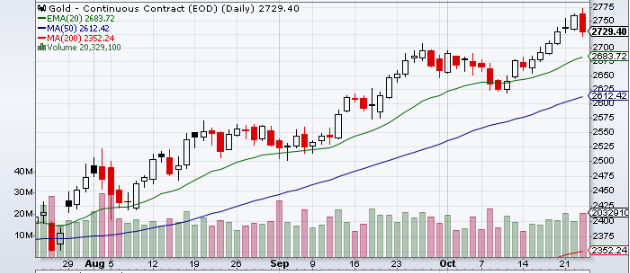

ecious metals, particularly gold and silver, have surged to new record highs, driven by a combination of global economic uncertainty, geopolitical tensions, and inflation concerns. Analysts expect gold prices to keep rising, citing the growing demand for safe-haven investments as major factors influencing the market.

One of the primary drivers behind the recent rally is the escalating conflict in the Middle East, which has heightened geopolitical risks and prompted investors to seek refuge in assets like gold and silver. Historically, these metals perform well during times of international instability, offering protection against economic and political shocks.

Companies Poised to Benefit from the Precious Metals Boom

As the market for precious metals heats up, there are several companies to watch in this space, these include, Platinum Group Metals (NYSE: PLG) (TSX.V: PTM), GoldMining Inc (NYSE: GLDG) (TSX: GOLD), RUA GOLD Inc (TSX-V: RUA) (OTCQB: NZAUF), Power Nickel Inc (TSX.V: PNPN) (OTCQB: PNPNF) and Clifton Mining Company (OTC: CFTN), which are poised to benefit from the continued rise in gold and silver prices.

Adding to the upward pressure on gold prices is the global economic landscape, where inflation continues to erode the value of fiat currencies. With central banks like the U.S. Federal Reserve adopting more cautious policies and pausing interest rate hikes, investors are turning to precious metals as a hedge against rising prices and a potentially slowing economy.

Furthermore, a weakening U.S. dollar has also played a role in boosting precious metal prices. When the dollar depreciates, gold and silver become more attractive to international buyers, further driving up demand.

In the U.S., the ongoing tight race in the presidential election has only added to the uncertainty, amplifying concerns about fiscal policies and economic direction. This, combined with increased demand for gold from central banks in emerging markets, has contributed to the sharp rise in prices.

As geopolitical and economic challenges continue to unfold, analysts expect gold prices to keep climbing, making it a preferred asset for investors seeking stability in a turbulent global environment.

As global uncertainties persist, the outlook for gold and silver remains strong, with analysts predicting continued upward momentum. Investors are closely watching how these precious metals will perform in the face of inflation, geopolitical risks, and economic instability. With companies like Platinum Group Metals (NYSE: PLG) and the others mentioned herein they are positioned to benefit from these trends, the precious metals market presents significant opportunities for growth and stability in the months ahead.

Disclaimers: The Private Securities Litigation Reform Act of 1995 provides investors with a safe harbor with regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, assumptions, objectives, goals, and assumptions about future events or performance are not statements of historical fact and may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements, indicating certain actions & quotes; may, could or might occur Understand there is no guarantee past performance is indicative of future results. Investing in micro-cap or growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor's investment may be lost or due to the speculative nature of the companies profiled. TheStreetReports (TSR) is responsible for the production and distribution of this content."TSR" is not operated by a licensed broker, a dealer, or a registered investment advisor. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. "TSR" authors, contributors, or its agents, may be compensated for preparing research, video graphics, podcasts and editorial content. "TSR" has not been compensated to produce content related to "Any Companies" appearing herein. As part of that content, readers, subscribers, and everyone viewing this content are expected to read the full disclaimer in our website.

Media Contact

Company Name: The Street Reports

Contact Person: Editor

Email: Send Email

Country: United States

Website: http://www.thestreetreports.com