The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Arbor Realty Trust (NYSE: ABR) and the rest of the thrifts & mortgage finance stocks fared in Q1.

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

The 22 thrifts & mortgage finance stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 18.5%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

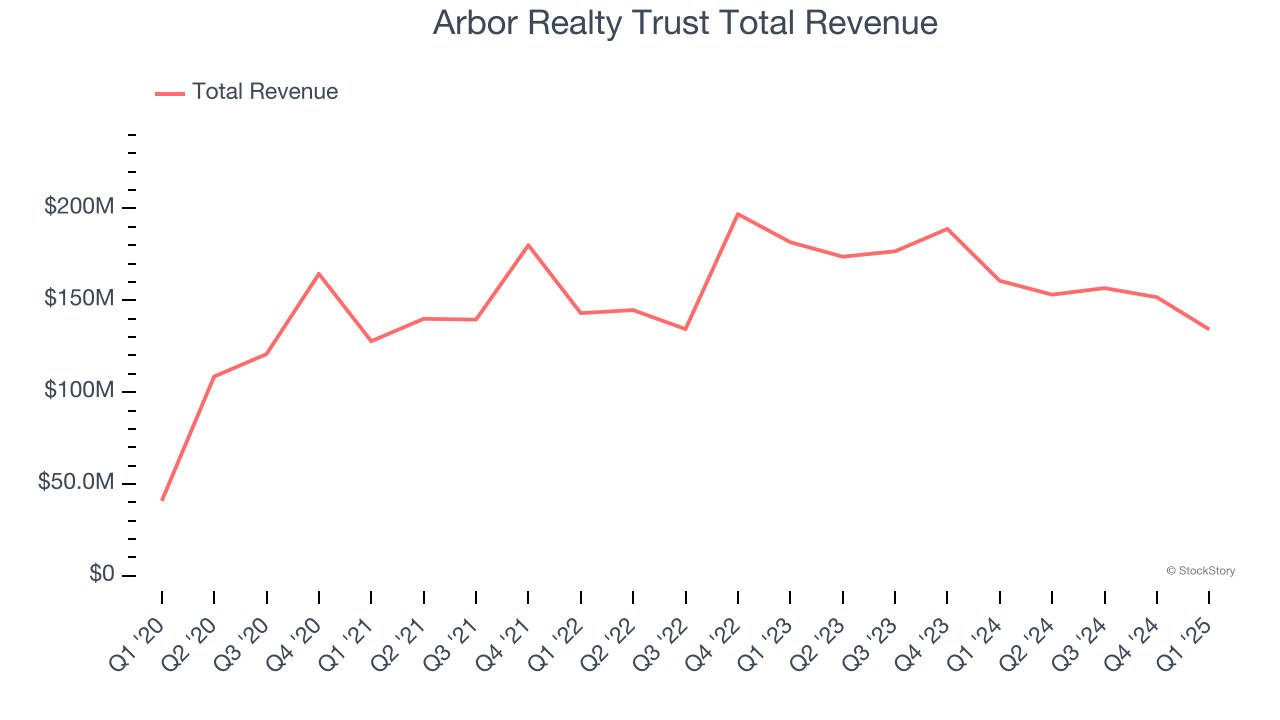

Arbor Realty Trust (NYSE: ABR)

With roots dating back to 2003 and a focus on the stability of multifamily housing, Arbor Realty Trust (NYSE: ABR) is a specialized lender that provides financing solutions for multifamily and commercial real estate while also originating and servicing government-backed mortgage loans.

Arbor Realty Trust reported revenues of $134.2 million, down 16.5% year on year. This print fell short of analysts’ expectations by 1.1%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

Unsurprisingly, the stock is down 7.3% since reporting and currently trades at $10.25.

Read our full report on Arbor Realty Trust here, it’s free.

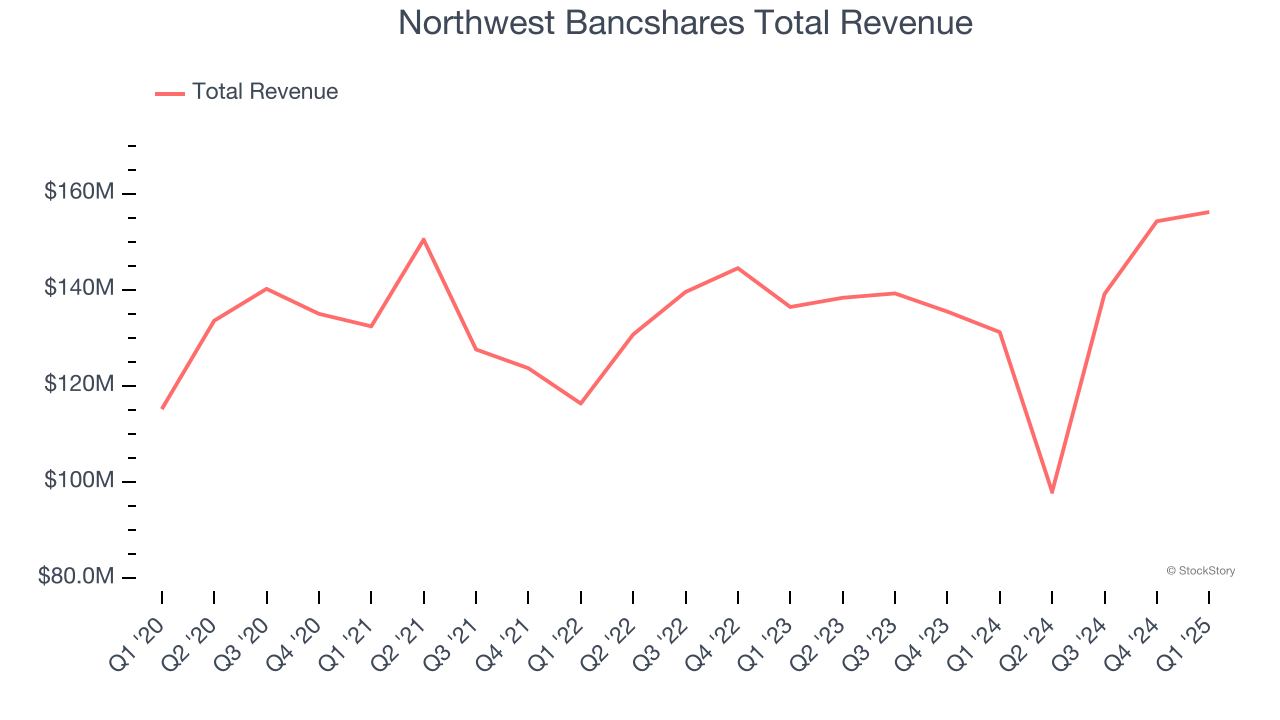

Best Q1: Northwest Bancshares (NASDAQ: NWBI)

Founded in 1896 and operating across Pennsylvania, New York, Ohio, and Indiana, Northwest Bancshares (NASDAQ: NWBI) is a bank holding company that operates Northwest Bank, providing personal and business banking, investment management, and trust services.

Northwest Bancshares reported revenues of $156.2 million, up 19% year on year, outperforming analysts’ expectations by 9.9%. The business had a stunning quarter with an impressive beat of analysts’ EPS and net interest income estimates.

The market seems content with the results as the stock is up 2.6% since reporting. It currently trades at $12.12.

Is now the time to buy Northwest Bancshares? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dynex Capital (NYSE: DX)

Operating in the financial markets since 1988 with a focus on capital preservation during economic turbulence, Dynex Capital (NYSE: DX) is a mortgage real estate investment trust that invests primarily in government-backed residential mortgage securities to generate income for shareholders.

Dynex Capital reported revenues of $17.13 million, up 637% year on year, falling short of analysts’ expectations by 22.4%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.7% since the results and currently trades at $12.26.

Read our full analysis of Dynex Capital’s results here.

TFS Financial (NASDAQ: TFSL)

Tracing its roots back to 1938 during the Great Depression era when savings and loans were vital to homeownership, TFS Financial (NASDAQ: TFSL) is a savings and loan holding company that provides mortgage lending, deposit services, and other retail banking products primarily in Ohio and Florida.

TFS Financial reported revenues of $77.62 million, flat year on year. This result beat analysts’ expectations by 2.2%. More broadly, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ net interest income estimates but EPS in line with analysts’ estimates.

The stock is down 6.1% since reporting and currently trades at $12.62.

Read our full, actionable report on TFS Financial here, it’s free.

Walker & Dunlop (NYSE: WD)

Originating as a small mortgage banking firm during the Great Depression in 1937, Walker & Dunlop (NYSE: WD) provides commercial real estate financing, property sales, appraisal, and investment management services with a focus on multifamily properties.

Walker & Dunlop reported revenues of $237.4 million, up 4.1% year on year. This print lagged analysts' expectations by 1.8%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ EPS estimates but a miss of analysts’ tangible book value per share estimates.

The stock is down 9.4% since reporting and currently trades at $66.91.

Read our full, actionable report on Walker & Dunlop here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.