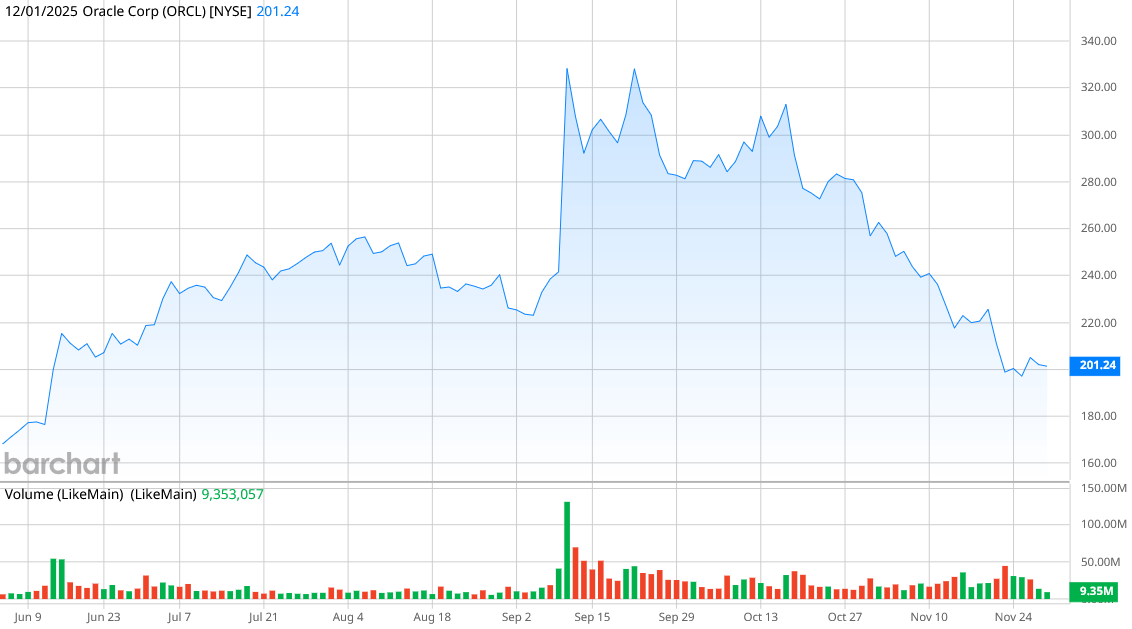

Oracle (ORCL) investors likely didn’t have a happy Thanksgiving, given the falling stock price. Shares are down more than 26% in the last month as the tech company suffered through the market’s growing concern about artificial intelligence spending and an overall pullback in AI stocks.

But not all is lost. Analysts at Deutsche Bank and HSBC both issued bullish notes about Oracle just before the holiday, indicating that the company’s weakness could be short-lived. HSBC reiterated its “Buy” rating and $382 price target, noting its remaining performance obligations of more than $500 billion. And Deutsche Bank analyst Brad Zelnick wrote that Oracle is “getting little if any credit for its business with OpenAI.”

The bullish commentary helped Oracle stock pop on Wednesday. Now it remains to be seen if the company can maintain that momentum and turn its recent losses around.

About Oracle Stock

Oracle is an Austin, Texas-based cloud computing company that makes software and systems that its customers use to store, manage, and analyze data. The company has a market capitalization of $575 billion, making it one of the 20 largest publicly traded companies in the world.

Despite the slump in the last month, share prices are up 21% in 2025, or roughly 4% better than the returns of the S&P 500 ($SPX). It slightly lags the performance of the S&P 1500 Information Technology Sector, however.

Oracle currently trades at a forward price-to-earnings ratio of 29.6, versus its mean five-year P/E ratio of 30.6. So historically, Oracle is trading at a value consistent with what shareholders should expect. The stock offers a modest dividend of $2 per share, or a dividend yield of 1% that is paid on a quarterly basis.

Oracle Misses on Earnings

Oracle announced its first quarter fiscal 2026 earnings on Sept. 9. Revenue was $14.92 billion, up 12% from a year ago, and net income was $2.92 billion, unchanged from the previous year. Oracle reported earnings per share of $1.47, missing analysts’ estimates by just a penny per share.

Much of the company’s growth in the quarter was in its cloud computing division, which saw revenue jump 28% in the quarter from a year ago. Software revenue fell 1%, hardware revenue rose only 2%, and the company’s services revenue increased by 7%.

It appears likely that cloud revenue will continue to grow quickly. Oracle announced that its remaining performance obligations, which are contracted revenue that is not yet recognized, were $455 billion, up 359% from the previous year. Oracle had signed an agreement during the quarter with OpenAI for 4.5 gigawatts of data center capacity. CEO Safra Catz said that Oracle signed four multibillion-dollar contracts during the quarter.

“It was an astonishing quarter, and demand for Oracle Cloud Infrastructure continues to build,” Catz said. “Over the next few months, we expect to sign up several additional multi-billion-dollar customers, and RPO is likely to exceed half a trillion dollars.”

Oracle’s guidance calls for cloud infrastructure revenue to increase 77% during the 2026 fiscal year to $18 billion and to continue growing to $144 billion by 2030.

What Do Analysts Expect for ORCL Stock?

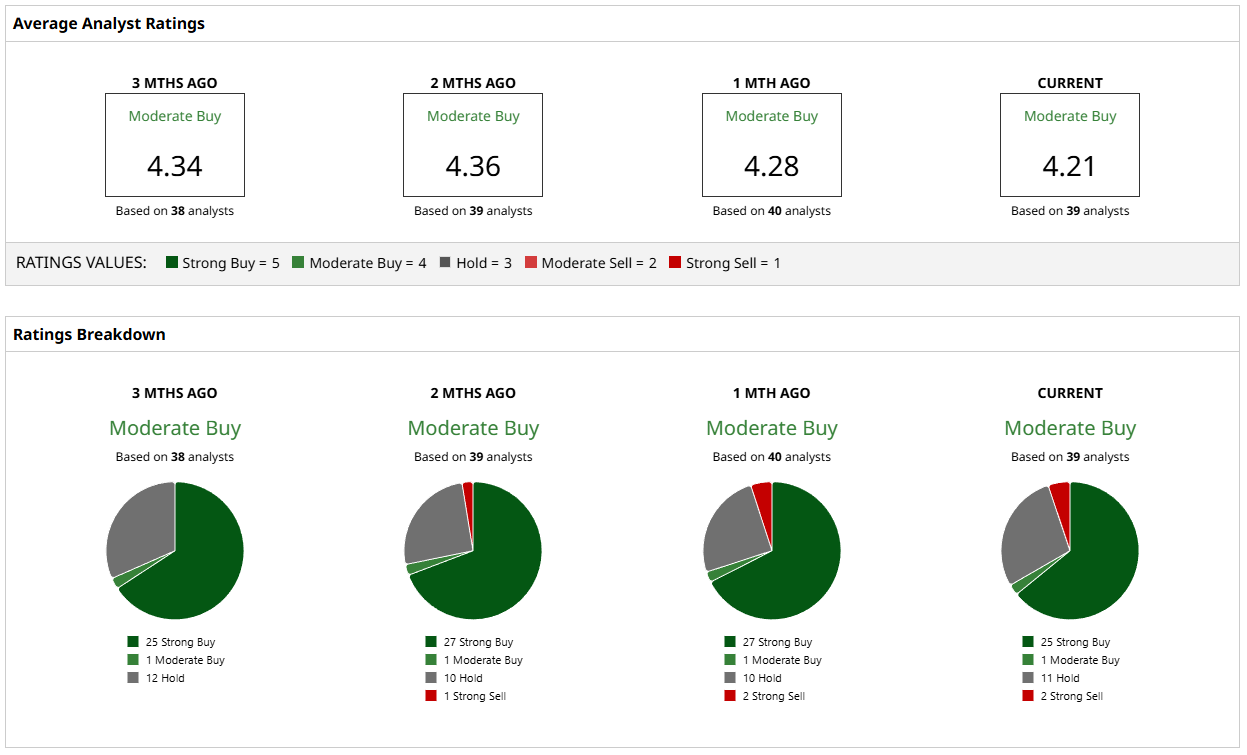

The 39 analysts currently covering ORCL stock have a consensus “Moderate Buy” on it, although sentiment has shifted down slightly in the last three months. Currently, 25 analysts have “Strong Buy” ratings, and two others have “Moderate Buy” ratings. Two analysts are bearish with “Strong Sell” ratings, and the rest recommend holding.

The mean price target of $346.60 suggests that ORCL stock should be moving higher soon—its current price is just over $200, indicating that investors can expect a 72% boost. If Oracle can hit the most bullish target price of $430, then investors would be looking at a 113% increase. The most bearish price target of $175 suggests only 13% risk.

Oracle looks to be attractively priced at this point. For investors who are looking to pick up a promising AI stock at bargain prices, there may be no better time to buy ORCL stock.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Symbotic Stock Surges on Automation-Driven Revenue Growth. Is SYM a Buy Now for 2026?

- Nvidia May Not Be Enron, But Does NVDA Stock Still Face AI Bubble Risks Here?

- Analysts Say Even the Bear Case for Oracle Stock Is Bullish. Should You Back Up the Truck on ORCL?

- With Apple Poised to Best Samsung in Smartphone Shipments, Should You Buy, Sell, or Hold AAPL Stock?