Shutterstock’s stock price has taken a beating over the past six months, shedding 47.8% of its value and falling to a new 52-week low of $18.81 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Shutterstock, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're swiping left on Shutterstock for now. Here are three reasons why we avoid SSTK and a stock we'd rather own.

Why Is Shutterstock Not Exciting?

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE: SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

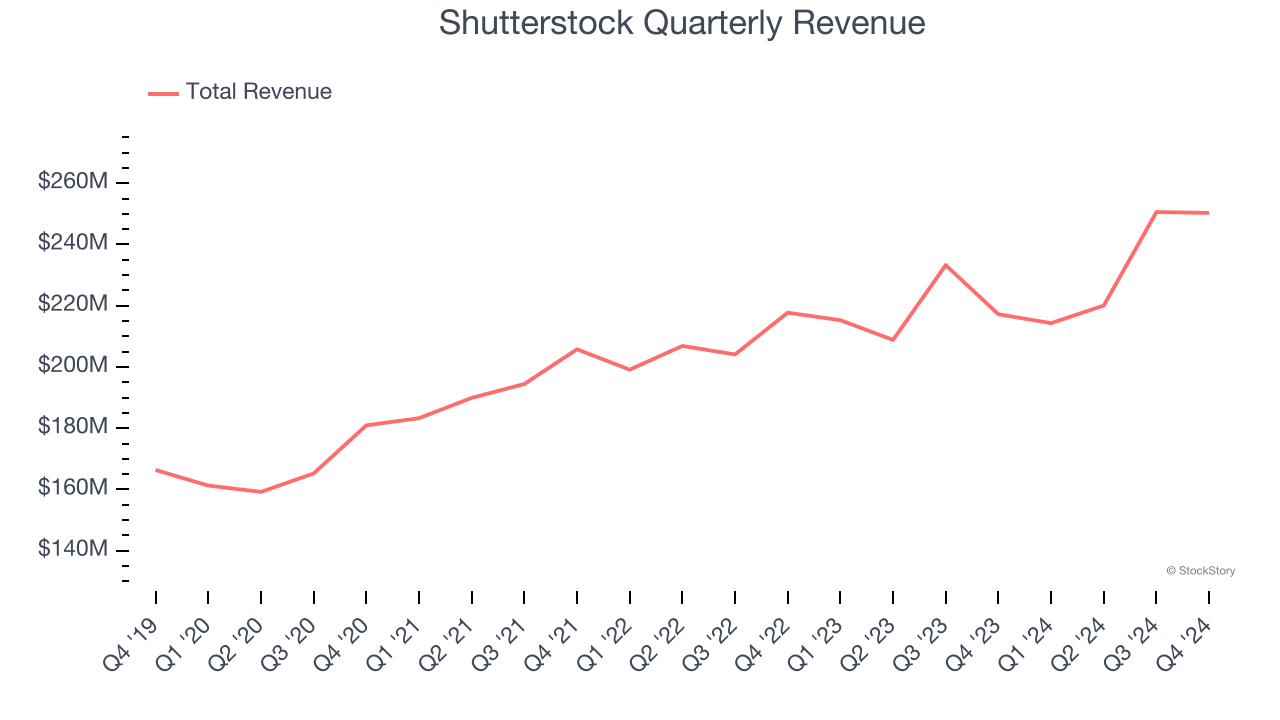

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Shutterstock’s sales grew at a tepid 6.5% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector.

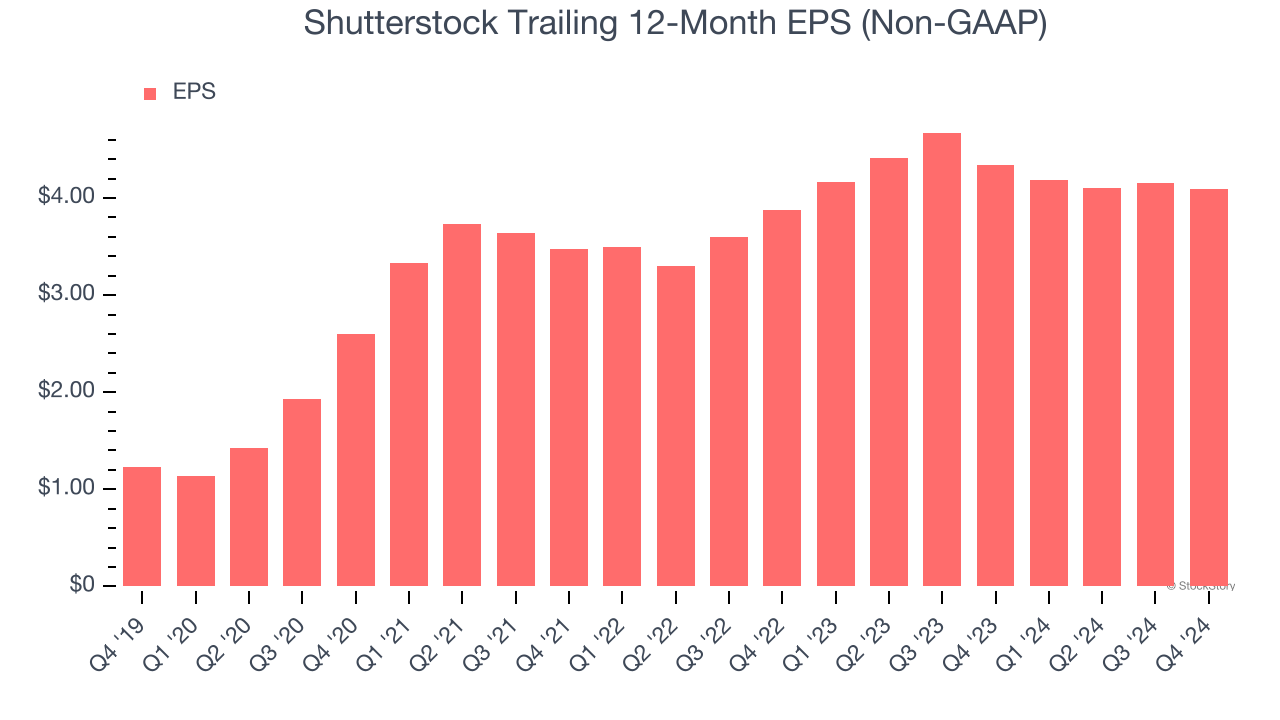

2. EPS Barely Growing

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Shutterstock’s unimpressive 5.6% annual EPS growth over the last three years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

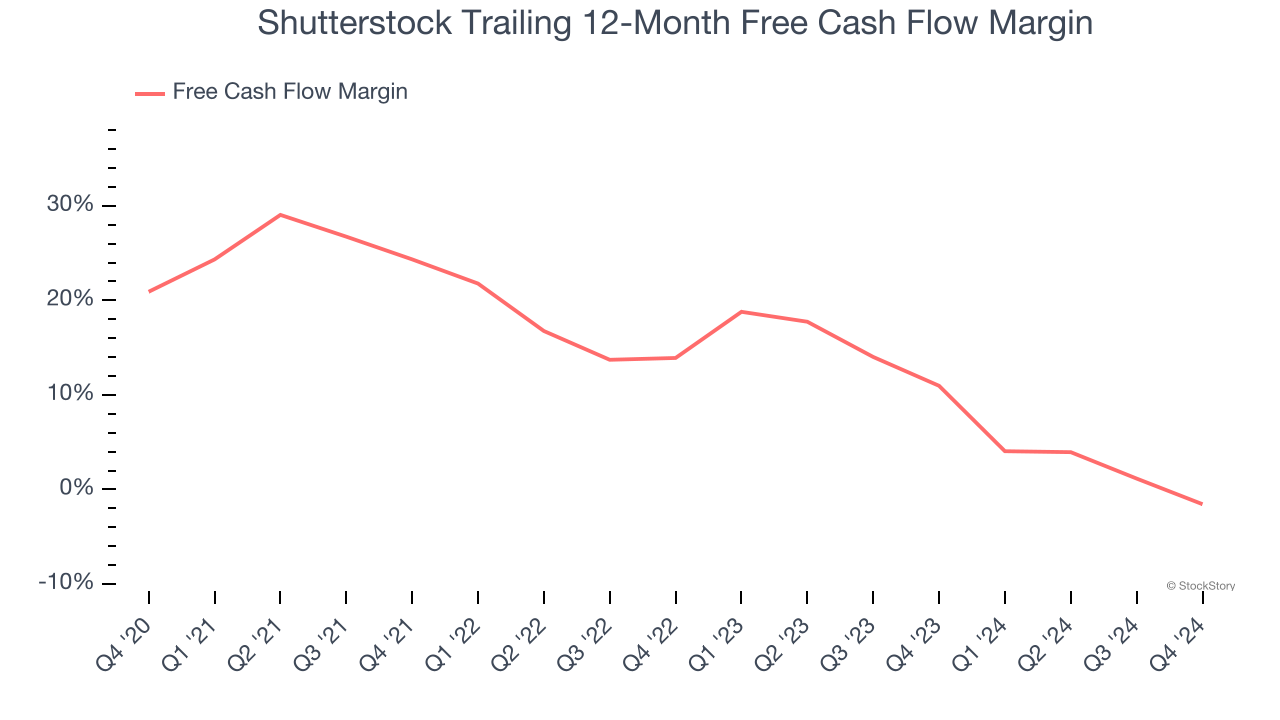

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Shutterstock’s margin dropped by 25.9 percentage points over the last few years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. Shutterstock’s free cash flow margin for the trailing 12 months was negative 1.6%.

Final Judgment

Shutterstock isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.4× forward EV-to-EBITDA (or $18.81 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Shutterstock

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.