After topping $5 trillion in market valuation, Nvidia (NVDA) stock has taken a breather. The correction from all-time highs is about 11%. With Nvidia due to report Q3 2025 earnings on Nov. 19, it might be a good time to consider the tech giant.

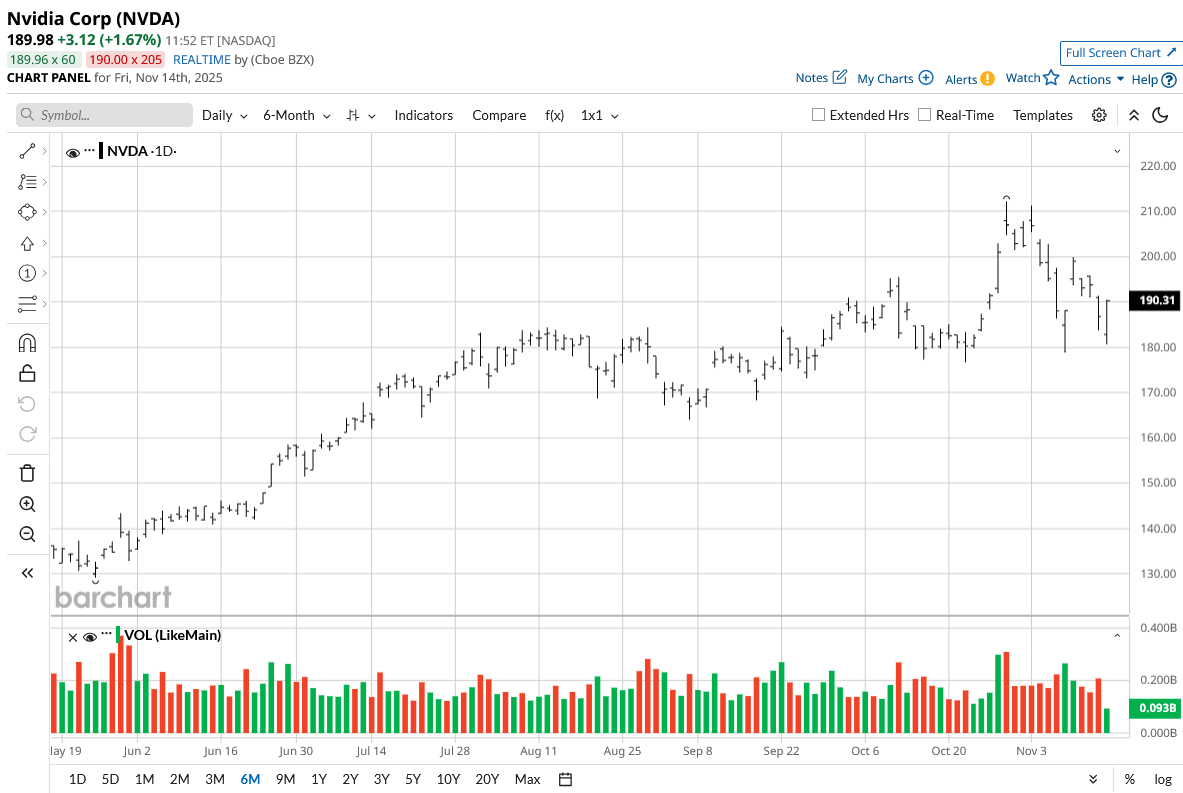

While there has been a correction in the recent past, NVDA stock has trended higher by almost 40% year-to-date (YTD). This rally has been backed by robust topline and cash flow growth. Additionally, the tailwind for the AI industry is likely to last beyond the decade.

About NVDA Stock

Nvidia is a global leader in accelerated computing. The company’s AI-based solutions support high-performance computing.

The company considers Blackwell as one of the most important products in its history that’s likely to power growth and value creation. From the perspective of addressable market, Nvidia believes that AI infrastructure spend is likely to be in the range of $3 to $4 trillion by the end of the decade.

Amidst the bull run in AI stock, NVDA stock has trended higher by 41% in the last six months.

Strong Growth Likely to Sustain

For Q2 2026, Nvidia reported revenue growth of 56% on a year-on-year (YoY) basis to $46.7 billion. For the same period, earnings growth was 61%.

Recently, Susquehanna raised the price target for NVDA stock to $230 with a “Positive” rating. Susquehanna expects better results and guidance on the back of GB300 ramping in the second half of the year. The analyst also believes that Nvidia has “one of the largest opportunity sets ahead.”

Further, a Wedbush analyst believes that Nvidia’s Q3 results will be “another major validation moment” for the AI revolution. According to Webbush, investors are still “underestimating” the scale of AI spending. If this view holds true, NVDA stock is positioned for re-rating.

In Q2 2025, Nvidia mentioned that “widespread market availability” of Blackwell Ultra is expected in the second half of the year. This is an important catalyst for healthy growth.

Overall, these views are in sync with the broader analyst estimates of earnings growth exceeding 40% for FY 2025 and FY 2026.

Cash Is King

In the long term, the key determinant of valuation is the company’s cash flow potential. From that perspective, Nvidia seems to be well positioned to create value.

For Q2 2025, the company reported operating cash flow of $15.4 billion. This implies an annualized cash flow potential of $60 billion. Considering the company’s growth trajectory on the back of AI tailwinds, cash flows are likely to swell.

Additionally, Nvidia reported a cash buffer of $56.8 billion as of Q2 2025. Given the financial headroom, Nvidia is well positioned to make aggressive investments in R&D. At the same time, Nvidia pursued seven acquisitions in 2024 and has acquired three companies in 2025. The acquisition of early-stage, innovation-driven companies is likely to support Nvidia’s growth trajectory.

It's also worth mentioning that for the first six months of 2025, the company repurchased shares worth $23.8 billion. It’s likely that share repurchases will remain robust and create value in addition to steady growth in dividend payout.

What Analysts Say About NVDA Stock

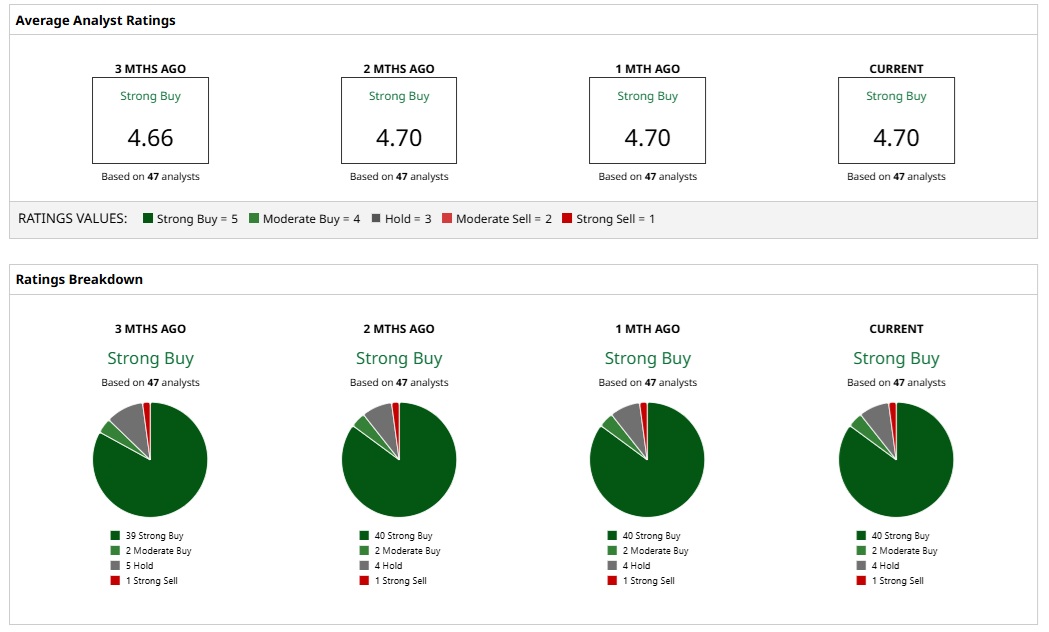

Based on the rating of 47 analysts, NVDA stock is a consensus “Strong Buy.”

An overwhelming majority of 40 analysts opine that the stock is a “Strong Buy,” with two and four analysts assigning a “Moderate Buy” and “Hold” rating, respectively. A single analyst gives it a “Strong Sell.”

Further, a mean price target of $234.12 implies an upside potential of 18%. The most bullish price target of $350 would imply an upside potential of 87%. Therefore, considering the broad analyst view, sentiments are bullish for NVDA stock.

It’s worth noting that NVDA stock trades at a forward price-earnings ratio of 45.7. Considering the industry tailwinds, company growth trajectory, and cash flow potential, valuations are not stretched. A price-earnings-to-growth ratio of 1.4 underscores this view for a company with a big addressable market.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.