Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Snap (NYSE: SNAP) and its peers.

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

The 5 social networking stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was 1.2% below.

While some social networking stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.1% since the latest earnings results.

Best Q4: Snap (NYSE: SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

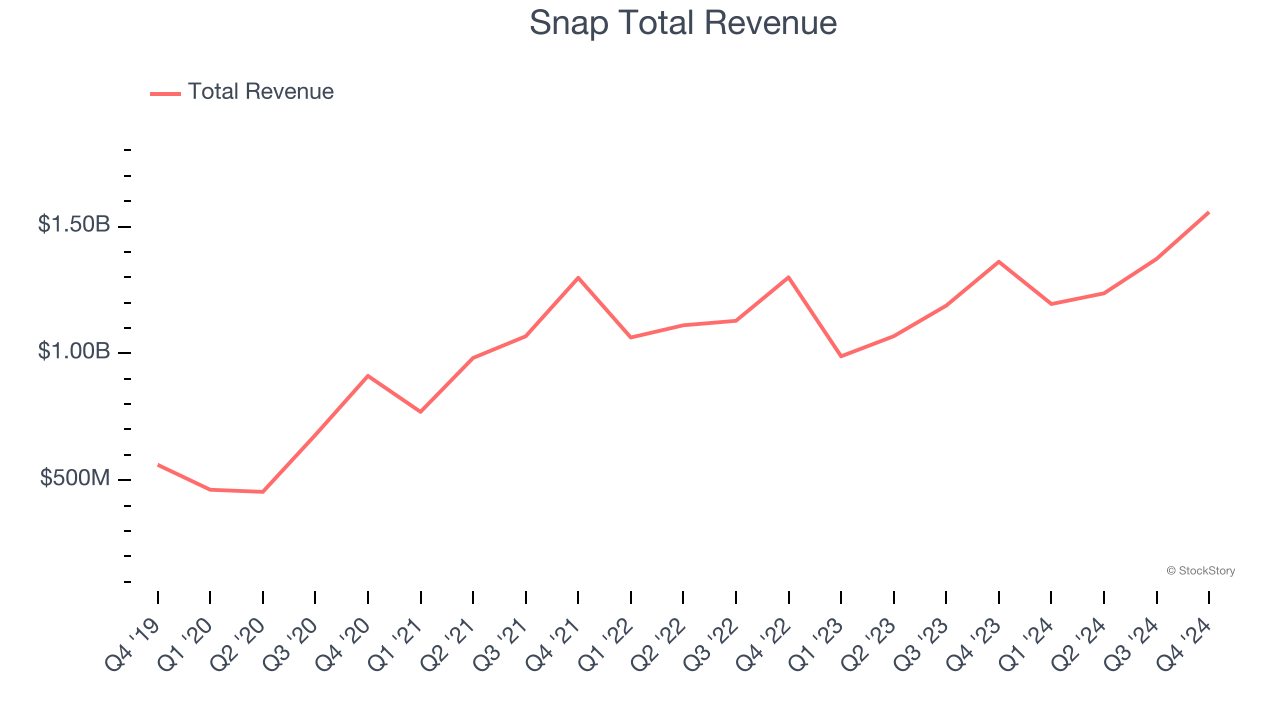

Snap reported revenues of $1.56 billion, up 14.4% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates.

“In 2024 we made significant progress on our core priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, while building toward our long-term vision for augmented reality,” said Evan Spiegel, CEO.

Snap delivered the weakest performance against analyst estimates of the whole group. The company reported 453 million daily active users, up 9.4% year on year. Unsurprisingly, the stock is down 8.6% since reporting and currently trades at $10.62.

Is now the time to buy Snap? Access our full analysis of the earnings results here, it’s free.

Pinterest (NYSE: PINS)

Created with the idea of virtually replacing paper catalogues, Pinterest (NYSE: PINS) is an online image and social discovery platform.

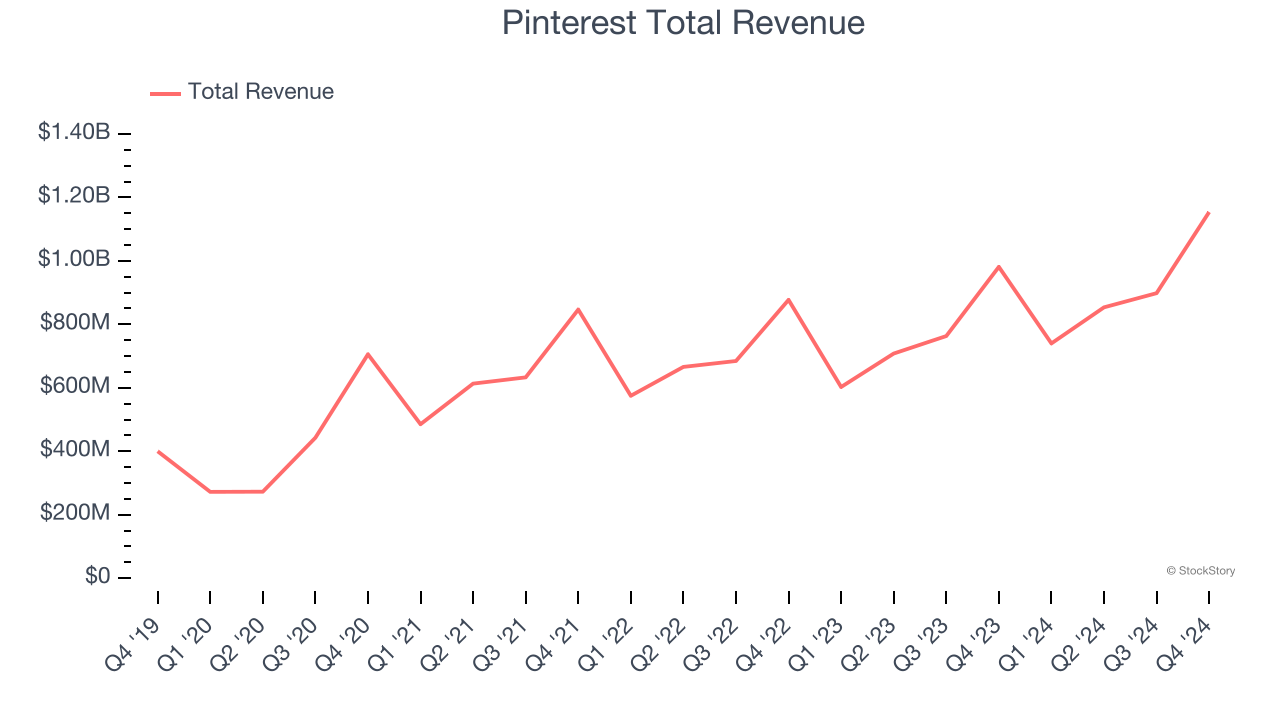

Pinterest reported revenues of $1.15 billion, up 17.6% year on year, outperforming analysts’ expectations by 1.2%. The business had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 18.3% since reporting. It currently trades at $39.75.

Is now the time to buy Pinterest? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Meta (NASDAQ: META)

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ: META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Meta reported revenues of $48.39 billion, up 20.6% year on year, exceeding analysts’ expectations by 2.9%. Still, it was a mixed quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly.

Interestingly, the stock is up 2.6% since the results and currently trades at $694.31.

Read our full analysis of Meta’s results here.

Yelp (NYSE: YELP)

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp reported revenues of $362 million, up 5.7% year on year. This result beat analysts’ expectations by 3.3%. Aside from that, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

Yelp had the slowest revenue growth among its peers. The stock is down 8.8% since reporting and currently trades at $36.98.

Read our full, actionable report on Yelp here, it’s free.

Reddit (NYSE: RDDT)

Founded in 2005 by two University of Virginia roommates, Reddit (NYSE: RDDT) facilitates user-generated content across niche communities (called subreddits) that discuss anything from stocks to dating and memes.

Reddit reported revenues of $427.7 million, up 71.3% year on year. This print topped analysts’ expectations by 4.6%. More broadly, it was a satisfactory quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ number of domestic daily active visitors estimates.

Reddit delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 48 million daily active users, up 31.9% year on year. The stock is down 19.4% since reporting and currently trades at $174.50.

Read our full, actionable report on Reddit here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.