Over the past six months, Marcus & Millichap has been a great trade, beating the S&P 500 by 6.9%. Its stock price has climbed to $35.01, representing a healthy 14.2% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Marcus & Millichap, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.We’re happy investors have made money, but we're cautious about Marcus & Millichap. Here are three reasons why there are better opportunities than MMI and a stock we'd rather own.

Why Is Marcus & Millichap Not Exciting?

Founded in 1971, Marcus & Millichap (NYSE: MMI) specializes in commercial real estate investment sales, financing, research, and advisory services.

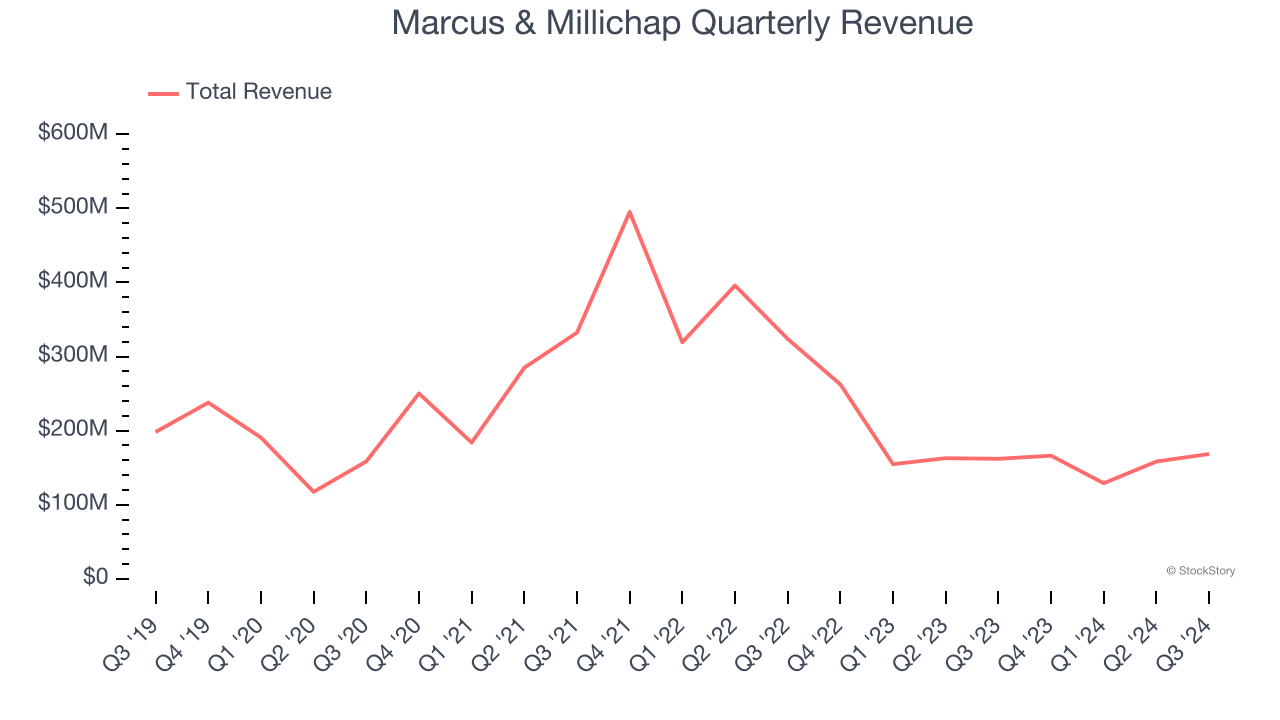

1. Revenue Spiraling Downwards

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Marcus & Millichap struggled to consistently generate demand over the last five years as its sales dropped at a 4.9% annual rate. This fell short of our benchmarks and signals it’s a lower quality business.

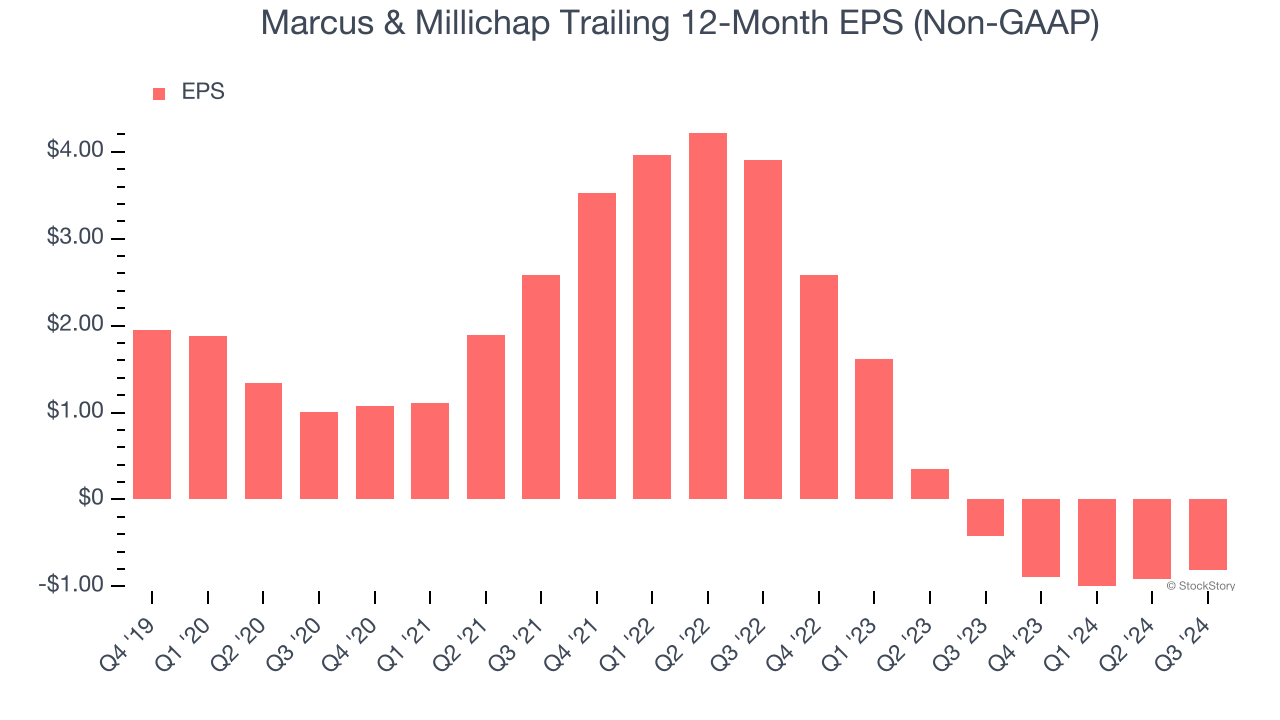

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Marcus & Millichap, its EPS declined by more than its revenue over the last five years, dropping 18.9% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

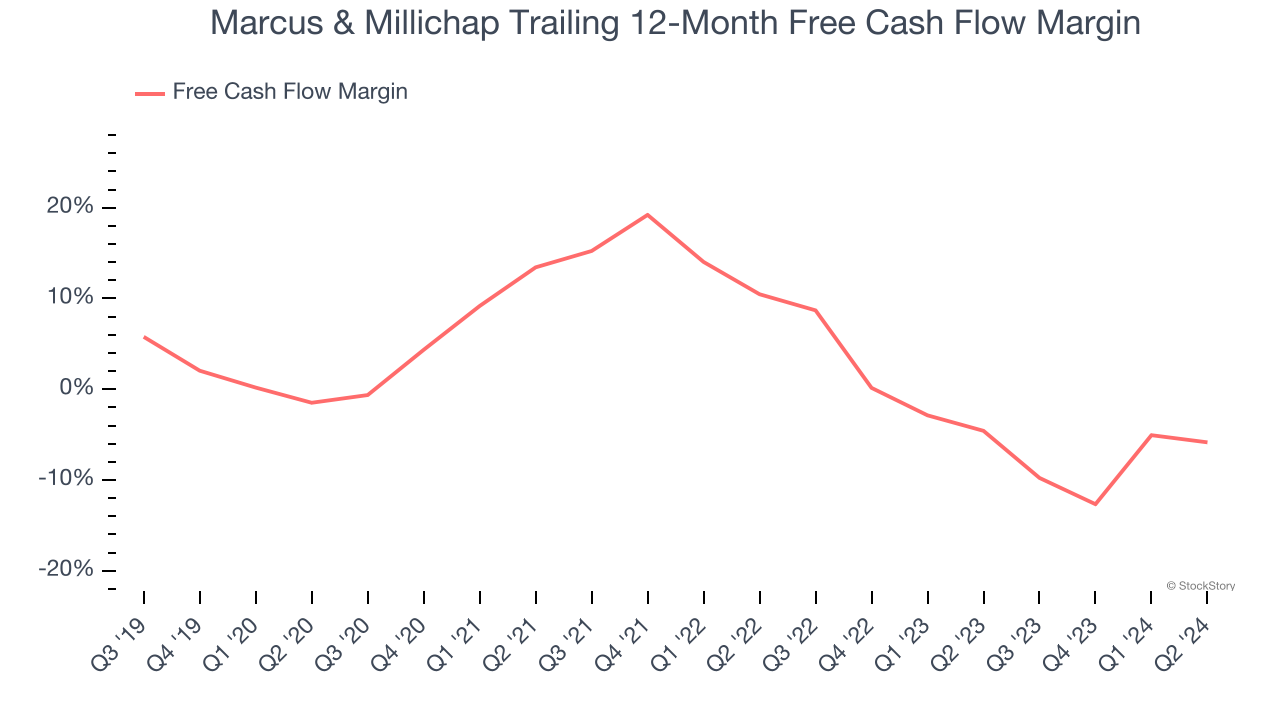

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Marcus & Millichap’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.5%, meaning it lit $9.53 of cash on fire for every $100 in revenue.

Final Judgment

Marcus & Millichap isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at $35.01 per share (or 2× forward price-to-sales). The market typically values companies like Marcus & Millichap based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d recommend looking at Costco, one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Marcus & Millichap

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.