Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Lovesac (NASDAQ: LOVE) and its peers.

A healthy housing market is good for furniture demand as more consumers are buying, renting, moving, and renovating. On the other hand, periods of economic weakness or high interest rates discourage home sales and can squelch demand. In addition, home furnishing companies must contend with shifting consumer preferences such as the growing propensity to buy goods online, including big things like mattresses and sofas that were once thought to be immune from e-commerce competition.

The 6 home furnishings stocks we track reported a satisfactory Q1. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

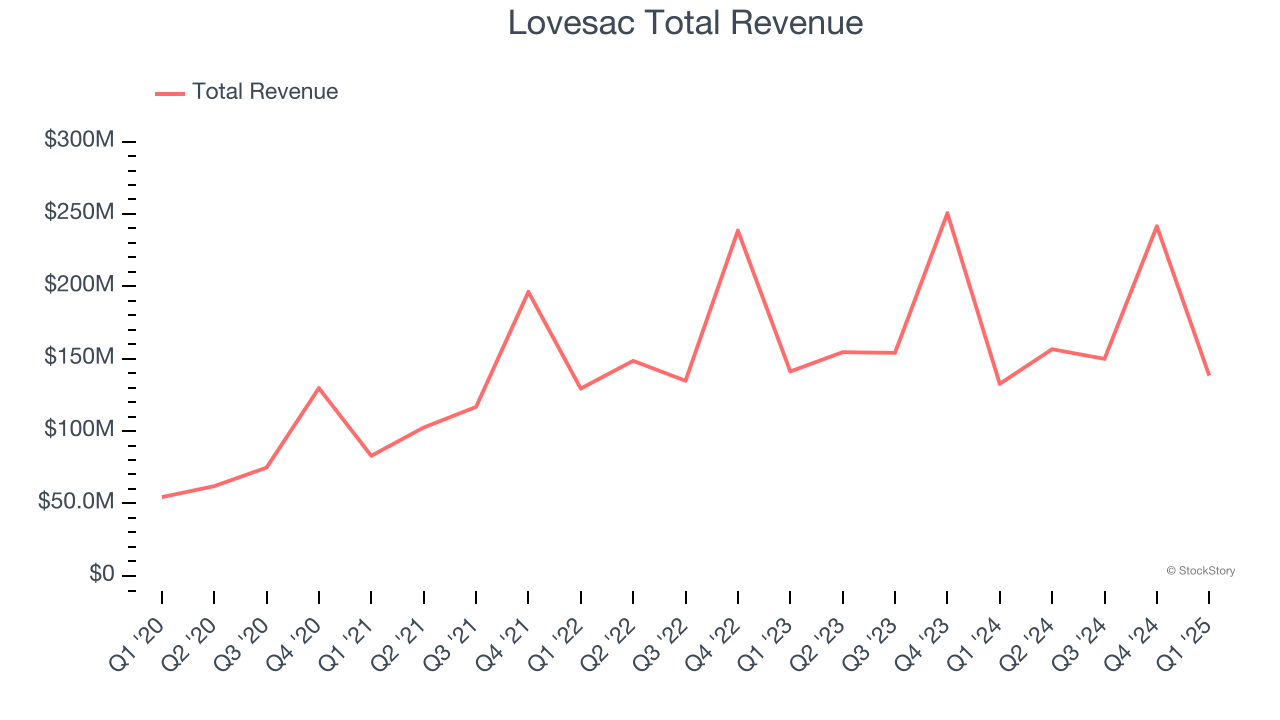

Lovesac (NASDAQ: LOVE)

Known for its oversized, premium beanbags, Lovesac (NASDAQ: LOVE) is a specialty furniture brand selling modular furniture.

Lovesac reported revenues of $138.4 million, up 4.3% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

Unsurprisingly, the stock is down 10.7% since reporting and currently trades at $18.35.

Is now the time to buy Lovesac? Access our full analysis of the earnings results here, it’s free.

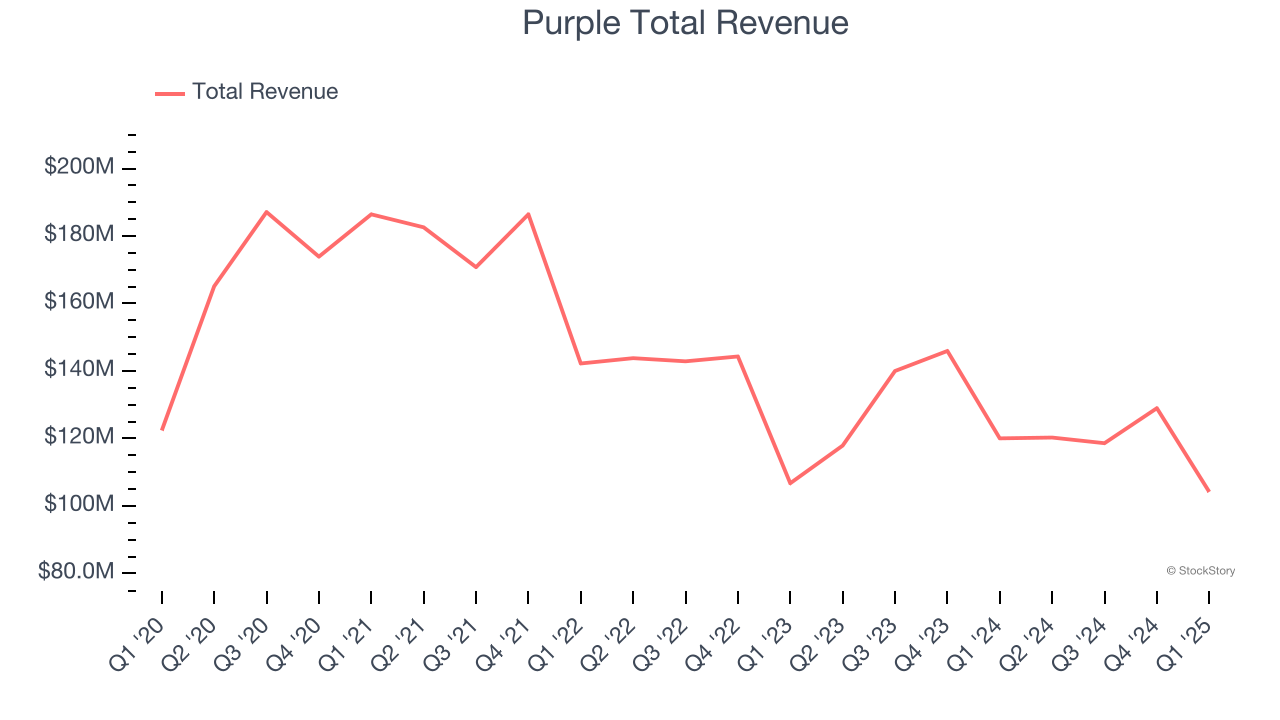

Best Q1: Purple (NASDAQ: PRPL)

Founded by two brothers, Purple (NASDAQ: PRPL) creates sleep and home comfort products such as mattresses, pillows, and bedding accessories.

Purple reported revenues of $104.2 million, down 13.2% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Purple pulled off the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.1% since reporting. It currently trades at $0.74.

Is now the time to buy Purple? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Somnigroup (NYSE: SGI)

Established through the merger of Tempur-Pedic and Sealy in 2012, Somnigroup (NYSE: SGI) is a bedding manufacturer known for its innovative memory foam mattresses and sleep products

Somnigroup reported revenues of $1.60 billion, up 34.9% year on year, falling short of analysts’ expectations by 1.8%. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations.

Somnigroup delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 7.1% since the results and currently trades at $64.90.

Read our full analysis of Somnigroup’s results here.

Leggett & Platt (NYSE: LEG)

Founded in 1883, Leggett & Platt (NYSE: LEG) is a diversified manufacturer of products and components for various industries.

Leggett & Platt reported revenues of $1.02 billion, down 6.8% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also logged a solid beat of analysts’ adjusted operating income estimates but a miss of analysts’ FF&T revenue estimates.

Leggett & Platt had the weakest full-year guidance update among its peers. The stock is up 25.5% since reporting and currently trades at $9.11.

Read our full, actionable report on Leggett & Platt here, it’s free.

Mohawk Industries (NYSE: MHK)

Established in 1878, Mohawk Industries (NYSE: MHK) is a leading producer of floor-covering products for both residential and commercial applications.

Mohawk Industries reported revenues of $2.53 billion, down 5.7% year on year. This print missed analysts’ expectations by 0.9%. Overall, it was a slower quarter as it also recorded EPS guidance for next quarter missing analysts’ expectations and a slight miss of analysts’ organic revenue estimates.

The stock is down 7.6% since reporting and currently trades at $98.45.

Read our full, actionable report on Mohawk Industries here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.