Leading designer of graphics chips Nvidia (NASDAQ:NVDA) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 77.9% year on year to $39.33 billion. Guidance for next quarter’s revenue was optimistic at $43 billion at the midpoint, 2.1% above analysts’ estimates. Its non-GAAP profit of $0.89 per share was 5.2% above analysts’ consensus estimates.

Is now the time to buy Nvidia? Find out by accessing our full research report, it’s free.

Nvidia (NVDA) Q4 CY2024 Highlights:

- Revenue: $39.33 billion vs analyst estimates of $38.34 billion (77.9% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.89 vs analyst estimates of $0.85 (5.2% beat)

- Adjusted Operating Income: $25.52 billion vs analyst estimates of $24.55 billion (64.9% margin, 3.9% beat)

- Revenue Guidance for Q1 CY2025 is $43 billion at the midpoint, above analyst estimates of $42.11 billion

- Operating Margin: 61.1%, in line with the same quarter last year

- Free Cash Flow Margin: 39.5%, down from 50.9% in the same quarter last year

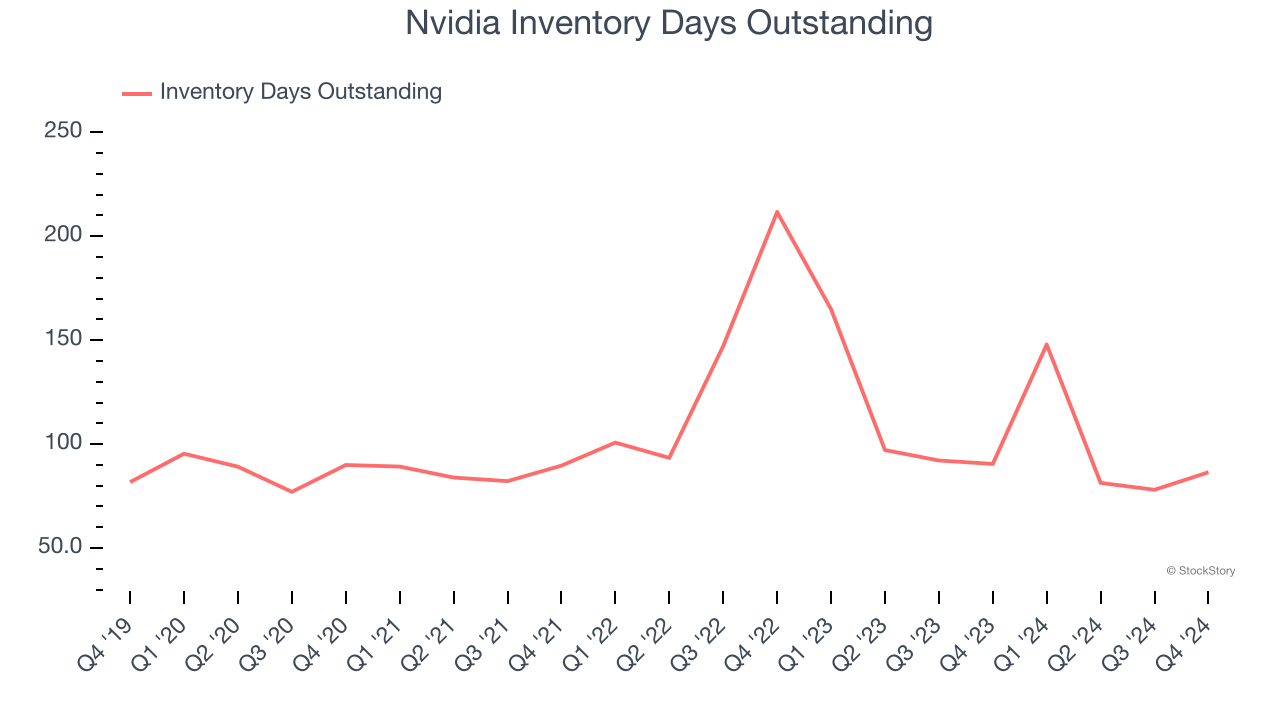

- Inventory Days Outstanding: 86, up from 78 in the previous quarter

- Market Capitalization: $3.10 trillion

“Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” said Jensen Huang, founder and CEO of NVIDIA.

Company Overview

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

Sales Growth

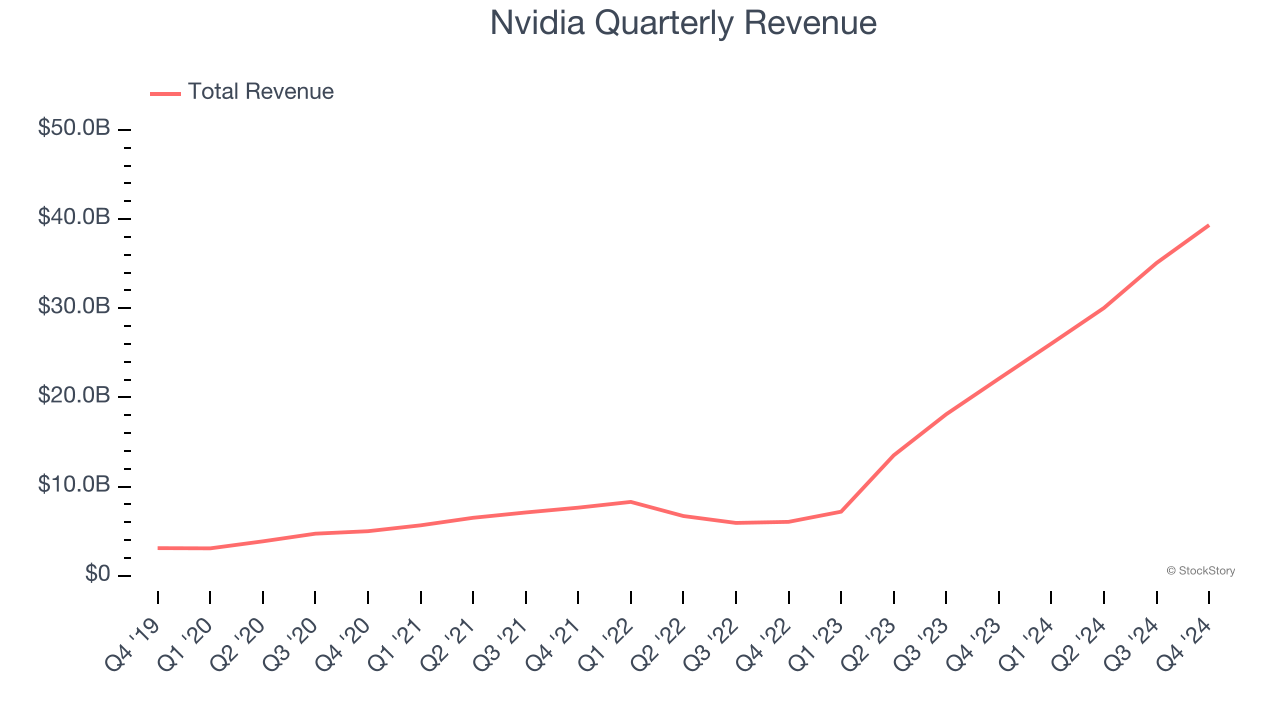

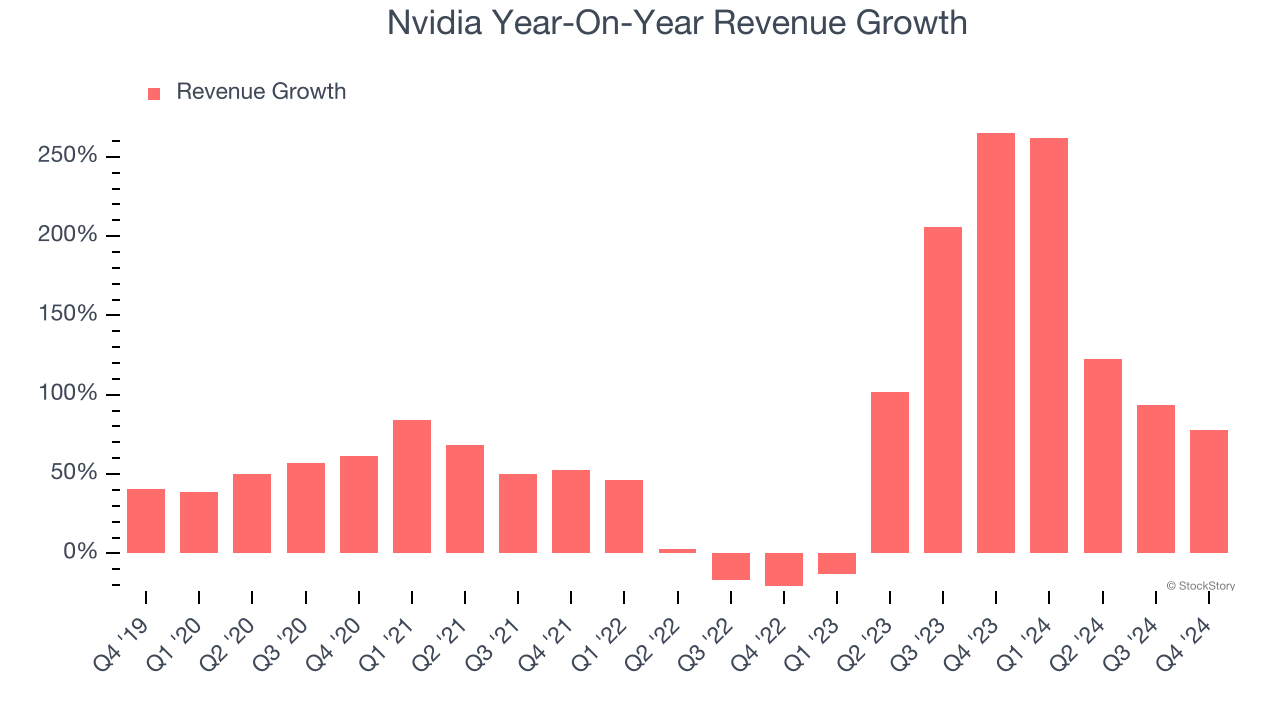

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Nvidia grew its sales at an incredible 64.2% compounded annual growth rate. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Nvidia’s annualized revenue growth of 120% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Nvidia reported magnificent year-on-year revenue growth of 77.9%, and its $39.33 billion of revenue beat Wall Street’s estimates by 2.6%. Despite the beat, this was its third consecutive quarter of decelerating growth, potentially indicating that the current upcycle is losing steam. Company management is currently guiding for a 65.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 50.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and implies the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Nvidia’s DIO came in at 86, which is 18 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

Key Takeaways from Nvidia’s Q4 Results

We enjoyed seeing Nvidia beat analysts’ revenue, EPS, and adjusted operating income expectations this quarter. We were also glad next quarter's revenue guidance topped Wall Street’s estimates. On the other hand, its inventory levels increased materially. Still, this quarter had some key positives and the stock remained flat at $130.65 immediately following the results.

Zooming out, investors are likely breathing a sigh of relief as many were afraid that some combination of DeepSeek's emergence and rumors surrounding weaker demand for Microsoft's cloud offerings would negatively impact results. These fears were reflected in Nvidia's options contract pricing going into the print, which implied a 10%+ move in either direction.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.