Oracle (ORCL) stock looked unbeatable just two months ago. The company was landing large back-to-back AI deals, with implicit backing from the current administration. The momentum seems to be wearing off as quickly as it started, with ORCL stock now down over 31% from its one-month high.

Some analysts are not losing hope and are doubling down instead. Mizuho Securities analyst Siti Panigrahi has been a long-time Oracle bull. He sees the crash as a buying opportunity and reiterated an "Outperform" rating on ORCL stock. The firm upped its price target from $350 to $400, which implies ~84% upside potential from the current price.

Why Mizuho Doubled Down

Mizuho noted that Oracle has increased its Oracle Cloud Infrastructure (OCI) and added $65 billion of remaining performance obligations tied to four customers. Margins are also higher, and Mizuho's increased confidence purportedly comes from the four key drivers: "AI infrastructure monetization, expanding multi-cloud partnerships, accelerating Database 26ai migrations, and growing Fusion AI capabilities."

In short, Mizuho sees accelerating momentum from Oracle, and it does not believe the stock deserves a correction just yet.

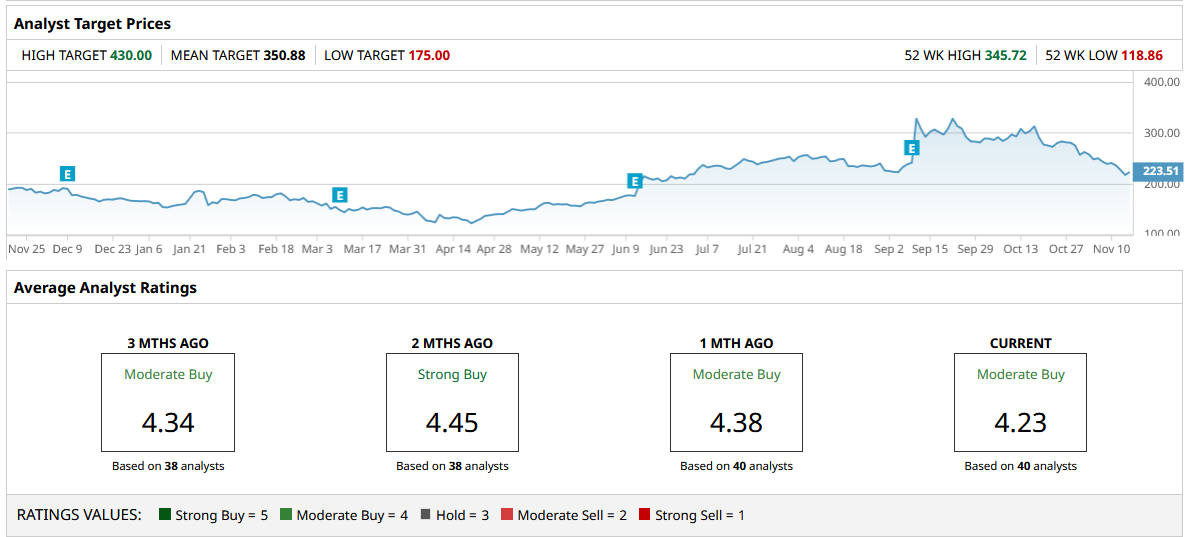

Most other analysts share Panigrahi's optimism.

The highest price target is even higher than Mizuho's at $430, with the average price target at $350.88. Their price targets are less aggressive on average. Stifel has a "Buy" rating with a $350 target. Evercore ISI recently lifted its target to $385 with an "Outperform," Barclays moved its target to $400 on AI momentum, and Citizens has a "Market Outperform" rating with a $342 target.

Will Oracle's Growth Story Persist? The Market Seems Skeptical

The market is now questioning how profitable this AI boom will actually be for Oracle. One analysis estimated that Oracle’s Nvidia (NVDA)-linked AI cloud unit generated roughly $900 million of revenue last quarter but only about $125 million in gross profit, for a modest 14% margin.

This is well below the higher margins typically seen at Microsoft (MSFT) Azure and Amazon (AMZN) Web Services. Rising energy costs, heavy data center capex, and infrastructure commitments are pressuring margins, and Oracle has acknowledged that it is currently renting AI chips through OCI at around a 16% gross margin while only projecting AI infrastructure margins to reach 30% to 40% by 2030.

J.P. Morgan’s Mark Murphy noted that Oracle’s 2030 targets imply net new revenue growth spiking to about 150% in FY 2028 before decelerating to ~22% in 2029 and then falling by about 27% in 2030. This is a trajectory that some investors view as both aggressive and lumpy.

Management remains ambitious and is guiding a sharp acceleration in cloud growth from here. CEO Safra Catz has said Oracle expects total cloud growth to increase to over 40% in FY 2026. Chairman and CTO Larry Ellison noted that multi‑cloud database revenue from partners like Amazon, Alphabet (GOOG) (GOOGL), and Microsoft “grew at the incredible rate of 1,529%” in Q1 FY 2026.

Should You Buy ORCL Stock Now?

For investors considering ORCL after a roughly 30% slide, you're looking at long‑term AI and cloud tailwinds versus the valuation risk. On the positive side, Oracle’s cloud and AI franchises are growing rapidly, and management is guiding to a significant acceleration in growth.

Conversely, the current AI infrastructure margins are low, and hyperscalers don't have the cash to keep up their CapEx spending, let alone expand it.

Long‑term revenue and EPS targets are extremely ambitious, and the stock still trades at a premium multiple that leaves little room for disappointment.

Currently, ORCL looks most persuasive for long‑term, growth‑oriented investors who believe Oracle can execute on its AI road map and are comfortable with volatility, rather than for conservative buyers seeking short‑term stability or immediate income. The recent drawdown has meaningfully improved the risk‑reward profile versus early‑September levels, but it has not removed the fundamental risks that sparked the correction. I'd give ORCL stock a "Hold" rating, and I wouldn't expect a meaningful bounce anytime soon due to market-wide skepticism about AI.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Joby Aviation’s Military Ambitions Are Taking to the Skies. Should You Buy JOBY Stock Here?

- Where Will the Bleeding End for Bitcoin Bulls? Our Top Chart Strategist Maps Out BTC’s Next Move.

- Cisco Delivered Strong, But Lower Free Cash Flow and FCF Margins - Has CSCO Stock Peaked?

- I’m Old Enough to Remember When a 500-Point-Drop in the Dow Jones Was a Crisis. Now It’s Just a Warning.