The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Helios (NYSE: HLIO) and the rest of the gas and liquid handling stocks fared in Q4.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.2% since the latest earnings results.

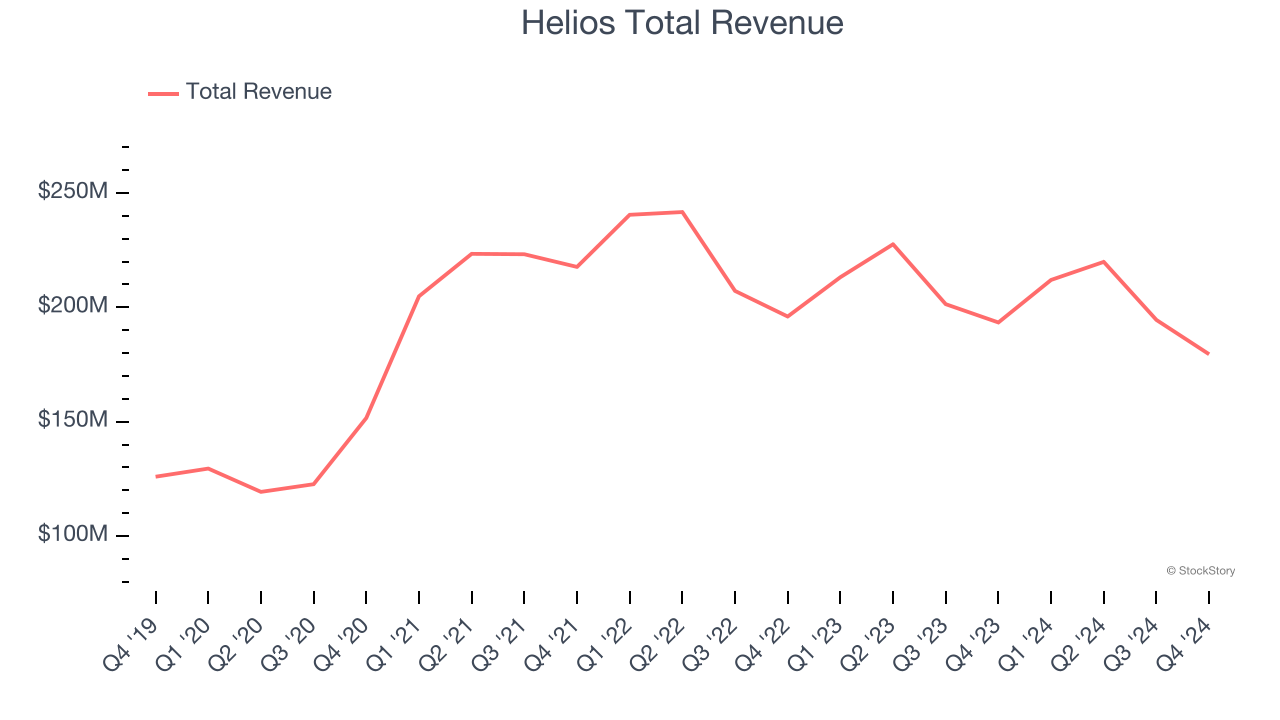

Helios (NYSE: HLIO)

Founded on the principle of treating others as one wants to be treated, Helios (NYSE: HLIO) designs, manufactures, and sells motion and electronic control components for various sectors.

Helios reported revenues of $179.5 million, down 7.2% year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

“During fiscal year 2024, we had record cash generation, strengthened our balance sheet and improved our financial flexibility by reducing and refinancing our debt. We measurably lowered our operating expenses and drove a new focus on our cash conversion cycle with a concerted effort to reduce inventory. We know we can achieve greater results as we were impacted by market conditions that reduced our expectations for the year. Our team maintained focus on innovation through the year launching many new products. We are better positioned to expand margins with growth and intend to re-energize our sales engine to capture greater market share while increasing diversification in customers and markets. Despite hurricanes, challenging market conditions, and leadership changes, the global team united to support each other and deliver on operational improvements that have enabled us to expand margins in the quarter on softer revenue,” said Sean Bagan, President, Chief Executive Officer, and Chief Financial Officer of Helios.

Helios scored the biggest analyst estimates beat but had the slowest revenue growth and slowest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 2.6% since reporting and currently trades at $34.98.

Read our full report on Helios here, it’s free.

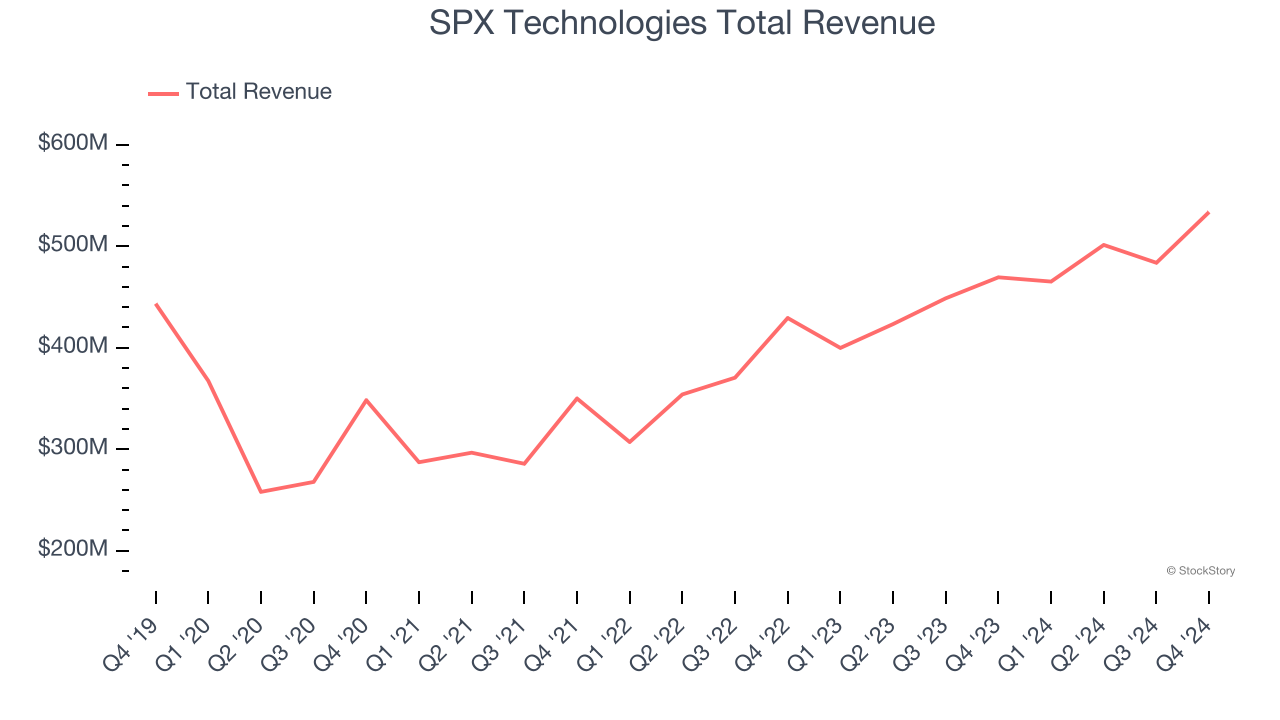

Best Q4: SPX Technologies (NYSE: SPXC)

SPX Technologies (NYSE: SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $533.7 million, up 13.7% year on year, in line with analysts’ expectations. The business had a very strong quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

SPX Technologies achieved the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.6% since reporting. It currently trades at $132.84.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Graco (NYSE: GGG)

Founded in 1926, Graco (NYSE: GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $548.7 million, down 3.2% year on year, falling short of analysts’ expectations by 1.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 3.3% since the results and currently trades at $83.23.

Read our full analysis of Graco’s results here.

Standex (NYSE: SXI)

Holding over 500 patents globally, Standex (NYSE: SXI) is a manufacturer and distributor of industrial components for various sectors.

Standex reported revenues of $189.8 million, up 6.4% year on year. This print beat analysts’ expectations by 0.5%. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EPS estimates.

The stock is down 8.5% since reporting and currently trades at $170.55.

Read our full, actionable report on Standex here, it’s free.

ITT (NYSE: ITT)

Playing a crucial role in the development of the first transatlantic television transmission in 1956, ITT (NYSE: ITT) provides motion and fluid handling equipment for various industries

ITT reported revenues of $929 million, up 12% year on year. This result met analysts’ expectations. More broadly, it was a slower quarter as it recorded full-year EPS guidance missing analysts’ expectations and a slight miss of analysts’ adjusted operating income estimates.

The stock is down 9.7% since reporting and currently trades at $135.29.

Read our full, actionable report on ITT here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.