NeoGenomics trades at $9.78 per share and has stayed right on track with the overall market, gaining 24.7% over the last six months. At the same time, the S&P 500 has returned 21.3%.

Is now the time to buy NeoGenomics, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think NeoGenomics Will Underperform?

We're sitting this one out for now. Here are three reasons we avoid NEO and a stock we'd rather own.

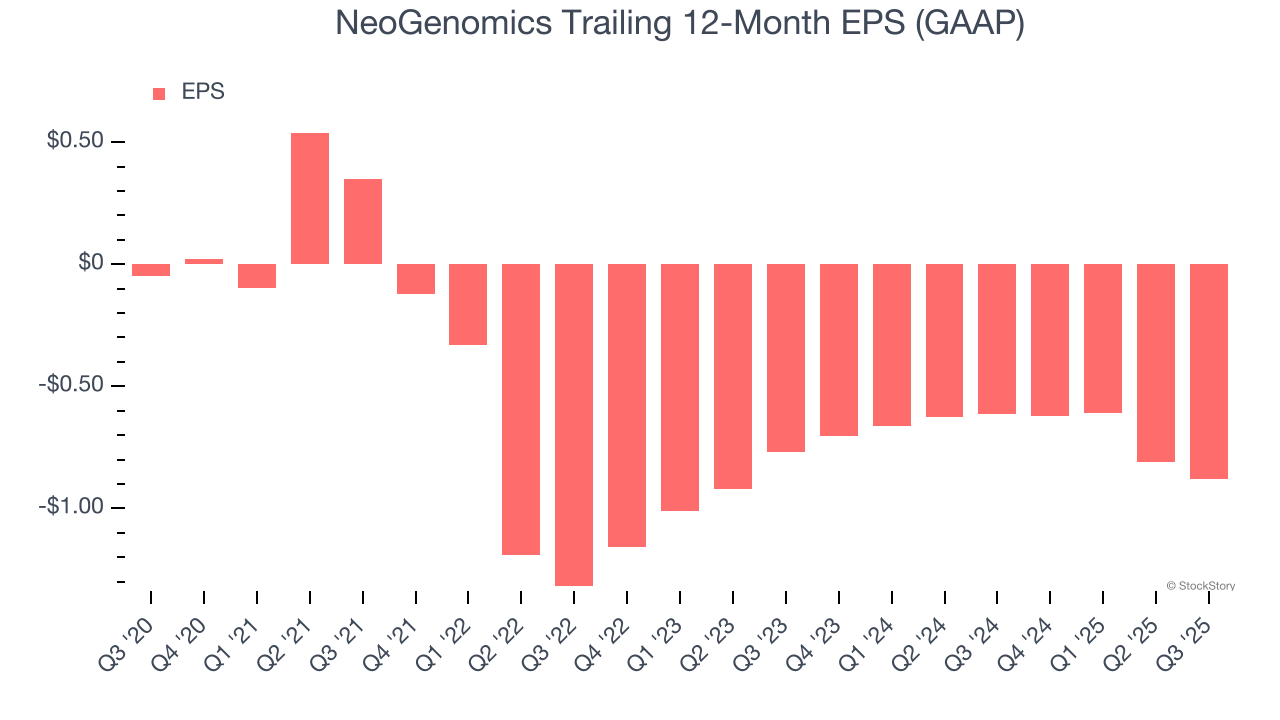

1. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

NeoGenomics’s earnings losses deepened over the last five years as its EPS dropped 78.5% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, NeoGenomics’s low margin of safety could leave its stock price susceptible to large downswings.

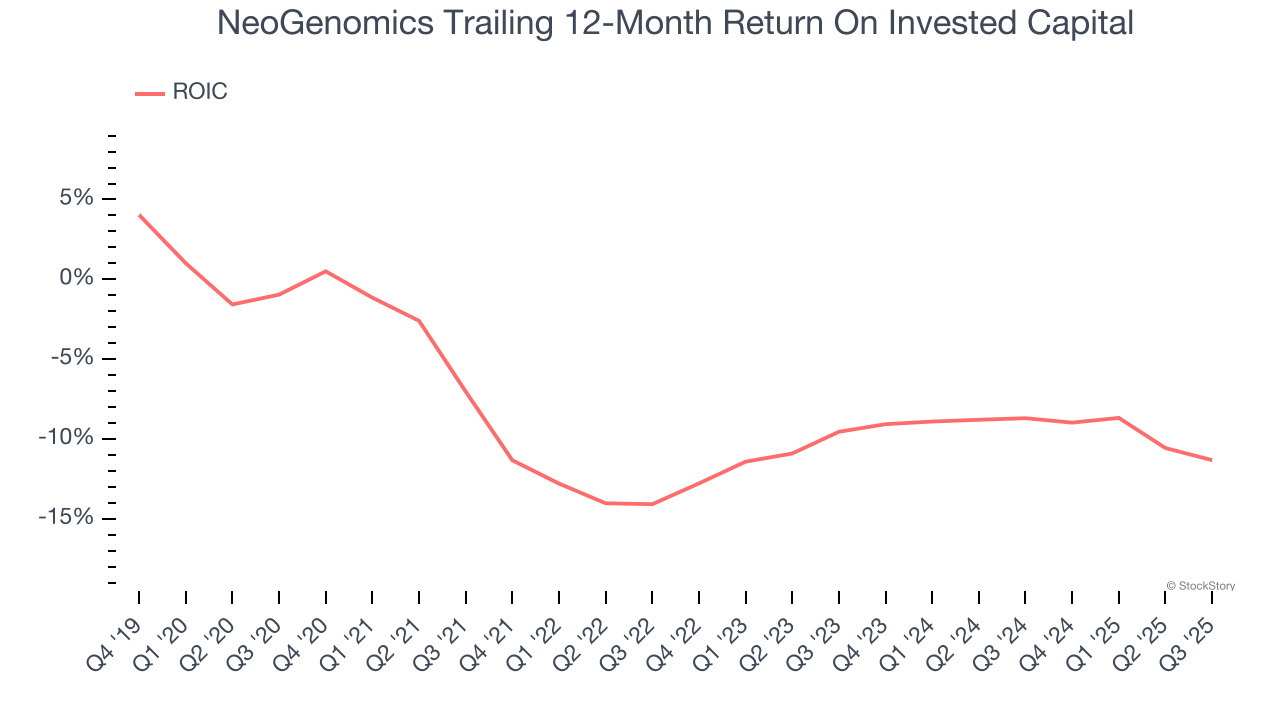

2. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

NeoGenomics’s five-year average ROIC was negative 10.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

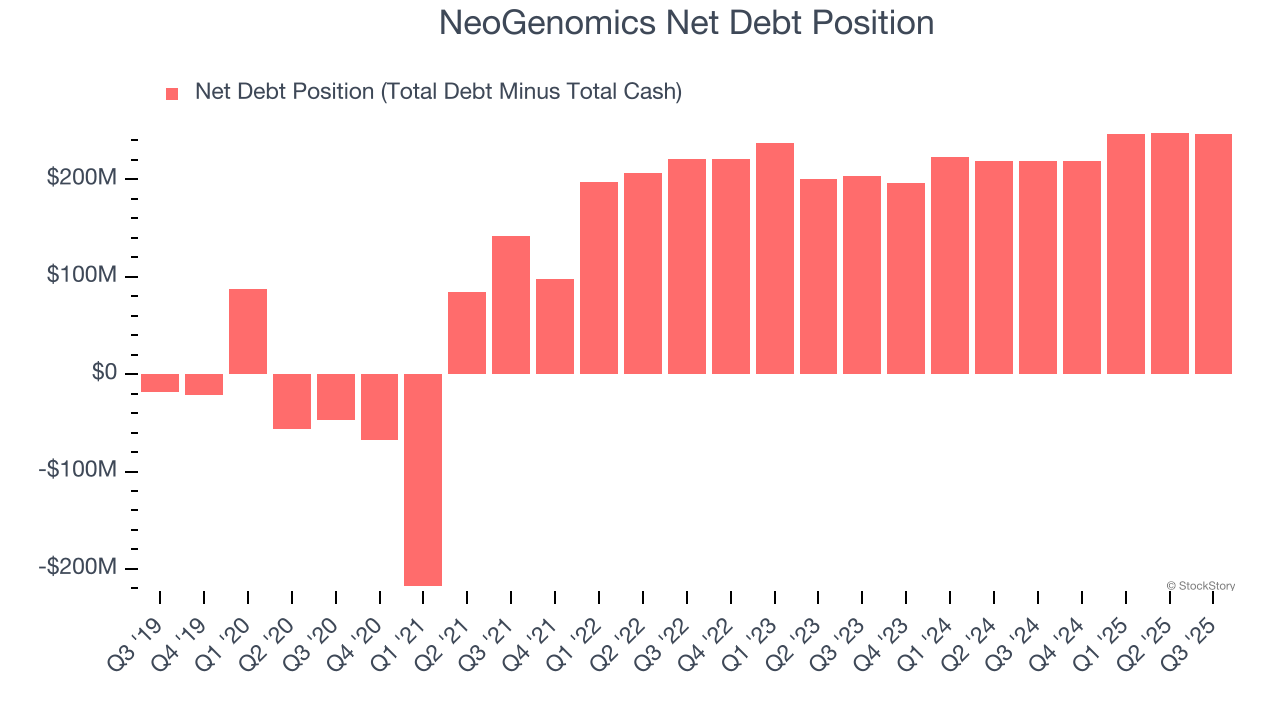

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

NeoGenomics’s $410.3 million of debt exceeds the $164.1 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $41.85 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. NeoGenomics could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope NeoGenomics can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies helping people live better, but in the case of NeoGenomics, we’ll be cheering from the sidelines. That said, the stock currently trades at 32.6× forward EV-to-EBITDA (or $9.78 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.