As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at specialized consumer services stocks, starting with Pool (NASDAQ: POOL).

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.5% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.6% since the latest earnings results.

Pool (NASDAQ: POOL)

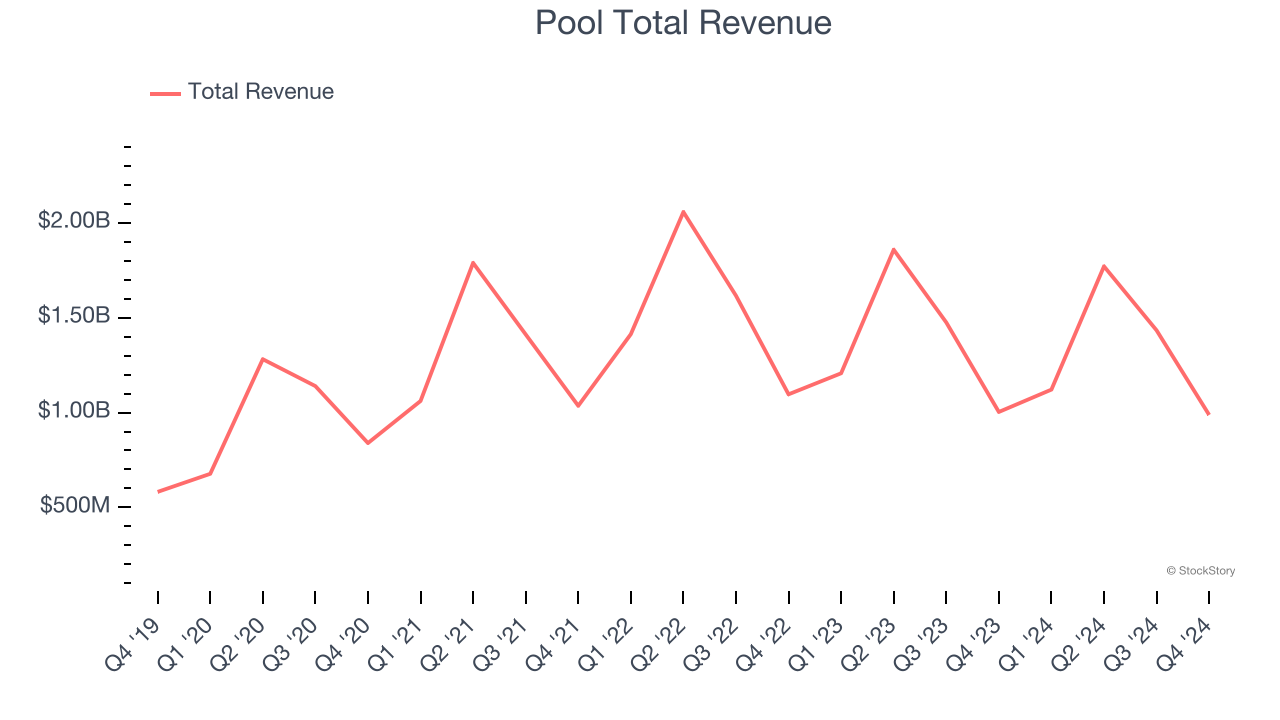

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ: POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $987.5 million, down 1.6% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ organic revenue estimates but full-year EPS guidance missing analysts’ expectations.

“Our results in 2024 highlight the strength of our business model in a pressured macroenvironment. Strategic execution in our growth initiatives allowed us to achieve net sales of $5.3 billion despite tempered discretionary spending. This year we enhanced our POOL360 digital ecosystem with technology rollouts and expanded our digital marketing programs, leading to increased sales of our private-label chemical products. We also continued to expand our sales center network, further improving our ability to serve our customers and widen our reach, with the addition of 10 greenfield locations and 2 acquisitions, bringing our total locations to 448 worldwide. We ended the year with strong operating cash flows of $659.2 million and are proud to have returned $483.4 million to our shareholders through dividends and share repurchases,” said Peter D. Arvan, president and CEO.

The stock is down 4.2% since reporting and currently trades at $326.63.

Is now the time to buy Pool? Access our full analysis of the earnings results here, it’s free.

Best Q4: Frontdoor (NASDAQ: FTDR)

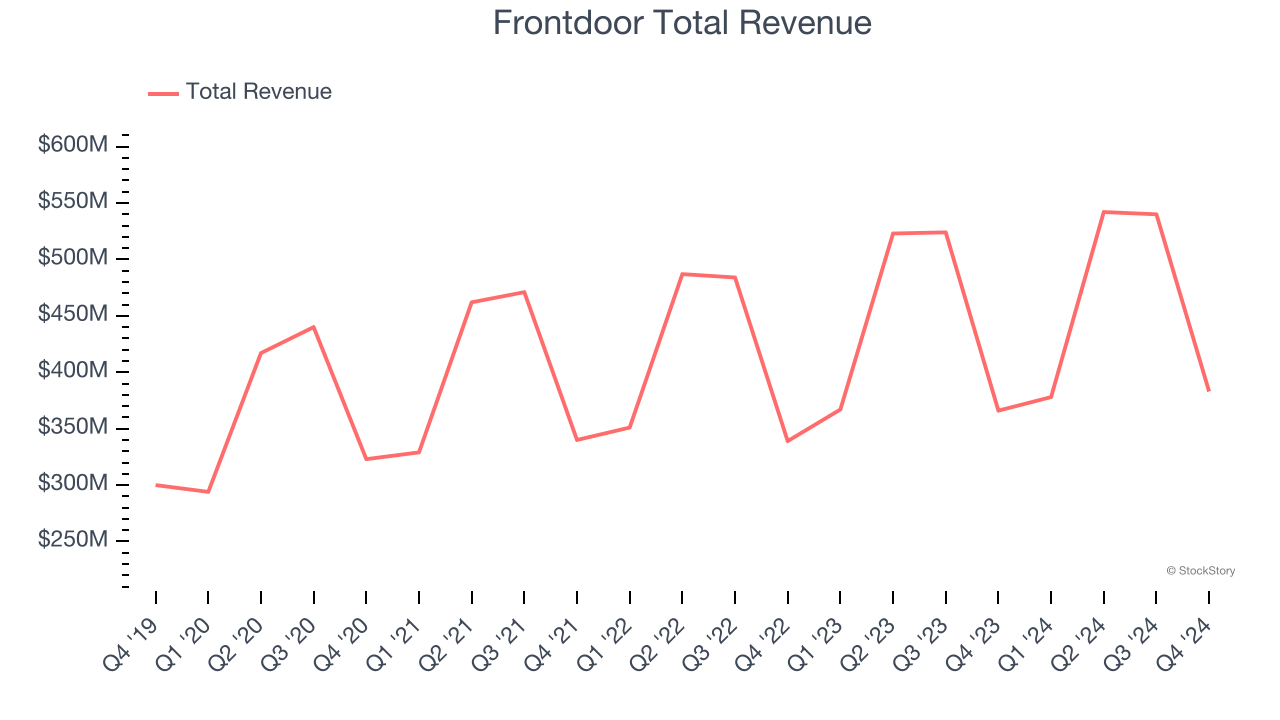

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ: FTDR) is a provider of home warranty and service plans.

Frontdoor reported revenues of $383 million, up 4.6% year on year, outperforming analysts’ expectations by 4.1%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Frontdoor delivered the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 33.9% since reporting. It currently trades at $37.74.

Is now the time to buy Frontdoor? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: 1-800-FLOWERS (NASDAQ: FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ: FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $775.5 million, down 5.7% year on year, falling short of analysts’ expectations by 3.4%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 34.7% since the results and currently trades at $5.75.

Read our full analysis of 1-800-FLOWERS’s results here.

Mister Car Wash (NASDAQ: MCW)

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE: MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $251.2 million, up 9.1% year on year. This print topped analysts’ expectations by 1.2%. Aside from that, it was a mixed quarter as it also produced an impressive beat of analysts’ same-store sales estimates but full-year revenue guidance missing analysts’ expectations.

Mister Car Wash achieved the fastest revenue growth among its peers. The stock is up 9.1% since reporting and currently trades at $8.29.

Read our full, actionable report on Mister Car Wash here, it’s free.

LKQ (NASDAQ: LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.36 billion, down 4.1% year on year. This number lagged analysts' expectations by 2%. More broadly, it was a satisfactory quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but organic revenue in line with analysts’ estimates.

The stock is up 3% since reporting and currently trades at $40.58.

Read our full, actionable report on LKQ here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.