VANCOUVER, BC / ACCESSWIRE / April 22, 2024 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide first quarter 2024 ("Q1 2024") production results from its San Albino gold mine ("San Albino") in northern Nicaragua, which is the eleventh full quarter of production results since declaring commercial production on July 1, 2021.

Q1 2024 Production and Financial Highlights

-

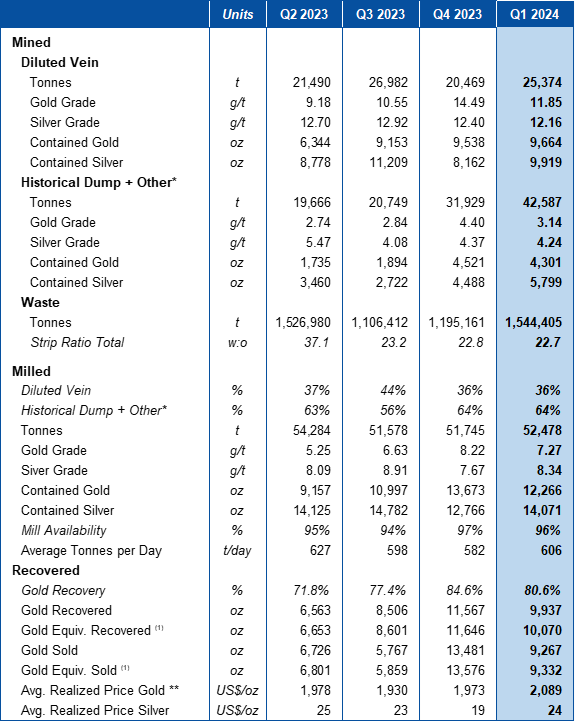

Record 67,961 tonnes mined containing 13,965 ounces of gold ("oz Au") at a blended grade of 6.39 grams per tonne gold ("g/t Au") and 15,718 ounces of silver ("oz Ag") at a grade of 7.19 grams per tonne silver ("g/t Ag")

- 25,374 tonnes mined containing 9,664 oz Au at 11.85 g/t Au and 9,919 oz Ag at 12.16 g/t Ag from diluted vein material

- 42,587 tonnes mined containing 4,301 oz Au at 3.14 g/t Au and 5,799 oz Ag at 4.24 g/t Ag from historical dump and other mineralized material above cutoff grade ("historical dump + other")

- 22.7:1 strip ratio

-

52,478 tonnes milled containing 12,266 oz Au at a blended grade of 7.27 g/t Au and 14,071 oz Ag at 8.34 g/t Ag

- 36% and 64% from diluted vein and historical dump and other, respectively

- 606 tonnes per day ("tpd") milled at 96% availability

- Recoveries of 80.6% for gold in Q1 2024

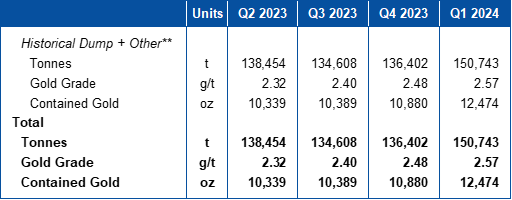

- 150,744 tonnes in stockpile containing 12,465 oz Au at a blended grade of 2.57 g/t Au

- 10,070 oz Au Equiv. recovered and 9,332 oz Au. Equiv. sold during the quarter

- Delivered 40,500 oz of silver on the Sailfish Silver Loan for a total of US$ 0.9 million during Q1 2024

- Entered into an environmental settlement and release agreement with GR Silver comprising US$0.5 million and the issuance of 296,710 common shares of Mako

- C$ 2.8 million in share repurchases equating to 1 million shares at an average price of C$ 2.80 so far in 2024

- Aprox. US$ 3.0 million increase in cash balance in Q1 2024 vs. Q4 2023

Akiba Leisman, Chief Executive Officer of Mako states that, "Q1 2024 was another highly profitable quarter for the Company, with recovered gold equivalent of over 10,000 ounces at industry leading AISC. The mine reported quarterly record throughput rates, which was achieved as we positively reconcile to the resource model, bringing in significantly more tonnes of mineralized material to the mine plan. Exploration is ramping up at site, the NCIB has been accelerated, and cash is building on the balance sheet as we prepare to close the Goldsource Mines acquisition later this quarter."

Table 1 - Production Results

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price.

(1) Equiv. Gold ounces are calculated by: Silver Rec. or Silver Sold (oz) / Avg. Realized Price of Gold (US$/oz) / Avg. Realized Price of Silver (US$/oz)

Table 2 - Quarter End Stockpile Statistics

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

Mining

The mine averaged 747 tpd of diluted vein and historical dump + other material in Q1 2024, which was by far the highest mining rate of mineralized material in the Company's history. This record came in a large part from a significant positive reconciliation of mineralized tonnes to the resource model. The strip ratio was 22.7:1 which included pre-stripping of the Southwest Pit within San Albino, and the commencement of the bulk sample of El Limon within Las Conchitas - South. The current stockpile is 150,743 tonnes containing 12,474 oz Au at 2.57 g/t Au. The average grade of the diluted vein was 11.85 g/t Au containing 9,664 oz Au.

The total production of diluted vein material in Q1 2024 came from 3 different zones; 39% of the total ounces were mined from the West Pit (San Albino), 19% from the Southwest Pit (San Albino), and 41% from Phase 1 in the Bayacun Pit (Las Conchitas). In Q2 2024, an important part of the production will also come from Phase 1 of the El Limon Pit (Las Conchitas).

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q1 2024, the plant throughput rate was 606 tpd with a plant availability of 96%. The plant processed 36% diluted vein material and 64% historical dump + other material to achieve a blended feed grade of 7.27 g/t Au. The gold recovery was lower at 80.6 % in Q1 compared to 84.6% in Q4 due to lower gold grades, and higher preg-robbing potential of the mill feed. This was due to differences in the upper portion of the Las Conchitas vein morphology as compared to San Albino, which led to higher amounts of peripheral, low-grade, preg-robbing material being included in the diluted vein. In addition, very little oxide material was processed, as the production predominantly came from relatively deeper material. In the latter half of Q2, a substantial portion of the mill feed will come from oxide material at El Limon, which should incrementally improve recoveries. The plant availability was 96% with 10,070 ounces of gold equivalent recovered.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and certain expectations and assumptions, including that Q1, 2024 detailed operating costs and financial results will be available by the end of this month; the additional optimizations noted may improve recoveries further; and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that the Company`s debt repayments and payables, royalties and taxes and cash balance are preliminary in nature and have not been audited by a third party; that the Company is not successful in operating San Albino profitably and/or funding its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company's exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q1 2024 production results at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com