Eyewear is quietly turning into a Big Tech story. Worldwide eyewear revenue is projected to reach roughly $151 billion in 2025, with steady growth through the rest of the decade. More vision needs and lifestyle use cases are cropping up. At the same time, augmented reality (AR) and virtual reality (VR) hardware are moving from niche to mainstream, with the combined AR/VR market expected to generate around $46.6 billion in revenue in 2025 alone, setting the stage for a new generation of wearable devices enabled by artificial intelligence (AI).

That backdrop helps explain why Alphabet's (GOOG) (GOOGL) Google is planning a 2026 launch of AI glasses — and why it matters. Google's choice of eyewear partner could be just as important as the chips or AI models inside the product. Warby Parker (WRBY) already operates at the intersection of technology and eyewear retail. The company sits in the Consumer Staples sector and generates more than $770 million in annual sales, holding a market capitalization near $2.25 billion.

If AI-powered glasses really do move from prototype to consumer product in 2026, could this relatively small but increasingly profitable eyewear specialist end up being one of the biggest winners of Google’s next hardware bet? Let’s find out.

Warby Parker’s Financial Vision

Warby Parker is a direct-to-consumer eyewear company with a straightforward approach. It designs its own frames, sells mainly through its own stores and website, and uses a tight, in-house setup to keep prices relatively affordable.

The company's valuation shows that investors already treat Warby Parker as a higher-growth name. The stock trades at a forward price-earnings ratio of about 268.7x, compared with roughly 17x for its sector.

So far, the financials are moving in a way that helps explain that rich multiple. In the third quarter of 2025, net revenue rose 15.2% year-over-year to $221.7 million, supported by a 9.3% increase in active customers and a 4.8% gain in average revenue per customer. Profitability is improving as well, with net income up to $5.9 million, a $9.9 million improvement, while adjusted EBITDA climbed $8.4 million to $25.7 million and adjusted EBITDA margin improved to 11.6%.

The company is still posting an annual net loss of about $20 million on $771 million in sales, but the direction is positive. Management is clearly investing for growth, adding 15 net new stores in the quarter and ending Q3 with 313 locations. The store base becomes even more important if AI-powered glasses move from concept to everyday product.

The Fundamentals Powering WRBY’s Next Chapter

Warby Parker’s partnership with Google sits at the center of the story. The two companies are working together on AI-powered glasses designed for all-day wear, combining Warby Parker’s eyewear design experience with Google’s technology platform.

Their first line of intelligent eyewear, featuring multimodal AI and both prescription and non-prescription options, is planned to launch after 2025, with more products expected after that. Google is supporting the effort with up to $75 million for product development and commercialization costs, plus another $75 million investment option for Warby Parker if certain collaboration milestones are met, which gives the eyewear company room to scale without putting too much pressure on its balance sheet.

At the same time, Warby Parker is working on the brand side. The company signed a three-year deal with Texas Longhorns quarterback Arch Manning, a longtime customer who has worn its glasses since middle school. Manning will feature the brand’s eyewear on and off the field, starting with a commercial during his debut as a starting quarterback alongside his father, Cooper.

Analysts See Bright Prospects for Warby Parker

For the full-year 2025, the company is guiding for net revenue of $871 million to $874 million, representing about 13% growth. Consensus estimates predict earnings per share of $0.01 for the current quarter and $0.08 for next quarter. That points to sharp expected growth of roughly 120% year-over-year for the current quarter and 100% for next quarter, with earnings set to move higher as Google’s AI glasses plan approaches launch.

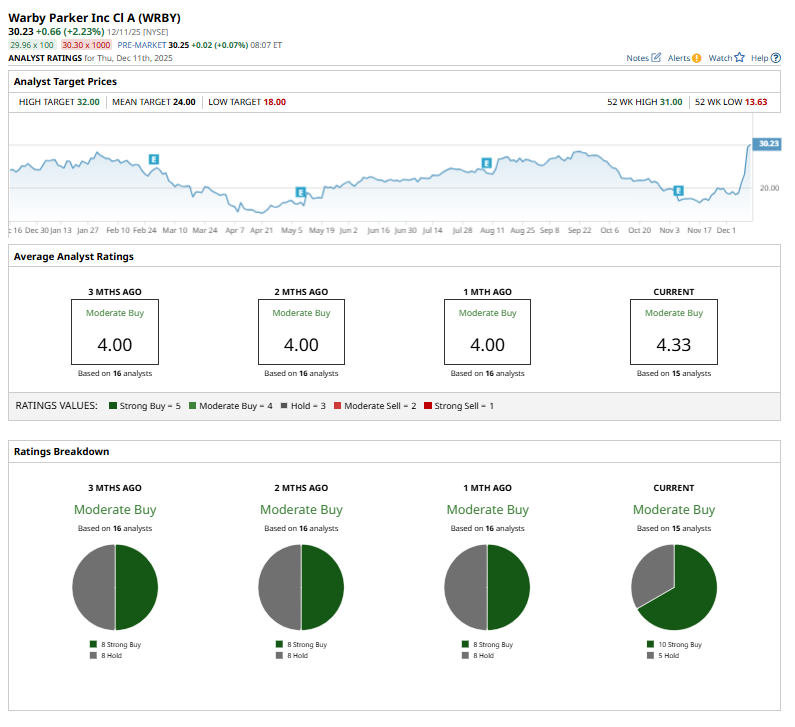

On the research side, Goldman Sachs analyst Brooke Roach raised her price target from $27 to $31 in early October 2025 while maintaining a “Buy” rating, showing strong confidence in Warby Parker’s path even before the formal AI eyewear partnership with Google was made public. Telsey Advisory Group has also remained positive, sticking with an “Outperform” rating and a $24 target.

Stepping back, the 15 analysts who currently cover the stock rate it a consensus “Moderate Buy,” and the average price target sits at $24.

The Bottom Line

If Google really does turn AI glasses into a mainstream platform starting in 2026, Warby Parker looks like one of the few pure-play stocks positioned to benefit directly at the intersection of hardware, vision care, and everyday fashion. The company already has the design, retail footprint, and prescription infrastructure, and now it has Google’s capital and technology stack behind a dedicated line of intelligent eyewear. That combination gives WRBY a real shot at growing into its premium valuation rather than just defending it. Over the next few years, the most likely path is choppy but upward, with shares grinding higher as execution on AI glasses and earnings growth catch up to the story.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart