Hunt Valley, Maryland-based McCormick & Company, Incorporated (MKC) markets, and distributes spices, seasoning mixes, condiments, and other flavorful products to the food industry. Valued at a market cap of $17.7 billion, the company provides a wide range of flavor products used in home cooking, restaurants, and packaged foods through its iconic brands such as McCormick, Lawry’s, and Frank’s RedHot.

Shares of this packaged foods company have considerably underperformed the broader market over the past 52 weeks. MKC has declined 12.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.1%. Moreover, on a YTD basis, the stock is down 12.8%, compared to SPX’s 15.1% return.

Narrowing the focus, MKC has also trailed behind the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 11.6% downtick over the past 52 weeks and 6.8% drop on a YTD basis.

On Nov. 11, shares of MKC surged 2.2% after its impressive Q3 earnings release. The company’s total net sales increased 2.7% year-over-year to $1.7 billion, slightly surpassing consensus estimates. Meanwhile, its adjusted EPS of $0.85 improved 2.4% from the year-ago quarter, topping analyst expectations by 4.9%. Due to the dynamic global trade environment, its gross margin was pressured by rising costs; however, MKC continued to drive operating profit growth through the effective execution of its cost savings initiatives, bolstering investor confidence.

For the current fiscal year, ending in November, analysts expect MKC’s EPS to grow 2.4% year over year to $3.02. The company’s earnings surprise history is mixed. It topped consensus estimates in three of the last four quarters, while missing on another occasion.

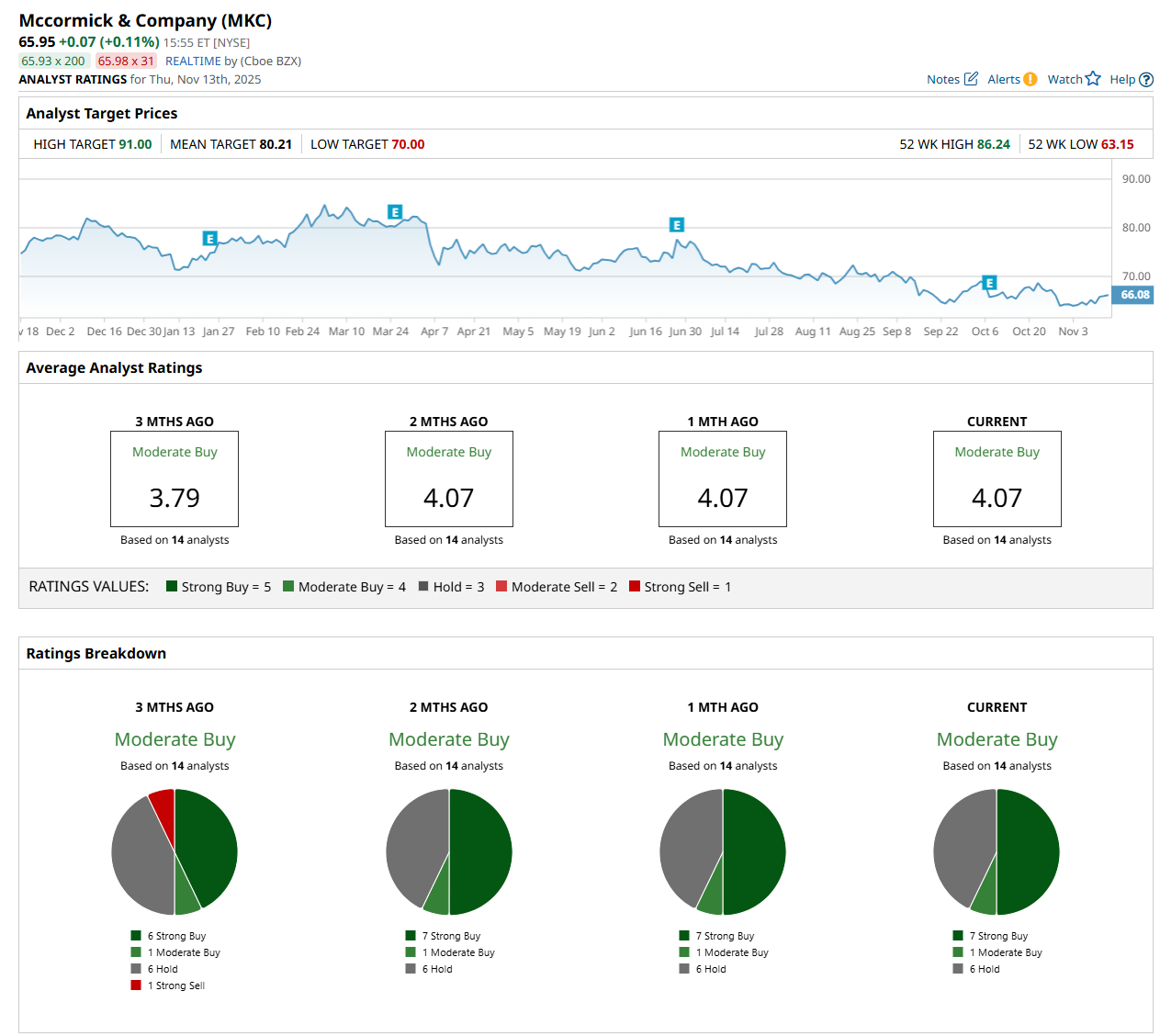

Among the 14 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” one "Moderate Buy,” and six “Hold” ratings.

This configuration is more bullish than three months ago, with six analysts suggesting a “Strong Buy” rating and one recommending "Strong Sell.”

On Oct. 28, Bernstein analyst Alexia Burland Howard maintained a “Buy” rating on MKC and set a price target of $91, the Street-high price target, indicating a 38% potential upside from the current levels.

The mean price target of $80.21 represents a 21.6% premium from MKC’s current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Who Is Phil Clifton? Michael Burry Names Successor as Famed Investor Deregisters Hedge Fund.

- Michael Burry Slams NVDA, PLTR, META, ORCL. Here’s What the Charts Say About His Tech-Focused ‘Big Short.’

- Get Ready for a Short Squeeze in Sweetgreen Stock

- Stablecoin Issuer Circle Faces ‘an Uphill Battle.’ Is It Time to Give Up on CRCL Stock?