As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the HR software industry, including Paycom (NYSE: PAYC) and its peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 5 HR software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 3.6% below.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

Paycom (NYSE: PAYC)

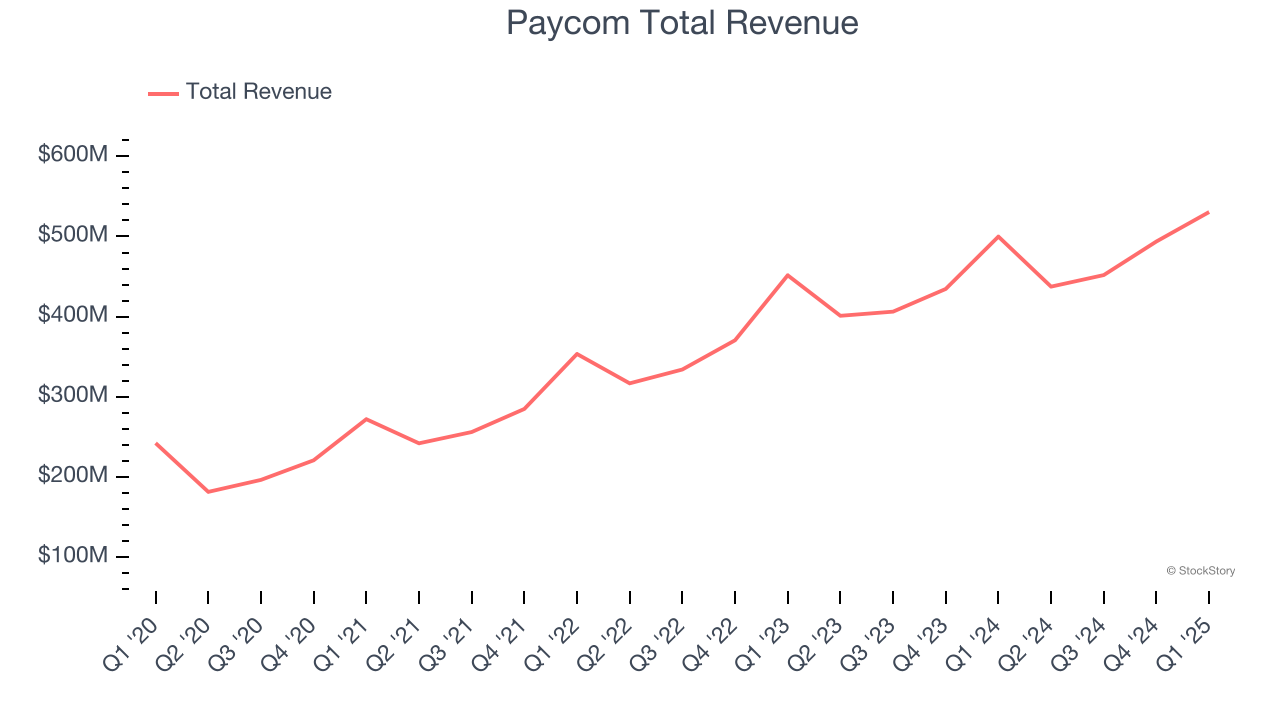

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE: PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Paycom reported revenues of $530.5 million, up 6.1% year on year. This print exceeded analysts’ expectations by 0.9%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

The stock is up 9% since reporting and currently trades at $249.

Is now the time to buy Paycom? Access our full analysis of the earnings results here, it’s free.

Best Q1: Paylocity (NASDAQ: PCTY)

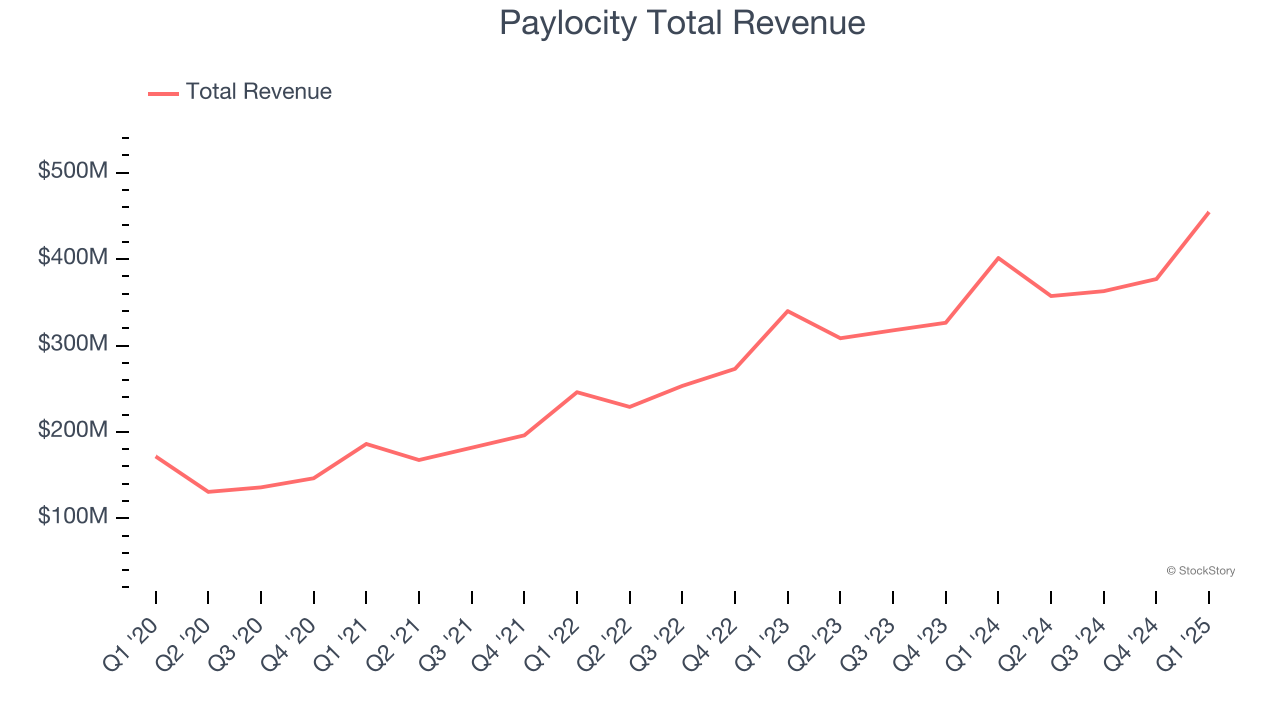

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ: PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $454.5 million, up 13.3% year on year, outperforming analysts’ expectations by 2.9%. The business had a very strong quarter with a solid beat of analysts’ EBITDA estimates.

Paylocity scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems unhappy with the results as the stock is down 6.4% since reporting. It currently trades at $181.98.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dayforce (NYSE: DAY)

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE: DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $481.8 million, up 11.7% year on year, exceeding analysts’ expectations by 1.1%. Still, it was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and billings in line with analysts’ estimates.

Dayforce delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 2.4% since the results and currently trades at $59.59.

Read our full analysis of Dayforce’s results here.

Asure (NASDAQ: ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $34.85 million, up 10.1% year on year. This number surpassed analysts’ expectations by 1.7%. Aside from that, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $9.75.

Read our full, actionable report on Asure here, it’s free.

Paychex (NASDAQ: PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ: PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.51 billion, up 4.8% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as its performance in some other areas of the business was disappointing.

Paychex had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 5.6% since reporting and currently trades at $152.12.

Read our full, actionable report on Paychex here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.