Dow Jones Industrial Average ($DOWI) component Caterpillar (CAT) is a key part of the construction industry. It is a $250 billion stock, which was much smaller last spring.

But since then, its price has surged. CAT’s earnings report a week ago took the stock down a few percentage points from its recent all-time high. It has more than tripled during the past 5 years. Not bad for an industrial company celebrating its 100th anniversary in 2025!

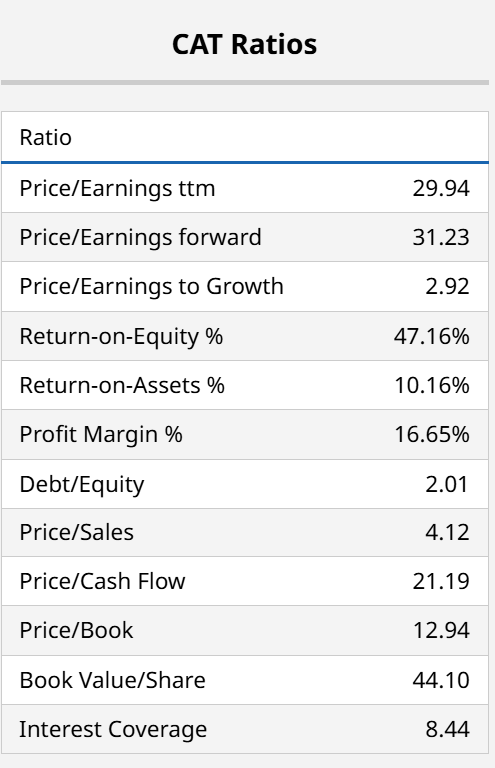

The stock is not cheap at 31x forward earnings. And its debt ratio, while understandable given its business and competitive environment, is not the stuff of undervalued equities.

So, what do we do with a stock like CAT? First, resist my inclination to provide a “litter” of puns about cats. Because after all, this is a giant business, part of a global duopoly in its industry, a trusted name in its field, and “CAT” is short for caterpillar, not cat.

Why You Should Hedge CAT

CAT is a classic setup for an option collar. Why? Because no one can accurately forecast the future well enough to know that a stock this elevated won’t simply fall back down. It could be company-specific, tariff-related, market-related, anything. Because markets don’t work like they used to. I’ll finish with a collar sample, after quickly reviewing the technical charts.

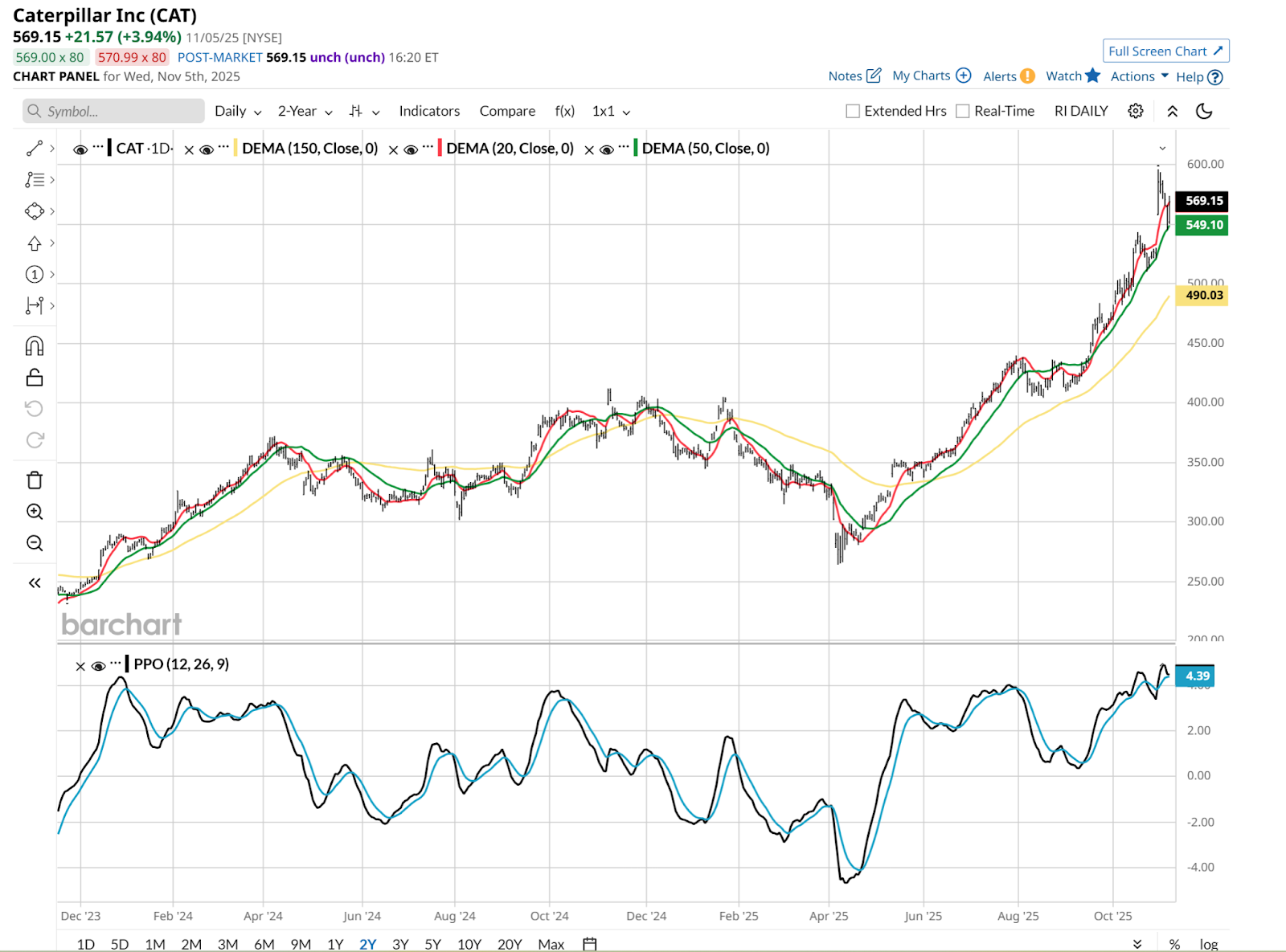

The daily is elevated, no doubt. But it was at the end of July, too. Selling out then would have been a nice way to miss a $150-a-share up move.

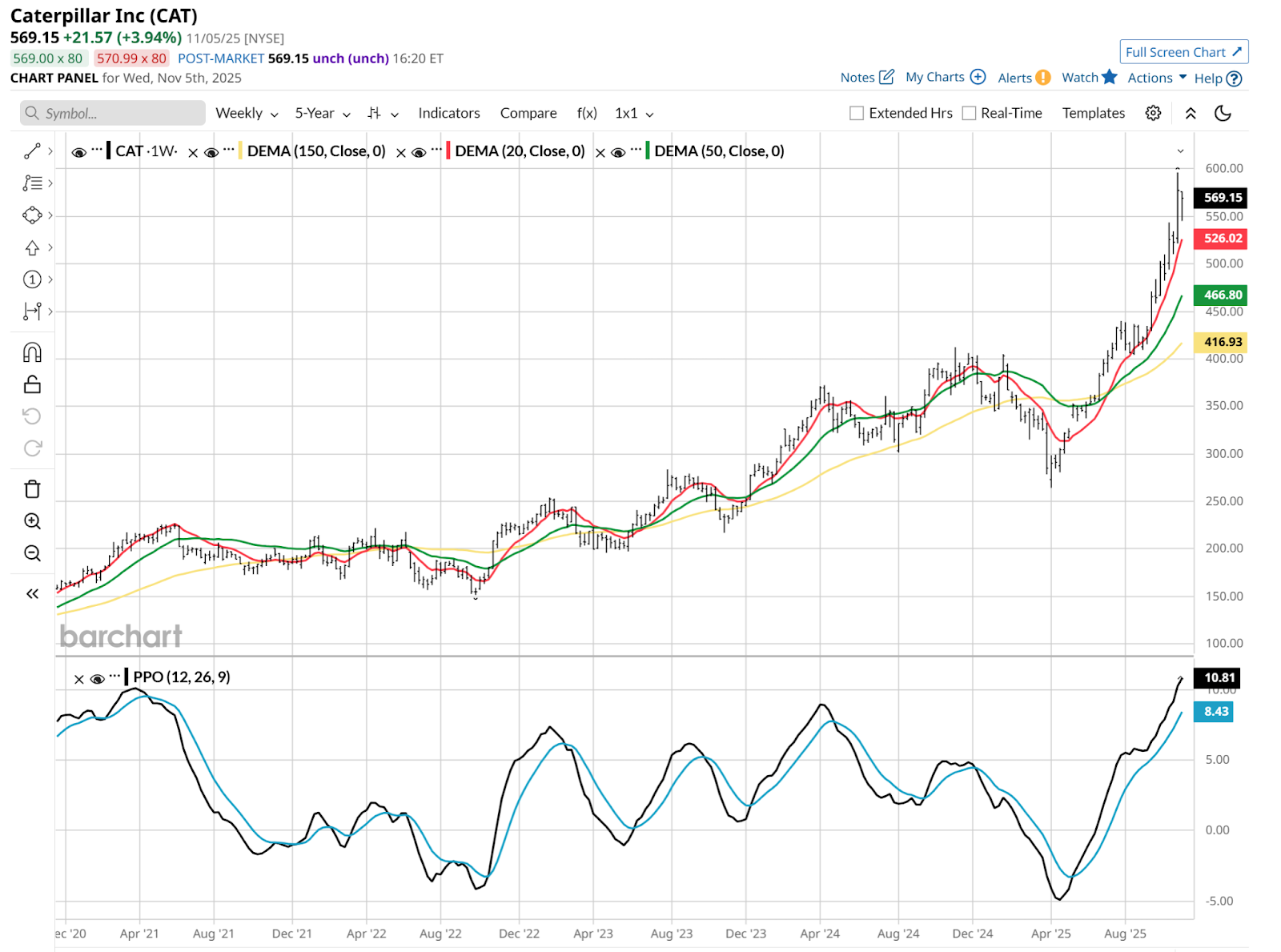

CAT’s weekly chart below is screaming “expensive.” But not yet signaling “crash likely.” That Percentage Price Oscillator (PPO) is about as rich as it can get without literally popping off the page, into the price chart above it. And the three moving averages are all flying.

A set up for a reversal? Quite possible. But when? That’s a great reason to collar.

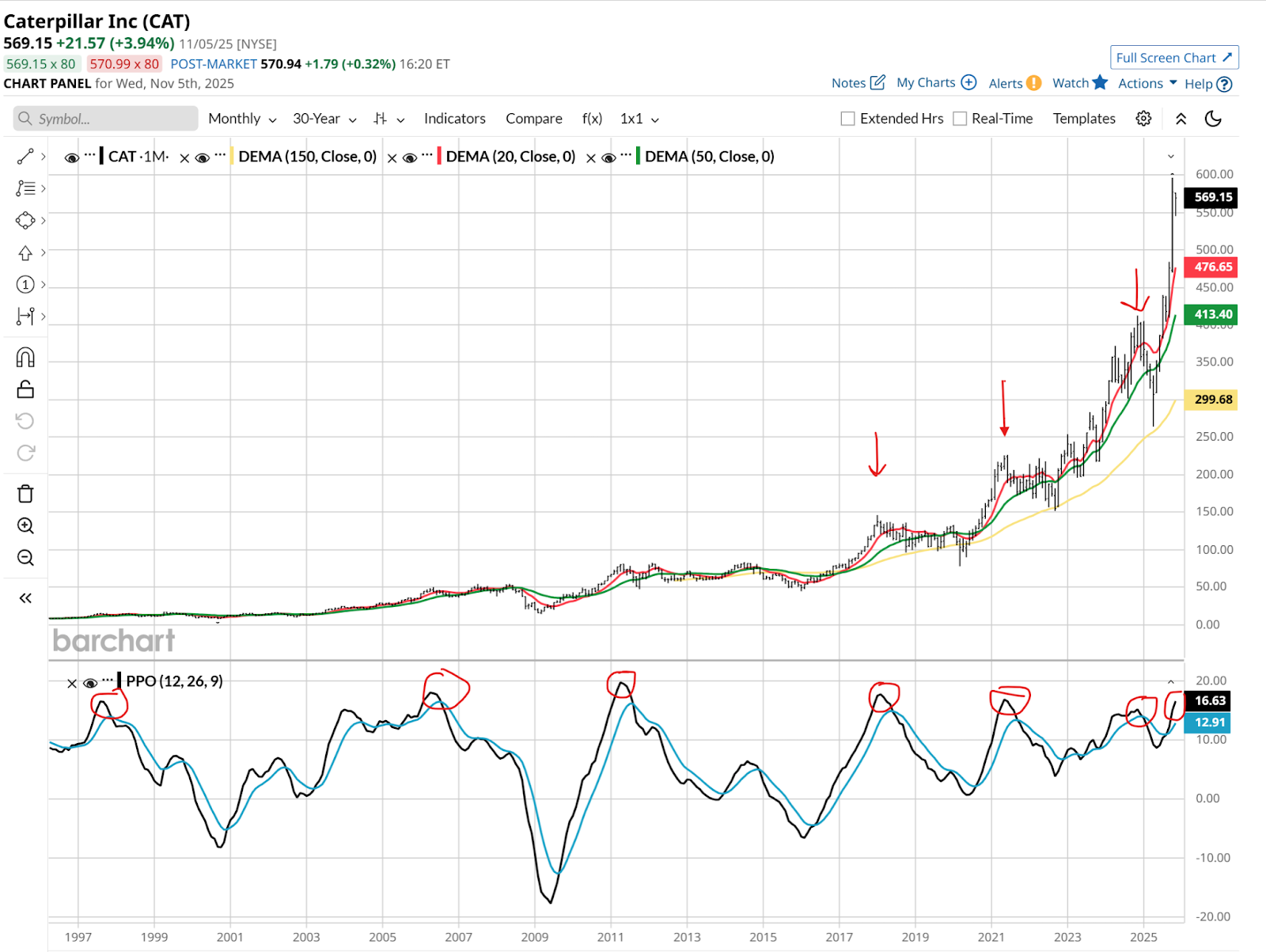

Even on a long-term (monthly) chart view, this stock looks super expensive technically. I’ve marked past peaks below. It looks similar to me.

If I owned CAT, I would be more likely to hedge it via a collar than sell it. Though selling part of the position is always an alternative.

How to Trade CAT Stock with an Option Collar Here

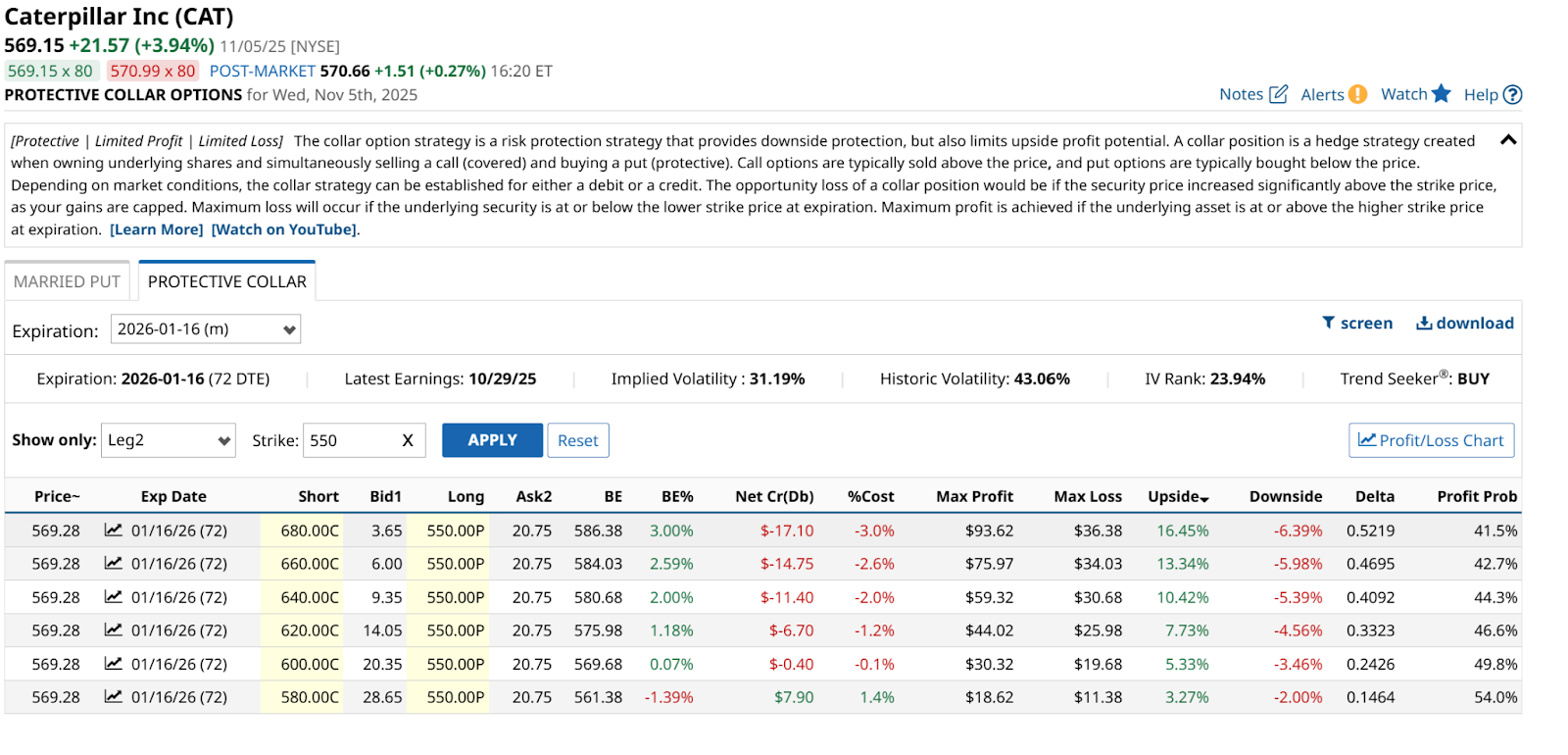

The table above shows a handful of collar possibilities, but I’ll focus on the top one. That’s where I can go out to Jan. 16, 2026, just over two months from now. The stock is around $569 and the collar put/call strikes are $550 and $680.

The net result: It costs about 3% of the current value (100 shares of CAT is worth about $57,000) to do this. The collar’s $680 call strike means that if it ramped up to there soon, I’d risk having to have it called away. High class problem!

The worst-case scenario is a 6.4% loss, versus a 16.4% gain. If this were a 12-month collar, that would be quite solid. But it’s only through January. And while the put cost of nearly $21 a share sounds high, remember that this is a $569 stock.

All in all, this is a nice tradeoff. CAT is a very liquid stock, but the options market, while offering plenty of choices, is not like collaring a Magnificent 7 name. So as always, do your homework, and determine if, how, and how much you want to use hedging techniques like this.

At the end of the day, just make sure this CAT doesn’t end up scratching up your portfolio and leaving a rat as a “gift” the way felines are known to do.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart