As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the software development industry, including PagerDuty (NYSE: PD) and its peers.

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 24.8% since the latest earnings results.

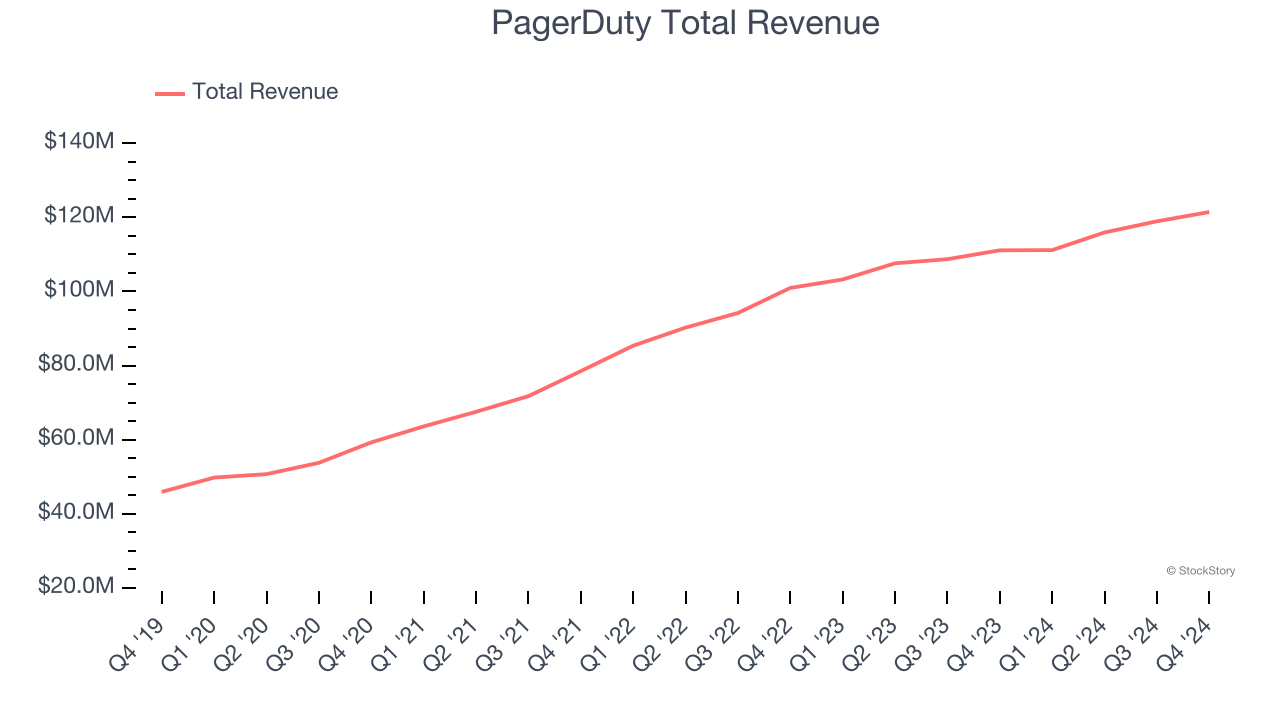

PagerDuty (NYSE: PD)

Started by three former Amazon engineers, PagerDuty (NYSE: PD) is a software-as-a-service platform that helps companies respond to IT incidents fast and make sure that any downtime is minimized.

PagerDuty reported revenues of $121.4 million, up 9.3% year on year. This print exceeded analysts’ expectations by 1.4%. Despite the top-line beat, it was still a mixed quarter for the company with accelerating customer growth but EPS guidance for next quarter missing analysts’ expectations significantly.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $15.52.

Is now the time to buy PagerDuty? Access our full analysis of the earnings results here, it’s free.

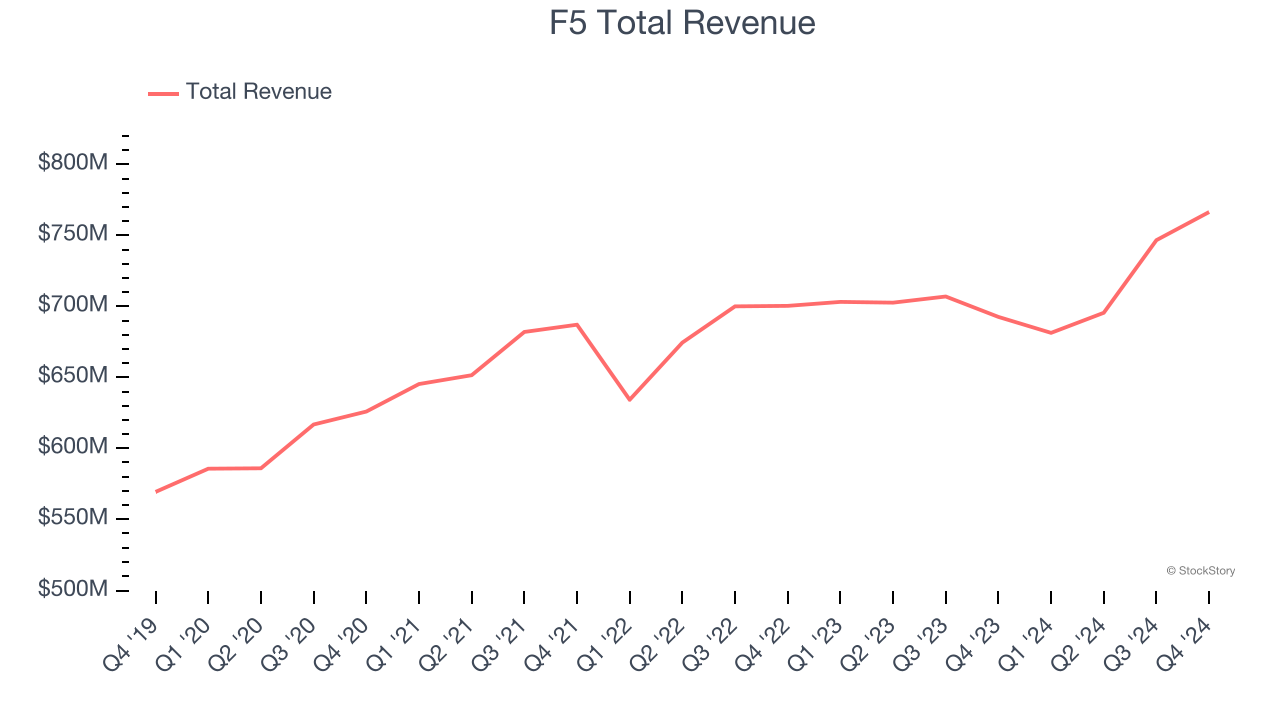

Best Q4: F5 (NASDAQ: FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ: FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $766.5 million, up 10.7% year on year, outperforming analysts’ expectations by 7.2%. The business had a strong quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

F5 delivered the biggest analyst estimates beat among its peers. The stock is down 2.3% since reporting. It currently trades at $263.61.

Is now the time to buy F5? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Akamai (NASDAQ: AKAM)

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ: AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $1.02 billion, up 2.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year guidance of slowing revenue growth.

Akamai delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 24.8% since the results and currently trades at $73.78.

Read our full analysis of Akamai’s results here.

JFrog (NASDAQ: FROG)

Named after the founders' affinity for frogs, JFrog (NASDAQ: FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

JFrog reported revenues of $116.1 million, up 19.3% year on year. This print beat analysts’ expectations by 1.5%. Zooming out, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The company added 52 enterprise customers paying more than $100,000 annually to reach a total of 1,018. The stock is down 16.9% since reporting and currently trades at $31.36.

Read our full, actionable report on JFrog here, it’s free.

Dynatrace (NYSE: DT)

Founded in Austria in 2005, Dynatrace (NYSE: DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Dynatrace reported revenues of $436.2 million, up 19.5% year on year. This number topped analysts’ expectations by 2.3%. Taking a step back, it was a satisfactory quarter as it also produced a solid beat of analysts’ EBITDA estimates.

Dynatrace delivered the highest full-year guidance raise among its peers. The stock is down 23.1% since reporting and currently trades at $44.19.

Read our full, actionable report on Dynatrace here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.