Technology real estate company Offerpad (NYSE: OPAD) beat Wall Street’s revenue expectations in Q3 CY2024, but sales fell 11.2% year on year to $208.1 million. On the other hand, next quarter’s revenue guidance of $172.5 million was less impressive, coming in 19.6% below analysts’ estimates. Its GAAP loss of $0.49 per share was 11.3% below analysts’ consensus estimates.

Is now the time to buy Offerpad? Find out by accessing our full research report, it’s free.

Offerpad (OPAD) Q3 CY2024 Highlights:

- Revenue: $208.1 million vs analyst estimates of $204.6 million (1.7% beat)

- EPS: -$0.49 vs analyst expectations of -$0.44 (11.3% miss)

- EBITDA: -$6.18 million vs analyst estimates of -$2.65 million (133% miss)

- Revenue Guidance for Q4 CY2024 is $172.5 million at the midpoint, below analyst estimates of $214.6 million

- Gross Margin (GAAP): 8.2%, down from 10.2% in the same quarter last year

- Operating Margin: -4.3%, up from -8.3% in the same quarter last year

- EBITDA Margin: -3%, up from -5.7% in the same quarter last year

- Free Cash Flow was $38.71 million, up from -$94.54 million in the same quarter last year

- Homes Sold: 615, down 88 year on year

- Market Capitalization: $85.34 million

“During the third quarter, we delivered revenue at the high end of our guidance. We’ve expanded our asset-light services, strengthened partnerships, and optimized our organization,” said Brian Bair, Offerpad’s CEO.

Company Overview

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE: OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

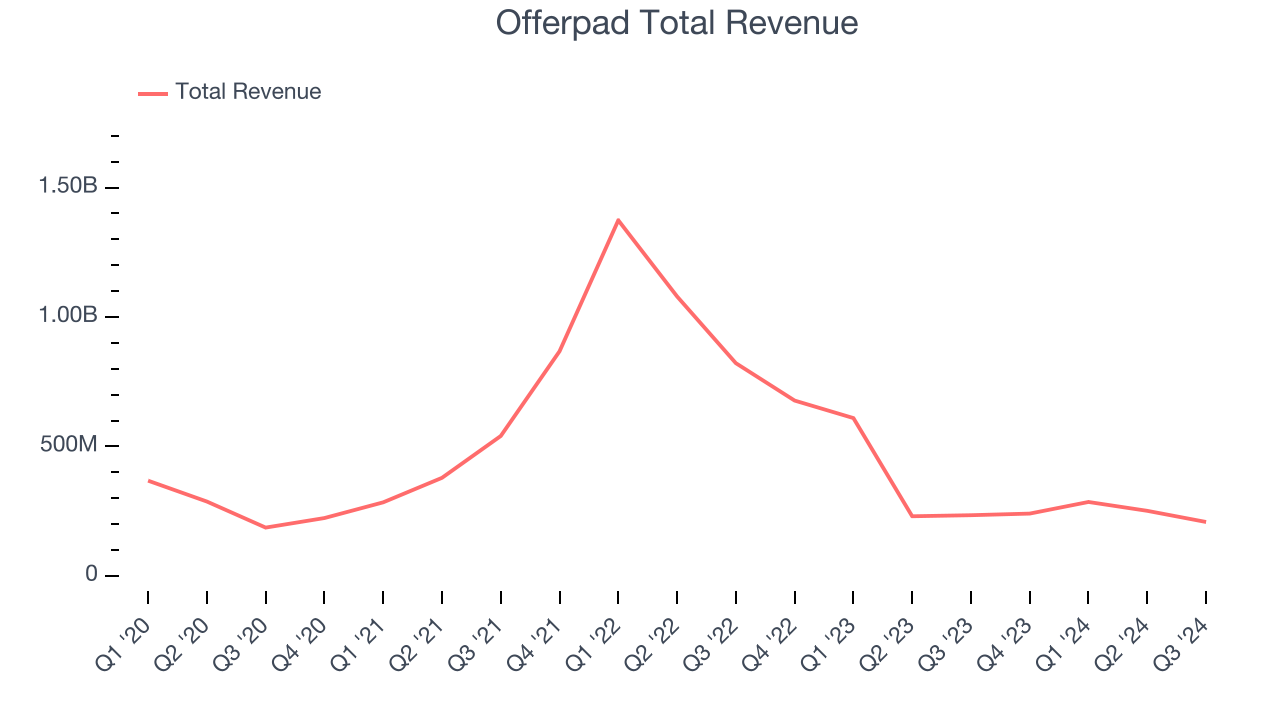

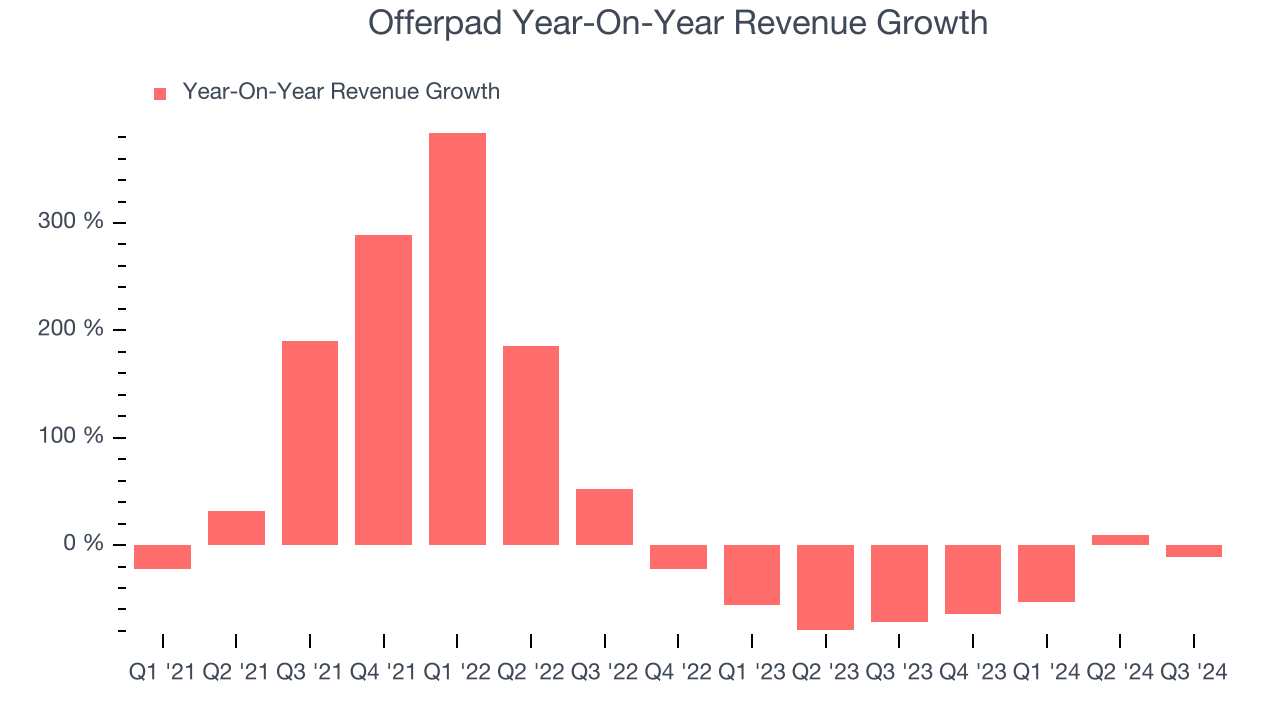

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Offerpad’s demand was weak over the last four years as its sales fell by 3% annually, a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Offerpad’s recent history shows its demand has stayed suppressed as its revenue has declined by 51.2% annually over the last two years.

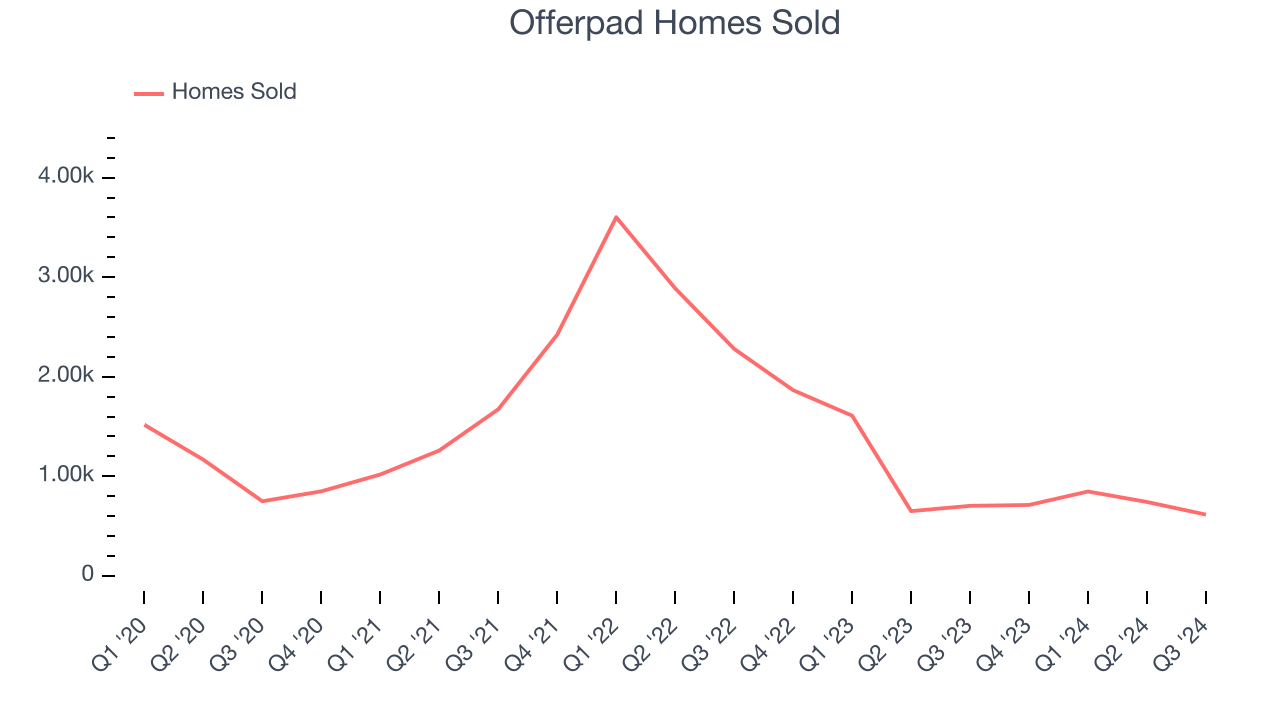

We can dig further into the company’s revenue dynamics by analyzing its number of homes sold and homes purchased, which clocked in at 615 and 422 in the latest quarter. Over the last two years, Offerpad’s homes sold averaged 41.6% year-on-year declines while its homes purchased averaged 25.7% year-on-year declines.

This quarter, Offerpad’s revenue fell 11.2% year on year to $208.1 million but beat Wall Street’s estimates by 1.7%. Management is currently guiding for a 28.3% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.4% over the next 12 months, an improvement versus the last two years. This projection is healthy and illustrates the market thinks its newer products and services will catalyze higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

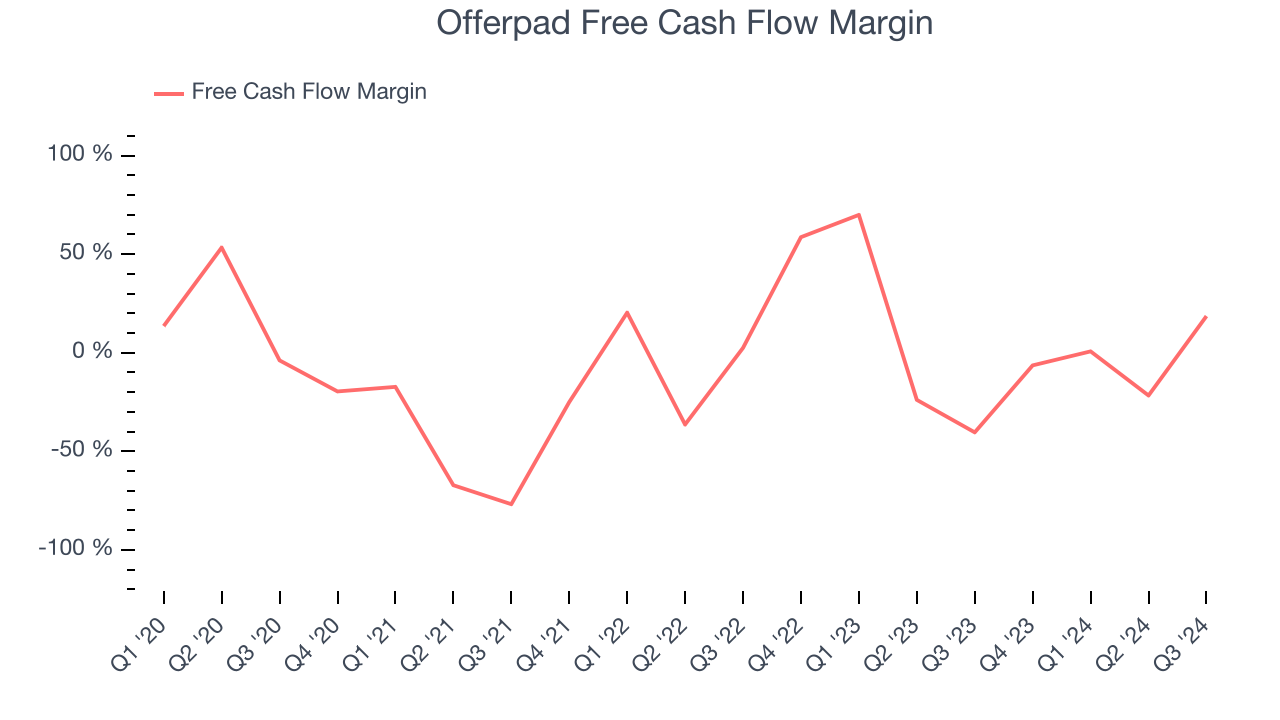

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Offerpad has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 23.6% over the last two years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Offerpad’s free cash flow clocked in at $38.71 million in Q3, equivalent to a 18.6% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Offerpad will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 2.9% for the last 12 months will increase to negative 1.8%.

Key Takeaways from Offerpad’s Q3 Results

It was good to see Offerpad beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 1.5% to $3.32 immediately following the results.

Big picture, is Offerpad a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.