Beverage company Coca-Cola (NYSE:KO) announced better-than-expected revenue in Q3 CY2024, but sales were flat year on year at $11.85 billion. Its non-GAAP profit of $0.77 per share was also 3.2% above analysts’ consensus estimates.

Is now the time to buy Coca-Cola? Find out by accessing our full research report, it’s free.

Coca-Cola (KO) Q3 CY2024 Highlights:

- Revenue: $11.85 billion vs analyst estimates of $11.61 billion (2.1% beat)

- Adjusted EPS: $0.77 vs analyst estimates of $0.75 (3.2% beat)

- Full Year Guidance: expects 10% organic revenue growth (9-10% prior) and 5-6% Adjusted EPS growth (same as previous guidance)

- Gross Margin (GAAP): 60.7%, in line with the same quarter last year

- Organic Revenue rose 9% year on year (11% in the same quarter last year)

- Sales Volumes fell 1% year on year (2% in the same quarter last year)

- Market Capitalization: $299.3 billion

Company Overview

A pioneer and behemoth in carbonated soft drinks, The Coca-Cola Company (NYSE:KO) is a storied beverage company best known for its flagship soda of the same name.

Beverages, Alcohol and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Coca-Cola is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have).

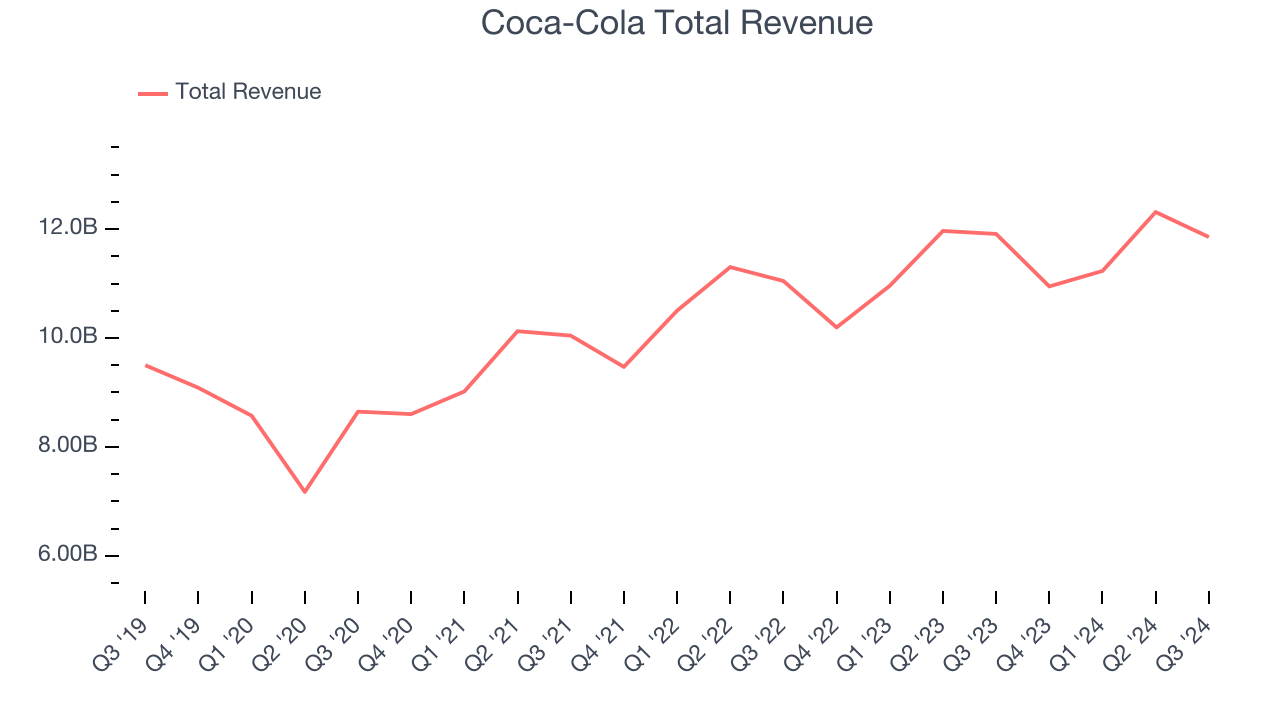

As you can see below, Coca-Cola grew its sales at a decent 7% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Coca-Cola’s $11.85 billion of revenue was flat year on year but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates the market believes its products will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Volume Growth

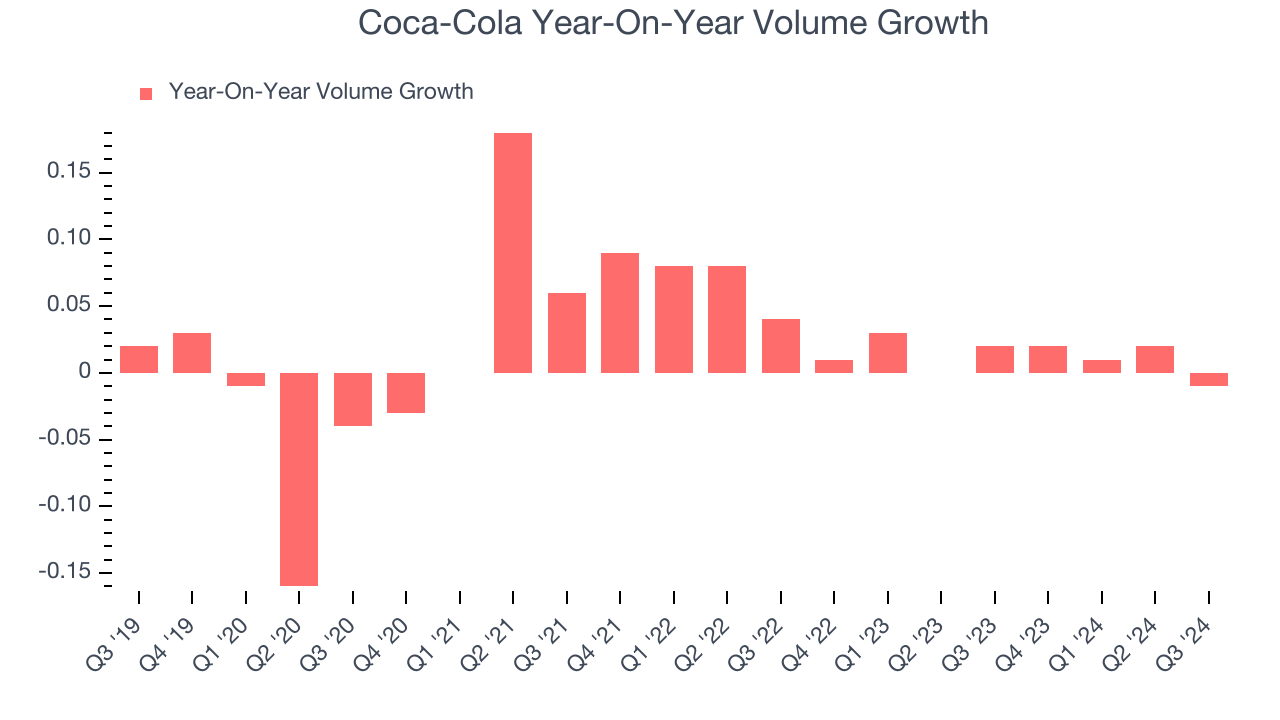

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

To analyze whether Coca-Cola generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Coca-Cola’s average quarterly volume growth was a healthy 1.2%. Even with this good performance, we can see that most of the company’s gains have come from price increases by looking at its 12% average organic revenue growth. The ability to sell more products while raising prices indicates that Coca-Cola enjoys some degree of inelastic demand.

In Coca-Cola’s Q3 2024, year on year sales volumes were flat. By the company’s standards, this result was a meaningful deceleration from the 2% year-on-year increase it posted 12 months ago. We’ll be watching Coca-Cola closely to see if it can reaccelerate demand for its products.

Key Takeaways from Coca-Cola’s Q3 Results

We liked that Coca-Cola exceeded analysts’ organic revenue growth expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin missed analysts’ expectations. Full year EPS guidance was maintained from its prior outlook given last quarter despite this quarter's beat. Shares traded down 2.2% to $67.90 immediately following the results.

Should you buy the stock or not?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings.We cover that in our actionable full research report which you can read here, it’s free.