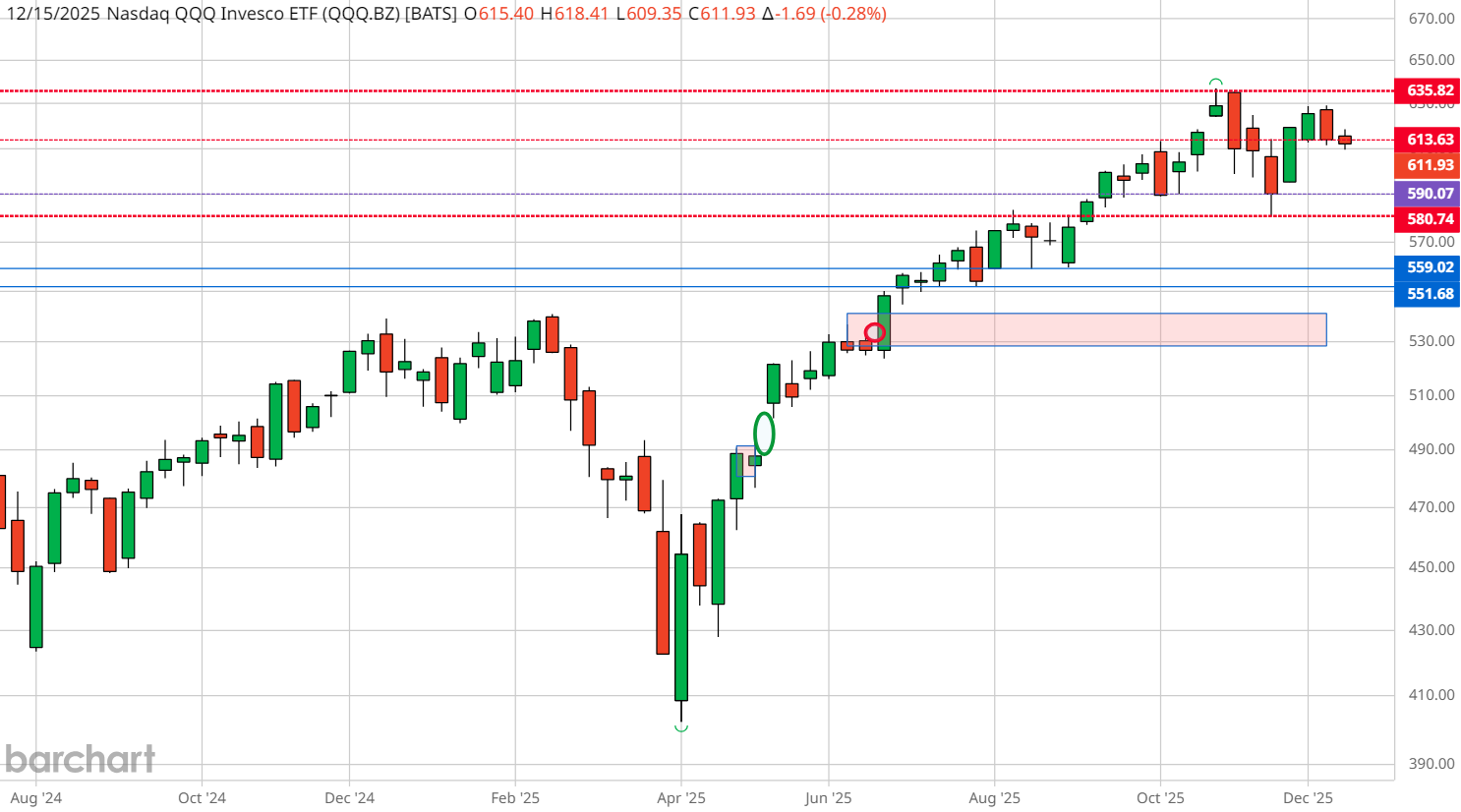

Last week's candlestick on the Invesco QQQ Trust (QQQ) created a momentum-confirming sentiment shift for the Nasdaq-100. This outside bearish engulfing candlestick on the QQQs is reinforced by today’s selling pressure in the tech space, led by Broadcom (AVGO) and Oracle (ORCL), both down about 4.0%.

In this case, the previous week's opening price was higher than the earlier week's close and reached a new high level in comparison. However, QQQ then reversed and marked a lower low than the week before, and closed lower from week to week (albeit only by one tick).

This type of price action can only be interpreted as a bearish sentiment. In other words, there are more sellers than buyers.

Today's early price action supplements this sentiment, with QQQ gapping higher – only to reverse and take out Friday's trading low of 611.36. Reading the tea leaves, the market should follow through to fill the Nov. 23 gap at 590.07, and possibly return to the lows of the Nov. 17 week (580.74).

From here, only a daily close above 619.25 can negate this bearish condition, and a weekly close above last week's candle high would signal an attempt at the all-time highs (ATHs).

Regardless of how you slice these two similar price actions, the market is telling us that the bull run from April is over. At best, we are heading into a period of consolidation. At worst, the combination of a new lower high along with a new weekly low tells us that bears, for the time being, are leading the price parade.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart