Since July 2024, Verizon has been in a holding pattern, posting a small loss of 2.4% while floating around $40.10. The stock also fell short of the S&P 500’s 7.3% gain during that period.

Is there a buying opportunity in Verizon, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We don't have much confidence in Verizon. Here are three reasons why there are better opportunities than VZ and a stock we'd rather own.

Why Do We Think Verizon Will Underperform?

Formed in 1984 as Bell Atlantic after the breakup of Bell System into seven companies, Verizon (NYSE: VZ) is a telecom giant providing a range of communications and internet services.

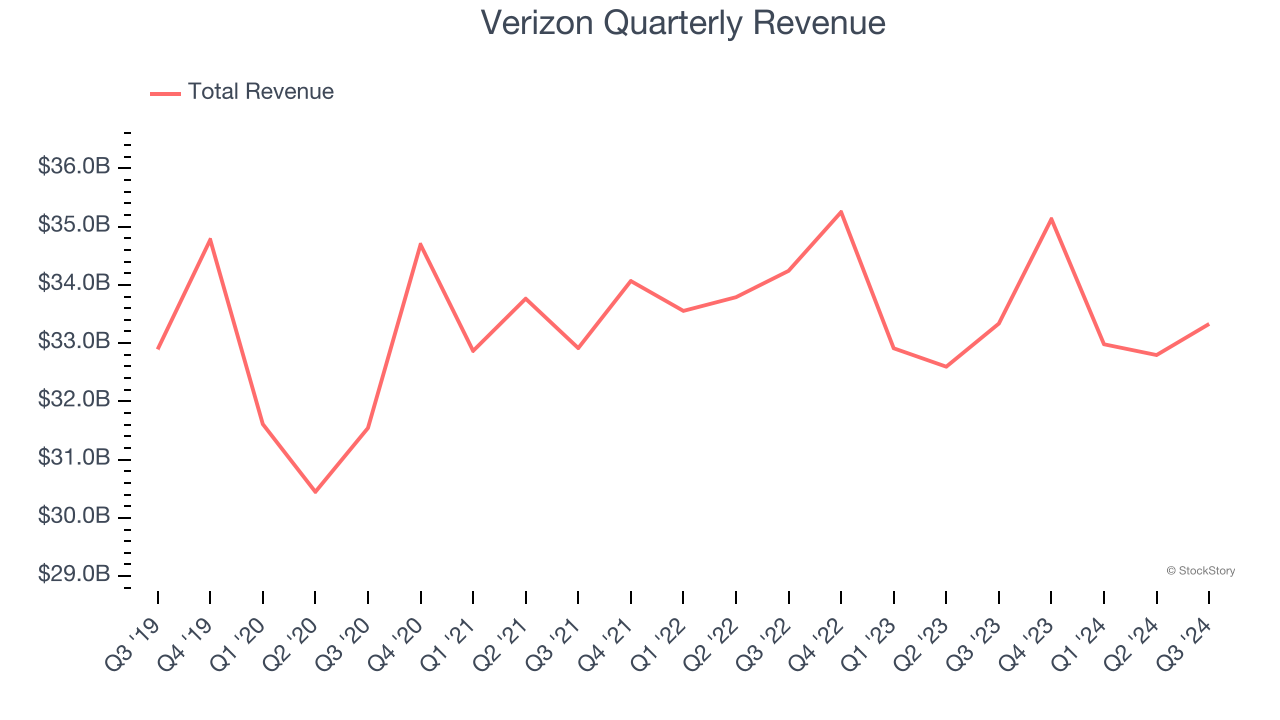

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Verizon struggled to consistently increase demand as its $134.2 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of poor business quality.

2. Customer Base Hits a Plateau

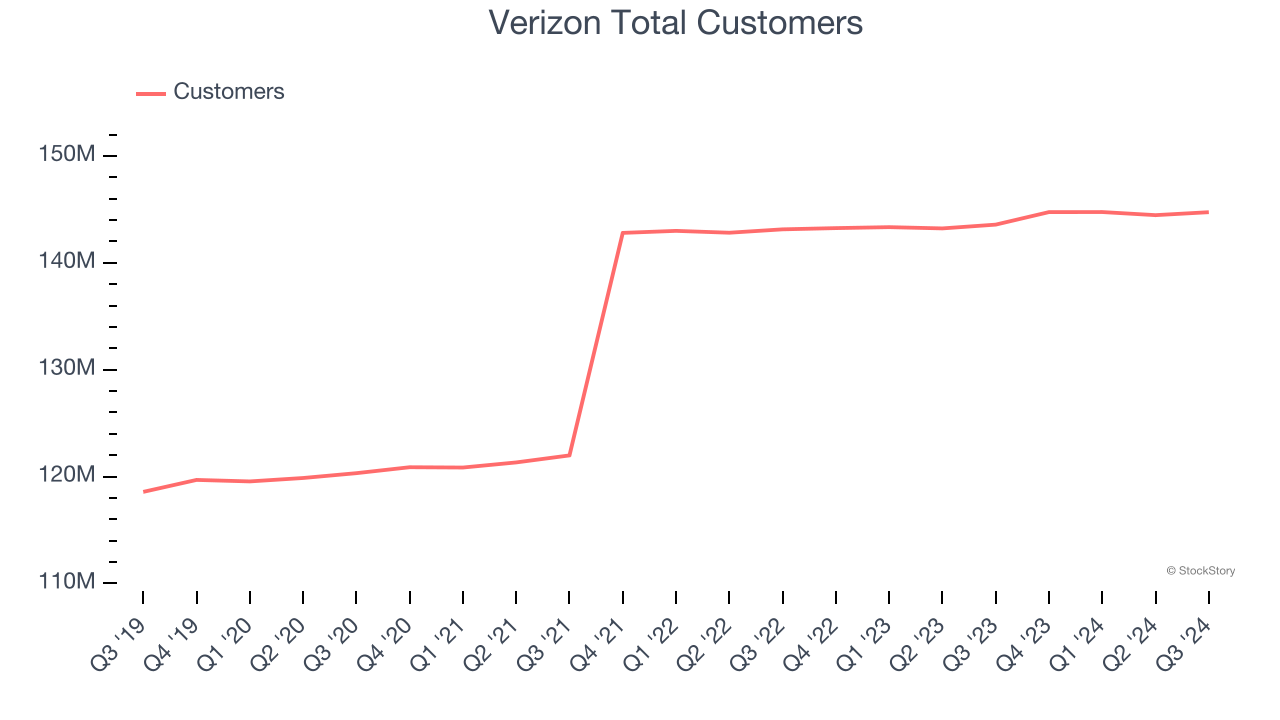

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Over the last two years, Verizon’s total customers were flat, coming in at 144.7 million in the latest quarter. This performance was underwhelming and shows the company faced challenges in landing new contracts. It also suggests there may be increasing competition or market saturation.

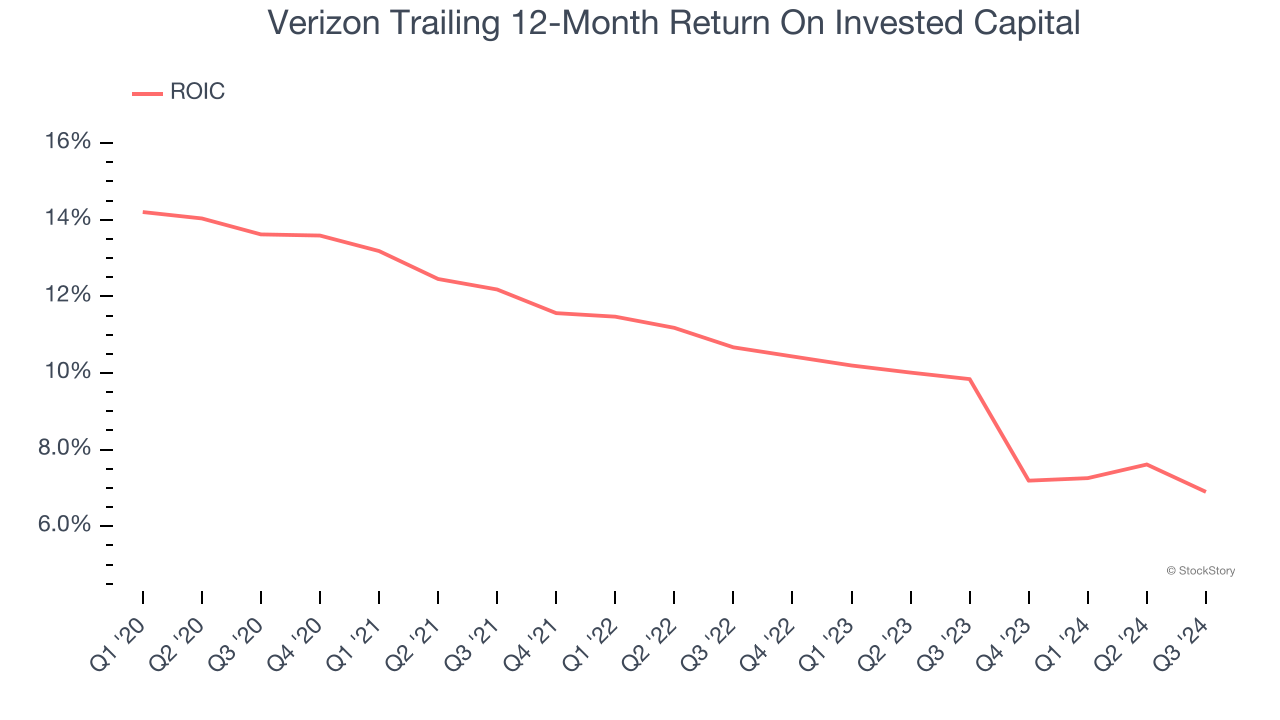

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We typically prefer to invest in companies with high returns because it means they have viable business models, but the trend in a company’s ROIC is often what surprises the market and moves the stock price. On average, Verizon’s ROIC decreased by 4.5 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of Verizon, we’re out. With its shares underperforming the market lately, the stock trades at 8.5× forward price-to-earnings (or $40.10 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d suggest looking at Wabtec, a leading provider of locomotive services benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Verizon

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.