The S&P 500 (NYSEARCA: SPY) is marching higher on signs that inflation has peaked, but it is not a rally you should trust. The latest reads on CPI and PPI confirmed this peak, which may be confirmed later this week when the PCE price index is released, but this isn’t the news the market needs.

The market needs to hear that earnings power will return to the S&P 500, and right now, it doesn’t look like that is happening. The most recent figures for S&P 500 earnings from Factset suggest that not only is this rally not to be trusted, but this market may even move down to set a new low.

Peak inflation is good news, but the FOMC and high prices hurt the S&P 500 earnings power. Inflation is up double-digits in the last two years and, coupled with historically high-interest rates, is hurting demand and S&P 500 margin. On the inflation front, while it is slowing, it has not gone away.

For higher prices to quit impacting consumers, they have to fall, and deflation isn’t central to the big picture, not yet anyway, although it has been creeping into the edges; for higher interest rates to stop hurting the economic outlook, they, too, will need to fall. With the FOMC sticking to its outlook of “higher rates for longer,” it doesn’t look like that pressure is out of the picture either.

What Do The Numbers Say?

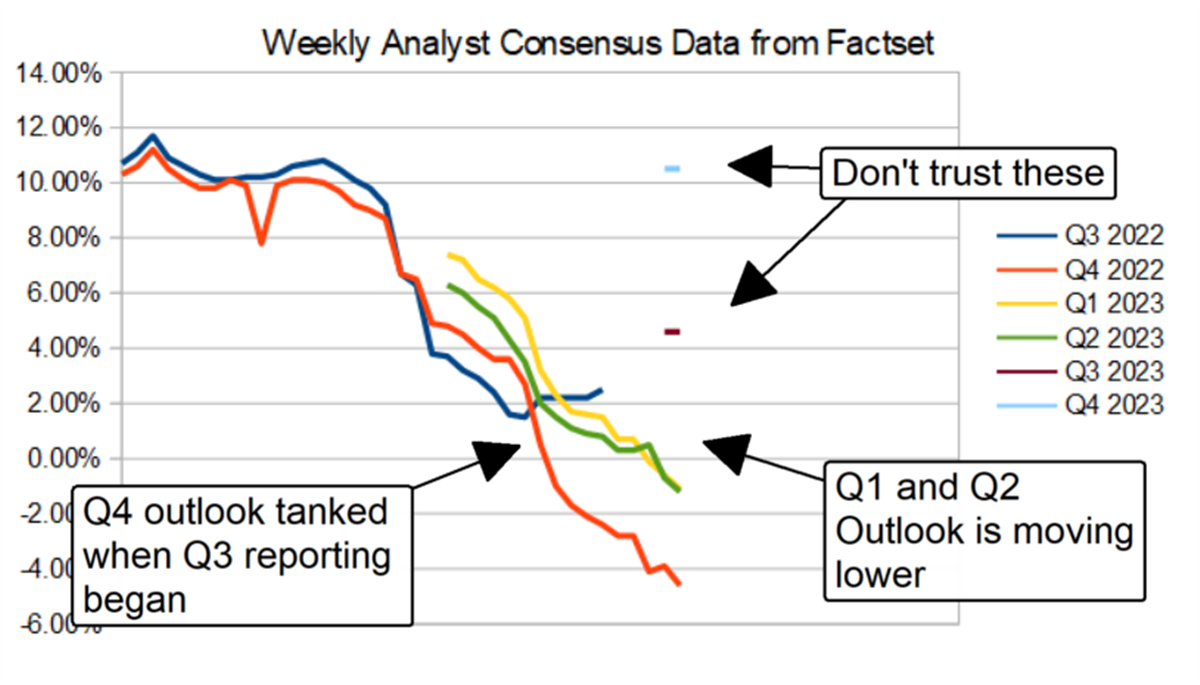

We’re a little more than 10% of the way into the Q4 reporting cycle, and the season is unfolding as expected, although this is not good news. First, the blended rate for growth, which includes companies that have reported and estimates for those that haven’t fallen to new lows, was unexpected. The latest figure is -4.6%, the lowest for the quarter since the 4th quarter of 2022 was included in the weekly report.

This is unexpected because it is contrary to the trend, the S&P usually outperforms its consensus estimate, and it opens the door to some unpleasant possibilities. The first is the analysts have underestimated Q4 weakness, leading to another, even more, sinister possibility: economic activity is slowing and contracting faster than the analysts can keep up with.

The forward data is equally gloomy. The consensus figures for Q1 and Q2 2023 turned negative at the start of the New Year, and the downtrend appears to be gaining momentum. If these figures move lower as the Q3 and Q4 figures did during the Q2 and Q3 reporting seasons, they will likely hit a high-single-digit decline by the time those reporting cycles roll around. That is a dead weight for a market price on the expectation for future earnings, but three is a ray of light.

Beware 2nd Half Optimism

The ray of light is the 2nd half of 2023. The first-reported consensus estimates show gains of 4.6% and 10.5%, which is good for two reasons. The first is that growth is back on the table, and the 2nd is the trajectory for growth is upward and accelerates on a quarter-to-quarter basis. That should keep the market interested, but there is a risk. These are the first released consensus estimates for a period that won’t begin for five months.

Since the pandemic began, analysts have been reluctant to alter their long-term forecasts due to economic uncertainty. That can be seen in the consensus data; the estimates for Q4 2022, Q1 and Q2 2023 had been trending lower but took a nosedive once Q3 reporting began. That trend is already playing out for Q1 and Q2 of 2023.

Regardless, 2023 is now expected to have slower earnings growth than 2022, which is also no reason to expect a market rally.

If this trend continues and the estimates for the 2nd half trend lower, it is unlikely the S&P 500 will be able to break out of this trading range. The best-case scenario, in this event, is the market will top out below 4,150 and remain range bound for 2023.

The worst-case scenario is that economic activity will continue to come under pressure because prices are high and interest rates are on the rise, the outlook for S&P 500 earnings will continue to deteriorate, and the index will fall back to its lows near 3,500 or lower.