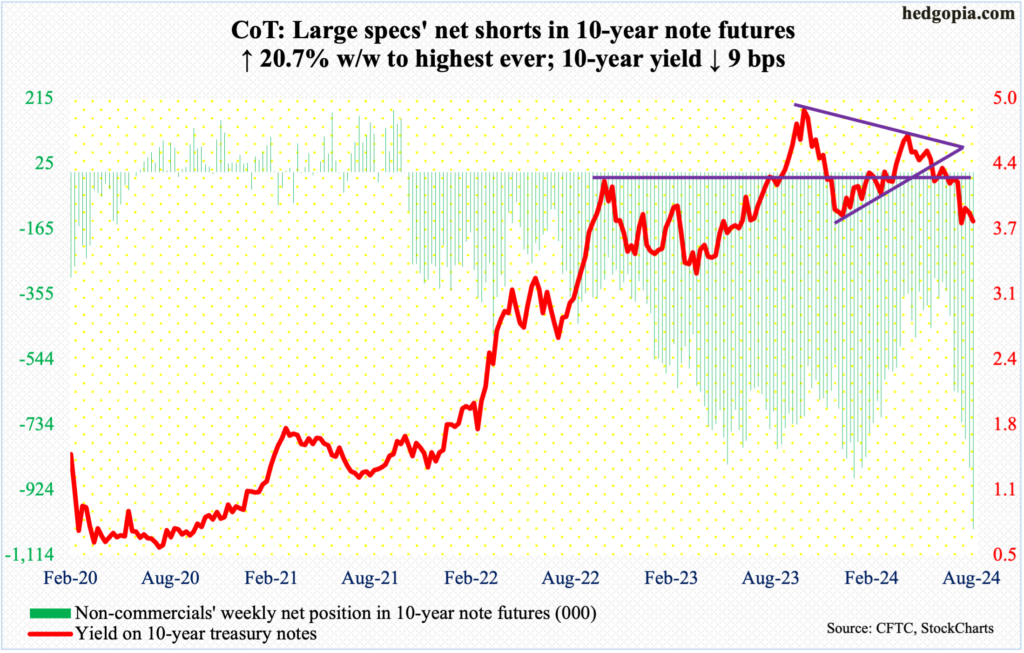

Speculator Extremes: Yen, Gold, 5-Year, 10-Year & Cotton Lead Bullish & Bearish Positions

August 25, 2024

Via Talk Markets

Exposures

Textiles

Asia Morning Bites For Friday, Aug 23

August 23, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.