New data from UK Expat Mortgage reveals that Australia continues to lead as the most common location for British expats seeking UK property finance. The findings highlight strong demand from the Middle East, North America, and Europe, with expats earning an average income of £101,141 and borrowing an average of £302,397. Residential mortgages narrowly outpaced investment buy-to-let loans, marking a shift in expat mortgage trends for 2025.

Bristol, UK – 25 September 2025 – UK Expat Mortgage, a specialist expat mortgage brokerage, has released its latest year-to-date statistics for 2025, providing unique insights into the financial and geographic profiles of British expatriates investing in UK property.

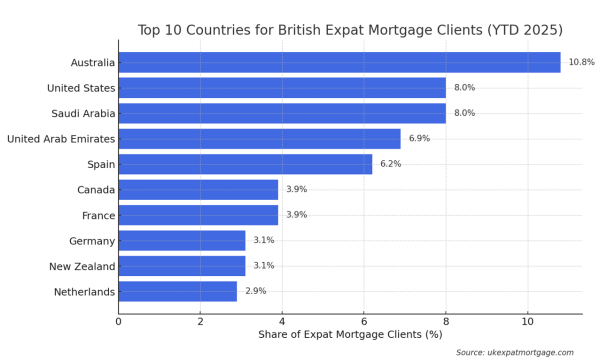

Global Client Distribution

Australia leads the way, accounting for 10.8% of all clients seeking UK mortgages. The United States (8.0%), Saudi Arabia (8.0%), and the United Arab Emirates (6.9%) also ranked highly. Spain (6.2%), Canada (3.9%), France (3.9%), Germany (3.1%), New Zealand (3.1%), and the Netherlands (2.9%) completed the top 10.

Regionally, Europe (28.9%) and Asia-Pacific (27.1%) dominate, followed by the Middle East (20.1%) and North America (13.9%). Africa and Latin America make up smaller but notable shares of the market at 2.6% and 1.5% respectively.

Income & Borrowing Power

The report found that British expats earn significantly more than their domestic counterparts, with an average income of £101,141. This translates into strong borrowing capacity, reflected in an average loan size of £302,397 across applications processed in 2025.

Mortgage Application Trends

Residential mortgages narrowly outpaced buy-to-let activity, accounting for 51.1% of applications compared to 48.9% for investment properties. Within these categories:

Residential Purchases made up 46.0% of total applications.

Residential Remortgages accounted for 5.1%.

Buy-to-Let Remortgages represented 27.7%.

Buy-to-Let Purchases made up 21.2%.

This shift highlights growing interest among expats in securing UK homes for personal use alongside continued investment demand.

Market Implications

The data underscores several key trends shaping the expat mortgage market in 2025:

Australia remains the top hub for British expats financing UK property.

Middle East demand reflects ongoing professional opportunities and strong expatriate communities in Saudi Arabia and the UAE.

Residential purchases rising suggests a trend towards expats planning for long-term relocation or family security in the UK.

Investment confidence strong, with nearly half of expats still prioritising buy-to-let as a stable asset class.

About UK Expat Mortgage

UK Expat Mortgage is a specialist brokerage helping British expatriates and foreign nationals secure property finance in the UK. With one of the most comprehensive datasets on expatriate mortgage activity, the firm’s insights are cited by financial publications, property analysts, and industry researchers.

For further information, interviews, or access to the full dataset, please contact:

Email: josh@ukexpatmortgage.com

Website: www.ukexpatmortgage.com

Media Contact

Organization: UK Expat Mortgage

Contact Person: Josh Thompson

Website: https://www.ukexpatmortgage.com/

Email:

josh@ukexpatmortgage.com

Country:United Kingdom

Release id:34495

View source version on King Newswire:

Australia Tops List of British Expat Mortgage Clients

It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release.