Payments and billing software maker Bill.com (NYSE: BILL) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 17.5% year on year to $358.5 million. The company expects next quarter’s revenue to be around $358 million, slightly above analysts’ estimates. Its non-GAAP profit of $0.78 per share was also 55.4% above analysts’ consensus estimates.

Is now the time to buy Bill.com? Find out by accessing our full research report, it’s free.

Bill.com (BILL) Q3 CY2024 Highlights:

- Revenue: $358.5 million vs analyst estimates of $347 million (3.3% beat)

- Adjusted EPS: $0.78 vs analyst estimates of $0.50 (55.4% beat)

- Adjusted Operating Income: $67.09 million vs analyst estimates of $54.39 million (23.3% beat)

- The company lifted its revenue guidance for the full year to $1.45 billion at the midpoint from $1.43 billion, a 1.3% increase

- Management raised its full-year Adjusted EPS guidance to $1.74 at the midpoint, a 17.2% increase

- Gross Margin (GAAP): 82%, down from 85.3% in the same quarter last year

- Operating Margin: -2.1%, up from -18.6% in the same quarter last year

- Free Cash Flow Margin: 22.7%, up from 21.3% in the previous quarter

- Market Capitalization: $6.70 billion

Company Overview

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE: BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

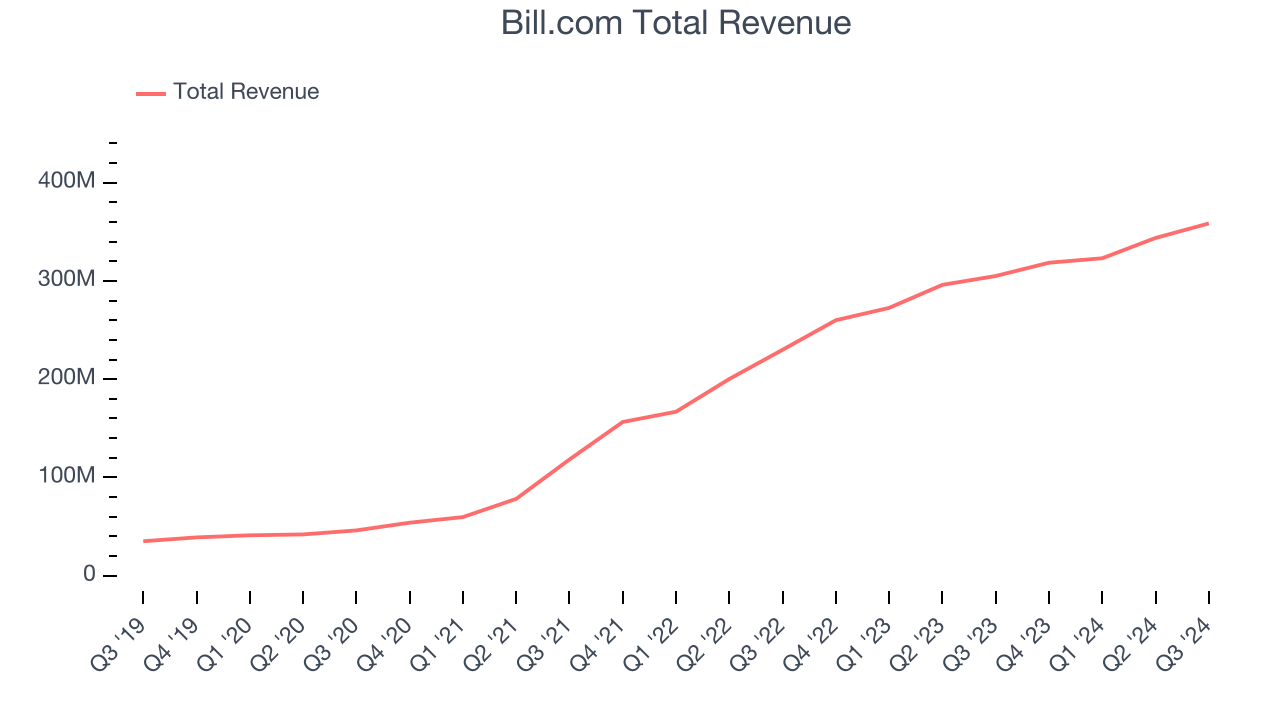

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Bill.com grew its sales at an incredible 63% compounded annual growth rate (partly thanks to some acquisitions along the way). This is encouraging because it shows Bill.com’s offerings resonate with customers, a helpful starting point.

This quarter, Bill.com reported year-on-year revenue growth of 17.5%, and its $358.5 million of revenue exceeded Wall Street’s estimates by 3.3%. Management is currently guiding for a 12.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is above the sector average and indicates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

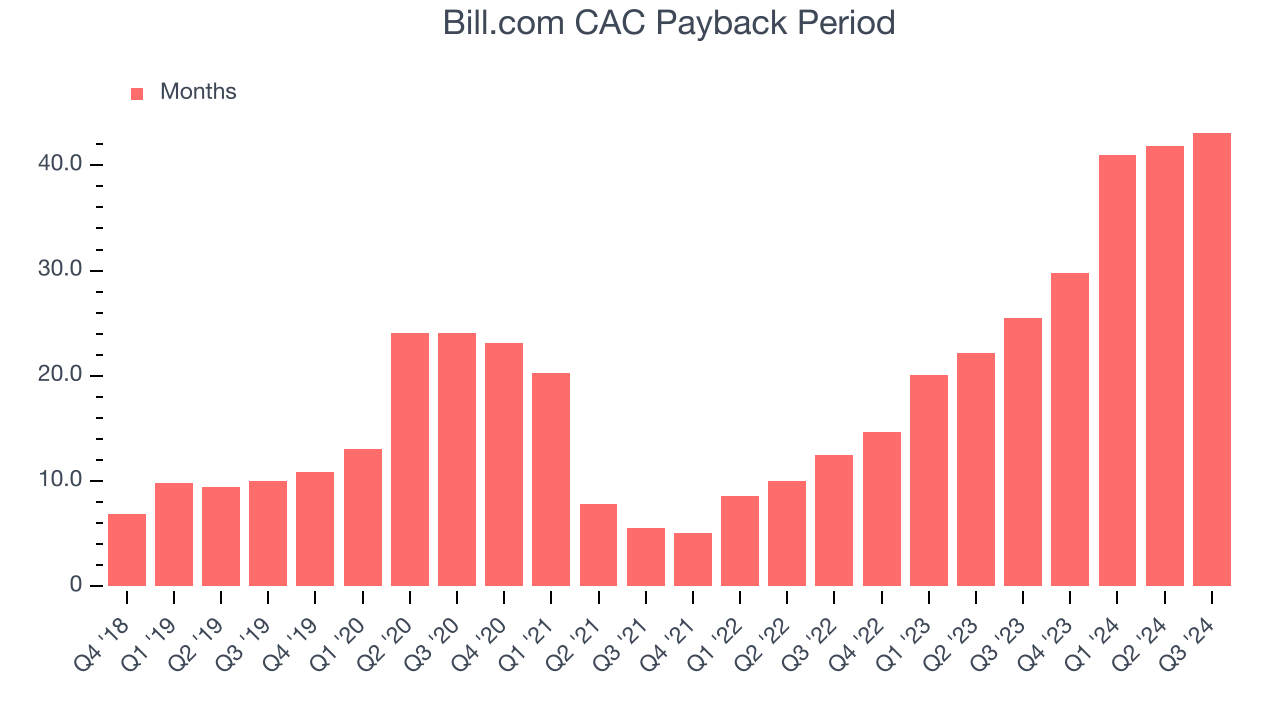

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Bill.com does a decent job acquiring new customers, and its CAC payback period checked in at 43.1 months this quarter. The company’s performance indicates relatively solid competitive positioning, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Bill.com’s Q3 Results

We were impressed by Bill.com’s optimistic EPS forecast for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its gross margin declined. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 15.4% to $76 immediately following the results.

Bill.com may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.