ServiceNow, Inc. (NOW) is a leading enterprise cloud platform company that specializes in digital workflow automation. Headquartered in Santa Clara, California, the company helps organizations streamline and optimize business processes across IT, employee management, customer service, security operations, and more. Its flagship product, the Now Platform, integrates AI, analytics, and low-code tools to unify workflows, eliminate operational silos, and drive efficiency at scale. The company has a market capitalization of $179.7 billion.

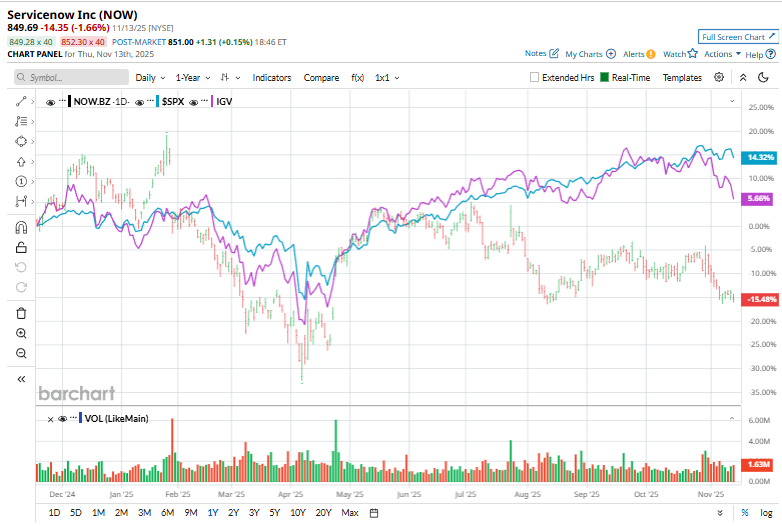

Over the past 52 weeks, ServiceNow’s stock has declined 18.7% and is down by 19.9% in 2025. It has broadly underperformed the S&P 500 Index ($SPX), which has gained 12.6% and 14.6% over the same periods, respectively.

On a closer focus, the stock has also lagged behind the iShares Expanded Tech-Software Sector ETF (IGV), which has gained 2.3% over the past 52 weeks and 6.7% year-to-date.

On Oct. 29, ServiceNow released its Q3 2025 earnings, and shares rose 2.5% in the following trading session as investors reacted to the company’s strong results. The quarter showcased robust momentum, with subscription revenue climbing to $3.3 billion, up 21.5% year over year. Total revenue also advanced 22% YoY to $3.4 billion.

Demand remained solid across the platform, reflected in a current RPO of $11.35 billion and total RPO of $24.3 billion, representing YoY increases of 21% and 24%, respectively. Beating its own guidance on growth and profitability, the company further raised its full-year outlook, highlighting strong AI-driven adoption and sustained enterprise spending momentum.

For the fiscal year 2025, ending in December, Wall Street analysts expect solid growth in ServiceNow’s EPS, forecasting a 35.8% YOY growth to $9.78 on a diluted basis. The company has a solid history of surpassing consensus estimates in each of the trailing four quarters.

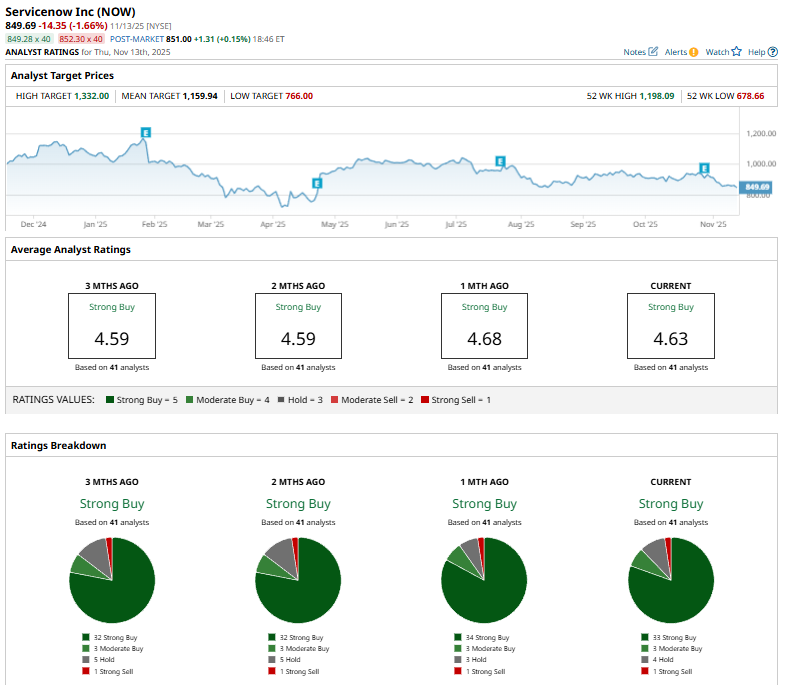

Among the 41 Wall Street analysts covering ServiceNow’s stock, the consensus is a “Strong Buy.” That’s based on 33 “Strong Buy” ratings, three “Moderate Buys,” four “Hold” ratings, and one “Strong Sell” rating.

The configuration of the ratings is bearish than it was a month ago, with 34 “Strong Buy” ratings.

On Oct. 14, Evercore ISI’s Kirk Materne reaffirmed his “Buy” rating on ServiceNow and set a $1,125 price target.

The consensus price target of $1,159.94 represents a 36.5% premium over the stock’s current levels. The street-high price target of $1,332 reflects a 56.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Post-Earnings Dip in Monday.com Stock?

- The ARKK ETF Is Leaking, and the Tech Stock Flood Could Reach Biblical Proportions. What Should You Do With Cathie Wood’s Fund Here?

- 1 Outperforming Growth Stock to Buy as the Government Shutdown Ends

- Stock Index Futures Plunge on Fed Rate-Cut Doubts and Valuation Concerns