Payments and billing software maker Bill.com (NYSE: BILL) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 13.9% year on year to $362.6 million. On the other hand, next quarter’s revenue guidance of $355 million was less impressive, coming in 1.6% below analysts’ estimates. Its non-GAAP profit of $0.56 per share was 20.1% above analysts’ consensus estimates.

Is now the time to buy Bill.com? Find out by accessing our full research report, it’s free.

Bill.com (BILL) Q4 CY2024 Highlights:

- Revenue: $362.6 million vs analyst estimates of $361 million (13.9% year-on-year growth, in line)

- Adjusted EPS: $0.56 vs analyst estimates of $0.47 (20.1% beat)

- Adjusted Operating Income: $62.81 million vs analyst estimates of $51.49 million (17.3% margin, 22% beat)

- Next quarter's revenue guidance calls for $355 million, missing expectations of $360 million

- Operating Margin: -6%, up from -21.3% in the same quarter last year

- Free Cash Flow Margin: 19.8%, down from 22.6% in the previous quarter

- Market Capitalization: $10.04 billion

Company Overview

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE: BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

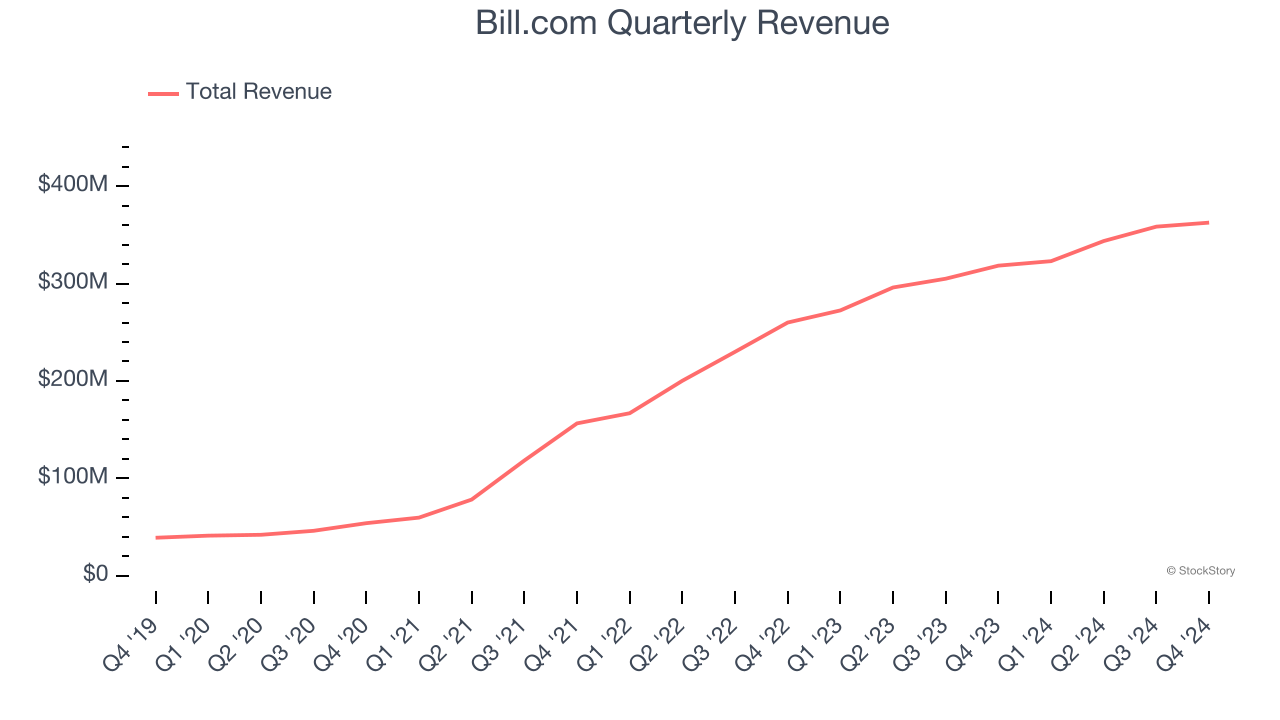

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Bill.com grew its sales at an incredible 49.8% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Bill.com’s year-on-year revenue growth was 13.9%, and its $362.6 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 9.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.2% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and indicates the market sees some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

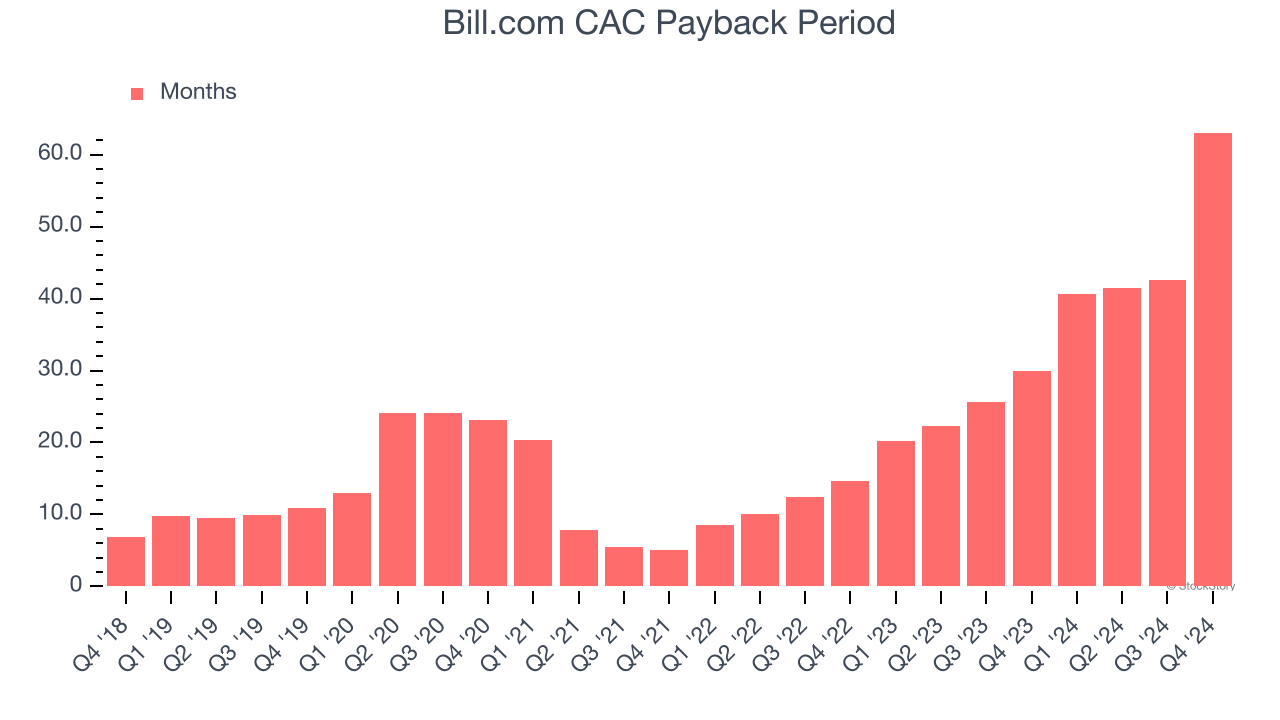

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Bill.com to acquire new customers as its CAC payback period checked in at 63.1 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a competitive market.

Key Takeaways from Bill.com’s Q4 Results

Revenue was just in line, although operating profit beat expectations. Bill.com's revenue guidance for next quarter missed significantly, and this seems to be weighing heavily on shares, showing that the market cares deeply about topline for this business. Shares traded down 28.1% to $69.30 immediately after reporting.

Is Bill.com an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.