All News about 3-7 Year Treas Bond Ishares ETF

Via Talk Markets

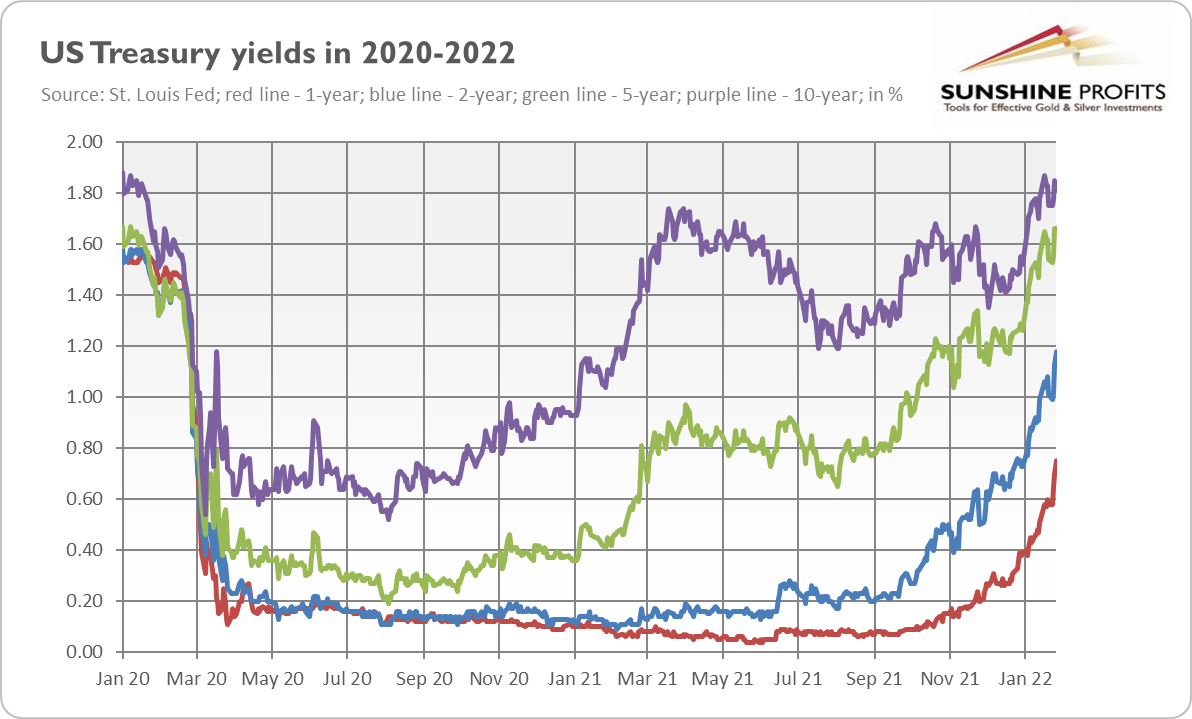

XAU/USD Forecast: Gold Price Extends Decline As Real Yields Tick Higher

December 02, 2021

Via Talk Markets

Topics

Economy

Exposures

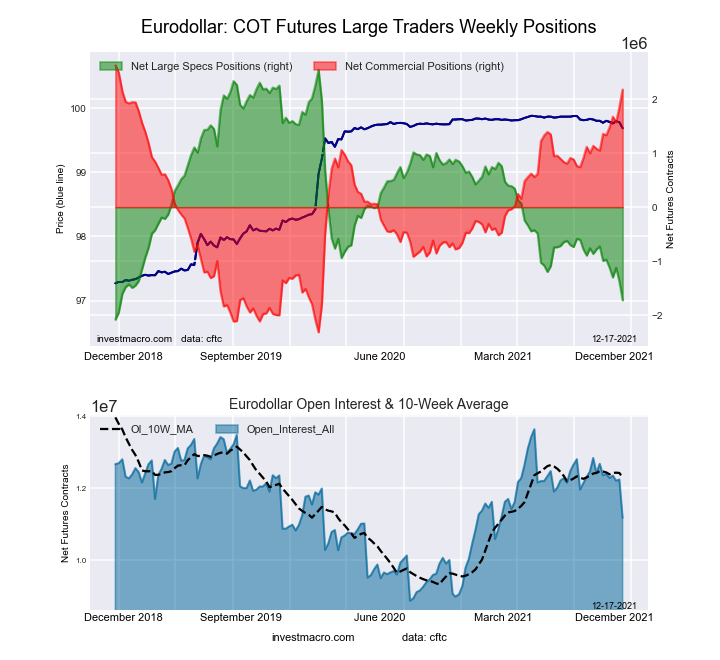

Interest Rates

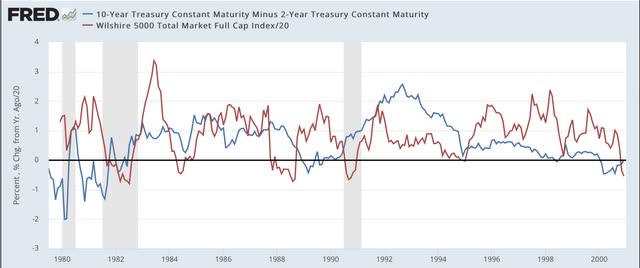

Do Treasury Yields Rise During Economic Expansions?

November 30, 2021

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.