Based in Connecticut, Interactive Brokers Group, Inc. (IBKR) is a global electronic brokerage firm known for its low-cost, high-speed trading infrastructure and deep multi-asset market access. The platform serves active traders, hedge funds, proprietary trading firms, financial advisors, and sophisticated retail investors across more than 150 markets worldwide. The company is currently valued at $113.1 billion by market cap.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and IBKR fits right into that category, signifying its substantial size, stability, and dominance in the capital market industry. Its value proposition centers on advanced execution technology, tight spreads, automated risk controls, and a highly scalable, capital-efficient business model.

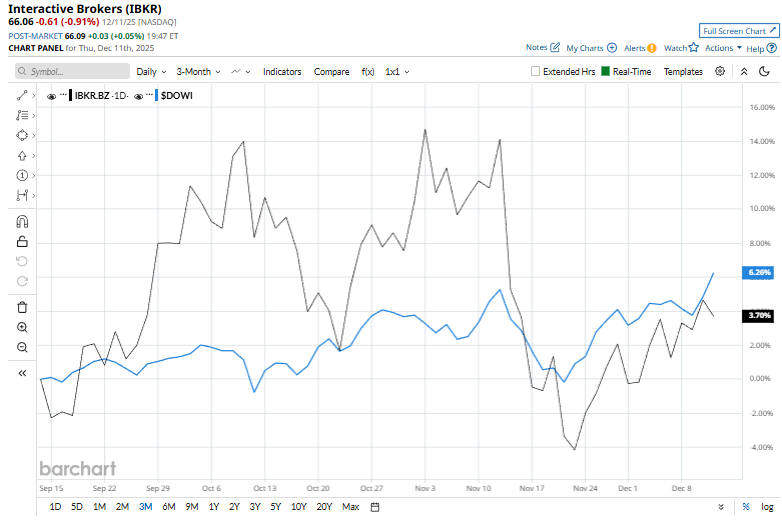

However, the leading financial services firm has fallen 9.9% from its 52-week high of $73.35. Shares of IBKR are up 4.3% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% rise over the same time frame.

However, in the longer term, IBKR leads with a 46.2% rise over the past year and a 49.6% return in 2025. By contrast, DOWI has surged 10.3% over the past 52 weeks and 14.5% on a YTD basis.

IBKR has been trading above its 200-day moving average since early April and has dipped below its 50-day moving average in the last month.

On Dec. 9, Interactive Brokers expanded its global reach by adding access to UAE equities through the Abu Dhabi Securities Exchange and the Dubai Financial Market. Clients worldwide can now trade UAE-listed stocks alongside global assets from a single platform, while investors in the region gain streamlined access to international markets. The move strengthens Interactive Brokers’ position in the Gulf Cooperation Council by broadening market access, supporting trading in 28 currencies, including AED, and enabling efficient low-cost FX conversions for global investors. Its shares rose 1.7% in the next trading session.

To emphasize the stock’s outperformance, rival Morgan Stanley (MS) has underperformed IBKR. MS stock has gained 41.3% in the past 52 weeks and is up 43.4% on a YTD basis.

The stock has a consensus rating of “Strong Buy” from the 10 analysts covering it, and the mean price target of $78.56 represents a 18.9% premium to current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Trump Takes a Stand Against Deere, How Should You Play the Blue-Chip Dividend Stock?

- Archer Aviation Is Bringing Its Flying Cars to Saudi Arabia. Is ACHR Stock a Buy Here?

- USA Rare Earth Just Revved up Its Commercial Timeline. Should You Buy USAR Stock Here?

- Robinhood Stock Gets Dragged Down by the Crypto Selloff. Should You Buy the Dip?