Website design and e-commerce platform provider Wix.com (NASDAQ: WIX) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 12.8% year on year to $473.7 million. On the other hand, next quarter’s revenue guidance of $487 million was less impressive, coming in 0.6% below analysts’ estimates. Its non-GAAP profit of $1.55 per share was 6.4% below analysts’ consensus estimates.

Is now the time to buy Wix? Find out by accessing our full research report, it’s free.

Wix (WIX) Q1 CY2025 Highlights:

- Revenue: $473.7 million vs analyst estimates of $471.9 million (12.8% year-on-year growth, in line)

- Adjusted EPS: $1.55 vs analyst expectations of $1.66 (6.4% miss)

- Adjusted Operating Income: $99.84 million vs analyst estimates of $94.63 million (21.1% margin, 5.5% beat)

- The company reconfirmed its revenue guidance for the full year of $1.99 billion at the midpoint

- Operating Margin: 7.9%, up from 2.3% in the same quarter last year

- Free Cash Flow Margin: 30.1%, up from 28.6% in the previous quarter

- Market Capitalization: $10.16 billion

“This year we are setting out to reimagine and expand the online creation experience and have set the bar high with the milestone release of Wixel, which I believe will democratize digital creation,” said Avishai Abrahami, Wix Co-founder and CEO.

Company Overview

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ: WIX) offers a free and easy to operate website building platform.

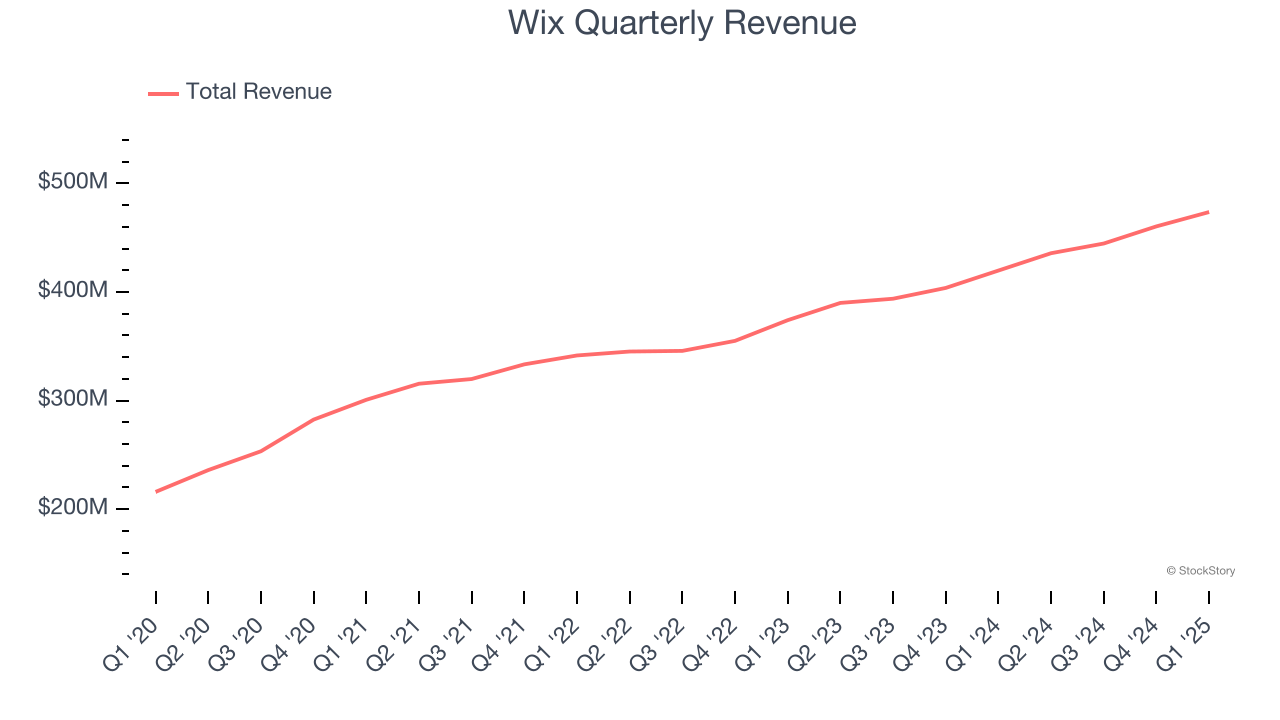

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Wix grew its sales at a 11.5% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Wix’s year-on-year revenue growth was 12.8%, and its $473.7 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 11.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Wix is efficient at acquiring new customers, and its CAC payback period checked in at 36.6 months this quarter. The company’s relatively fast recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Wix’s Q1 Results

We struggled to find many positives in these results. Its revenue guidance for next quarter slightly missed and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.8% to $177 immediately following the results.

The latest quarter from Wix’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.