Since December 2024, East West Bank has been in a holding pattern, posting a small return of 2.9% while floating around $100.

Given the underwhelming price action, is now a good time to buy EWBC? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free.

Why Does EWBC Stock Spark Debate?

As the largest independent bank in the U.S. focused on bridging financial services between America and Asia, East West Bancorp (NASDAQ: EWBC) operates a commercial bank that provides personal and business banking services with a unique focus on facilitating U.S.-Asia cross-border transactions.

Two Positive Attributes:

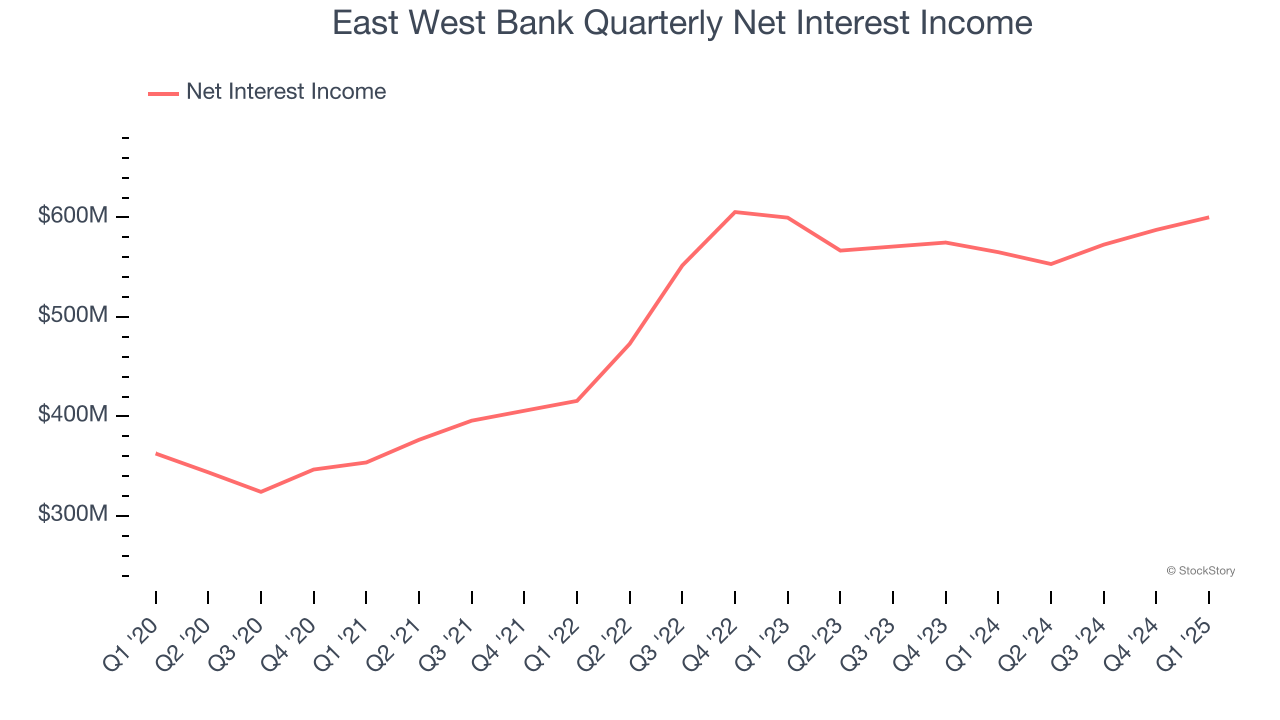

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

East West Bank’s net interest income has grown at a 14% annualized rate over the last four years, better than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

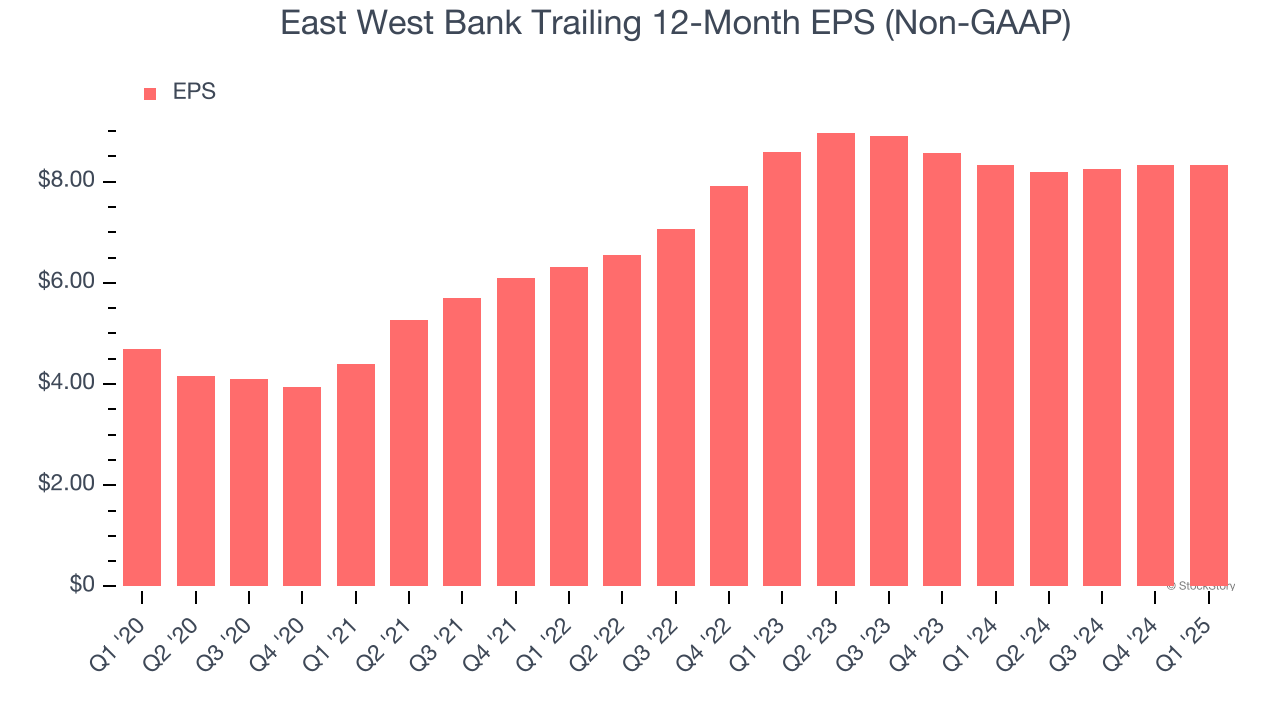

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

East West Bank’s EPS grew at an astounding 12.2% compounded annual growth rate over the last five years, higher than its 9.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

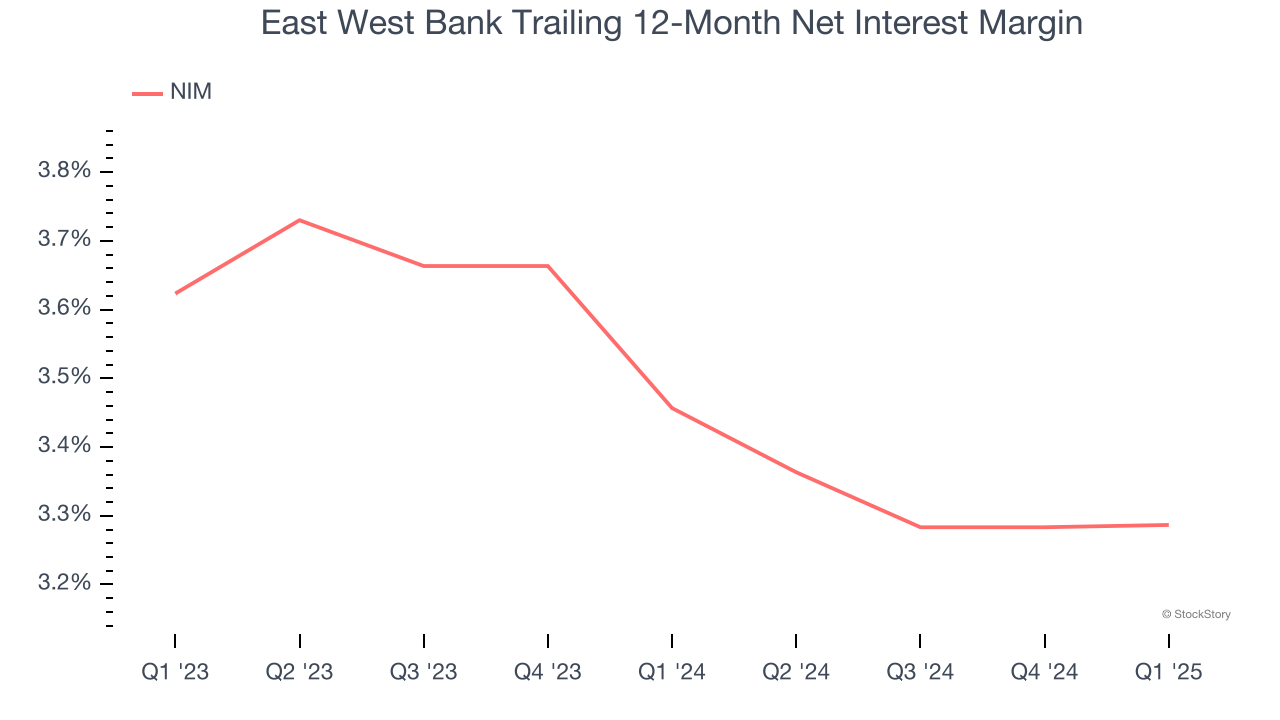

Net Interest Margin Dropping

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, East West Bank’s net interest margin averaged 3.4%. Its margin also contracted by 33.7 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean East West Bank either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition. One caveat is that net interest margins can also decrease to reflect lower default risk if banks begin making more conservative loans.

Final Judgment

East West Bank’s positive characteristics outweigh the negatives, but at $100 per share (or 1.6× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than East West Bank

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.