Self defense company AXON (NASDAQ: AXON) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 31.3% year on year to $603.6 million. The company’s full-year revenue guidance of $2.65 billion at the midpoint came in 1.2% above analysts’ estimates. Its non-GAAP profit of $1.41 per share was 13.5% above analysts’ consensus estimates.

Is now the time to buy Axon? Find out by accessing our full research report, it’s free.

Axon (AXON) Q1 CY2025 Highlights:

- Revenue: $603.6 million vs analyst estimates of $587 million (31.3% year-on-year growth, 2.8% beat)

- Adjusted EPS: $1.41 vs analyst estimates of $1.24 (13.5% beat)

- Adjusted EBITDA: $155.2 million vs analyst estimates of $137.6 million (25.7% margin, 12.8% beat)

- The company lifted its revenue guidance for the full year to $2.65 billion at the midpoint from $2.6 billion, a 1.9% increase

- EBITDA guidance for the full year is $662.5 million at the midpoint, in line with analyst expectations

- Operating Margin: -1.5%, down from 3.6% in the same quarter last year

- Free Cash Flow was $932,000, up from -$26.11 million in the same quarter last year

- Market Capitalization: $46.84 billion

Company Overview

Providing body cameras and tasers for first responders, AXON (NASDAQ: AXON) develops technology solutions and weapons products for military, law enforcement, and civilians.

Sales Growth

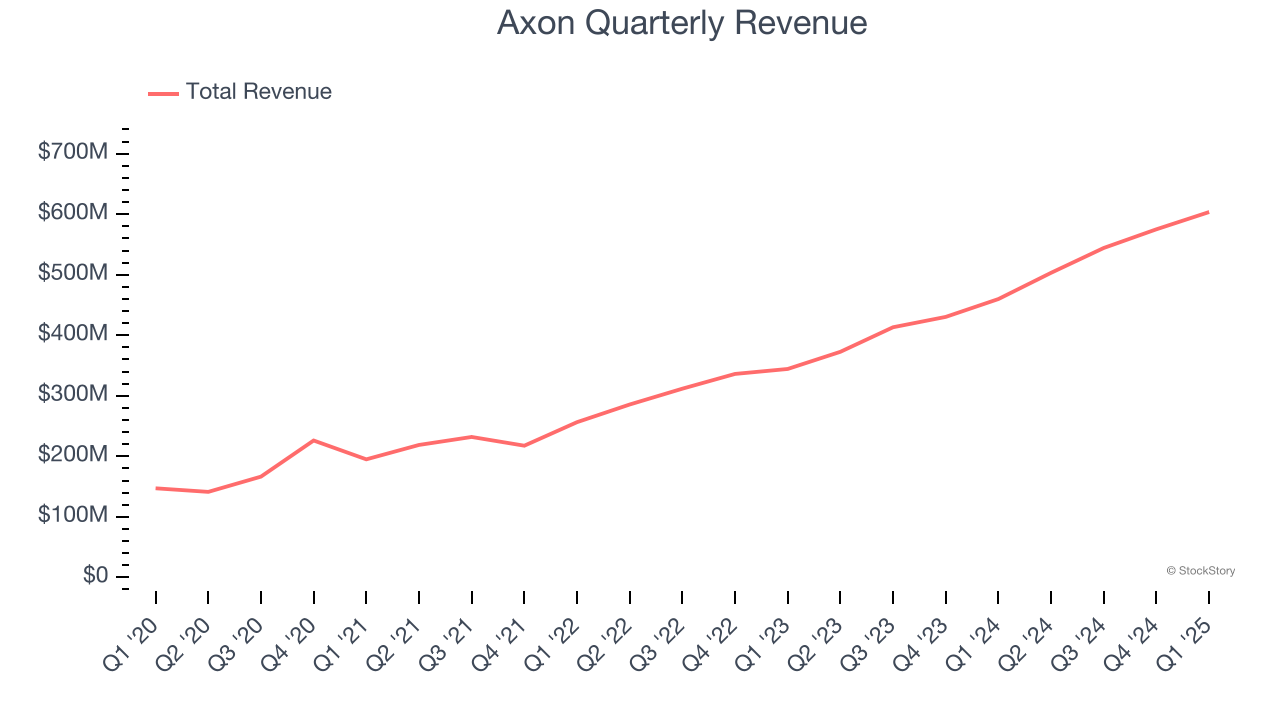

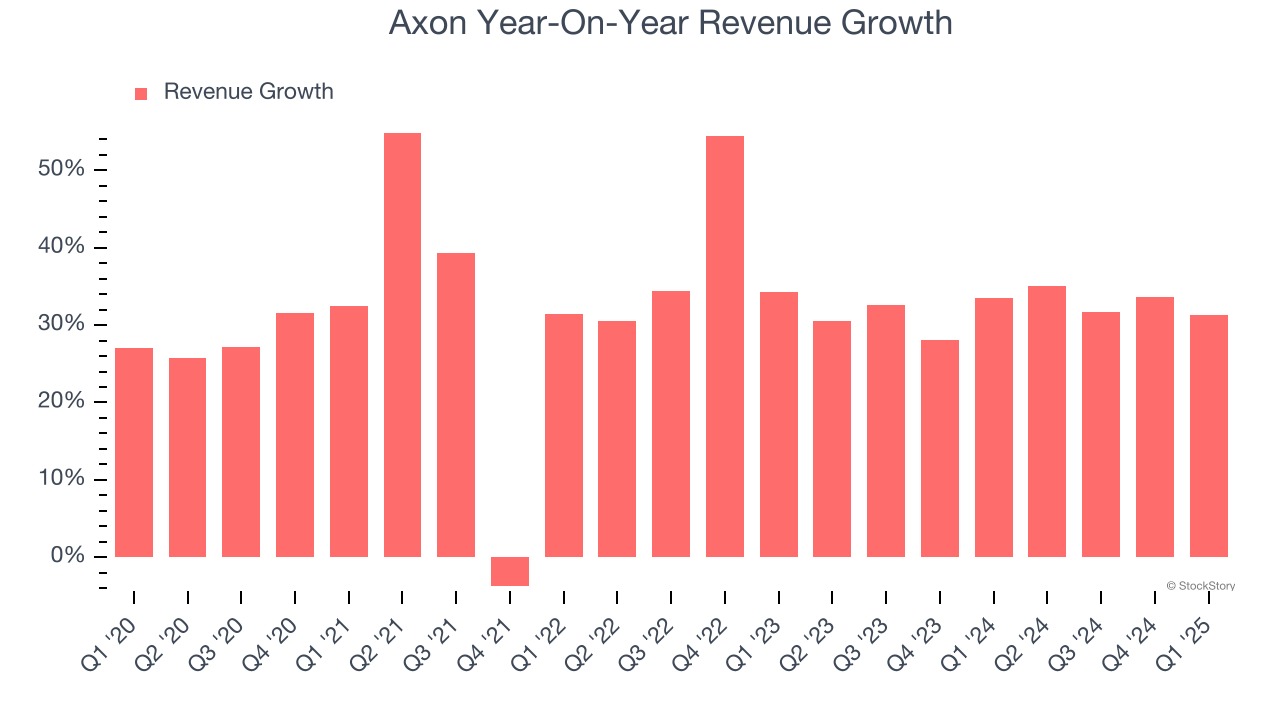

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Axon’s 31.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Axon’s annualized revenue growth of 32% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Axon reported wonderful year-on-year revenue growth of 31.3%, and its $603.6 million of revenue exceeded Wall Street’s estimates by 2.8%.

Looking ahead, sell-side analysts expect revenue to grow 23.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

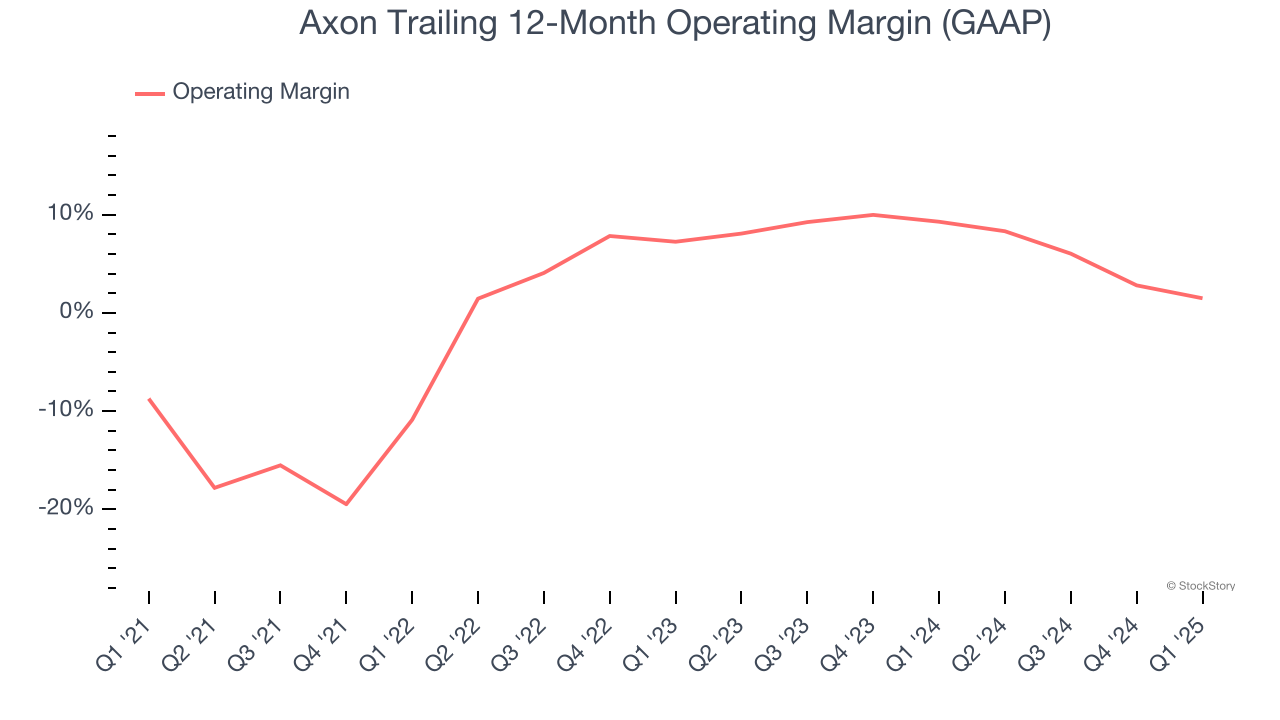

Axon was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.7% was weak for an industrials business.

On the plus side, Axon’s operating margin rose by 10.2 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q1, Axon generated an operating profit margin of negative 1.5%, down 5 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

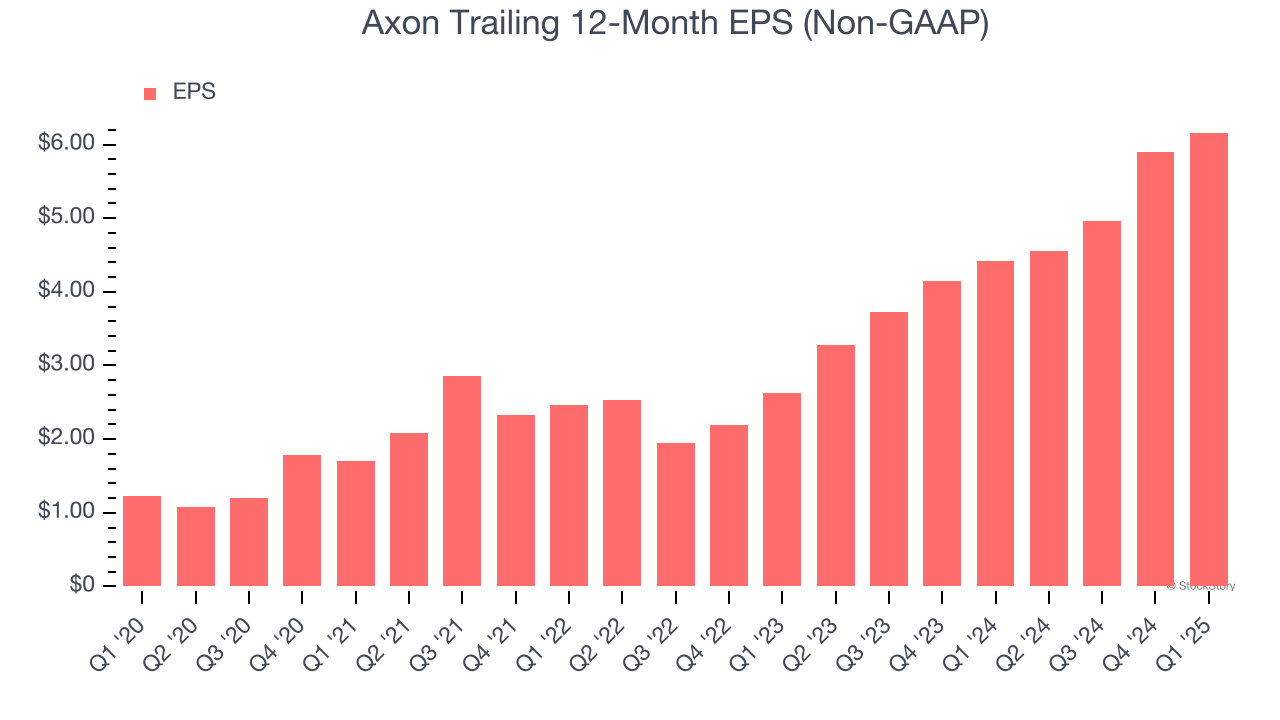

Axon’s EPS grew at an astounding 38.1% compounded annual growth rate over the last five years, higher than its 31.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Axon’s earnings can give us a better understanding of its performance. As we mentioned earlier, Axon’s operating margin declined this quarter but expanded by 10.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Axon, its two-year annual EPS growth of 53.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Axon reported EPS at $1.41, up from $1.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Axon’s full-year EPS of $6.16 to shrink by 3.4%.

Key Takeaways from Axon’s Q1 Results

This was a beat and raise quarter. We liked that Axon beat analysts’ revenue and EBITDA expectations this quarter. We were also glad its full-year guidance for revenue was raised. Zooming out, we think this was a solid print. The stock traded up 5% to $628.24 immediately after reporting.

Sure, Axon had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.