Regional bank Westamerica Bancorporation (NASDAQ: WABC) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, but sales fell by 13.6% year on year to $64 million. Its GAAP profit of $1.12 per share was 4.2% above analysts’ consensus estimates.

Is now the time to buy Westamerica Bancorporation? Find out by accessing our full research report, it’s free for active Edge members.

Westamerica Bancorporation (WABC) Q3 CY2025 Highlights:

- Net Interest Income: $53.85 million vs analyst estimates of $52.79 million (13.4% year-on-year decline, 2% beat)

- Net Interest Margin: 3.8% vs analyst estimates of 3.8% (in line)

- Revenue: $64 million vs analyst estimates of $62.51 million (13.6% year-on-year decline, 2.4% beat)

- Efficiency Ratio: 40.3% vs analyst estimates of 39.8% (50 basis point miss)

- EPS (GAAP): $1.12 vs analyst estimates of $1.08 (4.2% beat)

- Market Capitalization: $1.18 billion

"Westamerica’s third quarter 2025 results benefited from the Company’s low-cost operating principles. The annualized cost of funding interest-earning loans, bonds and cash was 0.26 percent for the third quarter 2025. The Company recognized no provision for credit losses in the third quarter 2025. At September 30, 2025, nonperforming assets were $2.6 million and the allowance for credit losses on loans was $11.9 million. Westamerica operated efficiently, spending 40 percent of its revenue on operating costs in the third quarter 2025,” said Chairman, President and CEO David Payne.

Company Overview

Founded in 1884 and serving communities from Mendocino County in the north to Kern County in the south, Westamerica Bancorporation (NASDAQ: WABC) provides banking services to individuals and small businesses throughout Northern and Central California.

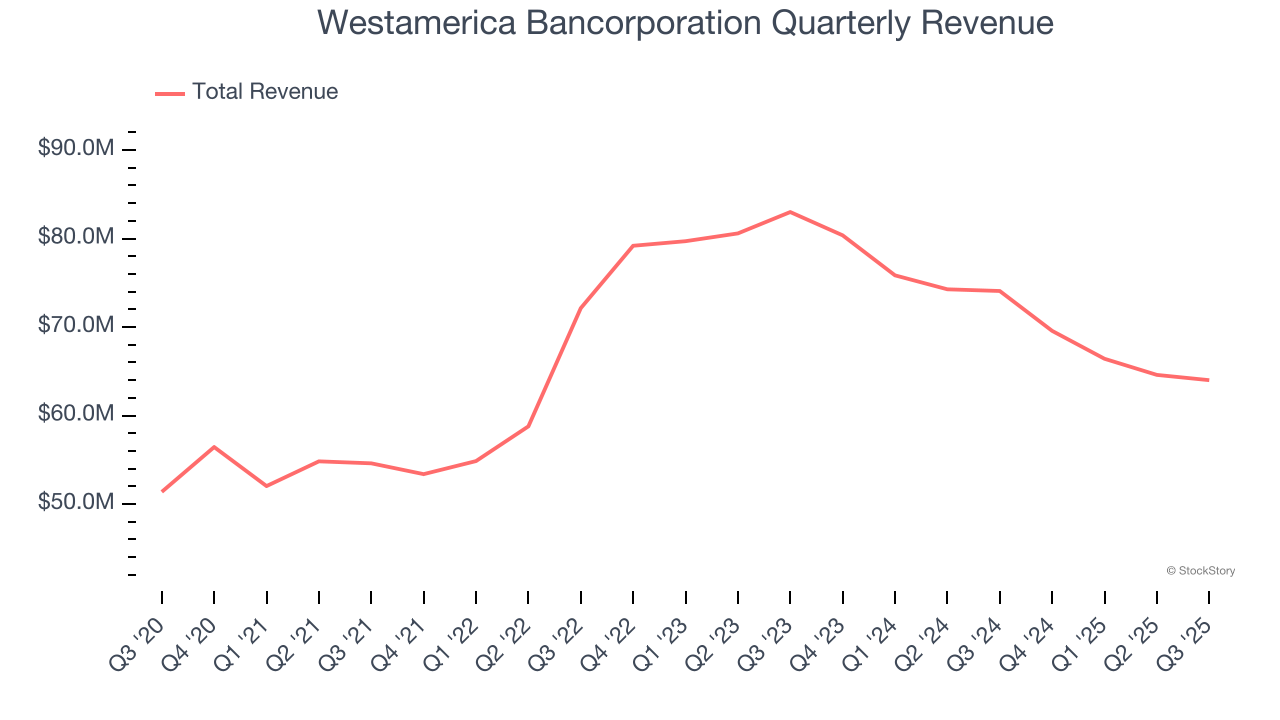

Sales Growth

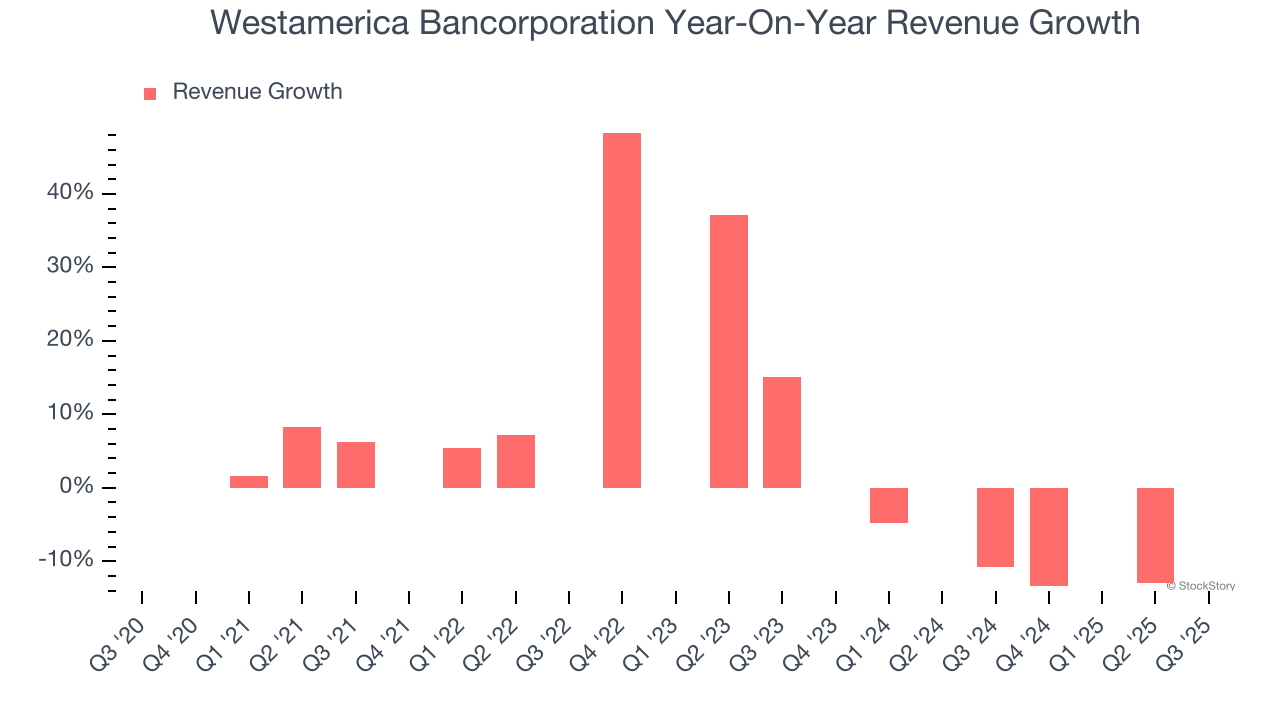

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Thankfully, Westamerica Bancorporation’s 5.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Westamerica Bancorporation’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.4% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Westamerica Bancorporation’s revenue fell by 13.6% year on year to $64 million but beat Wall Street’s estimates by 2.4%.

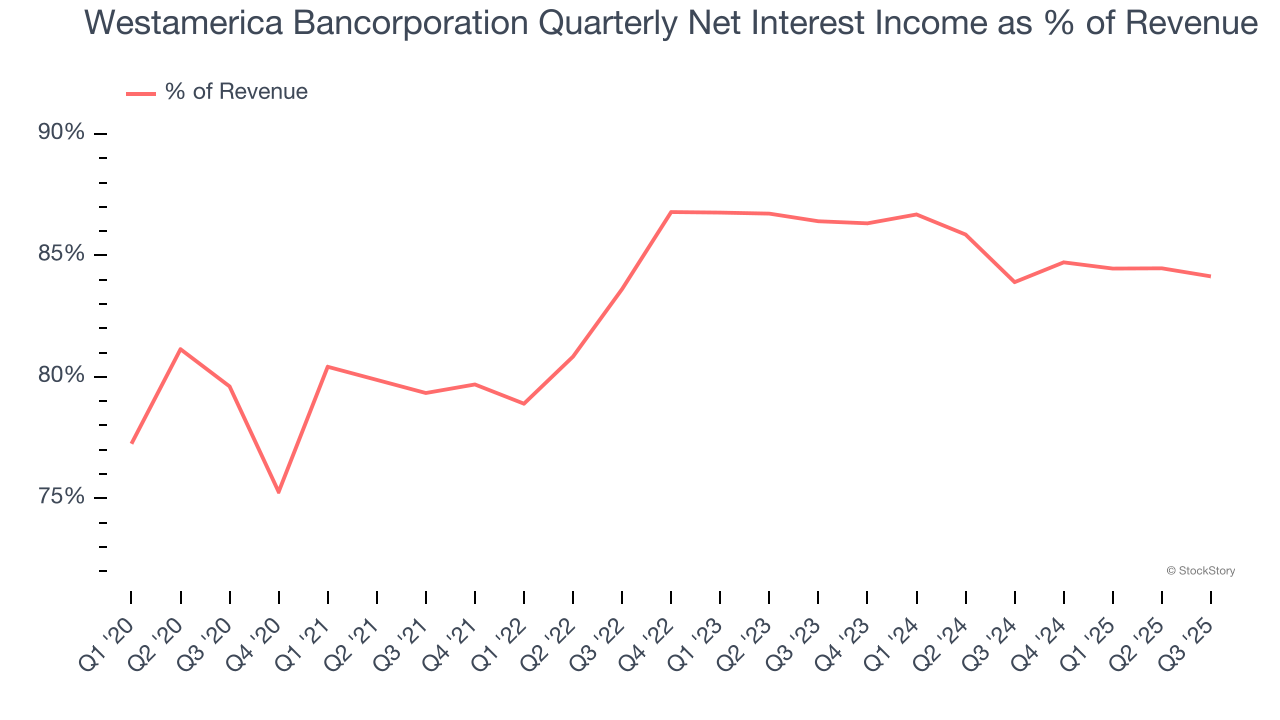

Net interest income made up 83.3% of the company’s total revenue during the last five years, meaning Westamerica Bancorporation barely relies on non-interest income to drive its overall growth.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Key Takeaways from Westamerica Bancorporation’s Q3 Results

It was encouraging to see Westamerica Bancorporation beat analysts’ revenue and EPS expectations this quarter. We were also happy its net interest income outperformed Wall Street’s estimates. On the other hand, net interest margin was just in line and efficiency ratio missed slightly. Overall, this print was still solid. The stock remained flat at $45.80 immediately after reporting.

Big picture, is Westamerica Bancorporation a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.