All News about S&P 500 EW Invesco ETF

Stocks Fail At Bull/bear Inflection Point

February 11, 2022

Via Talk Markets

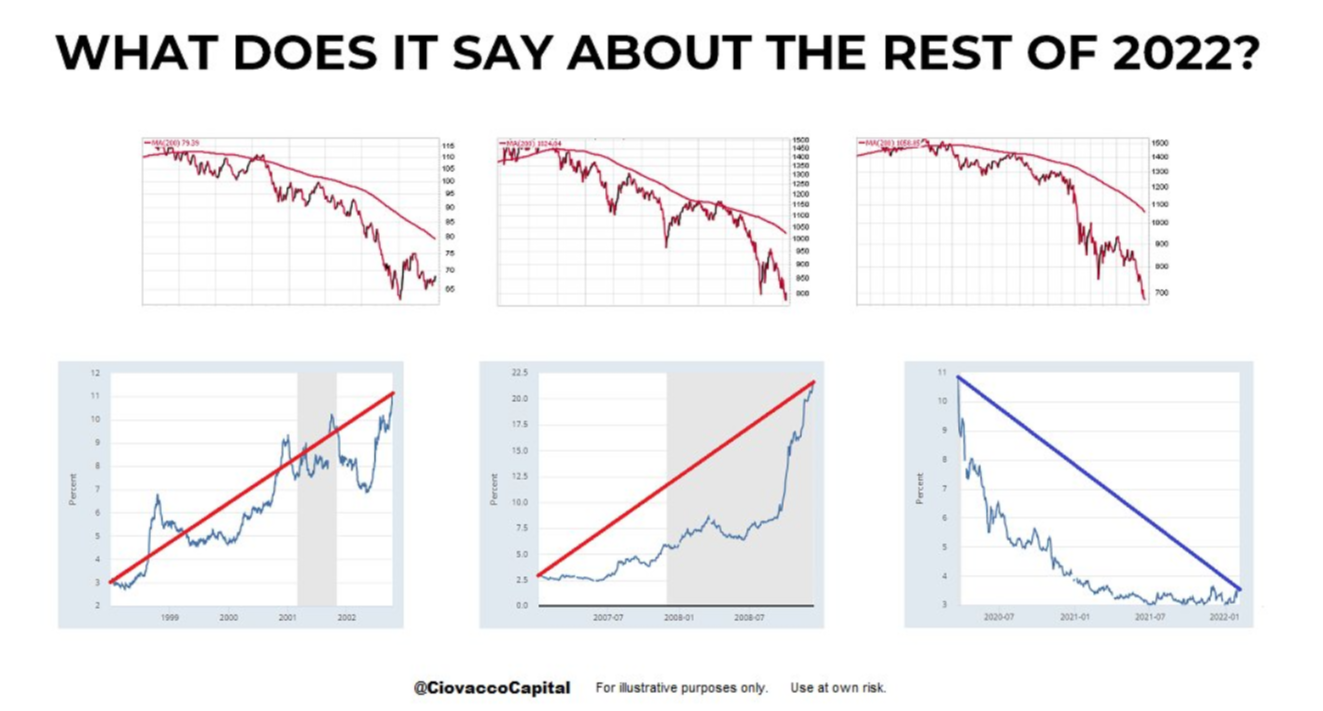

The Most Important Question For Investors

December 04, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

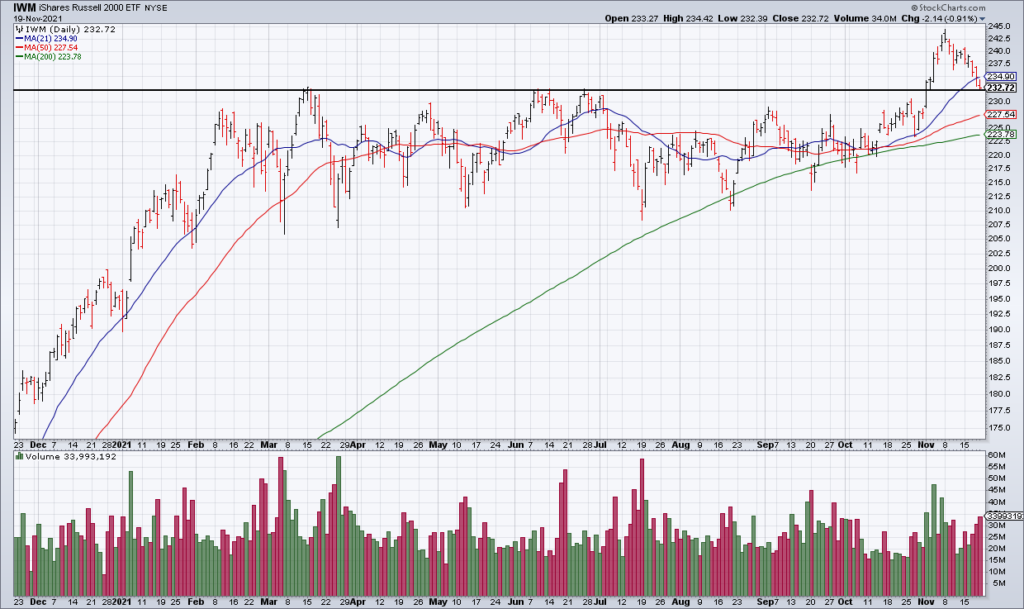

Volatility Should Pick-up Following Tomorrow’s Options Expiration

November 18, 2021

Via Talk Markets

Topics

Stocks

Exposures

US Equities

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.